US Economy Doing a Great Imitation of a Developing Double Dip Recession

Economics / Double Dip Recession Oct 10, 2010 - 08:45 AM GMTBy: Jesse

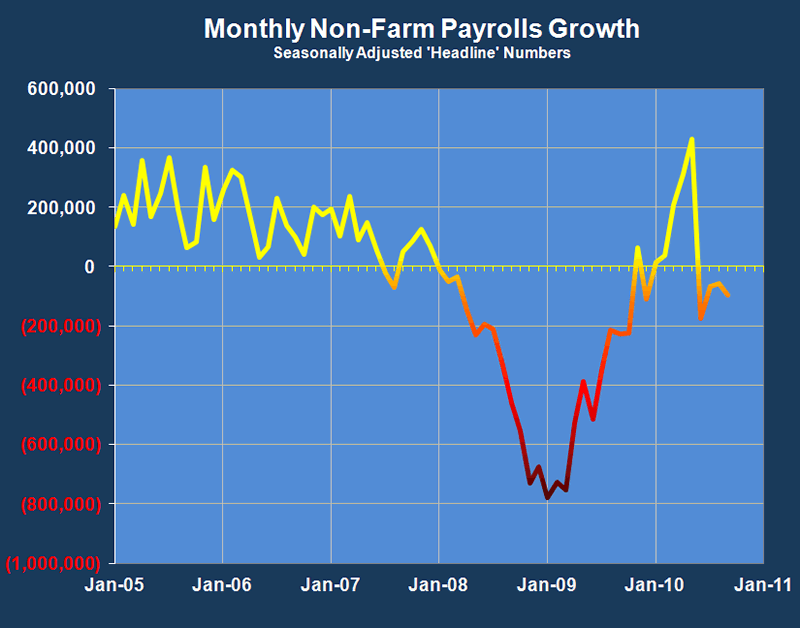

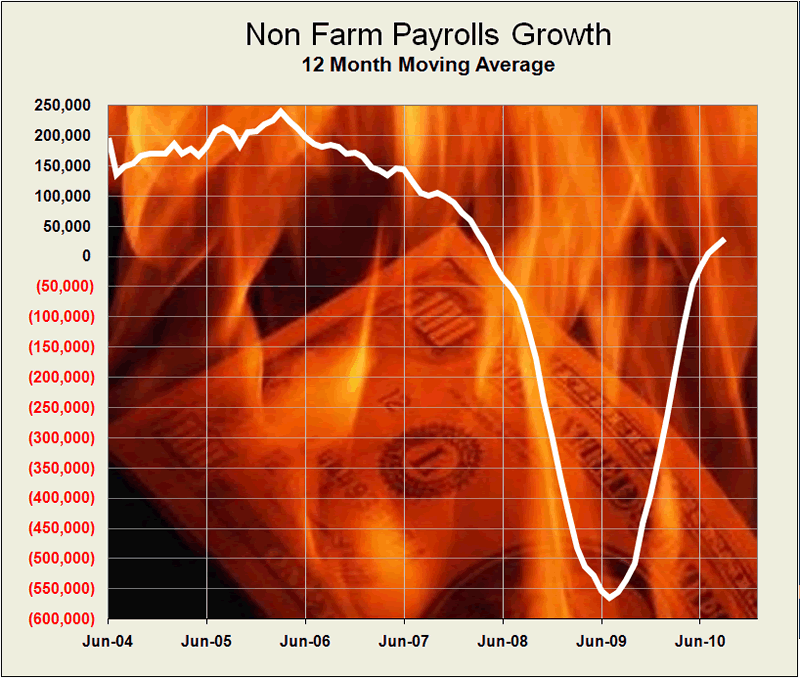

The September Non-Farm Payrolls report was not good news.

The September Non-Farm Payrolls report was not good news.

This is a remarkably unnatural US economic recovery, with gold, silver, and other key commodities soaring in price, the near end of the Treasury curve hitting record low interest rates, and stocks steadily rallying as employment slumps and the median wage continues to decline.

The US is a Potemkin Village economy with the appearance of prosperity hiding the rot of fraud, oligarchy, and political corruption.

The US is a Potemkin Village economy with the appearance of prosperity hiding the rot of fraud, oligarchy, and political corruption.

As monetary power and wealth is increasingly concentrated in fewer hands, the robust organic nature of the economy and the middle class continues to deteriorate.

This is what is happening, and monetary policy cannot affect it. The change must come from the source, which is in political and financial reform. And the powerful status quo is dead set against it.

The long term trend of employment has not yet turned lower which would make the second dip 'official' from our point of view. But the prognosis does not look good.

http://jessescrossroadscafe.blogspot.com

Welcome to Jesse's Café Américain - These are personal observations about the economy and the markets. In providing information, we hope this allows you to make your own decisions in an informed manner, even if it is from learning by our mistakes, which are many.

© 2010 Copyright Jesse's Café Américain - All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.