Stock Market SPX Topping Pattern Appears Complete

Stock-Markets / Financial Markets 2010 Oct 02, 2010 - 09:49 AM GMT FDIC Has Another Slow Week. -

The FDIC Failed Bank List announced two new bank closures this week. Lenders in Florida and Washington collapsed today, pushing the number of U.S. bank failures to 129 for the year, as financial firms suffer losses on loans tied to real estate.

FDIC Has Another Slow Week. -

The FDIC Failed Bank List announced two new bank closures this week. Lenders in Florida and Washington collapsed today, pushing the number of U.S. bank failures to 129 for the year, as financial firms suffer losses on loans tied to real estate.

Bank Of America Joins JPMorgan And Ally In Admitting It Never Validated Foreclosures Docs

(ZeroHedge) The third major bank joins JPM and Ally, which have already halted foreclosures, in admitting that one of its officials "signed up to 8000 foreclosure documents a month and typically didn't read them." Which means Bank of America is about to halt its foreclosure process. Which leaves us with the last big mortgage lender: Wells Fargo, which is quietly doing the opposite. As American Banker reports, Wells is actually curtailing extensions on residential short sales, in a last ditch attempt to accelerate the foreclosure process before it also falls under the spotlight of fraudulent foreclosure disclosure.

Bernanke's “All In"

(ZeroHedge) Bernanke had this to say about the employment situation yesterday:

“We need to do our part to help the economy recover” and ensure job growth in the U.S The labor market is growing “too slowly,”

What does that mean???

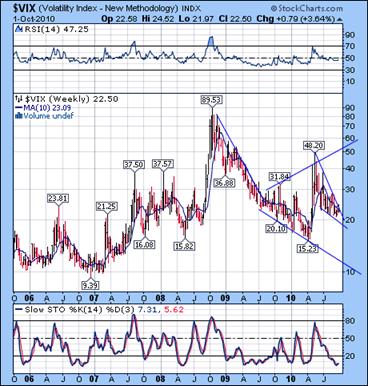

The VIX has attempted a breakout of the wedge fromation.

--This week the VIX retested the upper trendline of its bullish Wedge formation before falling back. It is now poised for an explosive move above the Wedge, likely to be stronger than the break above Resistance it made in April. The low expected in the VIX last week surprisingly did not happen as it remained in the upper portion of the wedge. The quarter is ended and there is no reason to suppress the Vix any longer.

--This week the VIX retested the upper trendline of its bullish Wedge formation before falling back. It is now poised for an explosive move above the Wedge, likely to be stronger than the break above Resistance it made in April. The low expected in the VIX last week surprisingly did not happen as it remained in the upper portion of the wedge. The quarter is ended and there is no reason to suppress the Vix any longer.

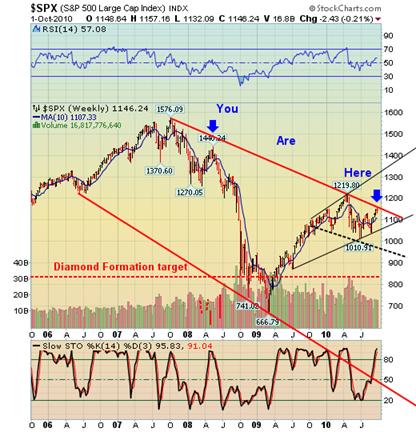

SPX Diamond Top appears complete.

The SPX pushed the rally another seven points on Wednesday, but fell back into its trading range of the prior week. The Diamond Formation appears to be the dominant pattern and I have adjusted the target accordingly.

The SPX pushed the rally another seven points on Wednesday, but fell back into its trading range of the prior week. The Diamond Formation appears to be the dominant pattern and I have adjusted the target accordingly.

Last weekend I did a comparison of the Flash Crash and subsequent rally to the initial decline from the 2007 high for subscribers. The comparison is striking. The rally from the March low in 2008 was 14.58% while this rally from the July 1 low was 14.47%.

The Diamond Formation suggests a swift decline through 1060 to its target.

The NDX seeks wave relationships.

--Upon closer examination, the NDX formation appears to be a Diamond Formation, although it is a bit skewed. I dug a little deeper into the similarities between the current pattern and that of 2007-2008.

--Upon closer examination, the NDX formation appears to be a Diamond Formation, although it is a bit skewed. I dug a little deeper into the similarities between the current pattern and that of 2007-2008.

The initial decline into the March 2008 low was 25.5%. The subsequent rally into the May high was 23.2%. The Flash Crash decline was 17.45%, while the subsequent rally has been 19.39%. You will notice that, although the rally was a larger percentage, the rally high is still below the April high. Interesting.

Gold met its upper trendline.

-- Gold has finally met its upper trendline and very nearly met its Head & Shoulders target as well. Tom Bulkowski, in his Encyclopedia of Chart Patterns (P. 262), tells us that an inverted Head & Shoulders pattern has an 83% probability of reaching its target. That suggests yet another probe to 1334 early in the week before the reversal.

-- Gold has finally met its upper trendline and very nearly met its Head & Shoulders target as well. Tom Bulkowski, in his Encyclopedia of Chart Patterns (P. 262), tells us that an inverted Head & Shoulders pattern has an 83% probability of reaching its target. That suggests yet another probe to 1334 early in the week before the reversal.

The wave 4 low at 681 is near the 61.8% retracement of the uptrend since 1999. If it can stay above that level by next summer, it may just go higher in the subsequent recovery.

$WTIC may have finished a strong retracement this week.

-- $WTIC has completed an 89% retracement of its August decline. This abnormally large and unexpected extension was likely due to the excess liquidity needed to keep equities afloat through the end of quarter. This has formed yet another Diamond Formation with a minimum target of 66.30.

-- $WTIC has completed an 89% retracement of its August decline. This abnormally large and unexpected extension was likely due to the excess liquidity needed to keep equities afloat through the end of quarter. This has formed yet another Diamond Formation with a minimum target of 66.30.

I’ll also be monitoring the Head & Shoulders pattern that has an even lower target in conjunction with the Broadening Top formation which is a crash formation. The reversal should be evident in the coming week.

The Bank Index remains stalled at the 10-week moving average.

--The $BKX hasn’t moved much this week, although it has made a reversal pattern in the daily chart. The Elliott wave pattern has a (i)-(ii), i-ii wave count on wave 3, which points to an extended wave just ahead.

--The $BKX hasn’t moved much this week, although it has made a reversal pattern in the daily chart. The Elliott wave pattern has a (i)-(ii), i-ii wave count on wave 3, which points to an extended wave just ahead.

Earnings season begins with a vengeance this week. Things do not look good for their trading margins, resulting in the proprietary trading desks being shut down or moved. Those are the guys that have been taking the other side of our trades. The problem is, there have been so many mutual fund withdrawals and hedge fund shrinkage ant the margins are dwindling rapidly.

The Shanghai Index above its 10-week M.A.

--The Shanghai Index appears to have gathered some strength. If it remains above its 10-week moving average, it could easily rally to its 50% retracement level before joining the rest of the world’s stock indexes.

--The Shanghai Index appears to have gathered some strength. If it remains above its 10-week moving average, it could easily rally to its 50% retracement level before joining the rest of the world’s stock indexes.

I am not trying to make predictions. I am only observing that the Shanghai cycle is far different than our own stock cycle.

It may be important to watch money flows in the next month. If the Shanghai index remains stronger than the other major indices, we may see more capital flowing there in the next bull market phase starting next year.

$USB passed the test at Trend support.

-- $USB appears to have successfully tested the 10-week moving average and trendline support for another rally higher. Whatever the Fed has been doing to prop up the Treasuries, the stock market will surely follow with a flight to safety as equities decline. Combine this with the Currency Catfight and we have an opportunity for bonds to rally much higher than the normal target at 142.00.

-- $USB appears to have successfully tested the 10-week moving average and trendline support for another rally higher. Whatever the Fed has been doing to prop up the Treasuries, the stock market will surely follow with a flight to safety as equities decline. Combine this with the Currency Catfight and we have an opportunity for bonds to rally much higher than the normal target at 142.00.

This rally is already approaching parabolic proportions. I currently have no idea how high the rally may go. Prechter suggests interest rates may drop to 0%. Could that be possible?

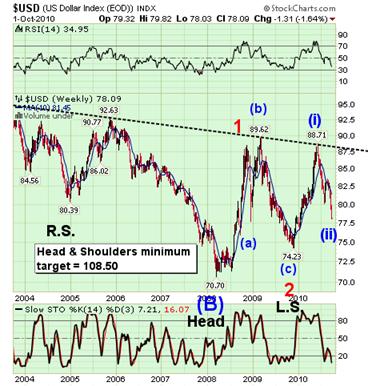

$USD drops lower, currency devaluation a new trend?

-- $USD extended its decline to the 74% retracement level this week. There seems to be a groundswell in the wave of competitive currency devaluation this week. Congress has passed the equivalent of the Smoot-Hawley tariff act this week. Luckily, the Senate won’t consider it until next year.

-- $USD extended its decline to the 74% retracement level this week. There seems to be a groundswell in the wave of competitive currency devaluation this week. Congress has passed the equivalent of the Smoot-Hawley tariff act this week. Luckily, the Senate won’t consider it until next year.

While the news media isn’t saying much about the actions of other countries to devalue their currencies, you can be sure that they will find a way to push back.

I hope you all have a wonderful weekend!

Regards,

Tony

Traders alert: The Practical Investor is currently offering the daily Inner Circle Newsletter to new subscribers. Contact us at tpi@thepracticalinvestor.com for a free sample newsletter and subscription information.

Our Investment Advisor Registration is on the Web

We are in the process of updating our website at www.thepracticalinvestor.com to have more information on our services. Log on and click on Advisor Registration to get more details.

If you are a client or wish to become one, please make an appointment to discuss our investment strategies by calling Connie or Tony at (517) 699-1554, ext 10 or 11. Or e-mail us at tpi@thepracticalinvestor.com .

Anthony M. Cherniawski, President and CIO http://www.thepracticalinvestor.com

As a State Registered Investment Advisor, The Practical Investor (TPI) manages private client investment portfolios using a proprietary investment strategy created by Chief Investment Officer Tony Cherniawski. Throughout 2000-01, when many investors felt the pain of double digit market losses, TPI successfully navigated the choppy investment waters, creating a profit for our private investment clients. With a focus on preserving assets and capitalizing on opportunities, TPI clients benefited greatly from the TPI strategies, allowing them to stay on track with their life goals

Disclaimer: The content in this article is written for educational and informational purposes only. There is no offer or recommendation to buy or sell any security and no information contained here should be interpreted or construed as investment advice. Do you own due diligence as the information in this article is the opinion of Anthony M. Cherniawski and subject to change without notice.

Anthony M. Cherniawski Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.