Market Tipping Points for Commodities, U.S. Dollar, Gold and Yuan

Stock-Markets / Financial Markets 2010 Sep 30, 2010 - 06:41 AM GMTNow that Summer just ends, the Summer doldrums of inactive markets abates. What is next?

One thing that concerns me is a repeat of quasi bubble peaking behavior in general commodities – as well as gold in my view, as the USD also shows a bit of weakness after a year long rally to the low 80’s on the USDX. Also of a bit of quandary is the Yuan’s strength, and a bit of competitive currency devaluation amidst the other major currencies, with the Yen peaking a bit and foreboding a further unwind of the Yen carry trade?

Or for that matter aside from the immense size of the USD around the world, what about positing the question of a USD carry trade unwind? Perhaps just before or during any new credit sovereign bond flap in the EU again? How much could the USD rally then?

Such trends appear ready to spring upon the world economies and currencies, should the Fall and Winter holiday shopping season flag due to bad US consumer sentiments, which are weakened by what appears to be a permanent US unemployment rate of around 10% officially, while really being more like 20% if you add the under employed who struggle at the poverty level.

In analytical thinking or particularly for people who try to see into the future (us), asking the right question is more than half the battle.

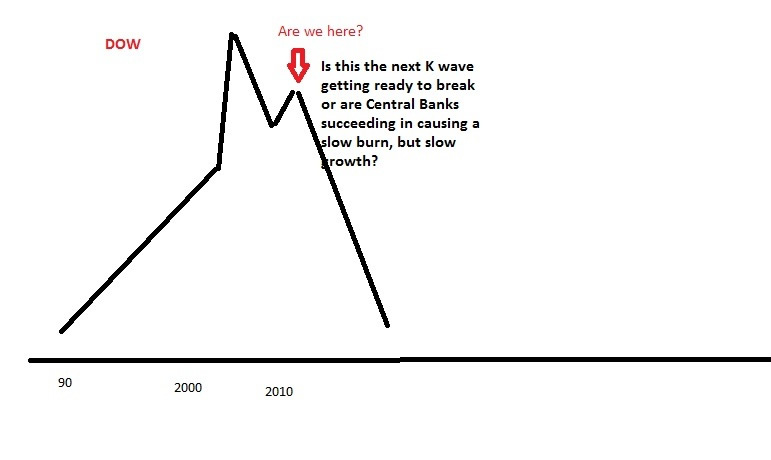

A larger question than whether the US and world stock bubble rebound from March 2009 to date is peaking is whether the large overdue Kondtratieff winter (a great depression scenario) will kick in, if only from the forced deleveraging (Yen carry trade for starters, then add real estate which has further to fall if this second stock crash happens due to the Kondratieff wave kicking in.)

This would be called forced deleveraging, or rather debt deflation (as debts are defaulted and assets dumped on the market a vicious downward price spiral begins) which would force the Fed and other central banks to use further arrows from their QE (quantitative easing or basically them just buying distressed assets at inflated prices with public money or credit in the sovereign bond markets, with the US, German, Japanese, and finally the emerging Chinese bond markets offering the stimulus).

I find it hard to imagine a Kondratieff winter being completely avoided. Rather the proscription appears to be more Central Bank meddling, which is supposed to result in a soft landing, if you can call our present employment picture soft looking.

In any case, lest we be perceived as only wealth preservation orientated, we now have some occasional stock selections, with some basic reasons for them, one being SIRI (Sirius satellite radio with great programming added each year) which is up about 20% from our suggestion several weeks ago when it was about $1.00.

But even so we warn that favorites for a longer term horizon (over a year is like an eternity now) can suffer in any initial stock crash, in which case we still just say buy it when the initial stock correction appears).

But we have strategies for longer term holds, of not only commodities or gold, but also some great tech companies which I foresee being part of the next big wave of the internet build out worldwide which is readying for another phase of super growth.

By Christopher Laird

PrudentSquirrel.com

Copyright © 2010 Christopher Laird

Chris Laird has been an Oracle systems engineer, database administrator, and math teacher. He has a BS in mathematics from UCLA and is a certified Oracle database administrator. He has been an avid follower of financial news since childhood. His father is Jere Laird, former business editor of KNX news AM 1070, Los Angeles (ret). He has grown up immersed in financial news. His Grandmother was Alice Widener, publisher of USA magazine in the 60's to 80's, a newsletter that covered many of the topics you find today at the preeminent gold sites. Chris is the publisher of the Prudent Squirrel newsletter, an economic and gold commentary.

Christopher Laird Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.