The End of the Great Recession is Official

Economics / Economic Recovery Sep 21, 2010 - 06:29 AM GMTBy: Asha_Bangalore

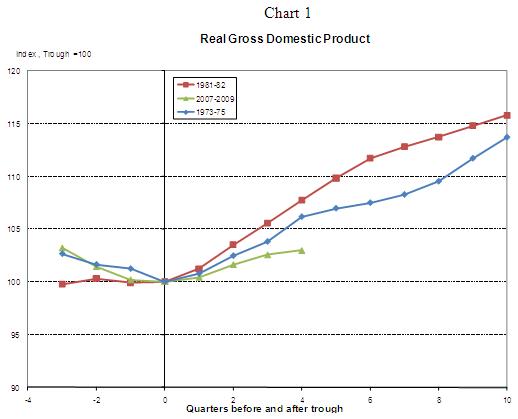

The Business Cycle Dating Committee of the National Bureau of Economic Research indicated today that the recession which commenced in December 2007 ended in June 2009. The 18-month recession is the longest on record in the post-war period. The 1973-75 and 1981-82 recessions lasted 16 months. The announcement is an official ritual; for all practical purposes, it has been widely known the recession ended in the middle of 2009. The important difference to note is that the pace of economic growth in the current recovery is significantly slower compared with the recoveries following the 1973-75 and 1981-82 recessions.

The Business Cycle Dating Committee of the National Bureau of Economic Research indicated today that the recession which commenced in December 2007 ended in June 2009. The 18-month recession is the longest on record in the post-war period. The 1973-75 and 1981-82 recessions lasted 16 months. The announcement is an official ritual; for all practical purposes, it has been widely known the recession ended in the middle of 2009. The important difference to note is that the pace of economic growth in the current recovery is significantly slower compared with the recoveries following the 1973-75 and 1981-82 recessions.

Chart 1 is an index chart where real GDP in the trough quarter is set equal to 100 and GDP readings are recomputed as indexes. An index reading of 105 implies that real GDP has risen by 5.0% from the trough. Real GDP rose 6.2% and 7.7% at end of four quarters of economic recovery following the 1973-75 and 1981-82 recessions, while it has risen only 3.0% after four quarters of economic growth this time around (see chart 1).

The Federal Open Market Committee's (FOMC) policy statement released after deliberations tomorrow will be scrutinized extensively for hints about the Fed's next policy action. The Fed is most likely to maintain the message that "exceptionally low levels" of the federal funds rate are warranted. President Hoenig of the Kansas City Fed dissented at the August 10 meeting and a similar vote should not be surprising on September 21.

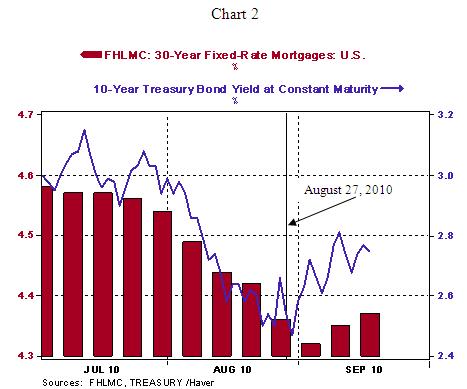

The tone of economic reports prior to Chairman Bernanke's speech was raising doubts about the durability of the economic recovery. The message of economic reports following this speech has turned more positive and reduced the probability of the Fed considering any action at the meeting tomorrow. Private sector payrolls (+67,000, eighth straight monthly increase) posted gains in August, the percentage of those experiencing long-term unemployment dropped to 42% in August from a peak of 46% in May. Retail sales moved up 0.4% in August, the July Pending Home Sales Index rose 5.2% following sharp declines in May and June, and the September the Housing Market Index of the National Association of Home Builders Index held steady after three consecutively monthly declines. The 10-year Treasury note yield has moved up since Mr. Bernanke spoke on August 27, (Chart data stops as of September 17).

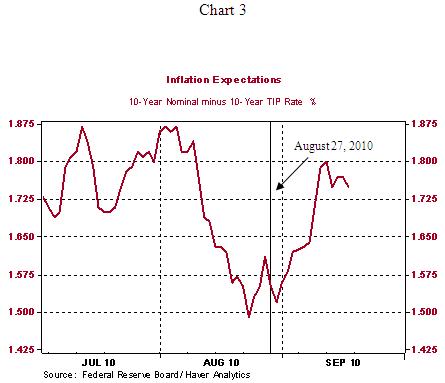

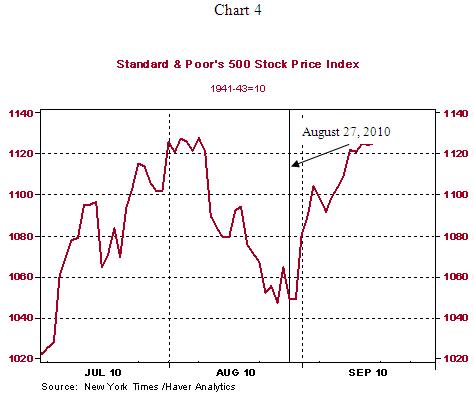

Inflation expectations as measured by the difference between the nominal U.S. Treasury note yield and 10-year inflation protected security has risen roughly 13 basis points since August 27, 2010 (see chart 3), while equity prices have also risen (see chart 4).

Asha Bangalore — Senior Vice President and Economist

http://www.northerntrust.com

Asha Bangalore is Vice President and Economist at The Northern Trust Company, Chicago. Prior to joining the bank in 1994, she was Consultant to savings and loan institutions and commercial banks at Financial & Economic Strategies Corporation, Chicago.

The opinions expressed herein are those of the author and do not necessarily represent the views of The Northern Trust Company. The Northern Trust Company does not warrant the accuracy or completeness of information contained herein, such information is subject to change and is not intended to influence your investment decisions.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.