The Fed Is Selling Paper Gold And Buying Physical Gold

Commodities / Gold and Silver 2010 Oct 04, 2010 - 04:19 PM GMTBy: Rob_Kirby

[the good ole ‘American way’ – through proxies] A couple of weeks ago, I pitched an idea to some associates of mine who are involved in SERIOUS [tonnage] PRECIOUS METALS procurement – physical metal only – let’s just say HUGE money. I asked them if they would be interested in purchasing an “option” – cash up front - for the exclusive rights [first right of refusal on off-take] of a gold producer [miner] for a set number of ounces for 3 – 5 years “at the market” – using LBMA pricing [a.m. / p.m. fixes] in the future. The answer I got back from my associates was “show us a terms sheet, we definitely have interest”.

[the good ole ‘American way’ – through proxies] A couple of weeks ago, I pitched an idea to some associates of mine who are involved in SERIOUS [tonnage] PRECIOUS METALS procurement – physical metal only – let’s just say HUGE money. I asked them if they would be interested in purchasing an “option” – cash up front - for the exclusive rights [first right of refusal on off-take] of a gold producer [miner] for a set number of ounces for 3 – 5 years “at the market” – using LBMA pricing [a.m. / p.m. fixes] in the future. The answer I got back from my associates was “show us a terms sheet, we definitely have interest”.

So, I spoke to a friend who is very close to an intermediate producer who is in the mode of raising money right now. I had them ask the producer if they would have interest – the producer said, “YES, we are interested - but just to let you know – J.P. Morgan has been asking us if we would sell them the same option”. So, while gold producers have shuttered their “gold hedge books” – the Bullion Banks are ‘synthetically’ trying to keep physical output captive – I would suggest FOR THE EXPRESSED REASON THAT THEY SELL EVERY PHYSICAL OUNCE AT LEAST 100 TIMES OVER.

Gold is going to get EXTREMELY scarce in the future folks. Big money interests are now cutting off [or bidding for / gaining exclusive access to] the traditional bullion supply chain “at the pit”.

The shorts of ‘paper gold’ at J.P. Morgan [the Fed in drag] are selling the daylights out of the paper market and simultaneously buying exclusive rights to producers’ future production so they can try to fudge their way through an unmitigated fraud and settle a big enough chunk of their bad bets to keep this ‘systemically ruinous’ precious metals ponzi-scheme alive.

Price of Gold and Interest Rates Are Joined at the Hip

The academic research that outlines the inter-relatedness of gold and interest rates is succinctly laid out in a 2001 treatise, Gibson's Paradox Revisited, by Reg Howe. From this one can deduct that ANY rigging of the gold price must go hand-in-hand with simultaneous rigging of interest rates.

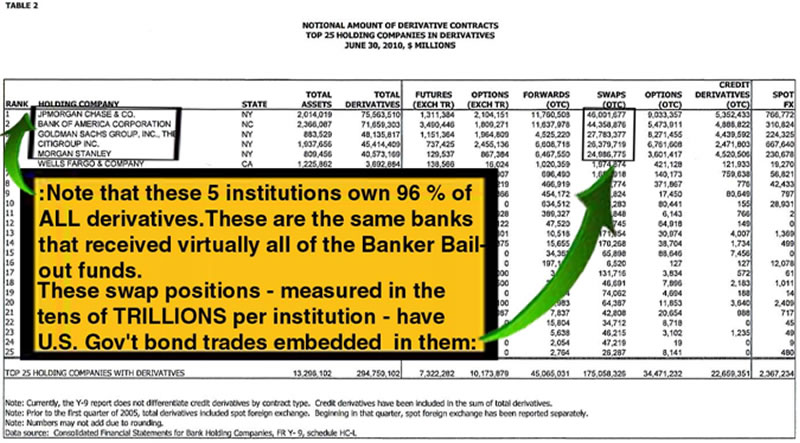

Folks would do well to realize how neatly emerging details of Fed surrogate Morgan’s ‘stealth’ activity in the bullion market dovetails with their obscene, obsequious activity elsewhere in their derivatives book – particularly their JUMBO TRILLIONS sized interest rate swap positions.

Stealth activity on the part of the Fed – utilizing proxy institutions to generate limitless artificial demand for any and all U.S. Government Debt – effectively gives the Fed control of the long end of the interest rate curve [the bond market].

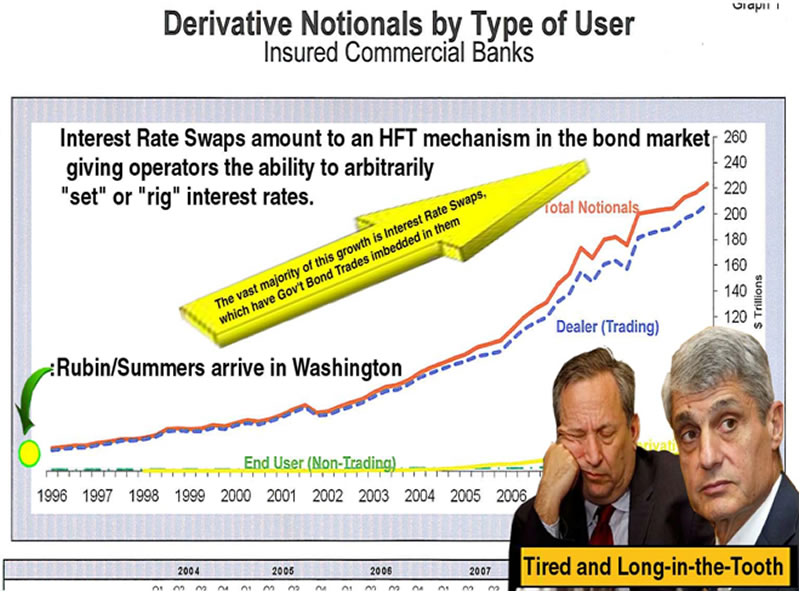

From a timing perspective, it is also noteworthy that gold price rigging – long maintained by GATA – is alleged to have begun in earnest during the Clinton Administration with the appointment of Robert Rubin as U.S. Treasury Secretary [along with understudy Lawrence Summers] in Jan. 1995. Coincidentally [or perhaps not?] we can trace the genesis of the “explosion” in the use of derivatives [mostly interest rate] to that exact same time frame. In fact, if we follow the time line in ‘reverse’ – the growth in the use of derivatives appears like a trail of bread crumbs – right back to the time when Professor Lawrence Summers, under the tutelage of Sir Robert of Rubin, brought his academic alchemy to Washington:

Does anyone with a pulse really believe that ANY Bank Holding Company in the U.S. would be permitted to have a derivatives position in excess of 75 TRILLION [five times the size of U.S. GDP] if they were not ‘in bed’ with the FED????

If you except the premise that, “J.P. Morgan “is” the Fed”, then, “IT’S REALLY THE FED WHO IS BUYING GOLD” and they [unfortunately, this means “America”] likely have NONE LEFT to sell.

NOTHING could be more bullish for the price of gold going forward.

Everyone needs to get it through their heads; these criminals are NOT IN IT for profits. The survival of our “BROKEN FIAT MONEY SYSTEM” “IS” their only goal.

Conclusions:

Officialdom will never admit it and it will NEVER be reported in the mainstream financial news but our financial system has NEVER been in a more precarious state. A banking crisis of unparalleled proportions is coming – probably soon – the exact timing is still sketchy.

Got physical precious metal yet?

By Rob Kirby

http://www.kirbyanalytics.com/

Rob Kirby is proprietor of Kirbyanalytics.com and sales agent for Bullion Custodial Services. Subscribers to the Kirbyanalytics newsletter can look forward to a weekend publication analyzing many recent global geo-political events and more. Subscribe to Kirbyanalytics news letter here. Buy physical gold, silver or platinum bullion here.

Copyright © 2010 Rob Kirby - All rights reserved.

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any trading losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors before engaging in any trading activities.

Rob Kirby Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.