Gold is on the Move

Commodities / Gold and Silver 2010 Sep 18, 2010 - 11:03 AM GMTBy: Aden_Forecast

Gold is looking good. Since its summer low of $1160 in late June, it has surged to $1275. That's a nearly 10% gain in less than two months, and even though gold has again broken its all-time record high, it's poised to move still higher.

Gold is looking good. Since its summer low of $1160 in late June, it has surged to $1275. That's a nearly 10% gain in less than two months, and even though gold has again broken its all-time record high, it's poised to move still higher.

What's Driving the Gold Price Up?

There are several key factors coming together at the same time and all of them are bullish for gold. But if we had to boil it down, the bottom line is uncertainty. This makes investors nervous, which has always been good for gold. But is this response rational?

We think so. Gold is the ultimate safe haven and as the economy stumbles, demand for gold has grown. That's been the case for almost a decade. In the second quarter of 2010, for instance, the economic indicators were down and gold demand was up 36%.

Investors are concerned. Not only did the economy falter this month, but the stock market declined as well. This has fueled uncertainty about the government's policies, the potential for a "double dip" recession, and the danger of a deflationary period.

At times like this, safety becomes the paramount consideration. Risk is avoided, and that's when gold shines. Gold provides a shelter from the storm, regardless of what lies ahead. The ongoing rise in the gold price has reinforced this maxim.

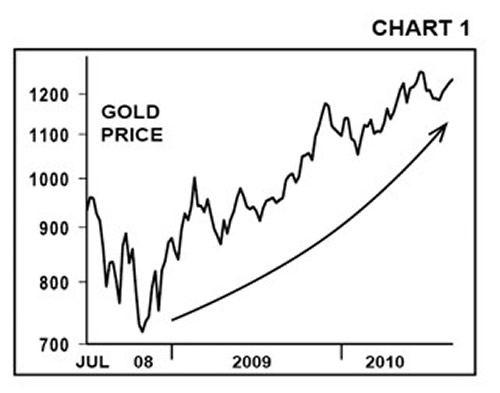

As you can see in Chart 1, gold has not had a steep downward correction in nearly two years. It's been moving up slowly and steadily. Consistently rising prices eventually attract attention, and that's now starting to happen.

It doesn't hurt that some of the most successful and well-known money managers have been buying gold and gold-related investments. But, despite the fact that growing demand has kept upward pressure on the gold price, the yellow metal has not yet become popular with mainstream investors. That's still to come, and it's one reason why gold's upside potential will continue to remain positive.

Uncertainty Is Growing

While mainstream investor sentiment shifts to gold, uncertainty looks set to increase in tandem.

Federal Reserve Chairman Bernanke recently affirmed that the Fed will do whatever it takes to boost the economy. In recent weeks, the Fed again started buying US government debt in the hope of stimulating the economy, and it is prepared to do much more.

If that means buying underwater mortgages, financing the ever-ballooning federal debt, or printing enough new dollars to fill the Grand Canyon, then so be it. As home sales fall and jobless claims rise, the pressure has mounted for Washington to act.

More and more investors understand that the side effects of Fed's actions will be a weaker dollar and high inflation.

In the end, whether deflation, recession, or inflation is the result, uncertainty is being kicked up several notches. This simply adds to gold's appeal.

On the international front, it's the same story. Demand is growing, especially in Asia and Europe. Investors are generally nervous and uneasy. They want something safe; and, as we saw again this month, gold always emerges as the safe harbor in times of uncertainty.

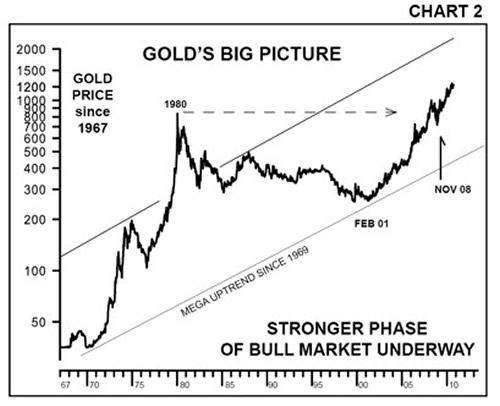

Obviously, gold will have its ups and downs along the way. That's normal - but there's every reason to believe that gold's mega-uptrend is going to stay on track (see Chart 2).

In fact, with each passing month, the case for gold grows stronger. For now, if gold can continue its record-breaking rally, it'll attract even more attention and the momentum will build on itself. This may already be happening, so stay tuned...

This article was exclusively written for Peter Schiff's Gold Report, a newsletter devoted to the precious metals market. Click here for more information and a free subscription.

By Mary Anne & Pamela Aden

Mary Anne & Pamela Aden are well known analysts and editors of The Aden Forecast, a market newsletter providing specific forecasts and recommendations on gold, stocks, interest rates and the other major markets. For more information, go to www.adenforecast.com

Aden_Forecast Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.