Gold - Currency Status since 2600 BC, Like A Thief In The Night

Commodities / Gold and Silver 2010 Sep 27, 2010 - 11:40 AM GMTBy: D_Sherman_Okst

To date, the crime syndicate has struck 3,800 times. At the bottom of this article you will find a partial list of the mob hits that have been made by the organized crime syndicate many refer to as: La Cosa Nos(Cen)tra(l) Banksters. The families of the diseased are large - entire nations. They made the unfortunate and common mistake of trusting their late, and once rich Uncle Currency with safeguarding the value stored in their life savings. Those that didn’t take out a life insurance plan suffered. Many, like the little children of Argentina, actually starved to death.

To date, the crime syndicate has struck 3,800 times. At the bottom of this article you will find a partial list of the mob hits that have been made by the organized crime syndicate many refer to as: La Cosa Nos(Cen)tra(l) Banksters. The families of the diseased are large - entire nations. They made the unfortunate and common mistake of trusting their late, and once rich Uncle Currency with safeguarding the value stored in their life savings. Those that didn’t take out a life insurance plan suffered. Many, like the little children of Argentina, actually starved to death.

The modus operandi is identical in every case. The loot is taken first, the heist ends with a rub on the mark.

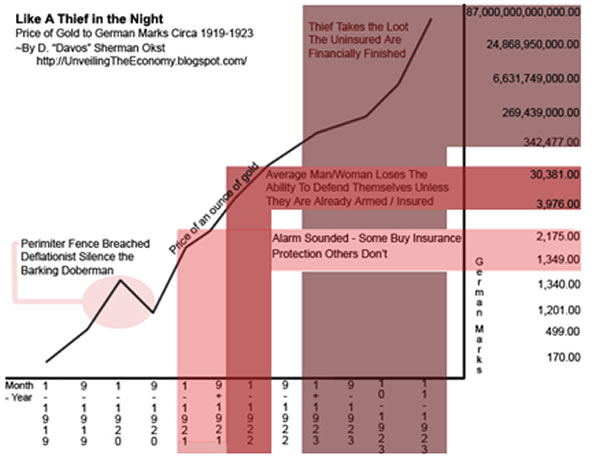

Let’s look at the above crime scene. Germany lost World War I. They were saddled with war debt and forced to pay reparation. The French took over Germany's industrial base when the Germans got behind on their payments. Without the industry revenues the German government began printing to cover their debt and avoid default.

- ‘Gave up its industrial base’.

- “...government began printing to cover their debt and avoid default.”

Sound familiar?

It should. Globalization off-shored the bulk of our industrial base. In 1959, manufacturing accounted for 30% of U.S. economic output. In 2008, it was 11%. The United States lost 32% of its manufacturing jobs since 2000. Manufacturing employment in the U.S. computer industry is now lower today than it was in 1975. Asia produces 84% of all printed circuit boards. The United States has lost 42,000 factories since 2001. In 2008, 1.2 billion cellphones were sold, none were made here.

An out of control deficit has left Ben-Willy-Nilly-Bernanke printing. The formula for what we print is this: (Tax revenues taken in + What Communist China et al will loan us) - (What we owe out) = Counterfeit / print the difference.

I hate gold - but I’m not stupid. I’m a realist. I know what Enron fraud smells like. I know that we have 13 trillion dollars of federal debt, add the GSE (Freddie/Fannie) debt to that and our Federal Debt is really over 18 trillion. Pile on the unfunded liabilities hidden off balance sheet on the government's cooked books:

| Liability | Unfunded (read: looted) Liability |

| Social Security | 14.6 trillion |

| Prescription Drugs | 19.2 trillion |

| Medicare | 76 trillion |

| Total | 109,800,000,000,000.00 |

109.8 trillion + 18 trillion = 127.8 trillion dollars.

Then we have the most disastrous deficit of all: The leadership deficit who continually make the absolute worst and totally incorrect economic decisions. With that in mind, gold for me is a life insurance policy against Uncle Buck.

Super guy our Uncle Buck is - but he’s a marked man. Street rules for dealing with marked men, two words; total avoidance. Willy-Nilly and his crew are going to do what made men have done for centuries - a loot-job followed by a hit-job.

Back to the German Job: The inflation alarm sounded in 1921 when gold spiked from 1,349 to 2,175. I bet a lot of Germans didn’t purchase an insurance plan then. I say this because of of a conversation I had with a friend of mine that I hadn’t seen in a month. When I saw him again, I asked, “Bought any gold?” “No, I looked at the [gold] chart (see current price chart below) and saw that in 1980 it was at $840.00 [an ounce] and in 1982 it fell to $290.00 [an ounce]”, he answered.

My hunch is that in Germany a lot of folks looked to the 1920 drop from 1,340 to 1,201 and thought deflation, or that things were under control. Just like my friend let this current retracement frighten him out of his purchase of life insurance.

The Germans were robbed and it came like a thief in the night. A year later their marked Mark was dead, rubbed out Central Bankster mob style. Their entire savings had been looted. Look at the table at the bottom of the page. You do not have to be a rocket scientist to understand what an overextended county’s M.O. is.

Recently gold has been “going up” (most of us know the basket of Fiats are going down and the price of gold just appears to be going up, when in fact it is just storing the value of “yesteryears” wealth / purchasing power).

Lets do a simple exercise: “If” gold were to go up to $2,175.00 an ounce within the next 12 months - how many Americans:

- Would buy gold (take out life insurance against Uncle Buck) at $2,175.00 an ounce?

- Would listen to the deflationists saying that gold will crash (I don’t think they see the 128 trillion pound debt gorilla)?

- Would listen to the chart technicians calling for technical retracements?

- Or, would they listen to CNBS’s guests who missed the housing bubble, the biggest bubble of the century (well save for the coming bond bubble)?

Please see the 44 second point, listen to the sarcasm in her voice.

“If” Gold then ‘shoots up’ to $3,976.00 an ounce a few months later how many would buy then?

And finally, if gold jumped to $30,381.00 an ounce weeks after - how many could even afford to buy it? My point is that “if” this happens, that will be the precise point at which they are priced out of the market.

Hope they can afford silver then. Plan B.

A lot of really smart people have affixed $5,000.00 or $11,000.00 price ceilings to gold. Their merits are actually quite excellent. I won’t argue them on those merits. But, I sincerely don’t think they take into account how stupid our government is or how inept our financial wizards are. We are talking colossally inept, totally incompetent economic imbeciles here. I am not being mean - these morons have repeatedly demonstrated destructive financial tendencies. Take Summers: He helped blow away Glass-Steagall with Congressman Phil Gramm, then he helped Greenspan, Congress, the banking criminals and Wall Street derivative mob muzzle Brooksley Born (then Chairperson of the Commodity Future Trading Commission) when she tried to regulate the derivatives which would years later blow up the economy. Summers, up until recently was Obama’s number one economic advisor. Frontline did a wonderful piece on this, if you haven’t seen “Warning” it is well worth the watch. Video. Podcast. Audio.

Going back in history we count 3,800 Fiat currencies that have been whacked by the Central Bank / Government Mob. I’m amazed at how many people I encounter think that we have some special bullet proof Kevlar paper that our currency is printed on. They believe that because our dollar is backed by the full faith and credit of our great country that Uncle Buck will never get whacked. We have no more faith and our credit is running out. We take in less than we owe. We borrow more to try to bridge the gap between what we take in and what we owe. And, when we can’t make ends meet - we counterfeit the difference so we don’t default. Full faith in having a date with Miss. Certain Disaster. One meeting can replace Uncle Buck with a newly elected reserve currency. And as they say in the city where I was born: “Whaddya gonna do bout it? Huh?”.

Here are some of the 3,800 Fiats that have been rubbed out. When I read this list I try to put my feet in the other citizens’ shoes and wonder what life would have been like without an insurance policy when thousands of zeros get added to the price of gas or food. What would it have been like when they tell you that it takes 1 million old dollars to get 1 new dollar. Most of all, I wonder how many of them regret not having a golden insurance policy or a silver bridge to preserve the value of their accumulated wealth.

Conspicuously missing from deceased list is the barbarous relic we call gold. I know a lot of us categorically categorize gold as a commodity. Oddly, the realization that it is listed on many currency exchanges gives credence to the fact that gold is also a currency. And, so far as I know, the only currency that dates back to 2600 BC when the Egyptians established it as a standard for trade. Seems that gold acts as a true barometer as to what the value of any currency is - or isn't.

There is a lot of speculation that we are going to see a major change in Quantitative Easing. Released in the minutes of one of the near future FRB FOMC - perhaps even as early as the November 3, 2010 - the Fed is expected to announce the beginning of direct monetization (buying bonds directly from Turbo-Tax-Cheating-Timmy-Geithner. No longer using the Primary Dealers as middlemen). The balance sheet is set to explode. We’re talking another 1.5 - 3 trillion here.

One of the main problems facing the Fed in indirectly monetizing US Treasurys (keep in mind the proper definition of monetization is the Fed buying bonds directly from the Treasury, as opposed to using Primary Dealer middlemen, which is how it operates currently), is that there simply are not enough bonds in circulation to be bid, under its current regime of operation! Readers will recall that as part of existing SOMA guidelines, the Fed is limited to holding at most 35% of any specific marketable CUSIP. Furthermore, applying the SOMA limit to the $2 trillion in upcoming next twelve month issuance, means that in the interplay of the prepayment feedback loop coupled with collapsing rates, the Fed will need to either change the cap on the SOMA 35% limit, or the Treasury will need to issue far more debt to keep up with the sudden expansion in the Fed's outright, and not just marginal, capacity for incremental debt.

...(and in fact we believe this is merely the first step to an outright monetary collapse also known in some textbooks as hyperinflation)

“If” this happens, where do you think Uncle Buck will wind up? Uncle Buck will NOT be taking to the mattress in my house! Total avoidance.

In Summary: My faith in the 5Gs: (G*(religious edit)d, Gold, Guns, Grub & The Government Will Continue to Screw It Up) remain really, really, really strong.

| Country | Year | Old Dollars Needed To Buy New Dollars |

| Angola | 1991-1999 | 1 New Kwanza = 1,000,000,000 1991 Kwanzas |

| Argentina | 1975-1991 | 1 New Peso = 100,000,000,000 1983 Pesos |

| Belarus | 1994-2002 | 50,000 = 100,000,000 2000 Rublei |

| Brazil | 1986-1994 | 1 Real = 2,700,000,000,000,000,000 1930 Reis |

| Bosnia-Herzegovina | 1993 | Massive hyperinflation |

| Bulgaria | 1991-1997 | Defaulted on its debt, food shortages, reduced the number of zeros that were added to its currency. |

| Chile | 1971-1973 | 500%+ Inflation military overthrew the democracy. |

| China | 1939-1950 | 1937 3.4 Yuan traded $1.00 USD. By May 1949, $1.00 USD = 23,280,000 Yuan |

| Ecuador | 2000 | Pegged to USD after 70-80% drop in its dollar |

| England | 1100s 1455-1485 1543-1551 | 1100s silver in coins fell. Coins were clipped. Henry VIII debased the coins to raise money |

| Greece | 1944-1953 | 1 1953 Drachma = 50,000,000,000,000 1944 Drachmai |

| France | 1789-1797 | Death sentence on anyone selling the notes at a discount to gold and silver livres. 1795 a new currency was issued, the mandat, which promptly lost 97% of its value. 1797, both paper currencies recalled new monetary system backed by gold. |

| Georgia | 1995 | 1 new lari = 1,000,000 laris. |

| Germany | 1923-1924 1945-1948 | See chart above. |

| Hungary | 1944-1946 | Forint 400,000,000,000,000,000,000,000,000,000 = 4 × 1029 Pengõ |

| Israel | 1979-1985 | Price freezes |

| Japan | 1944-1948 | 5,000%++ Inflation. Issued military currency, anyone caught with Honk Kong currency was tortured. |

| Krajina | 1993 | Country folded became part of Croatia. |

| Madagascar | 2004 | 1 Ariary = Madagascan Francs - Riots persisted. |

| Mexico | 1993-1994 | Defaulted 1982. 1 Nuevo Peso = 1,000 Old Pesos. |

| Nicaragua | 1987-1990 | 1 Gold Cordoba = 5,000,000,000 1987 Cordobas. |

| Peru | 1984-1990 | 1 Nuevo Sol = 1,000,000,000 1985 Soles de Oro. |

| Poland | 1990-1993 | 1 new Zloty.10,000 old Zlotych |

| Romania | 2000-2005 | 1 new Leu = 10,000 old Lei |

| Ancient Rome | 270AD | Took the Romans 300 years to do what the Fed did in 84 years - debase the currency by 95%. The Roman empire fell, they welcomed the Barbarians. |

| Russia | 1992-1994 | 100 Rubels = 1 USD 1991 30,000 Rubels = 1 USD 1999. |

| Taiwan | 1940-1950 | 1 New Taiwan Dollar = 40,000 old Taiwan yuan. |

| Turkey | 1990-2005 | 1 New Turkish Lira;= 1,000,000 old Lira. |

| Ukraine | 1993-1995 | 1 Hryvnya =100,000 Karbovantsivi |

| United States | 1812-1814 | Continental Currency - Failed |

| United States | 1861-1865 | Confederation Notes - Failed |

| Vietnam | 1981-1988 | Gold trading was outlawed. |

| Yugoslavia | 1989-1994 | 1 Novi Dinar = 1,300,000,000,000,000,000,000,000,000 Dinars. |

| Zimbabwe | 1999 - 2010 | Ongoing mess. |

By D. Sherman Okst

davossherman @ gmail.com

I'm an ex-airline captain with about 15,000 hours and am amazed at all the BS we are taught. Most of my friends still in the business were also taught the wrong aerodynamic principles with respect to what makes planes fly. Aviation or economics, Keynes to Austrian - Bernulli to Newton we've been sold bad goods. It's amazing anything works as backwards as we do things.

© 2010 Copyright D. Sherman Okst - Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.