Does a U.S. Dollar Crash Loom?

Currencies / US Dollar Oct 07, 2010 - 03:45 AM GMTBy: Clif_Droke

Even if you’re not one who tracks currency values, you just knew the dollar was on the ropes again if you bothered to check your mail box. Whenever the dollar shows any sustained weakness the newsletter publishers will send out bulk mail advertisements with sensational headlines like, “Dollar Crash Looms!” or “The Dollar Will Soon Be Devalued and Replaced.” After receiving two such mailings on the same day last week, it was obvious to me what the investor sentiment was like on the greenback.

Even if you’re not one who tracks currency values, you just knew the dollar was on the ropes again if you bothered to check your mail box. Whenever the dollar shows any sustained weakness the newsletter publishers will send out bulk mail advertisements with sensational headlines like, “Dollar Crash Looms!” or “The Dollar Will Soon Be Devalued and Replaced.” After receiving two such mailings on the same day last week, it was obvious to me what the investor sentiment was like on the greenback.

Another thing you can always count on whenever the U.S. dollar index declines for any considerable length is a chorus of writers and TV commentators who insist that “inflation is just around the corner.” In this commentary I’ll make the case that both of these claims are mistaken and that the dollar’s latest weakness, far from signaling a resumption of the financial crisis, is actually a sign of improving global economic health.

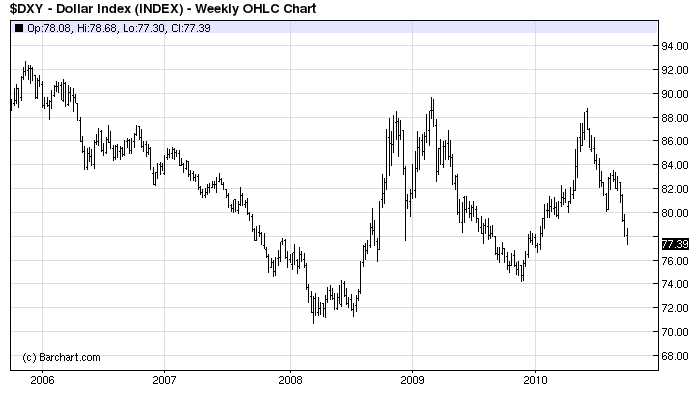

If the credit crisis of 2008 taught us any lesson, it is that in a true financial panic, any and all assets will be thrown overboard in the mad rush to achieve liquidity. That means the dollar is king in a crisis situation. If you look back over the last 10 years at the times when U.S. and global economic strength was most evident, the dollar was always in decline at those times. It was mainly during periods of uncertainty or outright crisis that the dollar showed any strength. The most conspicuous display of dollar strength was during the worst part of the credit crisis of 2008.

The first six months of this year also saw a strengthening dollar as concerns about the economic recovery faltering were rampant. The downward force of the 4-year cycle was another factor that pushed in favor of the dollar in the first half of the year. Since then there have been promising signs of further global economic recovery. Add to that the recent bottom of the latest 4-year cycle and you have the justification for more dollar weakness as concerns over the economic and financial situation fade and investors slowly lose their aversion to riskier assets like commodities and equities.

With the 4-year cycle bottom in and the 6-year cycle peaking a year from now, global financial markets should have at least one more year of recovery before the last of the long-term Kress cycles kick in their force is keenly felt on asset prices. Too many observers are bearish on the year-ahead prospects. I believe this outlook is mistaken. The equity market internal bottom was signaled the week of June 14 when Businessweek ran the following headline on its front cover. Historically, whenever the bear shows up on the front cover of a major news magazine the financial market’s performance is quite strong in the year or so that follows.

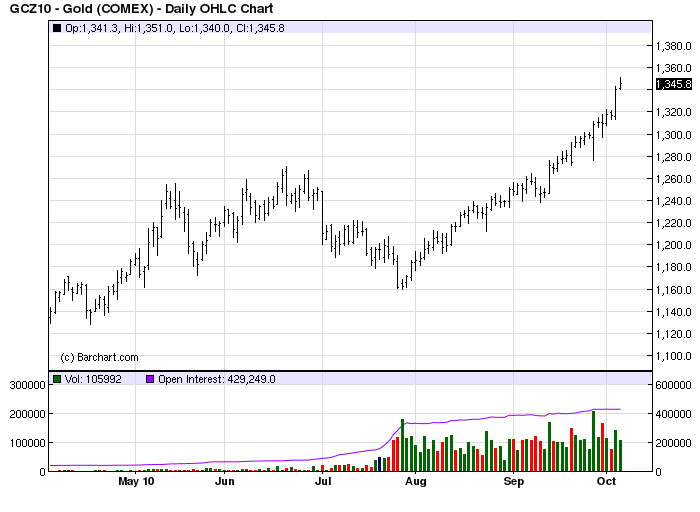

The price of gold should also benefit from the simultaneous concurrence of a weak dollar and an improving financial market outlook. Many “old school” investors are wedded to the mistaken notion that gold is the ultimate inflation hedge. Actually, gold is a beneficiary of sustained deflation, which is the long-term problem that plagues our economy. This is one of the reasons behind the gold bull market of the past decade, as we are in the final stage of both the 50-70 year economic long wave known as the Kondratieff Wave as well as the final years of the Kress 60-year cycle. Established investors with a longer term outlook than the trading crowd look for a stable asset that will both hold its value in the face of deflation as well as appreciate in price and gold fits this bill perfectly at this point in the long term cycle.

As for the idea that the dollar’s latest weakness will lead to a bout of inflation, keep in mind that with an official employment rate of about 10 percent, the economy isn’t strong enough to permit of any serious domestic price inflation any time soon. Until unemployment declines, the dollar can remain weak for an extended period without significant increases in retail prices.

Chart pattern trading techniques

The ability to read chart patterns is one of the most important skills a trader or investor can own. By a skillful application of chart reading methods, you eliminate the need for countless hours of scouring the balance sheets of companies for potential investment quality stocks. Good chart reading skills empower you to focus on stocks that have the best prospects for generating investment returns for short- or intermediate-term trading. For those with a fundamental approach, basic chart reading skills can also give you a “leg up” in identifying stocks with investment quality potential, which can then be supplemented by sound fundamental analysis.

While there are many resources available for learning how to read chart patterns, most are just repetitions of the simplistic techniques taught by the pioneers of technical market analysis, Edwards & Magee. This basic form of chart reading is a good place to start, but it won’t enable you to achieve maximum success in selecting the highest returning trading opportunities in the stock market. For that, you need something extra, namely the ability to gauge whether the stock you wish to trade has internal momentum in its favor or not. This is the “missing ingredient” in most forms of chart pattern analysis and it explains why most chart readers experience only sporadic success at best.

In my book, “How to Read Chart Patterns for Greater Profits,” I explain how to make internal momentum work for you and how to integrate momentum analysis with sound chart reading techniques. The techniques revealed in this book will put you in the driver’s seat and will help you to profit from the many opportunities awaiting you in the financial markets. Stock trading is a sure road to achieving capital gains, but only if you know how to read and act on the market’s signals. “How to Read Chart Patterns for Greater Profits” will put you on the path to success in the market and will give you a huge advantage over the average trader.

The book was written so that retail traders might be able to understand and practically apply these useful methods of market analysis. The book is now available for sale at:

http://www.clifdroke.com/books/readingchartpatterns.mgi

Order today to receive your autographed copy and a FREE 1-month trial subscription to the Gold Strategies Review newsletter. Published each week, the GSR newsletter uses the method described in this book for making profitable trades among the actively traded gold mining shares.

By Clif Droke

www.clifdroke.com

Clif Droke is the editor of the daily Gold & Silver Stock Report. Published daily since 2002, the report provides forecasts and analysis of the leading gold, silver, uranium and energy stocks from a short-term technical standpoint. He is also the author of numerous books, including 'How to Read Chart Patterns for Greater Profits.' For more information visit www.clifdroke.com

Clif Droke Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.