Leading Stocks To Consider Buying and Stocks To Forget

Companies / Company Chart Analysis Oct 09, 2010 - 03:57 AM GMTBy: David_Grandey

Time and time again we’ve said: “We do not chase buses around here as we’ve seen it time and time again where one jumps in thinking the short term trend is going to continue and then? WHAM 10-15 days worth of gains wiped out in 2 days. Those who like chasing stocks AFTER the fact? Good luck with that.”

Time and time again we’ve said: “We do not chase buses around here as we’ve seen it time and time again where one jumps in thinking the short term trend is going to continue and then? WHAM 10-15 days worth of gains wiped out in 2 days. Those who like chasing stocks AFTER the fact? Good luck with that.”

After all lead means BOTH directions. When we started buying them back in the end of September nobody wanted anything to do with most of them. A week ago or even Tuesday? Everyone had to have them and true to form the market obliged by letting those who had to have it, have it BUT not they way they wanted to mind you.

Make no mistake, the damage that has been done to some of these names will not be repaired overnight. CREE WAS a market leader and it’s been months and it still isn’t showing any sign of stabilizing from when it went into its correction.

Following are some leading stocks that were damaged significantly this week followed by leading stocks who may give us another opportunity to buy them at low-risk entry points in the near future.

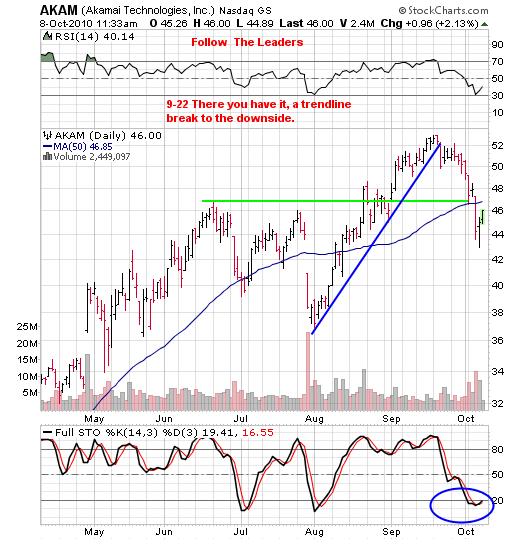

AKAM

One could say this issue had a head and shoulders top to it if you look close.

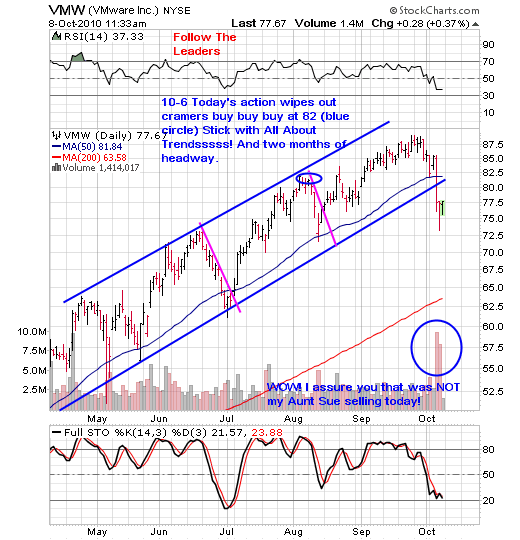

VMW

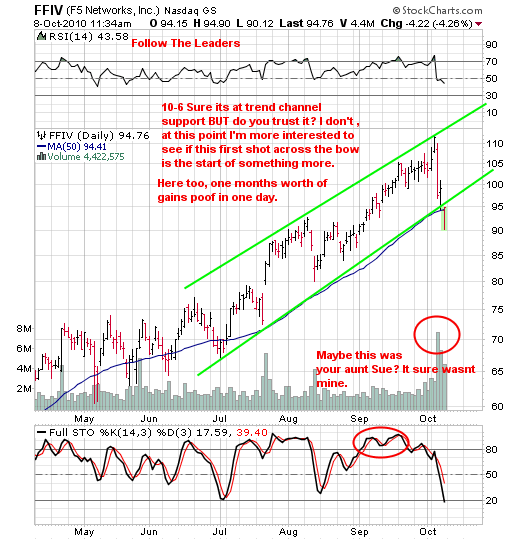

FFIV

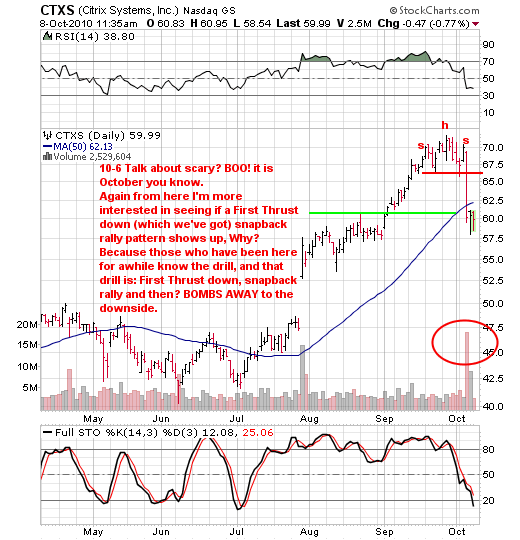

CTXS

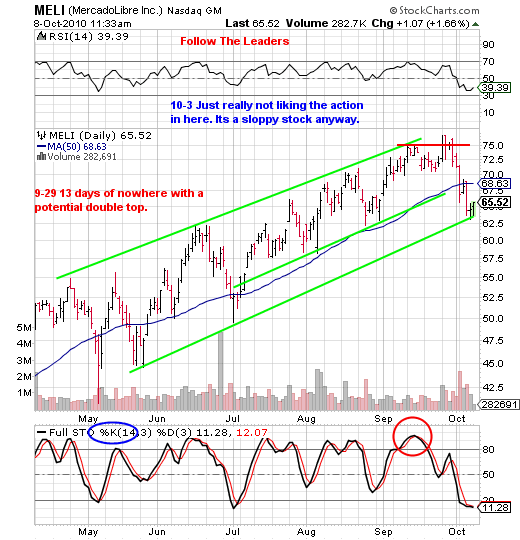

MELI

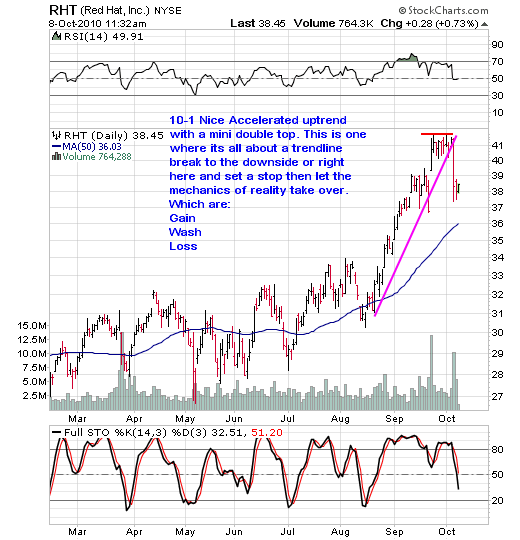

RHT

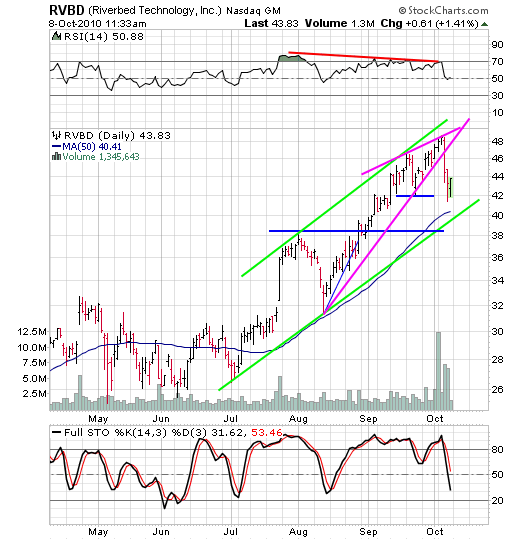

RVBD

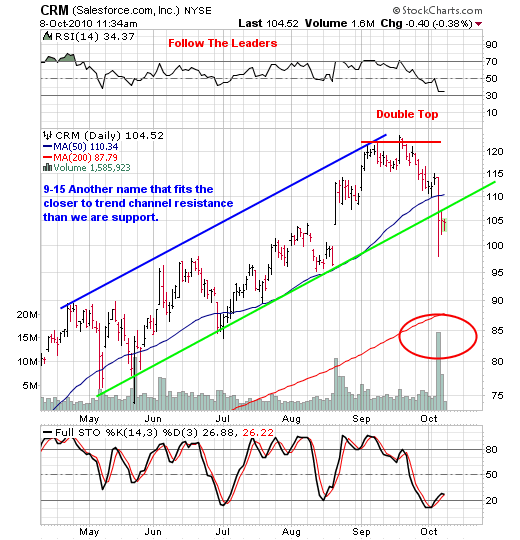

With all of the above, notice the double tops all over the place? Those double tops are your early warning alert system pattern telling you a potential change in trend is near, in this case up to down.

============================================================

ROVI

Talk to us at the blue line, it gets us interested on the long side for a trade.

NFLX

At or near the green line gets us interested in the long side for a trade.

SINA

The green line gets us interested on the long side for a potential trade.

By David Grandey

www.allabouttrends.net

To learn more, sign up for our free newsletter and receive our free report -- "How To Outperform 90% Of Wall Street With Just $500 A Week."

David Grandey is the founder of All About Trends, an email newsletter service revealing stocks in ideal set-ups offering potential significant short-term gains. A successful canslim-based stock market investor for the past 10 years, he has worked for Meriwest Credit Union Silicon Valley Bank, helping to establish brand awareness and credibility through feature editorial coverage in leading national and local news media.

© 2010 Copyright David Grandey- All Rights Reserved Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.