Bank Excess Reserves Have to Decline for Fed Policy to be Successful

Interest-Rates / Quantitative Easing Oct 06, 2010 - 04:52 AM GMTBy: Asha_Bangalore

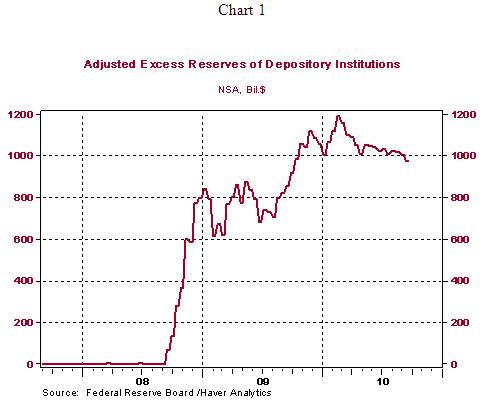

The nature of recent Fed rhetoric has raised the probability of a second round of quantitative easing (QE) as early as the November 2-3 FOMC meeting. New York Fed President Dudley's speech on October 1 makes a case for this action. Irrespective of Fed action on November 3, excess reserves of the banking system have to decline noticeably for self-sustained robust economic growth to occur. Excess reserves of the banking system, stood at $976 billion for the week ended September 22 and are down from a high of 1.192 trillion (see chart 1) in February 2010. Ideally, excess reserves have to be a negligible entity.

Excess reserves shot up after the collapse of Lehman Brothers in September 2008 and continue to hold at an elevated level. The Fed's job will be accomplished when excess reserves are converted to loan extensions by banks.

ISM Non-Manufacturing Survey Contains Bullish Elements

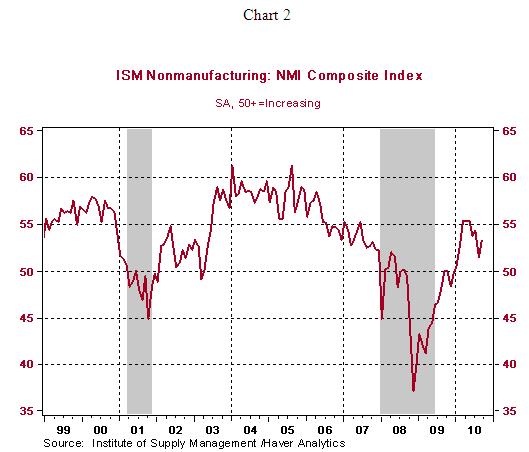

The ISM non-manufacturing survey results of September show pockets of strength. The composite index increased to 53.2 in September from 51.5 in the prior month. Indexes tracking new orders rose to 54.9 in September vs. 52.9 in August. The employment index advanced to 50.2 in September from 48.2 in the prior month, while the supplier deliveries index also increased to 55.0 from 51.0 in July.

Asha Bangalore — Senior Vice President and Economist

http://www.northerntrust.com

Asha Bangalore is Vice President and Economist at The Northern Trust Company, Chicago. Prior to joining the bank in 1994, she was Consultant to savings and loan institutions and commercial banks at Financial & Economic Strategies Corporation, Chicago.

The opinions expressed herein are those of the author and do not necessarily represent the views of The Northern Trust Company. The Northern Trust Company does not warrant the accuracy or completeness of information contained herein, such information is subject to change and is not intended to influence your investment decisions.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.