Stock Market Confusion? S&P 500 bullish, VIX bearish?

Stock-Markets / Stock Markets 2010 Sep 21, 2010 - 10:35 AM GMTBy: Marty_Chenard

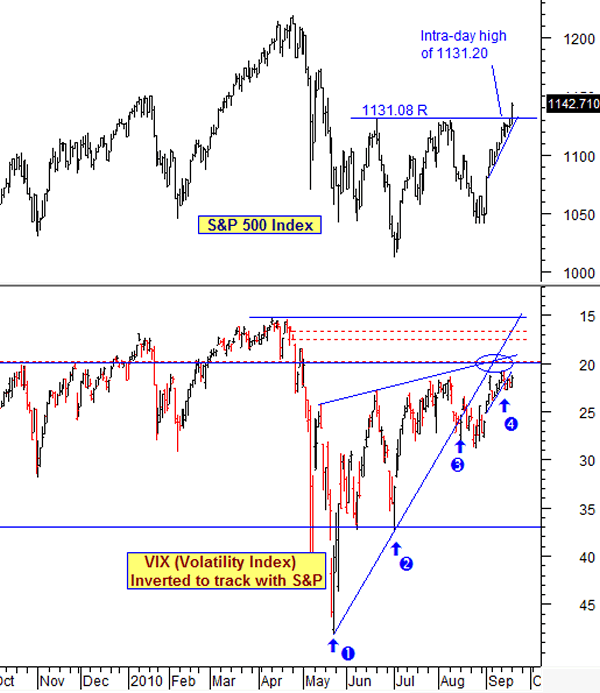

Below is a long term view of the VIX (Volatility Index).Note that the VIX has been below its September inverted support line for the past 4 days while the S&P has been above its support with a triple top upside breakout yesterday.

Below is a long term view of the VIX (Volatility Index).Note that the VIX has been below its September inverted support line for the past 4 days while the S&P has been above its support with a triple top upside breakout yesterday.

Yesterday, the S&P breakout was bullish, but the VIX falling below both of its inverted supports at labels 3 and 4 was bearish.

Investors are Confused and Cautious

Yesterday, NBER said the recession was officially over and the market rallied in belief ... even though there was disbelief showing when the ratio of "Protective Puts over Call options were 2 to 1 in favor of Puts" when the market closed. That indicated that investors distrusted and doubted yesterday's upside rally movement. Many fund managers thought that this was a short covering rally being forced on investors.

The VIX levels are saying that risk levels are remaining high because the VIX was below inverted supports which is bearish.

So conditions are actually mixed with a distrusted bullish condition. So, why is there such distrust and confusion? Please see our commentary below the chart for the reasons...

Commentary for Today: Is that all it took to end the recession?

All it took to end the recession was for the NBER to "say" it was officially over yesterday, and the market rallied in total belief ... even though there was disbelief showing when the ratio of "Protective Puts over Call options were 2 to 1 in favor of Puts" when the market closed.

What's a protective put? You buy a Protective Put when you are long, but want to protect yourself against a market correction. Protective Puts are used when investors are very risk averse, or when they believe that an investment is very risky. (Many fund managers I spoke with yesterday felt that the market was seeing a massive short covering rally.)

If the NBER is correct... Can the Fed and Bernanke go home, take a vacation, and cancel today's meeting ... because their job is done, finis, and ended ... because the recession ended last year? And what about the Fed's beige book survey, that was "prepared for the today's meeting" which revealed: "widespread signs of a deceleration" through the end of August after the Commerce Department revised second quarter GDP (showed) growth down to 1.6%"?

And while we are at it ... should Federal Express shipping company fire their CEO for being behind the NBER curve? CEO Fred Smith said he expects the pace of the world's economic recovery to slow in the months ahead. FedEx said they will be cutting as many as 17,000 jobs. Is the recession over or not?

Have these problems been resolved?

- Consumer debt loads are still exorbitantly high.

- Consumer debt has not been deleveraged yet.

- Unemployment is still very high.

- One in six people are on food stamps.

- Increasing gold prices have expressed discontent with the real value of paper currencies.

- There is no bond bubble? Everything is now normal, safe, and okay.

- Some analysts like Mohamed EL-Erian of Pimco thought that 25% to 35% deflation was coming. Is NBER suggesting that won't happen? Deflation would have meant falling prices, and with rising commodity prices, corporate profits would have gotten into serious trouble.

- What about David Rosenberg recent comments? He said that he thought that consumers don't moderate spending while they have untapped credit limits. Quite the contrary (relative to spending), he said ... "they accelerate spending until the charge off threshold at the lender is breached, and all credit is cut off, also resulting in a collapse in a creditor's FICO score, cutting him or her off completely from future (at least near term) credit access. " Maybe that explains why the historical, bank un-lendable FICO scores traditionally had 15% of consumers and now the number recently jumped to 25%?

- What about the Wall Street Journal's research agreeing with Rosenberg? Everyone thought that consumers were paying down debt. But, as the WSJ pointed out on yesterday ... it is not true. They essentially said that "over the past two years, consumers have not been deleveraging on their own volition, but instead have been aggressively increasing their amount of debt leveraging until creditors forced them into involuntary bankruptcy.

- You may have also read this announcement yesterday: "Americans are bracing for a weakening economic rebound in the coming months as consumer sentiment reached its lowest level in more than a year in September, according to Reuters. The preliminary reading for the Thomson Reuters/University of Michigan consumer sentiment index fell 2.3 points to reach 66.6 in September - the lowest reading since August 2009 - falling well short of economists' estimate for a moderate rise. The poll found a divergence among income groups, with households earning above $75,000 annually accounting for the entire decline in sentiment, while lower-income households reported improved sentiment. How does that factor in with the NBER announcement?

- Does the "Recession is over" pronouncement by NBER mean that the debate about inflation or deflation is a non issue now? The fact that countries are starting a deflationary war to debase their currencies to improve exports can now be ignored?

Who and what should you believe? If ... If you are confused, I fully understand.

Pimco, the Wall Street Journal, Rosenberg, the Federal Reserve, Bernanke, and the vast unemployed are also confused.

Common sense says that these opposite and conflicting opinions do not make sense.

Given the wide dispersion of market opinions, what are the risk levels in the market now?

Protective put buyers were 2 to 1 over call buyers yesterday, and that said that they did NOT trust the current up move. By their actions, they were saying that they believed the market risks were high.

None-the-less, there is liquidity coming into the market and that is pushing it higher. Liquidity levels have risen back into Expansion territory and that has a bullish bias.

So, computer programs from mutual funds and hedge funds are likely to stay bullish until the next downside catalyst.

So what is the most important question now? The most important question may well be: What is the next downside catalyst and will when will it happen?

So what is the most important question now?

- The most important question may well be: What is the next downside catalyst and will when will it happen?

- Or maybe there isn't an important question to ask. If this truly is a short covering rally as many are suggesting, then maybe it is just a matter of waiting until the shorts are done covering .. and that will end the rally.

Yes, things do appear to be confusing, but I do hope that this commentary has you thinking more about why the market is confused.

** Feel free to share this page with others by using the "Send this Page to a Friend" link below.

By Marty Chenard

http://www.stocktiming.com/

Please Note: We do not issue Buy or Sell timing recommendations on these Free daily update pages . I hope you understand, that in fairness, our Buy/Sell recommendations and advanced market Models are only available to our paid subscribers on a password required basis. Membership information

Marty Chenard is the Author and Teacher of two Seminar Courses on "Advanced Technical Analysis Investing", Mr. Chenard has been investing for over 30 years. In 2001 when the NASDAQ dropped 24.5%, his personal investment performance for the year was a gain of 57.428%. He is an Advanced Stock Market Technical Analyst that has developed his own proprietary analytical tools. As a result, he was out of the market two weeks before the 1987 Crash in the most recent Bear Market he faxed his Members in March 2000 telling them all to SELL. He is an advanced technical analyst and not an investment advisor, nor a securities broker.

Marty Chenard Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.