Fed Free Money Friday

Stock-Markets / Financial Markets 2010 Sep 24, 2010 - 12:52 PM GMTBy: PhilStockWorld

What a fun day for debate!

What a fun day for debate!

Former Fed Chair, Paul Volcker went way off-script in Chicago yesterday and "moved unsparingly from banks to regulators to business schools to the Fed to money-market funds during his luncheon speech. He praised the new financial overhaul law, but said the system remained at risk because it is subject to future “judgments” of individual regulators, who he said would be relentlessly lobbied by banks and politicians to soften the rules."

“This is a plea for structural changes in markets and market regulation,” he said at one point. He also had some great quotes:

“This is a plea for structural changes in markets and market regulation,” he said at one point. He also had some great quotes:

Banking — Investment banks became “trading machines instead of investment banks [leading to] encroachment on the territory of commercial banks, and commercial banks encroached on the territory of others in a way that couldn’t easily be managed by the old supervisory system.”

Financial system — “The financial system is broken. We can use that term in late 2008, and I think it’s fair to still use the term unfortunately. We know that parts of it are absolutely broken, like the mortgage market which only happens to be the most important part of our capital markets [and has] become a subsidiary of the U.S. government.”

Risk management — “Markets that are prone to excesses in one direction or another are not simply managed under the assumption that we can assume that everybody follows a normal distribution curve. Normal distribution curves — if I would submit to you — do not exist in financial markets. Its not that they are fat tails, they don’t exist. I keep hearing about fat tails, and Jesus, it’s only supposed to occur every 100 years, and it appears every 10 years.”

The recession — “It’s so difficult to get out of this recession because of the basic disequilibrium in the real economy.”

This afternoon, Richmond Fed President Jeffrey Lacker will speak in Kentucky (his hometown) on "Reflections on Economics, Policy and Financial Crisis!" and it always makes me nervous when Fed Presidents put exclamation marks on the word "crisis" so we’ll be paying attention to that one. After market hours, at 4:30, Uncle Ben comes to the plate with "Implications of the Financial Crisis for Economics," which sounds like a snoozer but that’s three Fed guys in a row saying "crisis" in the same day - I don’t like it!

I was bearish yesterday morning but we bottomed out earlier than I thought and I sent out an Alert to Members at 10:01 saying:

Of course DIA $105 puts are now up a huge 46% and the IWM $67 puts are $2.30, which is over 100% so shame on you if you don’t take that money and run - we can always find something else to trade later and you can put those profits into a sensible, long-term disaster hedge like the QID play from yesterday’s chat.

It was housing that was our big worry and we got better-than-expected Existing Home Sales with 4.13M homes (annualized)changing hands and that, thanks to the magic of a downwardly-revised July number, was up 7.6% vs flat expected. That is the fun thing about Government statistics - they tell you a better-than-expected 4.1M homes were sold in July and the market goes up, then we expect 4.1M homes to be sold in August (annualized) and that would not move the market but then, in August, the government revises July DOWN to 3.84M homes sold (which means our excitement over July was completely misplaced) and then reports 4.13M homes for August and calls that UP 7.6% - isn’t that INCREDIBLE?!?

It was housing that was our big worry and we got better-than-expected Existing Home Sales with 4.13M homes (annualized)changing hands and that, thanks to the magic of a downwardly-revised July number, was up 7.6% vs flat expected. That is the fun thing about Government statistics - they tell you a better-than-expected 4.1M homes were sold in July and the market goes up, then we expect 4.1M homes to be sold in August (annualized) and that would not move the market but then, in August, the government revises July DOWN to 3.84M homes sold (which means our excitement over July was completely misplaced) and then reports 4.13M homes for August and calls that UP 7.6% - isn’t that INCREDIBLE?!?

When I say "incredible" I mean, of course, lacking any and all sense of credibility. Nonetheless, the market loved it and we shot up on the "good" news. If we’re lucky, August will also be revised down and the same completely inept measurements will show September to be "improving" to 4.1M again and we can rally off that number.

Today it’s all about Durable goods and expectations are set so low there that it will be hard to miss at this point so we can celebrate the mediocrity as only Americans can this morning. We can expect a pop on Durable goods to take us back to yesterday’s open ahead of the bell and then we’ll see what sticks into the weekend.

8:30 Update - Confusion! Durable Goods were DOWN 1.3%, which is 30% WORSE than expected and last month was UP 0.4% but, ex-Transports, we are UP 2% vs. down 3.8% last month so that’s what they are focusing on in pre-markets and the futures are flying up about 1% already (8:45).

What a great opportunity this will be to re-enter our directional shorts - very exciting stuff for us as we can sell options to suckers who think we’re heading up and up and buy puts at ultra-low prices from bears who are getting squeezed out of positions. As I mentioned yesterday, though - we are still long-term bullish, the adjustments we’re discussing are just our directional short-term plays as we use those to ride the waves of the market while we PATIENTLY wait for our long-term positions to mature. Our new trade ideas yesterday were a mix with short plays on PCLN (back-spread), the Russell (a bullish TZA spread) and the Nasdaq (a bullish QID spread) and long plays on SKX, ADBE (see Wednesday’s post as well), XLF and TASR.

Gold is touching the $1,300 mark this morning, giving the metal bulls ore-gasms with dreams of $1,500 dancing in their heads. We’re sticking with our GLL trade (now $34.60) but maybe no more if the Fed boys sound like they are about to ramp up the printing presses. What I do know is that there is no way they are going to extend the tax cuts until after the election and if the Fed doesn’t punch the button on easing - I’m not sure how long investors are going to be willing to wait for the next government give-away.

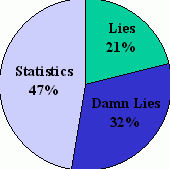

Speaking of Government bailouts for the rich as well as lies, damned lies and statistics - the Republicans revealed their "Pledge to America" but, strangely, none of them put their hands over their hearts and swore to anything… We had a great political discussion in last night’s chat so I won’t rehash it here and Jon Stewart summed it up very nicely last night when he was comparing the text to the old "Contract With America" of 25 years ago and ended up laughing so hard he couldn’t go on. One of our Conservative Members said that it all boils down to whether we are better off than we were two years ago and my response was:

Better off - Well, two years ago the S&P was at 750 (and still not done going down) and people were lining up at banks to take out their money because they thought the entire economy was going to collapse and whole wall street firms were going bankrupt overnight with thousands of people losing their jobs on a daily basis (close to 1M jobs lost in a single month at the peak).

During this crisis, we still couldn’t get the Republicans to pass legislation that was proposed by their own leadership because they thought that it was a good time to throw a temper tantrum and hold government hostage so, yes, I do think we are so much better off than we were two years ago that I can’t even imagine the workings of a mind that wants to go back to the insanity of Republican "leadership."

That’s all I have to say on the matter until after hours but I do feel a weekend post on the subject forming! Doug Kass agrees with me. Not about politics but about bonds as he now says that shorting bonds will be "the trade of the decade." I still think buying TASR for $4 will be the trade of the decade but shorting TLT at $105 was already the plan I’ve laid out in previous posts. Japan is having no luck propping up the Dollar this week and the 3am trade came early this morning as the Yen bottomed out at 85.38 at 12:20 and shot up to 84.10 and looks to be heading even higher this morning (lower is higher as it’s Yen to the dollar). That is a HUGE one-day move for a currency but, then again, it happens all the time lately as they step up the manipulation - kind of the way we’re used to up and down 100-point moves in the Dow these days.

The Nikkei did not, of course, like the move and they fell 1% to close the week at 9,471, over 1,300 points below the Dow this morning and 200 points "too tight" based on our invisible Nikkei-Dow rubber band theory that says they should stay within 1,100 points of each other. Europe was off to a cold start despite a rise in German Business Confidence but they cheered right up on our Durable Goods report and are now up about a point ahead of our open.

We did the charts earlier this week and no one is in any danger so we’ll be looking to just drift through the day and see what sticks but we’ll certainly be hedging into the weekend and picking up those same directional plays we already made money on twice this week. Will third time be a charm or do we break up and out next week on surprisingly good data - tune in and find out!

Have a great weekend,

By Phil

Philip R. Davis is a founder of Phil's Stock World (www.philstockworld.com), a stock and options trading site that teaches the art of options trading to newcomers and devises advanced strategies for expert traders. Mr. Davis is a serial entrepreneur, having founded software company Accu-Title, a real estate title insurance software solution, and is also the President of the Delphi Consulting Corp., an M&A consulting firm that helps large and small companies obtain funding and close deals. He was also the founder of Accu-Search, a property data corporation that was sold to DataTrace in 2004 and Personality Plus, a precursor to eHarmony.com. Phil was a former editor of a UMass/Amherst humor magazine and it shows in his writing -- which is filled with colorful commentary along with very specific ideas on stock option purchases (Phil rarely holds actual stocks). Visit: Phil's Stock World (www.philstockworld.com)

© 2010 Copyright PhilStockWorld - All Rights Reserved Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.