Gold Makes Successive New All Time Highs Despite Continuing Public Apathy

Commodities / Gold and Silver 2010 Sep 17, 2010 - 08:26 AM GMTBy: GoldCore

Gold and silver are higher again this morning with gold hitting new record nominal highs and silver having risen sharply to $20.995/oz which is a new multi-month high. A close above $21/oz will be important technically and a close above $21.24/oz would be very bullish technically with long term chart analysts looking at the 1980 record high (just below $50/oz) and the silver's record quarterly high close of $32.20/oz as the next levels of technical resistance.

Gold and silver are higher again this morning with gold hitting new record nominal highs and silver having risen sharply to $20.995/oz which is a new multi-month high. A close above $21/oz will be important technically and a close above $21.24/oz would be very bullish technically with long term chart analysts looking at the 1980 record high (just below $50/oz) and the silver's record quarterly high close of $32.20/oz as the next levels of technical resistance.

Gold is currently trading at $1,278.60/oz, €978.64 /oz, £816.66/oz.

While gold has risen to new record highs, sentiment remains lukewarm amongst the investment public with much of the mainstream press barely covering gold's new all time record highs. Skepticism remains high with many market participants expecting a pullback here and indeed one is quite likely at $1,300/oz. However, gold could surprise to the upside and surprise the consensus opinion as it has a habit of doing.

Despite some sensationalist headlines of gold "surging" and of a new "gold rush", gold's rise has been gradual and it is only up some 3% this week and some 3% this month. Gold is only up 16.5% year to date which corresponds with its average annual appreciation in the last 10 years. It is worth remembering that in the gold bull market of the 1970s when gold rose 24 fold - or by 2,300% - in 9 years. Gold rose 49.7% in 1972, 73.5% in 1973 and by 60.1% in 1974. In the final phase of the bull market in 1979, gold surged 140% in one year. Gold's recent rise has been tame and gradual by comparison.

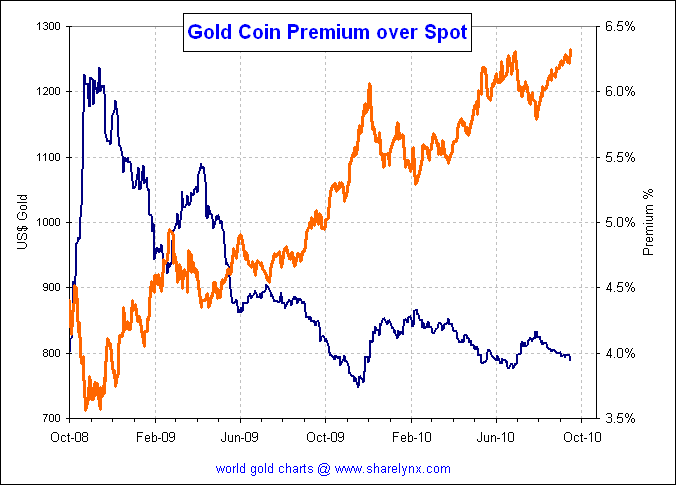

Another indication of the lack of animal spirits or irrational exuberance in the gold market is the recent decline in investor buying of gold (and silver) coins. This is clearly seen in the low bullion coin premiums which have fallen dramatically since late 2008 (see chart below). In the aftermath of the Lehman Brothers collapse and the ensuing crisis, premiums surged as investors and savers scrambled to buy bullion coins leading to rationing and shortages. There is nothing like that happening in the bullion markets today.

This apathy or lack of mania in the gold market is confirmed by our sales desk who are less busy now than they were in the aftermath of the Bear Stearns and Lehmans collapse and panics. Indeed, despite our extensive international media coverage this week inquiries and sales have remained steady but there is no element of the public "piling into" gold. Indeed, much of the buying is being done by existing clients, particularly wealthier clients adding to positions. This lack of bullishness is confirmed by official government mint bullion coin sales figures. Muenze Oesterreich AG, the Austrian mint that makes the Philharmonic coin, said gold coin and bar sales were 1.003 million ounces in the year through August, down 39 percent from same period last year. Demand declined from 1.637 million ounces in the eight months through August 2009.

Silver

Silver is currently trading at $20.83/oz, €15.95/oz and £13.33/oz.

Platinum Group Metals

Platinum is trading at $1,618.25/oz, palladium is at $546/oz and rhodium is at $2,050/oz.

This update can be found on the GoldCore blog here.

Mark O'Byrne

Director

IRL |

UK |

IRL +353 (0)1 632 5010 |

WINNERS MoneyMate and Investor Magazine Financial Analysts 2006

Disclaimer: The information in this document has been obtained from sources, which we believe to be reliable. We cannot guarantee its accuracy or completeness. It does not constitute a solicitation for the purchase or sale of any investment. Any person acting on the information contained in this document does so at their own risk. Recommendations in this document may not be suitable for all investors. Individual circumstances should be considered before a decision to invest is taken. Investors should note the following: Past experience is not necessarily a guide to future performance. The value of investments may fall or rise against investors' interests. Income levels from investments may fluctuate. Changes in exchange rates may have an adverse effect on the value of, or income from, investments denominated in foreign currencies. GoldCore Limited, trading as GoldCore is a Multi-Agency Intermediary regulated by the Irish Financial Regulator.

GoldCore is committed to complying with the requirements of the Data Protection Act. This means that in the provision of our services, appropriate personal information is processed and kept securely. It also means that we will never sell your details to a third party. The information you provide will remain confidential and may be used for the provision of related services. Such information may be disclosed in confidence to agents or service providers, regulatory bodies and group companies. You have the right to ask for a copy of certain information held by us in our records in return for payment of a small fee. You also have the right to require us to correct any inaccuracies in your information. The details you are being asked to supply may be used to provide you with information about other products and services either from GoldCore or other group companies or to provide services which any member of the group has arranged for you with a third party. If you do not wish to receive such contact, please write to the Marketing Manager GoldCore, 63 Fitzwilliam Square, Dublin 2 marking the envelope 'data protection'

GoldCore Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.