Chicago Fed National Activity Index Points to Slowing U.S. Economic Conditions

Economics / Double Dip Recession Sep 28, 2010 - 03:38 AM GMTBy: Asha_Bangalore

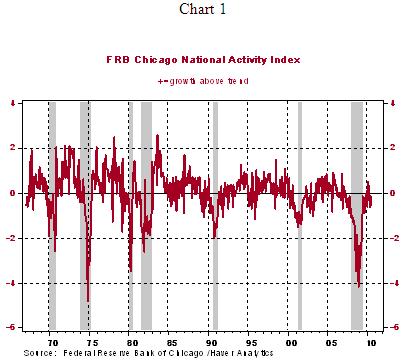

The Chicago Fed National Activity Index (CFNAI) dropped to -0.53 in August from -0.11 in July. The August decline marks the fourth consecutive monthly decline of the CFNAI, after two monthly gains. The 3-month moving average is -0.42 in August vs. -0.27 in July. The cut-off mark for the 3-month moving average of the CFNAI is -0.7. Readings above -0.7 after a period contraction suggest the recession has ended. The July and August readings of the CFNAI point to weakening economic conditions. The CFNAI is made up of 85 economic indicators classified under four categories - production and income, employment, unemployment and hours, personal consumption and housing, and sales, orders, and inventories.

The Chicago Fed National Activity Index (CFNAI) dropped to -0.53 in August from -0.11 in July. The August decline marks the fourth consecutive monthly decline of the CFNAI, after two monthly gains. The 3-month moving average is -0.42 in August vs. -0.27 in July. The cut-off mark for the 3-month moving average of the CFNAI is -0.7. Readings above -0.7 after a period contraction suggest the recession has ended. The July and August readings of the CFNAI point to weakening economic conditions. The CFNAI is made up of 85 economic indicators classified under four categories - production and income, employment, unemployment and hours, personal consumption and housing, and sales, orders, and inventories.

Employment-related indicators made a negative contribution (-0.12) to the index vs. a 0.09 reading in July. Total nonfarm payrolls are included in the computation of the index, which fell 54,000 in August, reflecting the loss of temporary Census-related jobs. By contrast private nonfarm payrolls moved up 67,000. The recent gains and losses of temporary Census-related jobs have exaggerated recent readings of the CFNAI. Therefore, the CFNAI of recent months should be adjusted for the large additions and losses of jobs that have been temporary Census-related jobs. The important implication is that if real GDP in the second half of 2010 is on the soft side and below potential GDP, it would imply that a higher unemployment rate is most likely.

Latest Rumblings about Fed Action

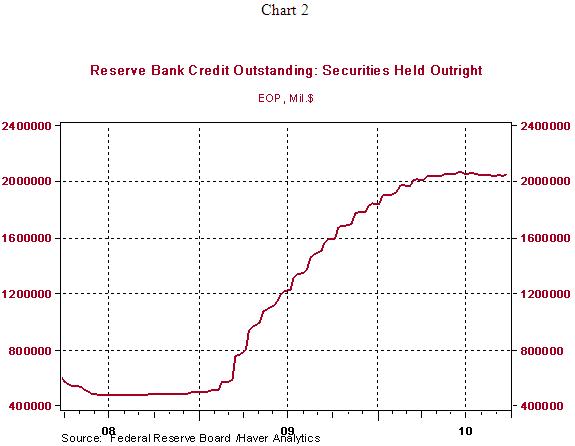

The next Fed meeting is scheduled for November 2-3 just prior to the October employment report will be published. Given that the Fed policy statement and Bernanke's speech of August 25 have both raised the probability of Fed action if economic conditions weaken, financial markets are mulling over different options of the Fed to support economic growth. The Wall Street Journal reports (Fed Weighs New Tactics to Bolster Recovery - WSJ.com) that the Fed may consider purchases of Treasury securities of small quantities without tying itself down to a large target amount by a certain date. The Fed purchased $300 billion of Treasury securities and $1.425 trillion of mortgage-backed securities and GSE securities before these programs were closed by March 2010. Of late, it has been replacing it holdings of mortgage-backed instruments to maintain its holdings of mortgage securities. The Fed's balance sheet contains securities of around $2.05 trillion since April 2010 (see chart 2).

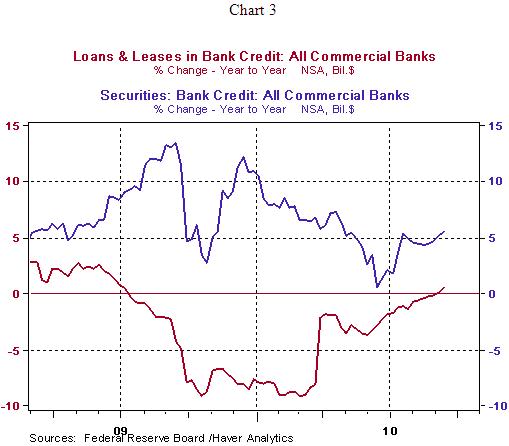

On the bullish side, bank credit has grown in July and August and the first three weeks of September. More importantly, loan extensions increased from a year in the two weeks ended September 15 after posting declines each week since July 15, 2009 (see chart 3). These data suggest tracking these numbers closely is necessary to determine the course of the economy and path of monetary policy. If bank credit gathers steam, the Fed could watch and wait for several more months.

Asha Bangalore — Senior Vice President and Economist

http://www.northerntrust.com

Asha Bangalore is Vice President and Economist at The Northern Trust Company, Chicago. Prior to joining the bank in 1994, she was Consultant to savings and loan institutions and commercial banks at Financial & Economic Strategies Corporation, Chicago.

The opinions expressed herein are those of the author and do not necessarily represent the views of The Northern Trust Company. The Northern Trust Company does not warrant the accuracy or completeness of information contained herein, such information is subject to change and is not intended to influence your investment decisions.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.