Agricultural Commodities, Population Growth and Black Swans

Commodities / Food Crisis Oct 01, 2010 - 03:22 AM GMTBy: Richard_Mills

In 1798 32 year-old British economist Malthus anonymously published “An Essay on the Principle of Population” and in it he argued that human population’s increase geometrically (1, 2, 4, 16 etc.) while their food supply can only increase arithmetically (1, 2, 3, 4 etc.). Since food is obviously necessary for us to survive, unchecked population growth in any one area or involving the whole planet would lead to individual pockets of humanity starving or even mass worldwide starvation.

In 1798 32 year-old British economist Malthus anonymously published “An Essay on the Principle of Population” and in it he argued that human population’s increase geometrically (1, 2, 4, 16 etc.) while their food supply can only increase arithmetically (1, 2, 3, 4 etc.). Since food is obviously necessary for us to survive, unchecked population growth in any one area or involving the whole planet would lead to individual pockets of humanity starving or even mass worldwide starvation.

"The power of population is indefinitely greater than the power in the earth to produce subsistence for man". Thomas Robert Malthus

"The power of population is indefinitely greater than the power in the earth to produce subsistence for man". Thomas Robert Malthus

Malthusian pessimism has long been criticized by doubters believing technological advancements in:

- Agriculture

- Energy

- Water use

- Manufacturing

- Disease control

- Fertilizers

- Information management

- Transportation

would keep crop production ahead of the population growth curve.

Enter the Black Swans

The Black Swan Theory or "Theory of Black Swan Events" was developed by Nassim Nicholas Taleb to explain: 1) the disproportionate role of high-impact, hard to predict, and rare events that are beyond the realm of normal expectations in history, science, finance and technology, 2) the non-computability of the probability of the consequential rare events using scientific methods (owing to their very nature of small probabilities) and 3) the psychological biases that make people individually and collectively blind to uncertainty and unaware of the massive role of the rare event in historical affairs. Black Swan Theory refers to unexpected events of large magnitude and consequence and their dominant role in history. Such events, considered extreme outliers, collectively play vastly larger roles than regular occurrences. Wikipedia

A "perfect storm" of circumstances is setting the stage for possible massive food price increases, food riots, supply chain disruptions, country versus country water disputes and increasing numbers of hungry people.

Consider:

- Record setting droughts and worldwide abnormal weather

- Exploding populations and eastern diets shifting to a western style one

- Worldwide crop failures

- Diminishing world food stocks

- Income deflation

- Flooding

- Freak cold snaps

- Aquifers are being depleted faster than natural refreshment rates

- Farmers ability to buy seeds and fertilizers was hampered during the financial crisis by a lack of credit – this limited production and then low prices towards the end of 2008 discouraged the planting of new crops in 2009

- Relocation of produce for energy production - corn for ethanol

- Desertification - new deserts are growing at a rate of 51,800 square kilometers per year. As an example Nigeria (Africa’s most populous country) is losing almost 900,000 acres of cropland per year to desertification because of increased livestock foraging and human needs

Harvests around the world are going to be smaller, the world’s food inventories are going to be lower while at the same time global demand for basic food staples - and simultaneously a richer diet containing more meat - is at an all time high and growing.

The U.N. calls the global food crisis a "silent tsunami.”

So just how bad are things around the world?

Saudi Arabia was once the world's eighth largest wheat grower but are phasing out grain production by the year 2016. The Saudis feared an embargo on grain after the 1972 oil embargo so they decided to grow their own. They farmed the desert and today have almost pumped their aquifer almost dry.

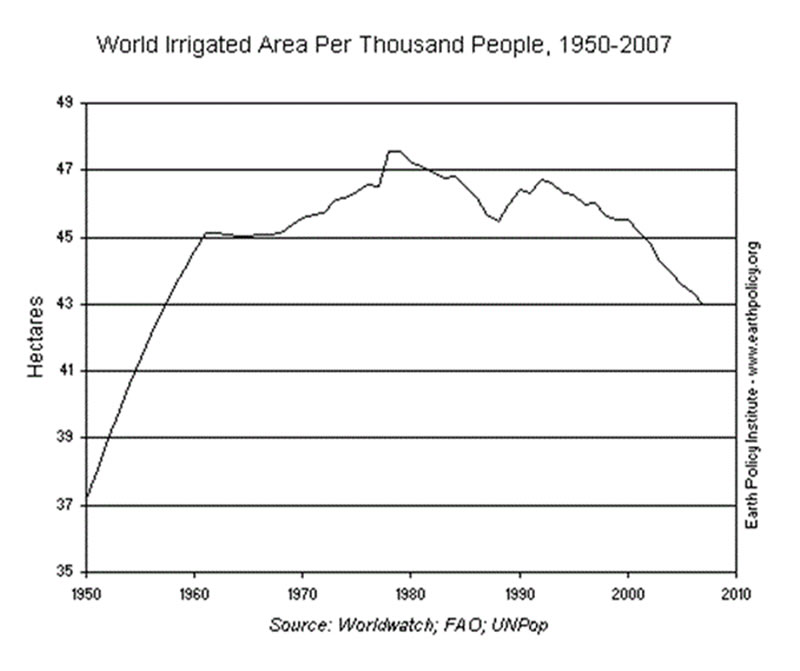

Past growth in agricultural production was fueled in part by expanding irrigation

“We are entering a new food era, one marked by higher food prices, rapidly growing numbers of hungry people, and an intensifying competition for land and water resources that has now crossed national boundaries as food-importing countries try to buy or lease vast tracts of land in other countries.” Lester Brown, Earth Policy Institute

Almost biblical like droughts in Kazakhstan, Ukraine and Russia which also had to deal with brutal, massive wildfires - firefighters in Russia were battling 520 separate wheat field fires spanning over 700 miles in area.

Pakistan lost most of its stored grain in its recent flood disaster.

India has suffered its worst drought in 37 years - total rainfall is 23 percent below average. India’s monsoon rains are extremely important to the countries farmers because almost 70 percent of India's farms are not irrigated and depend on rainfall during the monsoon season.

Food prices are rising around 15% a year in India, Nepal, Latin America and China.

Corn is at its highest price in two years because of a wetter than expected US harvest and freezing weather in China and Canada. US corn prices broke through the $5-a-bushel level for the first time since September 2008.

Agriculture assistance today is 3.5 percent of overall U.S. development aid - down from 18 percent in 1979.

Emergency food aid is needed now to prevent famine in Niger, Mali, Chad, Burkina Faso, Mauritania, and northern Nigeria.

The drought in East Africa is in its fifth year, 23 million Africans in that region are on the verge of starvation.

The U.N. Food and Agriculture Organization (FAO) recently cut its 2010 global wheat forecast by 4 percent.

The FAO projects average wheat and coarse grain prices to increase 15-40% over the next ten years. Vegetable oil prices are expected to increase more than 40%, with dairy prices increasing 16-45%.

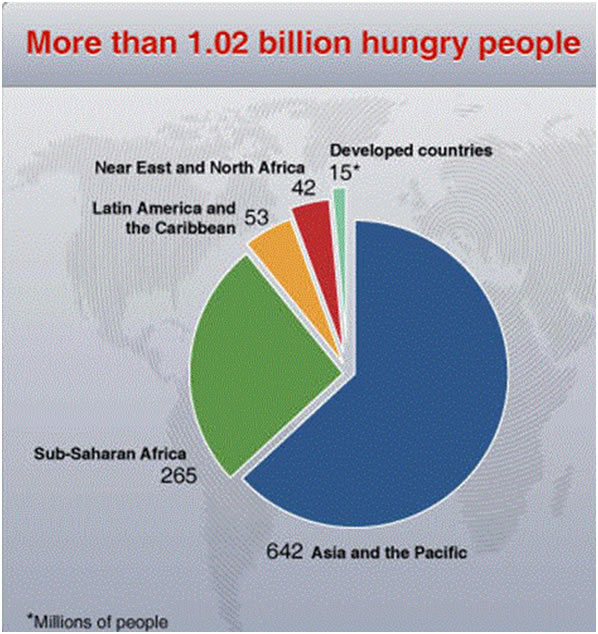

By 2050 the FAO says a 70% increase in food production will be required to keep pace with projected population growth. Already, according to the FAO, more than one billion people go to bed hungry every night.

Australia is being called the new "dust bowl" the country’s drought is so bad.

Russia, the world's fourth largest wheat producer, has imposed an export ban on grain that will stay in place till after the 2011 harvest. The ban is forcing importers in the Middle East and North Africa to turn to Europe and the US for supplies.

Germany could become reliant on wheat imports for the first time in 10 years. The winter wheat harvest will be 9% lower this year than last forcing Germany to import grain from France and the US.

White sugar is climbing in price because of speculation that India, Pakistan and other importers will purchase more as a supply deficit looms.

The FAO Food Price Index (FFPI) averaged 176 points in August 2010, up 5 percent, from July. The FFPI stands at its highest level since September 2008.

Global food prices are growing at a rate that rivals some of the worst months of 2008 – but still down 38 percent from their peak in June 2008.

Meat prices have risen because a drop in production coincided with rising demand from China. In August the FAO's meat price index climbed 16% yoy.

Lamb prices are at a 37-year high, pork and poultry are also priced higher.

Last week, the FAO called an emergency meeting for 24th September to discuss the current food crisis – just two short years after the last food crisis. The emergency meeting is being seen by many as a warning that there may yet be another food crisis looming.

As in 2008, rocketing prices are the result of rising demand and supply shortages caused by freak weather and poor harvests (Export bans in some 38 countries during the price crisis in 2007-2008 caused a dramatic drop in cereal stocks).

“If no decisive action is taken, the prices of key food commodities are likely to be 50 to 100 per cent higher by 2020 than they were at the turn of the millennium. This would dramatically increase the level of hunger and malnutrition, around the world.” Harald von Witzke, president, Humboldt Forum for Food and Agriculture

Conclusion

If a person was so inclined they could bury their head in the sand and write off all of the above as nothing more than temporary conditions impacting world food supply.

That might not be a prudent move.

Western consumers are, for all intent and purposes, totally dependent on retail food stores for their subsistence. Yet these stores have only 2 - 3 days of inventory on hand at any one time. If any kind of a short term crisis hits, let alone a massive disruption in the food supply chain, stockpiling and hoarding will quickly empty store shelves.

Too much Doom and Gloom? Perhaps, but given all of the above two things are abundantly clear to this author - firstly the era of cheap food is over and secondly a serious disruption in the food supply chain - one lasting longer than a couple of days - to a grocery store near you might become more than a temporary minor inconvenience.

Are agricultural commodities and your local grocers supply chain on your radar screen?

If not, maybe they should be.

By Richard (Rick) Mills

If you're interested in learning more about our junior markets please visit us at www.aheadoftheherd.com. Membership is free, no credit card or personal information is asked for.

Richard is host of aheadoftheherd.com and invests in the junior resource sector. His articles have been published on over 200 websites, including: Wall Street Journal, SafeHaven, Market Oracle, USAToday, National Post, Stockhouse, Casey Research, 24hgold, Vancouver Sun, SilverBearCafe, Infomine, Huffington Post, Mineweb, 321Gold, Kitco, Gold-Eagle, The Gold/Energy Reports, Calgary Herald, Resource Investor and Financial Sense.

Copyright © 2010 Richard (Rick) Mills - All Rights Reserved

Legal Notice / Disclaimer: This document is not and should not be construed as an offer to sell or the solicitation of an offer to purchase or subscribe for any investment. Richard Mills has based this document on information obtained from sources he believes to be reliable but which has not been independently verified; Richard Mills makes no guarantee, representation or warranty and accepts no responsibility or liability as to its accuracy or completeness. Expressions of opinion are those of Richard Mills only and are subject to change without notice. Richard Mills assumes no warranty, liability or guarantee for the current relevance, correctness or completeness of any information provided within this Report and will not be held liable for the consequence of reliance upon any opinion or statement contained herein or any omission. Furthermore, I, Richard Mills, assume no liability for any direct or indirect loss or damage or, in particular, for lost profit, which you may incur as a result of the use and existence of the information provided within this Report.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.