Fiat Currency Wars, Competitive Devaluations Fuel Gold’s Rally to $1,300/oz

Currencies / Fiat Currency Sep 22, 2010 - 02:31 PM GMTBy: Gary_Dorsch

With the price of gold zeroing in on yet another major milestone, - $1,300 /oz, some heavy hitters in the marketplace are beginning to wonder if the yellow metal’s rally, is getting a bit too frothy, or even worse, whether a speculative bubble is brewing, that might ultimately deflate under its own weight, and lead to a sharp correction. On Sept 15th, famed hedge fund trader George Soros said that gold prices might continue to rise, but warned that that gold is the “ultimate bubble.”

With the price of gold zeroing in on yet another major milestone, - $1,300 /oz, some heavy hitters in the marketplace are beginning to wonder if the yellow metal’s rally, is getting a bit too frothy, or even worse, whether a speculative bubble is brewing, that might ultimately deflate under its own weight, and lead to a sharp correction. On Sept 15th, famed hedge fund trader George Soros said that gold prices might continue to rise, but warned that that gold is the “ultimate bubble.”

“Gold is the only actual bull market currently. It just made a new high yesterday. In the present circumstances that may continue. I call gold the ultimate bubble, which means it might go higher. But it’s certainly not safe and it’s not going to last forever,” he warned. Soros has been bullish on gold in a big way, and as of June 30th, the Soros fund held 5.24-million shares of the SPDR Gold Trust GLD, a stake worth about $650-million today. Soros’s fund also held equity holdings in miners of gold and other minerals worth almost $250-million.

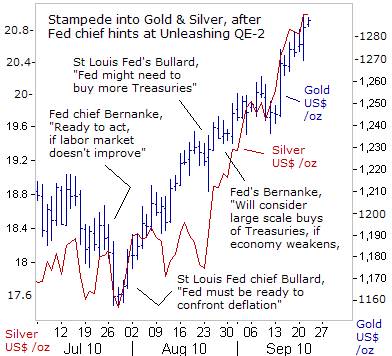

Over the past two months, there’s been a global stampede into precious metals, with investors of many different stripes, and from many countries, scurrying to buy gold and silver, in both the physical market and through exchange traded funds. The World Gold Council reported that the demand for gold worldwide surged 36% in the second quarter of 2010, to 1,050-tons. The Greek debt crisis, instability in Irish and Portuguese bonds, and expectations the Fed would unleash “Quantitative Easing, (QE-2), - flooding the world with a new tidal wave of freshly printed US-dollars, has supported the historic bull-run. Europe accounted for more than 35% of the retail purchases of gold coins during the second quarter.

Over the past two months, there’s been a global stampede into precious metals, with investors of many different stripes, and from many countries, scurrying to buy gold and silver, in both the physical market and through exchange traded funds. The World Gold Council reported that the demand for gold worldwide surged 36% in the second quarter of 2010, to 1,050-tons. The Greek debt crisis, instability in Irish and Portuguese bonds, and expectations the Fed would unleash “Quantitative Easing, (QE-2), - flooding the world with a new tidal wave of freshly printed US-dollars, has supported the historic bull-run. Europe accounted for more than 35% of the retail purchases of gold coins during the second quarter.

The latest surge in gold and silver prices was sparked in July, following comments from Fed officials, signaling that QE-2 could be around the corner. On July 22nd, Fed chief Ben “Bubbles” Bernanke reassured congressional lawmakers the central bank is prepared to print more dollars, if the US-jobless rate continues to hover around 10-percent. “We are ready and will act if the economy does not continue to improve, if we don’t see the kind of improvements in the labor market that we are hoping for and expecting. Unemployment is the most important problem that we have right now. What we can do is make financial conditions as supportive of growth as we can and we certainly are doing that,” Bernanke said.

On August 19th, St Louis Fed chief James Bullard was more explicit, signaling his backing for further monetization of the US-government’s debt. “Should economic developments suggest increased disinflation risk, purchases of Treasury securities in excess of those required to keep the size of the balance sheet constant may be warranted. Any additional Treasury buying should be undertaken in a measured, deliberate manner, commensurate with the magnitude of the deflation threat.”

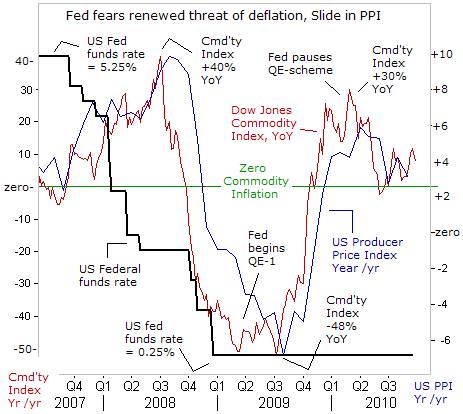

The Fed’s propaganda artists are operating behind a veil of “smoke-and mirrors,” trying to instill the fear of deflation in the bond market, in order to justify another big round of stealth monetization of the US-government’s debt. The Fed’s first go-around with QE, totaling $1.75-trillion, combined with the Bank of England’s 200-billion pound QE-scheme, and the Bank of Japan’s 21-trillion yen QE-scheme, fueled a powerful rally in key commodity markets last year, lifting the Dow Jones Commodity Index, (DJCI) from deep in negative territory, and onto the positive side, thus warding off the threat of deflation in the global economy.

The Fed’s propaganda artists are operating behind a veil of “smoke-and mirrors,” trying to instill the fear of deflation in the bond market, in order to justify another big round of stealth monetization of the US-government’s debt. The Fed’s first go-around with QE, totaling $1.75-trillion, combined with the Bank of England’s 200-billion pound QE-scheme, and the Bank of Japan’s 21-trillion yen QE-scheme, fueled a powerful rally in key commodity markets last year, lifting the Dow Jones Commodity Index, (DJCI) from deep in negative territory, and onto the positive side, thus warding off the threat of deflation in the global economy.

However, since the Fed completed its 12-month buying spree in Treasury bonds, and mortgage backed bonds, in March 2010, the year-over-year rate of increases in the DJCI and the US-Producer Price Index have petered-out. Last November, the DJCI was hanging around the 135-level, just a shade below the 138.40-level that prevails today. If the DJCI stays stagnant or turns lower in the months ahead, it could knock the US-PPI into negative territory by year’s end, signaling the onset of another bout of deflationary pressures, and triggering a second round of the Fed’s QE.

Sept 1st, Philadelphia Fed chief Charles Plosser, said the Fed would embark upon further monetary easing, if faced with a dangerous downward price spiral. “If we do need to act, if fears of deflation were to become real, then we would need every ounce of credibility we can muster to convince markets we are not going to let deflation happen.” Plosser said he would be open to further bond purchases if he saw deflation as a real risk. “I would certainly entertain the solution if I feared deflation, and if I feared that expectations were coming unglued in that direction, - then we would have to take actions,” he warned.

Interestingly enough, amid all this gloomy talk by Fed officials about the bogeyman of deflation, the demand for precious metals, - traditional hedges against inflation and currency devaluations, - is booming. Traders realize that the Fed’s magic elixir for fighting the scourge of deflation is more money printing, - otherwise known as nuclear QE-scheme. US-bond dealers, who trade directly with the Fed, aren’t questioning whether QE-2 is on the table, but rather, are taking bets on the size of QE-2, with estimates ranging between $300-billion and $1-trillion.

Competitive Currency Devaluations

Speculation that the Fed would unleash QE-2 has already spearheaded a new round of currency wars across the globe. Central bankers in Brazil, China, Chile, Japan, Russia, South Korea, and Thailand, have all stepped up their interventions, by injecting large sums of paper into the currency markets, while trying to prevent a precipitous decline in the value of the US-dollar versus their own currencies.

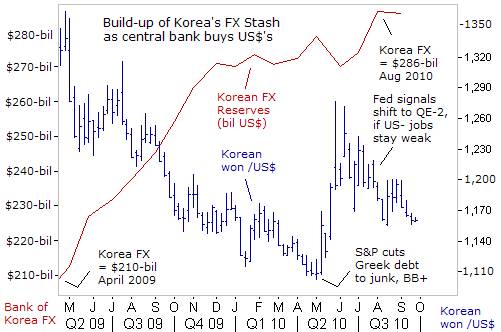

The amount of foreign currency reserves stashed away in the coffers of the Bank of Korea, (BoK) have climbed by $76-billion since April 2009, to a record high of $286-billion, - to become the world’s sixth-largest after China, Japan, Russia, Taiwan and India. The BoK’s currency reserves are an indicator of the approximate size of its interventions in the foreign-exchange market, utilized to artificially hold down the value of the Korean won vs the US-dollar.

The value of the US-dollar is critical to Seoul, since Beijing pegs the Chinese yuan to the US-dollar, and China is the biggest customer for Korean exporters. Thus, the BoK aims to protect its exporters in both the Chinese and US-markets. However, the BoK hasn’t been able to turn the bearish tide against the US-dollar. It’s been overwhelmed by ideas the Fed would unleash nuclear QE-2. Instead, the BoK can only try to stem the bleeding, - engineering an orderly retreat for the greenback.

The value of the US-dollar is critical to Seoul, since Beijing pegs the Chinese yuan to the US-dollar, and China is the biggest customer for Korean exporters. Thus, the BoK aims to protect its exporters in both the Chinese and US-markets. However, the BoK hasn’t been able to turn the bearish tide against the US-dollar. It’s been overwhelmed by ideas the Fed would unleash nuclear QE-2. Instead, the BoK can only try to stem the bleeding, - engineering an orderly retreat for the greenback.

The BoK would be much wealthier, if it had judged the gold market more correctly. The BoK holds only 14-tons of gold, equivalent to only 0.03% of its total reserves. On Dec 9th, 2009, the BoK’s FX-chief, Lee Eung Baek argued, “There’s an illusion in gold. Out of more than 200-nations, how many have bought bullion? Like other central banks, we have been increasing the types of currency reserves outside the dollar. Gold offers little value, with no cash returns. Since India and Russia with large reserves bought gold, there’s speculation that Korea might buy it too. But we are not classified in the same category. There’s a slim chance that we will buy gold from the IMF,” Lee said, when the yellow metal was changing hands at $1,226 /oz.

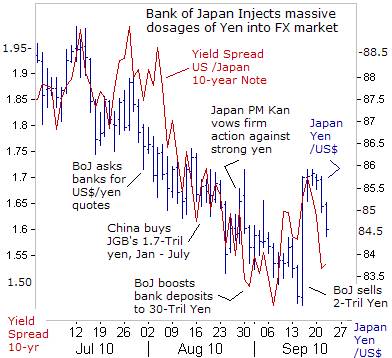

On Sept 16th, Tokyo’s financial warlords intervened in world currency markets to drive down the exchange rate of the yen by selling an estimated 2-trillion yen ($23-billion). The first such intervention by Japan in more than six years was also the biggest ever one-day currency action, and breached a tacit agreement among the Group-of-Seven industrial powers to avoid unilateral currency interventions.

On Sept 16th, Tokyo’s financial warlords intervened in world currency markets to drive down the exchange rate of the yen by selling an estimated 2-trillion yen ($23-billion). The first such intervention by Japan in more than six years was also the biggest ever one-day currency action, and breached a tacit agreement among the Group-of-Seven industrial powers to avoid unilateral currency interventions.

Japan had threatened such action for more than six-weeks, after the value of the US-dollar had declined by 10% since May to a 15-year low of 83-yen. The Japanese yen also climbed sharply in relation to the Euro and the Chinese yuan. Japan’s multinationals, listed on the Nikkei-225 index, are heavily dependent on exports, and the dollar’s value had declined far below their average break-even point of 93-yen, and threatens their ability to sell goods abroad.

Japan’s foray into the currency markets triggered a short squeeze on over-zealous US-dollar bears, and lifted the dollar to as high as 86-yen. However, the dollar’s one-day rally quickly stalled out, as speculators began to bet that the size of the Fed’s QE-2 would exceed the size of the BoJ’s devaluation schemes. Earlier, the BoJ boosted the size of excess yen sitting in deposits held by Japanese bans to 30-trillion yen, ($350-billion), in an effort to put a floor under the dollar at 84-yen.

Despite the massive size of the BoJ’s injections of yen into the local banking system, it hasn’t been able to turn the US-dollar’s bearish tide against the yen. That’s because currency traders expect the Fed’s next round of QE-2 would trump the size of the BoJ’s interventions. Also, US-Treasury yields could resume falling further than comparable Japanese bond yields, thus narrowing the US-dollar’s interest rate advantage over the yen. In the current round of competitive currency devaluations, the Fed holds the trump card over the BoJ.

Despite the massive size of the BoJ’s injections of yen into the local banking system, it hasn’t been able to turn the US-dollar’s bearish tide against the yen. That’s because currency traders expect the Fed’s next round of QE-2 would trump the size of the BoJ’s interventions. Also, US-Treasury yields could resume falling further than comparable Japanese bond yields, thus narrowing the US-dollar’s interest rate advantage over the yen. In the current round of competitive currency devaluations, the Fed holds the trump card over the BoJ.

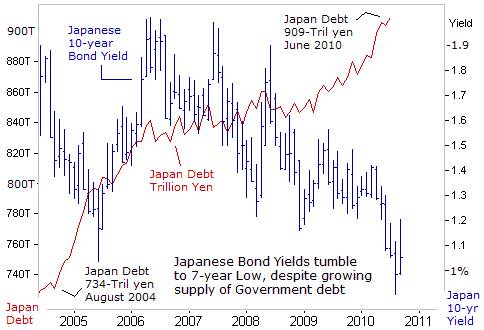

Most interesting, Japanese 10-year bond yields are flirting with the psychological 1% level, despite the ballooning of the size of Japan’s public debt, now at 909-trillion yen, or ($10.5-trillion). Japan’s bond yields are falling, even though its debt-to-GDP ratio is about 180%, which on the surface, is worse than 115% for Greece. Yet although public attention tends to focus on Japan’s gross debt, which has soared to ¥909-trillion, the government also owns about ¥700-trillion in assets.

The ¥700 trillion in assets includes roughly ¥180-trillion in real assets, such as public office buildings, and ¥520-trillion in financial assets, including stakes in special corporations. The government can sell these assets and use the proceeds to pay down debt. Thus, Japan's net debt is about ¥200-trillion, or about 40% % of its nominal GDP, which is over ¥500 trillion. Perhaps, this is why Beijing hasn’t been afraid to buy 1.7-trillion yen of JGB’s in the first seven months of 2010.

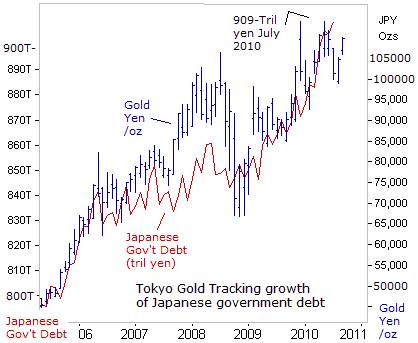

Still, at yields of 1% or less for 10-year Japanese bonds, the only buyers would be short-term gamblers, or those who are convinced that Japan’s economy would be snared in the deflation trap for year’s to come. Buying JGB’s at yields of 1% or less could lead to large losses over the longer-term. Thus, the more sensible investment for Japanese investors is to buy Tokyo gold, which has more than doubled over the past five-years, and served as a good hedge against the BoJ’s printing schemes.

Still, at yields of 1% or less for 10-year Japanese bonds, the only buyers would be short-term gamblers, or those who are convinced that Japan’s economy would be snared in the deflation trap for year’s to come. Buying JGB’s at yields of 1% or less could lead to large losses over the longer-term. Thus, the more sensible investment for Japanese investors is to buy Tokyo gold, which has more than doubled over the past five-years, and served as a good hedge against the BoJ’s printing schemes.

Already, the BoJ is monetizing half of Tokyo’s annual budget deficit of 44-trillion yen this fiscal year, and there’s pressure on the central bank to buy more JGB’s to weaken the yen. Although some traders might view the BoJ’s bond buying operations as a buy signal for JGB’s, investors in Tokyo gold have profited more handsomely. Tokyo gold has been tracking the size of Japan’s outstanding debt, since Tokyo’s ruling elite prefer to pressure the central bank to monetize its debts, rather than sell-off state owned assets to finance budget shortfalls.

Bank Rossii, Russia’s central bank, manages the rouble against a basket of dollars and Euros to limit currency swings that may hurt it exporters. In August, Bank Rossii bought $1.1-billion and 136-million Euros, while trying to keep the rouble within a floating range against the Euro-dollar’s basket. The worst drought in decades this summer has already shrunk Russia’s trade surplus to $8.3-billion in August, or 29% less than a year ago, and has slowed its economy’s growth rate to +2.4%, with 60% of the fall attributed to the agricultural sector. Thus, Bank Rossi is liable to start increasing the supply of roubles in the money markets, to limit further damage from adverse exchange rates moves to its economy.

Bank Rossii, Russia’s central bank, manages the rouble against a basket of dollars and Euros to limit currency swings that may hurt it exporters. In August, Bank Rossii bought $1.1-billion and 136-million Euros, while trying to keep the rouble within a floating range against the Euro-dollar’s basket. The worst drought in decades this summer has already shrunk Russia’s trade surplus to $8.3-billion in August, or 29% less than a year ago, and has slowed its economy’s growth rate to +2.4%, with 60% of the fall attributed to the agricultural sector. Thus, Bank Rossi is liable to start increasing the supply of roubles in the money markets, to limit further damage from adverse exchange rates moves to its economy.

The Kremlin earns most of its foreign currency from the sale of Urals blend crude oil, natural gas, and other natural resources, such as timber, platinum, and nickel. Along with rebounding energy and metals markets, Russia’s FX reserves have been replenished to around $478-billion today, from as low as $380-billion in March 2009. Moscow is keen to diversify some of its FX stash into gold, and last May, added 1.1-million ounces equaling 16% of monthly global mining output.

Overall, the Russian central bank bought gold at an average rate of 250,000-ounces /month for the past three-years, and now holds an estimated 23.6-million ounces. As of the first quarter of 2010, Saudi Arabia said it had more than doubled its gold holdings from 143-tons in Q’1, 2008 to 323-tons, for an average increase of 241,000 ounces a month, or about the same as Russia’s purchases. Thus, gold traders will keep a close eye on the FX reserves of these two key oil producers.

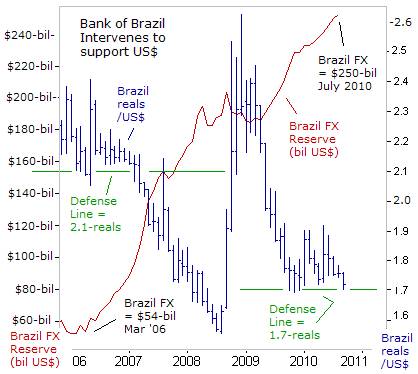

Brazil has ramped-up its intervention efforts in the foreign currency markets, buying US-dollars twice each day, in order to prevent the greenback from falling below its latest defense line at 1.70-reals. Largely due to its super strong currency, Brazil’s trade surplus fell 44% to $7.9-billion in the first half of 2010, down from $13.9-billion a year ago, as imports grew nearly twice as fast as its exports.

Brazil has ramped-up its intervention efforts in the foreign currency markets, buying US-dollars twice each day, in order to prevent the greenback from falling below its latest defense line at 1.70-reals. Largely due to its super strong currency, Brazil’s trade surplus fell 44% to $7.9-billion in the first half of 2010, down from $13.9-billion a year ago, as imports grew nearly twice as fast as its exports.

Four-years ago, the Bank of Brazil (BoB) tried to prevent the US-dollar from falling below 2.10-reals, but failed in its $100-billion intervention effort. Currently, the BoB is trying to draw a red-line in the sand for the US-dollar at 1.70-reals, but Brazil’s high short term interest rates, offered at 10.75%, are simply too irresistible to yield hungry investors from around the globe. Foreign inflows of cash into Brazil in the first ten-days of September alone, was $2.14-billion. As a result of its relentless intervention efforts, trade surpluses, and foreign direct investment, Brazil’s FX stash has grown to $250-billion, and it’s the fifth largest lender to the US-Treasury.

On Sept 15th, Brazil’s Finance chief Guido Mantega vowed to defend the country’s exporters, joining other governments worldwide that seek to weaken their currencies as a way of speeding up an economic recovery. “We will not sit on the sidelines watching the game, while other countries weaken their currencies at the expense of Brazil. We’re going to take appropriate measures to stop the real from appreciating,” he declared in Rio de Janeiro.

Under conditions of slowing growth in the US-economy, there’s been an eruption of currency wars, with an increasing number of governments around the world seeking to secure their share of export markets, through outright intervention in the currency markets. Last week, Senate Banking Committee chairman Christopher Dodd declared China a currency manipulator and said its “economic and trade policies present roadblocks to our recovery.” He accused Beijing of stealing intellectual property, violating international trade agreements and dumping goods. Since then, the US-dollar tumbled 1.2% to 6.7035-yuan.

Under conditions of slowing growth in the US-economy, there’s been an eruption of currency wars, with an increasing number of governments around the world seeking to secure their share of export markets, through outright intervention in the currency markets. Last week, Senate Banking Committee chairman Christopher Dodd declared China a currency manipulator and said its “economic and trade policies present roadblocks to our recovery.” He accused Beijing of stealing intellectual property, violating international trade agreements and dumping goods. Since then, the US-dollar tumbled 1.2% to 6.7035-yuan.

The US-Treasury chief suggested that China should raise the yuan’s exchange rate by at least 20% and issued a thinly veiled threat, noting that “China has a very substantial economic stake in access to the US market.” The biggest beneficiary of the growing currency trade wars is the precious metals- gold and silver, basking in the growing supply of freshly printed paper currency worldwide.

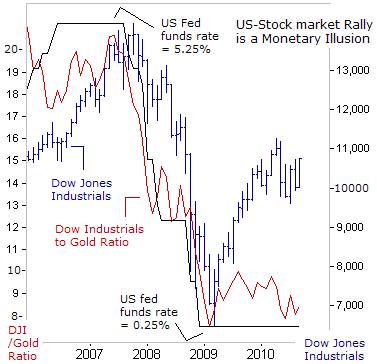

The prospect of QE-2 by the Fed is prompting other central bankers to counter with currency devaluations of their own. Some central banks such as Banco de Chile, the Bank of Australia, and the Bank of India, are going the opposite way, - lifting their interest rates, and their currencies have become magnets for foreign capital. But the Fed has concluded that the only expedient weapon in its arsenal to speed-up the US-economy is to inject another tidal wave of US-dollars into the banking system, while aiming to artificially inflate the US-stock market higher, and thus, create the illusion of greater wealth and better times ahead.

However, when seen through the lens of gold, or in “hard money” terms, the Dow-to-Gold ratio is still trapped near its lows of Q’2, 2009, highlighting the notion that the US-economic recovery has been mostly limited to Wall Street, and US-multinationals. Meanwhile, the divide between rich and poor in the US is getting wider. The Dow Industrials’ 3,800-point rally from the low of March 2009 was a monetary illusion, and Gold is still best way to preserve wealth.

This article is just the Tip of the Iceberg of what’s available in the Global Money Trends newsletter. Subscribe to the Global Money Trends newsletter, for insightful analysis and predictions of (1) top stock markets around the world, (2) Commodities such as crude oil, copper, gold, silver, and grains, (3) Foreign currencies (4) Libor interest rates and global bond markets (5) Central banker "Jawboning" and Intervention techniques that move markets.

By Gary Dorsch,

Editor, Global Money Trends newsletter

http://www.sirchartsalot.com

GMT filters important news and information into (1) bullet-point, easy to understand analysis, (2) featuring "Inter-Market Technical Analysis" that visually displays the dynamic inter-relationships between foreign currencies, commodities, interest rates and the stock markets from a dozen key countries around the world. Also included are (3) charts of key economic statistics of foreign countries that move markets.

Subscribers can also listen to bi-weekly Audio Broadcasts, with the latest news on global markets, and view our updated model portfolio 2008. To order a subscription to Global Money Trends, click on the hyperlink below, http://www.sirchartsalot.com/newsletters.php or call toll free to order, Sunday thru Thursday, 8 am to 9 pm EST, and on Friday 8 am to 5 pm, at 866-553-1007. Outside the call 561-367-1007.

Mr Dorsch worked on the trading floor of the Chicago Mercantile Exchange for nine years as the chief Financial Futures Analyst for three clearing firms, Oppenheimer Rouse Futures Inc, GH Miller and Company, and a commodity fund at the LNS Financial Group.

As a transactional broker for Charles Schwab's Global Investment Services department, Mr Dorsch handled thousands of customer trades in 45 stock exchanges around the world, including Australia, Canada, Japan, Hong Kong, the Euro zone, London, Toronto, South Africa, Mexico, and New Zealand, and Canadian oil trusts, ADR's and Exchange Traded Funds.

He wrote a weekly newsletter from 2000 thru September 2005 called, "Foreign Currency Trends" for Charles Schwab's Global Investment department, featuring inter-market technical analysis, to understand the dynamic inter-relationships between the foreign exchange, global bond and stock markets, and key industrial commodities.

Copyright © 2005-2010 SirChartsAlot, Inc. All rights reserved.

Disclaimer: SirChartsAlot.com's analysis and insights are based upon data gathered by it from various sources believed to be reliable, complete and accurate. However, no guarantee is made by SirChartsAlot.com as to the reliability, completeness and accuracy of the data so analyzed. SirChartsAlot.com is in the business of gathering information, analyzing it and disseminating the analysis for informational and educational purposes only. SirChartsAlot.com attempts to analyze trends, not make recommendations. All statements and expressions are the opinion of SirChartsAlot.com and are not meant to be investment advice or solicitation or recommendation to establish market positions. Our opinions are subject to change without notice. SirChartsAlot.com strongly advises readers to conduct thorough research relevant to decisions and verify facts from various independent sources.

Gary Dorsch Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.