China PMI Cheers Stock Markets While PIGS Fly Tighter

Stock-Markets / Stock Markets 2010 Oct 01, 2010 - 08:39 AM GMTBy: PaddyPowerTrader

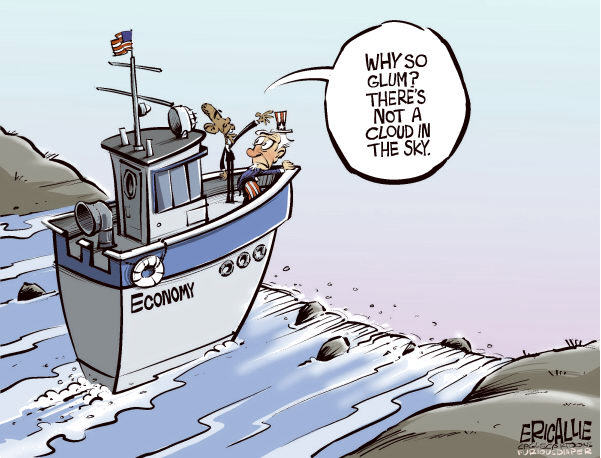

US macro data sent the markets higher initially Thursday (GDP beat 1.7% v 1.6% cons; Chicago PMI 60.4 v 55.5 cons; weekly jobless data was also better), with the S&P500 breaking through the 1150 mark to new highs. However, the break did not last long as the futures desk’s month end flow was better to sell (the chatter from the US was that asset allocators were going to have to dump equities on the close given the outperformance of equities in September). The selling pressure eroded the majority of macro-led gains, leading to a finish in negative territory on the day.

US macro data sent the markets higher initially Thursday (GDP beat 1.7% v 1.6% cons; Chicago PMI 60.4 v 55.5 cons; weekly jobless data was also better), with the S&P500 breaking through the 1150 mark to new highs. However, the break did not last long as the futures desk’s month end flow was better to sell (the chatter from the US was that asset allocators were going to have to dump equities on the close given the outperformance of equities in September). The selling pressure eroded the majority of macro-led gains, leading to a finish in negative territory on the day.

European equity markets have opened higher this morning despite yesterday’s late day sell off and lower closes in the US overnight. Data out of China in the form of PMI manufacturing showed its strongest gain in 4-months and highlights the strength in the economy. It also confirms a positive outlook in particular for the mining sector e.g. Antofagasta, Rio Tinto and BHP Billiton. On the currency side the Euro is approaching the €1.37 level against the dollar. With an imminent announcement of further quantitative easing and issues in peripheral Europe being put on the back burner for now (with Irish, Greek and Portuguese yields continuing to tighten like bandits) the dollar will continue to remain weak.

Does Good Friday Follow Black Thursday ?

Yesterday marked a critical point in the future of the Irish banking system with a credible recapitalisation strategy being announced by the Minister of Finance. The plan, while being more severe than expected, was broadly welcomed by the markets and Irish spreads – both sovereign and financials – rallied over the course of the day. Any suggestion that Ireland may have to call on the EFSF or the IMF has been continually denied in recent weeks by a number of Irish and international bodies and confirmation of this yesterday, from IMF chief Dominique Strauss-Kahn and CEO of the EFSF Klaus Regling, should offer comfort in this regard.

Focus is likely to turn now towards December’s Budget with the Minister of Finance reiterating that Ireland is “committed” to achieving a Budget Deficit as a % of GDP below 3% by 2014. While Department of Finance growth forecasts are likely to be reduced for the next 4 years, a combination of increased spending cuts or increased taxation looks set to continue for the coming years.

Today’s Market Moving Stories

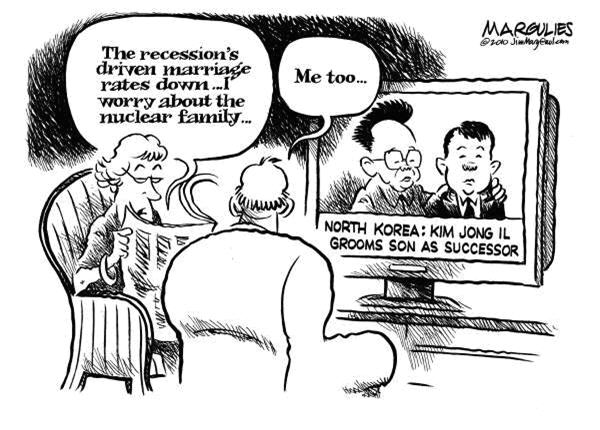

UK: Citing the BOE’s Credit Conditions Survey, the Telegraph writes that UK lending conditions are about to become even more difficult. It said ‘Tougher rules because of fears that higher unemployment will result in more home owners defaulting on loans … it will make it even harder for first-time buyers to get on to the property ladder, while those who need to renew their mortgages are likely to be offered less attractive deals’

And September’s UK CIPS/Markit report on manufacturing suggests that industrial recovery is continuing to lose momentum. The drop in the composite PMI from (a downwardly revised) 53.7 to 53.4 was the fourth monthly fall in a row and left the index at its lowest level since last November. Meanwhile, the further fall in the output balance, from 55.8 to 54.5, means that it is now broadly consistent with quarterly growth in manufacturing output of less than 0.5% – a far cry from the 2% plus gains achieved earlier this year. The new export orders balance also fell – to below the 50 expansion/contraction mark. And although the overall orders balance rose, the increase reversed only a fraction of September’s huge drop. Pretty disappointing stuff. At least the CBI Industrial Trends Survey has remained more upbeat. Nonetheless, today’s survey adds to other evidence suggesting that the economic recovery is fading fast.

Germany: Against expectations, German retail sales declined (in volumes, excluding motor vehicles) 0.2% m/m in August, printing the second consecutive monthly fall. On an annual basis, though, sales rose 3.3% y/y from 2.2% y/y previously. The consensus had expected an increase in the month (consensus: 0.4% m/m).

Wheat: The potential for Russia’s wheat crop in 2011 might be worse than expected because late planting has shortened the growing season before the onset of winter agricultural forecaster Martell Crop Projections said. Wheat in the Volga Federal District’s Saratov region should have been planted by September 1st to give the grain enough time to develop hardiness against winter cold.

USD: The FT cites US Treasury secretary Tim Geithner as saying that the CNY is on track for significant appreciation against the USD and that there would be no “trade war” or “currency war” between the US and China.

US: Cleveland Fed President, Sandra Pianalto, said that US growth is currently too slow to significantly reduce the “stubbornly high” unemployment rate and that inflation is “too low”, noting that at under 2%, it is below the 2% level that she sees as consistent with the Fed’s longer-term objective of price stability.

Euro-zone: The Xinhua news agency reports that Chinese Premier Wen Jiabao is to give a “vote of confidence” in Greece’s economy when he visits the country. Chinese Ambassador to Greece Luo Linquan told Xinhua that Wen’s visit “will again send a clear signal to the world that China has made a vote of confidence in Greece’s economic prospects, and is taking practical actions to support Greece, the EUR and the EU to escape from crisis as soon as possible and achieve a steady recovery”.

Meanwhile Greek Prime Minister George Papandreou also told Xinhua that “If we had wanted to default, we would have done that. That would have been a decision we had made initially. But we made another decision, a decision not to default”.

The ECB’s Ewald Nowotny tells Wirtschaftswoche that the ECB will continue buying government bonds as long as there are inefficiencies in the markets.

Nowotny also added that markets were exaggerating the risk premiums on government bonds in many countries.

Asia: The official Chinese manufacturing PMI rose to 53.8 in September from 51.7 in August – far above the consensus forecast of 52.0

Japanese finance minister Yoshihiko Noda tells a news conference “We will take decisive steps [to cap JPY strength] when necessary going forward”.

Prime minister Naoto Kan has called for multi-party tax reform talks having warned that “If the current fiscal situation is left alone, it will be unsustainable at some point”. Kan added that tax reform must also include the sales tax, but assured that he would seek a mandate from voters before deciding on any rise. Kan also repeated his resolve to curb a rise in the JPY.

Core consumer prices fell on a year-on-year basis for the 18th consecutive month in August. The unemployment rate also fell to 5.1% in August from 5.2%. And finally the government’s survey of household spending showed a rise of 1.7% y/y compared with a consensus forecast of +1.3%.

Technically Speaking

S&P had topped out at the 1150 area on 5 separate occasions over the last week or so and although we are trading above this area I would say that currently technicals are not supporting a break through this area. Bull channel resistance comes in at 1155 on the day and we have declining daily RSI & Momentum suggesting that further upside is unlikely.

Company / Equity News

•Spanish oil giant Repsol which has jumped 5.5% on news that Chin’as Sinopec will buy new shares in the company’s Brazilian unit and will hold 40% of that division after the capital increase. Repsol will also hold the remaining 60% stake. It’s U.K. partner BG Group Plc climbed 5.2% while Sacyr Vallehermoso , which owns 20% of Repsol, surged 12%. And Galp Energia SGPS , Portugal’s biggest oil company, increased 5% .

•HSBC gained 1.5% after Goldman Sachs Group Inc. added Europe’s biggest bank to its “conviction buy” list. Analysts already rated the shares “buy” since August.

•Cap Gemini, Europe’s largest computer services provider, rallied 3.1% after Dublin-based Accenture forecast net revenue of $5.6 billion to $5.8 billion for the quarter ending November. Analysts had projected $5.62 billion, according to the average of estimates compiled by Bloomberg.

•BP’s board made comments yesterday relating to asset sales and more importantly resumption of dividends. The group is looking for another $20-25bn in asset sales with the group CEO stating the Board must decide whether to resume dividends. He believes from the performance of the business, BP will return to paying dividends.

•Hewlett-Packard has appointed the former SAP Chief Executive Leo Apotheker as CEO to succeed Mark Hurd. Given Apotheker’s software experience he will drive the group’s continued expansion in this area to further diversify the business towards areas where operating margins are stronger. Earlier this week HP raised its earnings guidance in a sign the company is seeing a strengthening business outlook and is likely to continue to increase returns to shareholders in the form of higher dividends and share buybacks.

By The Mole

PaddyPowerTrader.com

The Mole is a man in the know. I don’t trade for a living, but instead work for a well-known Irish institution, heading a desk that regularly trades over €100 million a day. I aim to provide top quality, up-to-date and relevant market news and data, so that traders can make more informed decisions”.© 2010 Copyright PaddyPowerTrader - All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

PaddyPowerTrader Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.