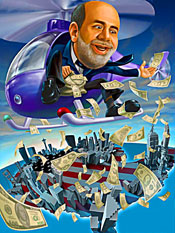

Fed Money Printing a Definition of Insanity, Doing the Same Thing and Expecting a Different Result

Interest-Rates / Quantitative Easing Sep 24, 2010 - 09:35 AM GMTBy: Mike_Larson

This week, Federal Reserve officials did it. They jumped the shark. Crossed the Rubicon. Bought a ticket on the express train to financial Never Never Land. Whatever you want to call it.

This week, Federal Reserve officials did it. They jumped the shark. Crossed the Rubicon. Bought a ticket on the express train to financial Never Never Land. Whatever you want to call it.

I say that because Fed Chairman Ben Bernanke and the rest of the members of the Federal Open Market Committee opened the door to a new round of quantitative easing, or “QE2.” Specifically, they said (with the important passages bolded by me):

“Measures of underlying inflation are currently at levels somewhat below those the Committee judges most consistent, over the longer run, with its mandate to promote maximum employment and price stability. With substantial resource slack continuing to restrain cost pressures and longer-term inflation expectations stable, inflation is likely to remain subdued for some time before rising to levels the Committee considers consistent with its mandate …

“The Committee will continue to monitor the economic outlook and financial developments and is prepared to provide additional accommodation if needed to support the economic recovery and to return inflation, over time, to levels consistent with its mandate.”

In plain English, the Fed is explicitly saying it wants to create inflation. This from the central bank that has spent decades FIGHTING it! And if rates near zero percent aren’t going to get things done, they’re just going to print money and buy any old asset they come across as part of a QE2 program.

Definition of Insanity: Doing the Same Thing and Expecting a Different Result

|

The Fed seems to think that just flooding the markets with cheap money will drive all assets up. That will magically cause the economy to ramp higher, and lead to the kind of job creation we need for a healthy recovery.

But just look at what happened in the housing and mortgage arena, the prime focus of the “QE1″ plan …

The Fed bought $175 billion in debt sold by Fannie Mae and Freddie Mac. It also bought $300 billion in U.S. Treasuries, and $1.25 TRILLION in mortgage backed securities — bonds made up of bundles of home loans.

The stated goal was to juice the housing market and spur a massive bout of mortgage refinancing, which would theoretically unleash a gargantuan new wave of consumer spending.

Were the Fed’s efforts successful? Let’s look at the evidence …

The Fed rolled out the first stage of its mortgage manipulation scheme in November 2008, then added to it in the months afterward. Here’s what has happened to key housing indicators since then:

- In November 2008, housing starts were running at a seasonally adjusted annual rate (SAAR) of 652,000 units. In August of this year, the comparable figure was 598,000. Net change? Down 8.3 percent.

- In November 2008, builders were selling homes at an annualized rate of 389,000. In July 2010, they sold 276,000 homes. Net change? Down 29 percent.

- In November 2008, 4.53 million existing homes changed hands (again, this is an annualized rate). That compared to 4.13 million in August. Net change? Down 8.8 percent.

- In November 2008, the S&P Case-Shiller 20-city home price index came in at 154.50. The most recent reading — for June 2010 — was 147.97. Net change? Down 4.2 percent.

|

So there you have it folks. Four key housing market indicators are ALL WORSE than they were before the Fed conjured up and spent almost $2 TRILLION to drive mortgage rates lower.

So naturally, given the dismal failure of QE1, we should do more of the same? Pardon my French, but just what the heck are they smoking in Washington? The only real, concrete impact of the Fed’s latest move was a collapse in the U.S. dollar. The Dollar Index plunged 79 points in the hours after the Fed’s announcement, then tanked another 76 points on Wednesday.

That lit an even bigger fire under gold …

Gold had already surged more than $100 from its July low. Then this week, it came within a couple bucks of $1,300 an ounce! This is outright currency debasement — something that makes each and every dollar in your pocket worth less!

And it’s not just the Fed that’s lost its marbles by embarking on this path …

Central Bank Currency Debasement Is Becoming a Global Disease!

Minutes from the Bank of England’s September 9 meeting included a passage that read:

“The probability that further action would become necessary to stimulate the economy and keep inflation on track to hit the target in the medium term had increased.”

That means the BOE could soon ramp up its current QE plan, which involves buying 200 billion pounds ($313 billion) of government debt. That, in turn, seems like a backdoor way of devaluing the pound.

|

Don’t forget the Japanese, either …

The Bank of Japan is buying roughly 21.6 trillion yen ($255 billion) of government bonds per year. And the BOJ recently intervened massively in the currency market to drive the yen down from a 15-year high against the dollar. Market sources estimate it dumped 2 trillion yen, or about $24 billion, to drive the yen down — the biggest single-day intervention in BOJ history.

It truly is a sad state of affairs …

But until Bernanke gets “broomed” like the rest of the Obama economic team (Larry Summers, the director of the president’s National Economic Council, is hitting the street later this year; budget director Peter Orszag and chief economic forecaster Christina Romer already jumped ship), it’s what we have to deal with.

My suggestion? You simply have to take protective steps …

I recommend you consider owning gold, selling off higher-risk bonds, and most importantly, buying instruments that go UP in value when stocks FALL.

Until next time,

Mike

This investment news is brought to you by Money and Markets. Money and Markets is a free daily investment newsletter from Martin D. Weiss and Weiss Research analysts offering the latest investing news and financial insights for the stock market, including tips and advice on investing in gold, energy and oil. Dr. Weiss is a leader in the fields of investing, interest rates, financial safety and economic forecasting. To view archives or subscribe, visit http://www.moneyandmarkets.com.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.