Gold Forecast Over $1,450/oz as Implications of Competitive Currency Devaluations Assessed

Commodities / Gold and Silver 2010 Sep 29, 2010 - 07:31 AM GMTBy: GoldCore

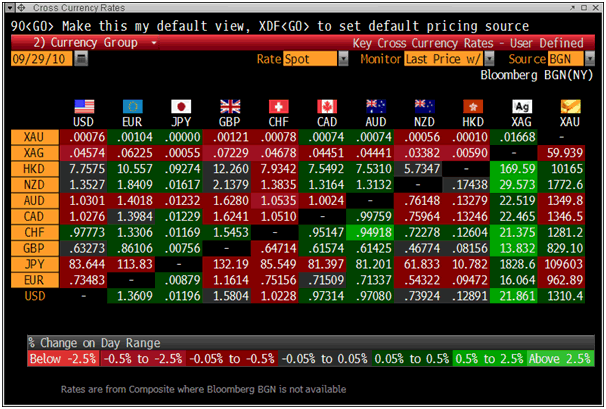

Gold has remained well bid above the $1,300/oz level and silver has risen another 0.7% and looks set to challenge the $22/oz level. Participants at the LBMA conference see gold rising to over $1,450/oz over the next year due to concerns about central banks' reaction to the economic crisis. LBMA delegates forecast silver to trade at $24/oz in 12 months time which it is a conservative estimate given the very strong technical and fundamental situation.

Gold has remained well bid above the $1,300/oz level and silver has risen another 0.7% and looks set to challenge the $22/oz level. Participants at the LBMA conference see gold rising to over $1,450/oz over the next year due to concerns about central banks' reaction to the economic crisis. LBMA delegates forecast silver to trade at $24/oz in 12 months time which it is a conservative estimate given the very strong technical and fundamental situation.

Gold is currently trading at $1,308.98/oz, €961.14/oz, £829.10/oz.

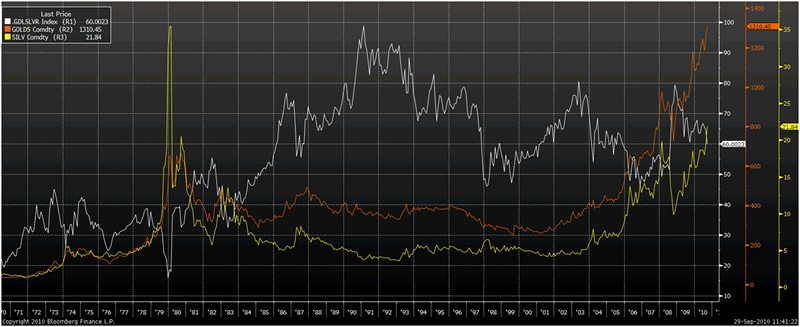

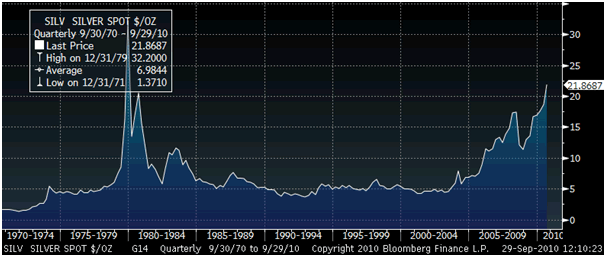

Silver looks very well technically and the gold/silver ratio has fallen to below 60 (59.84 - 1308/21.86) with 55 and 50 looking potential targets in the coming months. The relative undervaluation of silver to gold and the fact that it remains less than half of its (nominal) record price in 1980 is leading to strong demand for silver internationally and in Asia particularly. A period of high inflation or stagflation as was seen in the 1970s would again be bullish for silver and it would likely again outperform gold.

Gold (orange), Silver (yellow) and Gold/ Silver Ratio (white) - 40 Years

With governments such as Japan, the US, Switzerland, the UK, Brazil, Korea, Taiwan, China and many others internationally devaluing their currencies there is a growing risk of inflation and indeed stagflation. Free markets are becoming less free with manipulation of currencies and bond markets increasingly common and the likelihood that there may also be intervention in equity and precious metal markets.

The financial crisis is spreading from the private sector and into the public sector as massive private sector debt and liabilities is socialised and monetised. Governments internationally facing deflationary pressures, particularly from falling property markets, appear to be embarking on competitive currency devaluation battles in order to weaken currencies to stimulate export driven economic growth. This has profound implications for the international monetary system itself which is why some investors and many central banks are diversifying into gold.

The quasi demonetisation of gold seen in recent years has ended and gold looks set to again be appreciated as an important monetary asset. The 'Emperor's clothes' of today's international monetary system are being questioned and markets are worried by what lies underneath the international fiat monetary system. The majority of retail investors remain unaware of the growing risks posed by the monetary system but this will likely change in the coming months especially when inflation takes off, which it inevitably will.

While the talk now is of currency wars - it is but a short step away from trade friction and trade wars and the recent Chinese-US tensions in this regard bear monitoring. Another potential risk (and one alluded to by the Brazilian Finance Minister) is that governments will resort to capital controls in an attempt to control and prevent capital flows destabilising world trade and prevent capital flight.

This is a heady cocktail indeed and one that should lead to the continuation of gold's secular bull market for the foreseeable future.

Silver

Silver is currently trading at $21.80/oz, €16.01/oz and £13.81/oz.

Platinum Group Metals

Platinum is trading at $1,642.00/oz, palladium is at $564/oz and rhodium is at $2,300/oz.

This update can be found on the GoldCore blog here.

Mark O'Byrne

Director

IRL |

UK |

IRL +353 (0)1 632 5010 |

WINNERS MoneyMate and Investor Magazine Financial Analysts 2006

Disclaimer: The information in this document has been obtained from sources, which we believe to be reliable. We cannot guarantee its accuracy or completeness. It does not constitute a solicitation for the purchase or sale of any investment. Any person acting on the information contained in this document does so at their own risk. Recommendations in this document may not be suitable for all investors. Individual circumstances should be considered before a decision to invest is taken. Investors should note the following: Past experience is not necessarily a guide to future performance. The value of investments may fall or rise against investors' interests. Income levels from investments may fluctuate. Changes in exchange rates may have an adverse effect on the value of, or income from, investments denominated in foreign currencies. GoldCore Limited, trading as GoldCore is a Multi-Agency Intermediary regulated by the Irish Financial Regulator.

GoldCore is committed to complying with the requirements of the Data Protection Act. This means that in the provision of our services, appropriate personal information is processed and kept securely. It also means that we will never sell your details to a third party. The information you provide will remain confidential and may be used for the provision of related services. Such information may be disclosed in confidence to agents or service providers, regulatory bodies and group companies. You have the right to ask for a copy of certain information held by us in our records in return for payment of a small fee. You also have the right to require us to correct any inaccuracies in your information. The details you are being asked to supply may be used to provide you with information about other products and services either from GoldCore or other group companies or to provide services which any member of the group has arranged for you with a third party. If you do not wish to receive such contact, please write to the Marketing Manager GoldCore, 63 Fitzwilliam Square, Dublin 2 marking the envelope 'data protection'

GoldCore Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.