Gold Rises to Near Record Nominal Highs in British Pounds but Lags in Euros

Commodities / Gold and Silver 2010 Oct 06, 2010 - 11:18 AM GMTBy: GoldCore

All currencies except for the yen have fallen against gold today. The dollar and sterling have sold off again and the dollar is looking technically vulnerable at 77.61 on the US Dollar Index. Currency markets continue to be the primary focus of markets with growing concerns about competitive currency devaluations. The IMF is now warning of currency wars and the increasing vulnerability of the global financial system.

All currencies except for the yen have fallen against gold today. The dollar and sterling have sold off again and the dollar is looking technically vulnerable at 77.61 on the US Dollar Index. Currency markets continue to be the primary focus of markets with growing concerns about competitive currency devaluations. The IMF is now warning of currency wars and the increasing vulnerability of the global financial system.

Gold is currently trading at $1,344.30/oz, €969.14/oz, £847.60/oz.

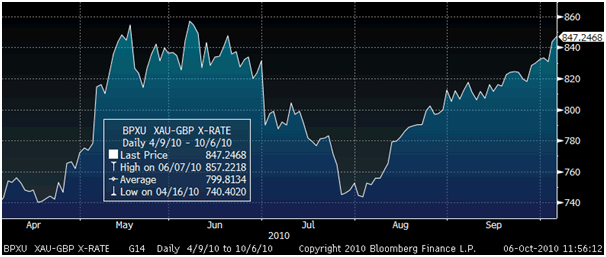

Gold in GBP - 6 Months (Daily).

Printing money and inflation of the currency is a short term panacea but the medicine may in the long term do more damage than good. This will motivate more defensive investors to allocate more funds to gold.

Gold's recent rise has been primarily a function of the recent fall in the dollar and to a lesser extent sterling's fall against the euro and other currencies (see charts). Gold has also been strong in sterling and may challenge the record nominal sterling high of £857.22/oz in the coming days on further sterling weakness.

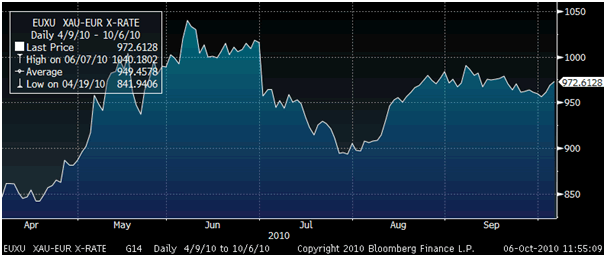

Gold in Euros - 6 Months (Daily).

Gold remains well below its euro high of €1,040.18/oz and actually fell in euro terms in September. The euro will likely fall again versus gold in the coming months when the euro again comes under pressure due to a continuation, and possible deterioration, of the bank and sovereign debt crisis.

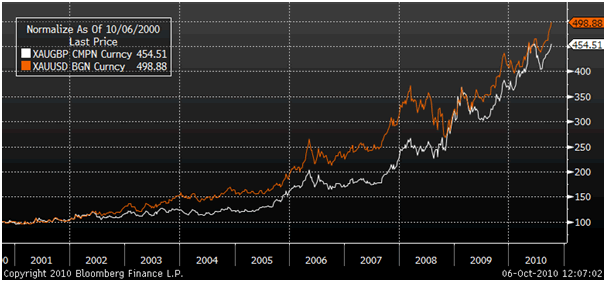

Gold in USD and GBP - 10 Year (Weekly).

The spectre of competitive currency devaluations loomed large for some months but were only recognised by many market participants and commentators recently. Similarly, today the threat of trade wars and capital controls is increasing but remains unacknowledged. The present macroeconomic and monetary conditions are likely to lead to a continuation and possibly a deepening of gold's bull market in all fiat currencies. However, gold is not rising in value - rather fiat currencies are being devalued and are falling against the finite currency and monetary reserve that is gold.

Silver

Silver is currently trading at $22.86/oz, €16.48/oz and £14.41/oz.

Platinum Group Metals

Platinum is trading at $1,697.25/oz, palladium is at $584/oz and rhodium is at $2,175/oz.

This update can be found on the GoldCore blog here.

Mark O'Byrne

Director

IRL |

UK |

IRL +353 (0)1 632 5010 |

WINNERS MoneyMate and Investor Magazine Financial Analysts 2006

Disclaimer: The information in this document has been obtained from sources, which we believe to be reliable. We cannot guarantee its accuracy or completeness. It does not constitute a solicitation for the purchase or sale of any investment. Any person acting on the information contained in this document does so at their own risk. Recommendations in this document may not be suitable for all investors. Individual circumstances should be considered before a decision to invest is taken. Investors should note the following: Past experience is not necessarily a guide to future performance. The value of investments may fall or rise against investors' interests. Income levels from investments may fluctuate. Changes in exchange rates may have an adverse effect on the value of, or income from, investments denominated in foreign currencies. GoldCore Limited, trading as GoldCore is a Multi-Agency Intermediary regulated by the Irish Financial Regulator.

GoldCore is committed to complying with the requirements of the Data Protection Act. This means that in the provision of our services, appropriate personal information is processed and kept securely. It also means that we will never sell your details to a third party. The information you provide will remain confidential and may be used for the provision of related services. Such information may be disclosed in confidence to agents or service providers, regulatory bodies and group companies. You have the right to ask for a copy of certain information held by us in our records in return for payment of a small fee. You also have the right to require us to correct any inaccuracies in your information. The details you are being asked to supply may be used to provide you with information about other products and services either from GoldCore or other group companies or to provide services which any member of the group has arranged for you with a third party. If you do not wish to receive such contact, please write to the Marketing Manager GoldCore, 63 Fitzwilliam Square, Dublin 2 marking the envelope 'data protection'

GoldCore Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.