The Silent Stock Market Crash, Dow Continues Slide vs. Gold

Commodities / Gold and Silver 2010 Oct 05, 2010 - 03:15 PM GMTBy: Tarek_Saab

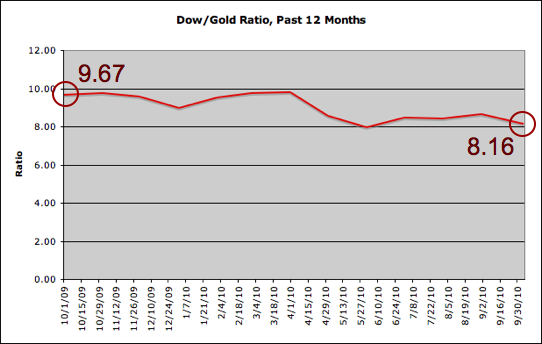

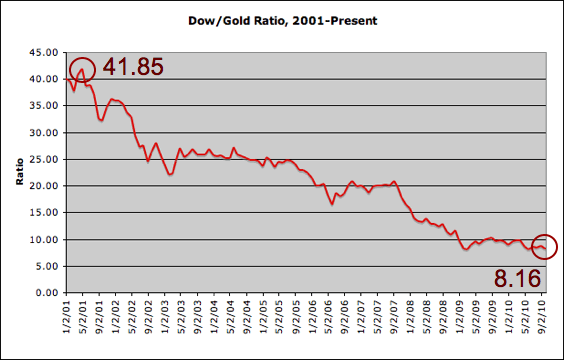

Rise in equities got ya bullish? Be cautious. Amidst the October push to 11,000, the Dow Jones Industrial Average has continued its calamitous descent against gold which began in 2001 and shows no signs of abating. The silent market crash is real, and the fall of this paper tiger is surreptitiously ferocious.

Rise in equities got ya bullish? Be cautious. Amidst the October push to 11,000, the Dow Jones Industrial Average has continued its calamitous descent against gold which began in 2001 and shows no signs of abating. The silent market crash is real, and the fall of this paper tiger is surreptitiously ferocious.

As I wrote earlier this year, gold is not an investment. Gold is money - real money (See: Aristotle). Today, the rise in the Dow is being shown for what it really is - a crash - by that golden bedrock of monetary stability.

In the past 10 years, gold has fallen in nominal value sharply at times. In 2008, it plummeted over 20% in six months. It may happen again. But the real statistic worth measuring is purchasing power.

Gold's real value is determined not in the price of a fiat currency, but as a ratio to other assets. The Dow/Gold ratio simply determines how many ounces of gold it takes to purchase one Dow Jones Industrial Index. Whether the economy suffers through deflation or hyperinflation, it's the purchasing power that matters.

Dow/Gold Ratio

I follow the Dow/Gold ratio closely as a measure of equity strength. It is worth noting that, in the two most difficult economic periods in the past one hundred years, the Dow/Gold Ratio approached 1. As of today it sits at 8.16.

July 1932 - Deflationary Depression

Dow 41.22, Gold $20.67

Ratio: 1.99

January 1980 - Inflation

Dow 872, Gold $850

Ratio: 1.03

Will the gold price catch the Dow to the upside as a result of hyperinflation, or will the Dow plummet towards the gold price in a deflationary vacuum? There are well-qualified arguments for each scenario. Regardless of direction, what we do know is that the ratio is narrowing - and fast!

'Til next time, that's my Saab Story.

By Tarek Saab

Website: trustedbullion.com E-mail: tarek@trustedbullion.com

Tarek Saab is an entrepreneur, speaker, and nationally syndicated author. He is the founder of Saab & Company Inc., which owned the online bullion business, Guardian Commodities, before it was acquired by Trusted Bullion in August 2010. An avid precious metals enthusiast, his column, Saab Stories, is published on this site and syndicated on many others.

Tarek rose to fame as a popular contestant on Season Five of The Apprentice with Donald Trump. He has been prominently featured in such magazines as Us Weekly, TV Guide, People, Enigma, In Touch Weekly, The Dallas Business Journal, The Fort Worth Business Journal, Digital Gold Currency Magazine, The Mensa Bulletin and numerous other print and online publications.

© 2010 Copyright Tarek Saab - All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.