Gold/Silver Ratio Analysis

Commodities / Gold and Silver 2010 Sep 22, 2010 - 03:01 AM GMTBy: Jordan_Roy_Byrne

The Gold/Silver ratio has just broken in favor of Silver. In other words, the ratio has broken to the downside. This development along with persistent strength in Gold has prompted the mainstream gurus and “experts” to talk up Silver. We've been writing about the potential in Silver on more than one occasion.

The Gold/Silver ratio has just broken in favor of Silver. In other words, the ratio has broken to the downside. This development along with persistent strength in Gold has prompted the mainstream gurus and “experts” to talk up Silver. We've been writing about the potential in Silver on more than one occasion.

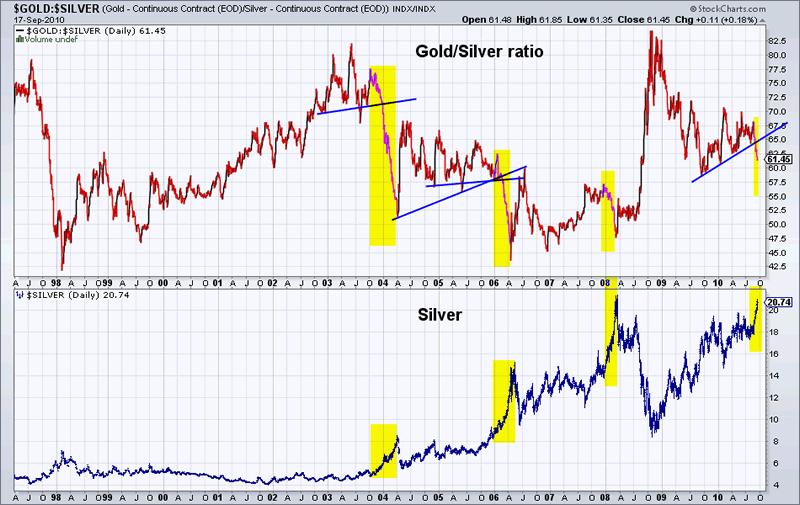

There are some important points to take away from the Gold/Silver ratio. We show the Gold/Silver ratio in Silver in the chart below. Take a look and think about what you see.See here and here.

The positive is that breakdowns in the Gold/Silver ratio tend to be an accelerant for Silver. However, such breakdowns often occur at about the midpoint of a move. Note that Silver has made an important top after each major breakdown in the Gold/Silver ratio. Should we expect that soon? The chart shows there is plenty of room for the ratio to fall. A fair target looks like 57.

Our target of $24-$25 for Silver looks well on track after the breakout past $19.50. There is plenty of room ahead in the next few months. However, that target could be the point where the market begins a multi-month pullback. Don't assume that Silver will forever outperform Gold. It comes in fits and starts. Breakdowns in the Gold/Silver ratio lead to big moves but also to important interim tops.

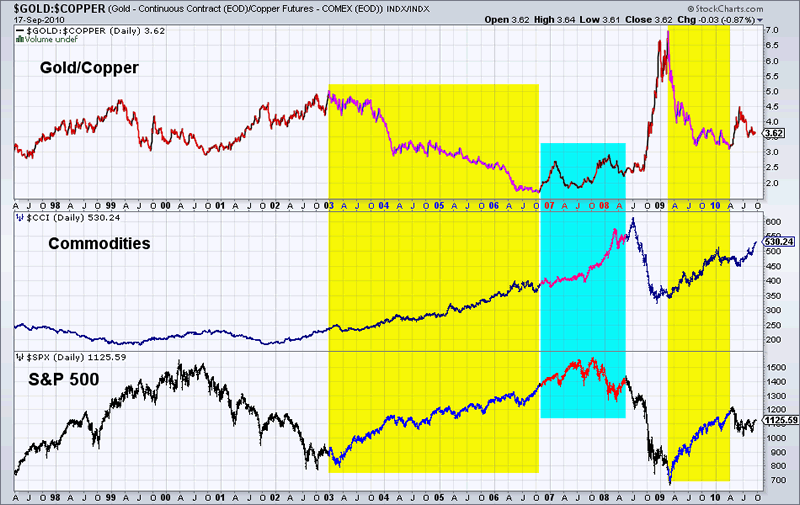

The Gold/Silver ratio can be an economic indicator as a surge can indicate recession, tightening of credit, etc. The reverse can be true on the downside. However, we are currently in a strong precious metals bull market. For over a year Silver has acted far more like Gold than an industrial metal. For a better economic indicator, I would look at the Gold/Copper ratio. In the chart below we show the Gold/Copper ratio, Commodities and the S&P 500.

We highlight (in yellow) when Copper outperformed Gold. Stocks were especially strong during those periods and Commodities also performed well. The point is that Gold/Copper is presently a better economic indicator than the Gold/Silver ratio. Don't assume that a falling Gold/Silver ratio is bullish for Stocks and Commodities. Check the Gold/Copper ratio for confirmation.

The Gold/Silver ratio, as applied to precious metals can tell us quite a bit. Typically, a breakdown tells us that a more speculative, momentum filled run is beginning and that the sector is moving closer to a top. This being said, the breakout in Silver past $20 will be the most significant breakout to date. We do expect a top at $24-$25, but nothing major.

How does one play the Gold/Silver ratio? Our recent editorials called for an overweighting in Silver stocks as there was more opportunity and better value there. Continue to hold those positions. Realize that a weak Gold/Silver ratio means the market is in a more speculative mood which means greater volatility, risk and reward. Make sure you are buying a stock for the right reason. If it is a long-term play than look for something that isn't overheated. If you are wanting momentum and short-term gains, make sure to define your risk.

These are all factors we employ in our premium service. It has allowed us and or subscribers to take advantage of the different opportunities within the changing environment in the precious metals sector. If you are interested in more professional guidance in navigating this bull market, then consider a free 14-day trial to our service.

Good luck ahead!

Jordan Roy-Byrne, CMT

Jordan@thedailygold.com

http://www.thedailygold.com/newsletter

Trendsman” is an affiliate member of the Market Technicians Association (MTA) and is enrolled in their CMT Program, which certifies professionals in the field of technical analysis. He will be taking the final exam in Spring 07. Trendsman focuses on technical analysis but analyzes fundamentals and investor psychology in tandem with the charts. He credits his success to an immense love of the markets and an insatiable thirst for knowledge and profits.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.