Stock Markets Supported by M&A News

Stock-Markets / Stock Markets 2010 Sep 27, 2010 - 09:22 AM GMTBy: PaddyPowerTrader

U.S. stocks rose strongly Friday, sending benchmark indexes to a fourth straight weekly gain, as signs of improving demand for capital goods and technology products tempered concern the economic rebound is slowing. Apple surged to a record as an analyst boosted sales estimates for the iPad tablet computer, while Google climbed to an almost five-month high and Nike surged to the highest price since its initial public offering in 1980 after earnings topped estimates on growing demand in North America and China.

U.S. stocks rose strongly Friday, sending benchmark indexes to a fourth straight weekly gain, as signs of improving demand for capital goods and technology products tempered concern the economic rebound is slowing. Apple surged to a record as an analyst boosted sales estimates for the iPad tablet computer, while Google climbed to an almost five-month high and Nike surged to the highest price since its initial public offering in 1980 after earnings topped estimates on growing demand in North America and China.

Today’s Market Moving Stories

•Turning to this week and stocks on the move in London today include Spice Plc which rallied 5.3 per cent on the broader All-Share index after Cilantro Acquisitions agreed to buy the company for about £251.1 million in cash to expand its energy sector business. An PZ Cussons also advanced, climbing 2.3 per cent after the company today said it bought St Tropez Holdings Ltd. from U.K. private equity group LDC for a £62.5 million in cash. But Smiths Group dropped 1.5 per cent on a broker downgrade at BofA- Merrill Lynch who downgraded the shares to “neutral” from “buy.”

•And Actelion, Switzerland’s largest biotechnology company, sank 7.5 per cent after saying its clazosentan medicine didn’t meet the main goal of a study in patients who had suffered from bleeding in the brain.

•While Vestas Wind Systems , the world’s largest maker of wind turbines, slipped 1.9 per cent on news that the German government has scaled back its energy and climate change plan, scrapping provisions for some carbon dioxide emissions cuts and money for energy programs, Financial Times Deutschland reported.

•To the upside is Latecoere which has rallied a stonking 19 per cent on a story that Spirit Aerosystems Holdings., the airplane component maker spun off from Boeing Co. in 2005, is mulling a bid for Toulouse, France- based Latecoere, Le Figaro said. Officials from Wichita, Kansas- based Spirit will meet Latecoere Chairman Pierre Gadonneix to discuss a tie-up, the French daily newspaper reported, without giving a date for the meeting or citing anybody.

•And Micro Focus International has gained 5.2 per cent today, the biggest rally in the Stoxx 600, as Barclays rated the shares “buy” in new coverage.

•Pernod Ricard has risen 2.5 per cent Monday after the company reported that it had an increase in summer sales of 7 per cent versus 2008, La Lettre de L’Expansion reported, without citing anyone. Pernod Ricard benefited from a recovery in demand in cafes, hotels and restaurants, according to the weekly newsletter, which didn’t define the dates of the summer period.

•Separately according to Bloomberg today the European Central Bank considered activating the euro-region’s rescue fund to assist Ireland in refinancing debt, German newspaper Handelsblatt reported, citing unidentified government officials. Various euro-area countries had already been told to raise money on Ireland’s behalf if the need arose, the newspaper said, without giving more details. In the end, the authorities decided against the plan, it said. The spread, or extra yield, investors demand to hold 10- year Irish bonds instead of German debt of the same maturity widened to a record 411 basis points last week.

•A possible flashpoint this week for the Euro & peripheral spreads is Thursday 30th as this sees the deadline for US rating agency Moody’s review of Spain’s sovereign rating. They have previously mused publically about a 1 or 2 notch downgrade.

•UK House prices fell by 0.4 per cent m/m in September, the third consecutive monthly decline, according to Hometrack. The number of home buyers fell at the sharpest rate in more than 18 months, making further price falls likely, according to the company, although there are signs of increased reluctance on the part of seller to put their home on the market.

•And today’s BoE release on bank lending shows that de-leveraging continues to be a theme for the UK private sector. The trend in outstanding bank lending to individuals continues to be very weak, with some recent signs of decelerating: in July, the monthly net flow of lending to individuals was just £258million, weaker than the average monthly change of £692million in Q2 and £1252million in Q1 (and an average net monthly flow of £879million in 2009). Lending to individuals was especially weak on account of just £86mn of net new mortgages being extended, compared with an average monthly flow of £617mn in Q2 and of £1001million in Q1. Meanwhile, the net increase in consumer credit was £173million in July, vs £75mn on average in Q2 and £251million on average in Q1.

It’s STILL all about Anglo.

D Day on the “final” cost of the Anglo Irish debacle should be this week as an announcement is scheduled for Friday 1st Oct

And Ireland and Portugal were again the focus & in the cross hairs Friday until the ECB finally and belatedly came in as “buyer of last resort” in good sized in the afternoon after spreads had gapped wider again during the morning session. Whether this long overdue action means they will now step up and draw a line in the sand or whether we are back to €10 million clips today only time will tell but I fear the latter. Asian accounts have been selling Portugal and Ireland for months now and they keep selling, also some heavy hitter EU Asset Managers were seen selling as price action was so weak.

The Sunday Times (Irish edition) reported yesterday that Anglo will conduct a buyback programme of its Sub and Senior debt. The article referred to a haircut of up to 90 per cent on Sub debt (presumably Tier 1 which we mark at around 10). We would expect a haircut on Lower Tier 2 bonds to be less (say 66 per cent -75 per cent) but the buyback price is unlikely to be above recent market levels. The Department of Finance denied the story at market open this morning stating that it is “incorrect” to say the government will adopt this approach to senior debt (note it doesn’t deny the comments regarding Sub debt). A Buyback of Anglo Sub debt if announced should be Fixed Income positive for Ireland as it would bring clarity on this “thorny” topic without creating the headline attached to an outright default. In our view, buybacks (effectively a restructure with haircuts) on Senior Anglo Debt will have negative implications for Irish Fixed Income as the market would have concerns over who might be next to adopt such a strategy (i.e, it sets a dangerous precedent). It also has broader implications for the European Banking sector particularly if it is perceived as being endorsed by the European Commission. While they may achieve a €1bn capital saving (as suggested by the Sunday Times) they risk an investor backlash to Ireland Inc. I don’t believe the risk /reward is justifiable – particularly given the fragility of current market sentiment.

And today Moody’s has downgraded the un-guaranteed senior debt of Anglo Irish Bank by three notches to Baa3 while maintaining the review for possible downgrade. It also cut the subordinated debt rating by six notches to Caa1. The Moody’s downgrade is a direct response to the decision of the Irish government not to extend its guarantee to holders of subordinated Anglo-Irish debt last week. The rating agency lowered its rating for this paper to Caa1 from Ba1 and assigned a negative outlook. The downgrade of the senior debt is a precautionary ahead of the government announcement of the total costs for bailing out Anglo Irish. The release is due on Friday. Reading through the Moody’s release, the agency is concerned that the government will not provide an explicit guarantee for senior unsecured debt. The rating downgrade further highlights uncertainty about more capital injections (seen a supportive for the paper). All in all, I think that the indications by the Finance minister last week that the Irish government is willing to share the burden of the restructuring with private bond holders is already having an impact. As we wrote in Friday’s daily, while the actions of the authorities could lead to growing concerns about the quality of some EUR-denominated assets and weigh on the EUR, the negative impact could be negated somewhat by the fact that costs for the authorities may be less as a result. The positive twist should come from the fact that (controlled) private bondholder losses will be offset by relatively smaller deterioration of government finances, which in turn could provide for greater public flexibility during the downturn. This could explain some of the EUR resilience to the news.

To get an idea of just how much focus is on the artist formerly known as the Celtic Tiger.

Farewell Hoenig, Hello Plosser

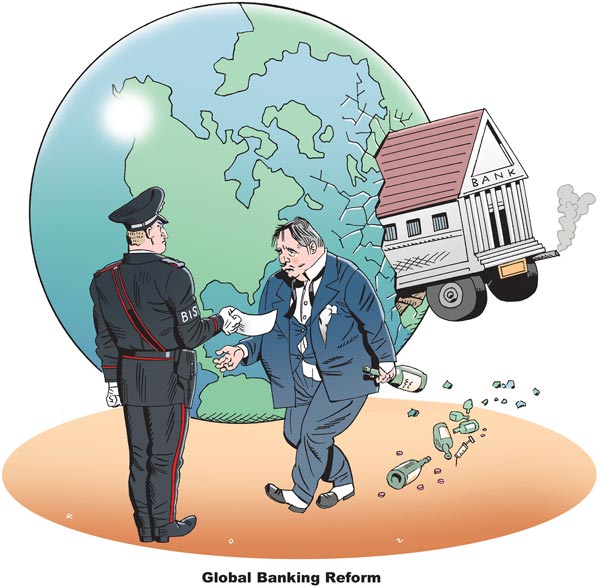

Fed’s Plosser gets his vote on the FOMC in Jan 2011 – the same day that serial dissenter and uber-hawk Hoenig loses his. And if Plosser’s speech on Friday night is anything to go by, Hoenig’s dissenting spirit will live on well into 2011. Unlike Hoenig who was concerned about an exceptionally low policy rate, Plosser is more concerned about balance sheet expansion. He said the Fed’s emergency lending and balance sheet expansion have created moral hazard. He called for an explicit limit on the side of the balance sheet, and said the balance sheet should eventually be shrunk back to it’s pre-crisis size and composition. Not a big fan of further QE then it seems. Plosser was always on the hawkish side, but recent events clearly haven’t prompted a change of heart. Here’s the speech.

The FT reports that Japan’s DPJ plans to introduce a supplementary budget of up to USD 55 Bn to pay for further stimulus measures aimed at combating the impact of the strong JPY and kick-starting the economy. Prime Minister Naoto Kan is due to ask DPJ officials today to draw up a supplementary budget proposal to be submitted to an emergency Diet session starting on Friday. Tetsuro Fukuyama, deputy chief cabinet secretary, confirms that Prime Minister Kan has ordered ministers to form an extra budget but does not confirm the amount.

Company / Equity News

•Unilever confirmed a WSJ report that it has agreed to acquire the US based hair/personal care business Alberto Culver for $3.7 billion cash. Alberto Culver owns a range of brands including TRESemme, VO5, Nexxus, St Ives and Simple. The acquisition will make Unilever the world leader in hair conditioning, the second largest in shampoo and the third largest in “styling”. In the year ending June 2010, Alberto Culver generated $250m on revenue of $1.6 billion. The acquisition multiple is 14.8x in EBITDA terms, although the Company has indicated that synergies are substantial, which should bring this multiple down significantly. The deal is subject to regulatory and shareholder approval.

•Speculation over the weekend suggests that the M&T’s talks with Santander are off once again, on disagreements over control. Bloomberg reports that the merger between M&T and Santander’s US operations would have created the 9th largest bank in the US by deposits

•Despite fears earlier in the year of an earnings decline food group Aryzta’s eps grew 4 per cent to 244c. That was helped by a better that expected profit in Origin (accounting for 24 per cent of group EBIT) but it was also assisted by growth in North America (+3.6 per cent) and the Asia-Pacific region (+180 per cent). Joint ventures were of value too with the Canadian Tim Hortons associate (since converted into 100 per cent ownership) raising its profit by 44 per cent to €19.9m. At year end Aryzta debt was €1.1bn (Origin’s debt of €111m is separate and non-recourse) implying a debt to EBITDA of 2.96x after a series of acquisitions. For FY July ’11 the group guides a 45c kicker from acquired business which suggests 290c as a starting point for forecasts. Assuming 7 per cent growth in underlying pre acquisition profit produce an eps of 306c which is in line with consensus.

•UK plumbing & materials group Wolseley has reported trading profits of £450m for the 12 months to the end of July, which is ahead of the consensus range of £402-440m. It would appear to be down to better top-line (£13,203, 1 per cent ahead), as the group as a whole returned to positive lfl growth in Q4 of 4 per cent. While management note that demand across its markets remains mixed and the economic outlook is unclear, revenue growth in the current year is in line with Q4 and it has the confidence to resume the dividend at the half year results. Given that the US is one of CRH’s largest exposure (44 per cent of group EBITA), it is of note that Wolseley’s US business has returned to growth for the first time in three years (lfl 5 per cent in Q4), on the back of recovery in new residential and rmi, while commercial remains weak.

At the Movies: Wall St 2; Reviewed

By The Mole

PaddyPowerTrader.com

The Mole is a man in the know. I don’t trade for a living, but instead work for a well-known Irish institution, heading a desk that regularly trades over €100 million a day. I aim to provide top quality, up-to-date and relevant market news and data, so that traders can make more informed decisions”.© 2010 Copyright PaddyPowerTrader - All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

PaddyPowerTrader Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.