Silver Surges But Remains 'Ugly Sister' and Still Playing Catch Up With Gold

Commodities / Gold and Silver 2010 Oct 07, 2010 - 09:50 AM GMTBy: GoldCore

Precious metals have risen to new highs on deepening concerns about the US economy and the growing risk of currency devaluations internationally. Gold reached new nominal record highs at $1,364.77/oz and silver reached new 30 year record nominal highs at $23.52/oz.

Precious metals have risen to new highs on deepening concerns about the US economy and the growing risk of currency devaluations internationally. Gold reached new nominal record highs at $1,364.77/oz and silver reached new 30 year record nominal highs at $23.52/oz.

Gold is currently trading at $1,355.95/oz, €968.88/oz, £848.97/oz.

Silver

While gold has been grabbing some headlines recently, especially in the financial media, poor man's gold silver remains the 'ugly sister' and is rarely covered in the financial media and almost never in the mainstream press and media. From a contrary perspective this is bullish as it shows that silver remains very much off the radar of the retail investor and 'Joe Public' - most of whom do not even know the price of silver - let alone how to invest in it.

Silver is currently trading at $23.29/oz, €16.64/oz and £14.58/oz.

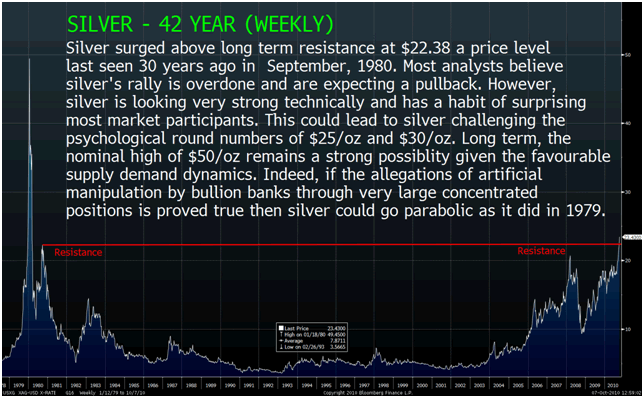

Silver - 42 YEAR (Weekly).

Silver surged on Tuesday after rising above the long term resistance Goldcore had identified last week at $22.38/oz. Most analysts remain bearish on silver and believe silver's rally is overdone and are expecting a pullback. However, silver is looking very strong technically and has a habit of surprising most market participants. This could lead to silver challenging the psychological round numbers of $25/oz and $30/oz prior to a pullback. Long term, the nominal high of $50/oz remains a strong possibility given the favourable supply demand dynamics. Indeed, if the allegations of artificial manipulation by bullion banks (as alleged by GATA) through very large concentrated positions is proved true, then silver could go parabolic as it did in 1979.

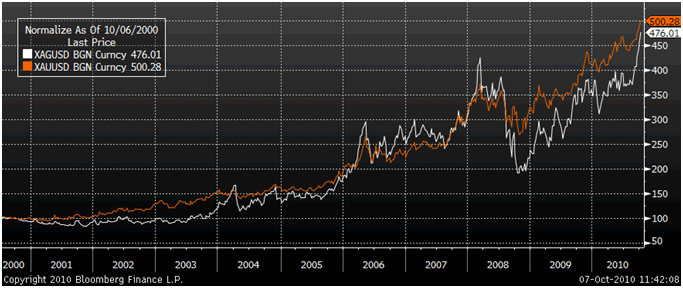

Gold and Silver - 10 Year Comparative Performance.

While gold's rise has been gradual in recent weeks, as we expected, silver has outperformed. Silver trades like a leveraged form of gold and if gold rises 1% to 2% in a day than silver almost always rises by more - normally by some 2% to 4%. Conversely, when gold falls by 1% to 2%, silver will fall by 2% to 4%.

Prudent investors should not be put off by silver's volatility and as ever those who adopt a 'buy and hold' strategy to silver will likely be rewarded in the coming years - as they have been in recent years. Trying to trade silver is extremely high risk but investors can take profits and sell part of their silver allocation after very sharp price gains. However, they should always keep a small allocation as financial insurance against a systemic or monetary crisis.

Platinum Group Metals

Platinum is trading at $1,713.00/oz, palladium is at $594/oz and rhodium is at $2,175/oz

This update can be found on the GoldCore blog here.

Mark O'Byrne

Director

IRL |

UK |

IRL +353 (0)1 632 5010 |

WINNERS MoneyMate and Investor Magazine Financial Analysts 2006

Disclaimer: The information in this document has been obtained from sources, which we believe to be reliable. We cannot guarantee its accuracy or completeness. It does not constitute a solicitation for the purchase or sale of any investment. Any person acting on the information contained in this document does so at their own risk. Recommendations in this document may not be suitable for all investors. Individual circumstances should be considered before a decision to invest is taken. Investors should note the following: Past experience is not necessarily a guide to future performance. The value of investments may fall or rise against investors' interests. Income levels from investments may fluctuate. Changes in exchange rates may have an adverse effect on the value of, or income from, investments denominated in foreign currencies. GoldCore Limited, trading as GoldCore is a Multi-Agency Intermediary regulated by the Irish Financial Regulator.

GoldCore is committed to complying with the requirements of the Data Protection Act. This means that in the provision of our services, appropriate personal information is processed and kept securely. It also means that we will never sell your details to a third party. The information you provide will remain confidential and may be used for the provision of related services. Such information may be disclosed in confidence to agents or service providers, regulatory bodies and group companies. You have the right to ask for a copy of certain information held by us in our records in return for payment of a small fee. You also have the right to require us to correct any inaccuracies in your information. The details you are being asked to supply may be used to provide you with information about other products and services either from GoldCore or other group companies or to provide services which any member of the group has arranged for you with a third party. If you do not wish to receive such contact, please write to the Marketing Manager GoldCore, 63 Fitzwilliam Square, Dublin 2 marking the envelope 'data protection'

GoldCore Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.