Fed QE2 Rhetoric Tied to Mandate of Full Employment and Inflation Stability

Interest-Rates / Quantitative Easing Oct 08, 2010 - 03:19 AM GMTBy: Asha_Bangalore

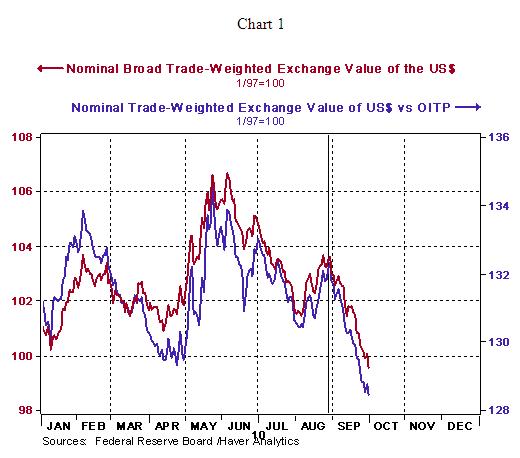

Financial markets are largely convinced the Fed will embark on QE2 at the November 2-3 FOMC meeting. Bernanke's speech on August 27 was the trigger, followed by the FOMC policy statement on September 21 and recent rhetoric of Fed officials Dudley, Evans, and Rosengren. The dollar has lost significant ground vis-à-vis its major trading partners and others (see chart 1) in a short span to time.

Financial markets are largely convinced the Fed will embark on QE2 at the November 2-3 FOMC meeting. Bernanke's speech on August 27 was the trigger, followed by the FOMC policy statement on September 21 and recent rhetoric of Fed officials Dudley, Evans, and Rosengren. The dollar has lost significant ground vis-à-vis its major trading partners and others (see chart 1) in a short span to time.

The dollar is the exclusive domain of the Treasury. The Fed's dual mandate of full employment and price stability is the focus of monetary policy. The upside of the dollar's depreciation is the benefit from projected growth in exports, which is indicative of less support that may be required from monetary policy. The Fed will have to navigate the turbulent situation with deft remarks about the type of support available from monetary policy changes. The Fed could accomplish this task with a cap on the amount of Treasury securities or tie Fed action to the performance of one (or more) key economic indicator(s). The Fed adopted the former route when purchasing Treasuries and mortgage-backed securities of $1.625 trillion before the programs expired earlier this year. This time around, the Fed is likely to link purchases of securities to the nature of economic data in an implicit manner. In other words, the policy statement will reflect the Fed's full employment and price stability mandate as guidance for the extent of support it is likely to provide.

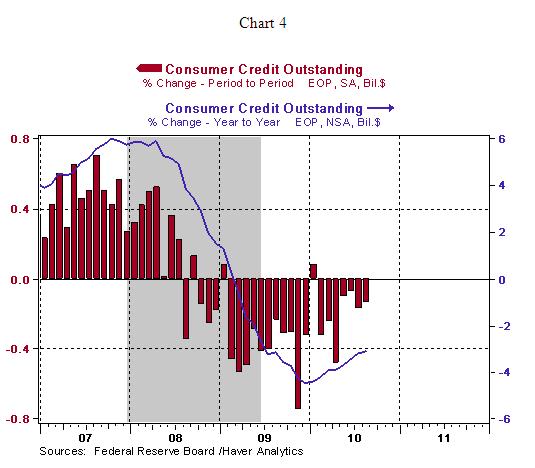

Consumer Credit: Non-Revolving Credit Posts Second Year-to-Year Gain

Consumer credit outstanding fell 0.14% in August after a 0.17% decline in the prior month. The good news is that consumer credit is falling less rapidly compared with the situation in 2009 (see chart 4). On a year-to-year basis, consumer credit fell 3.1% in August vs. 3.2% in July.

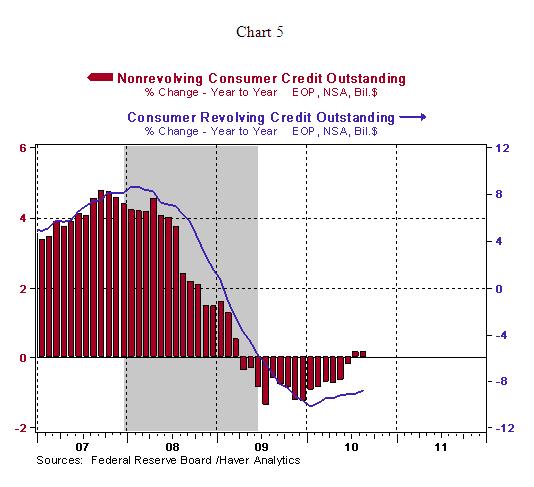

Among the two major components of consumer credit, revolving credit (credit cards) and non-revolving credit (borrowing for purchases of cars, mobile homes, durable goods and vacation expenses), non-revolving credit posted the second consecutive monthly year-to-year increase (see chart 5). These numbers suggest that preference for consumer credit is gradually improving.

Asha Bangalore — Senior Vice President and Economist

http://www.northerntrust.com

Asha Bangalore is Vice President and Economist at The Northern Trust Company, Chicago. Prior to joining the bank in 1994, she was Consultant to savings and loan institutions and commercial banks at Financial & Economic Strategies Corporation, Chicago.

The opinions expressed herein are those of the author and do not necessarily represent the views of The Northern Trust Company. The Northern Trust Company does not warrant the accuracy or completeness of information contained herein, such information is subject to change and is not intended to influence your investment decisions.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.