Gold Price in All Major Currencies

Commodities / Gold and Silver 2010 Sep 17, 2010 - 05:38 AM GMT A common flaw that we see the average investor make is to follow their investments measured in foreign currencies and at the same time forget to calculate their local exchange rate on those investments. This is a HUGE mistake as the fluctuation of an investor’s home currency has a massive impact on their returns.

A common flaw that we see the average investor make is to follow their investments measured in foreign currencies and at the same time forget to calculate their local exchange rate on those investments. This is a HUGE mistake as the fluctuation of an investor’s home currency has a massive impact on their returns.

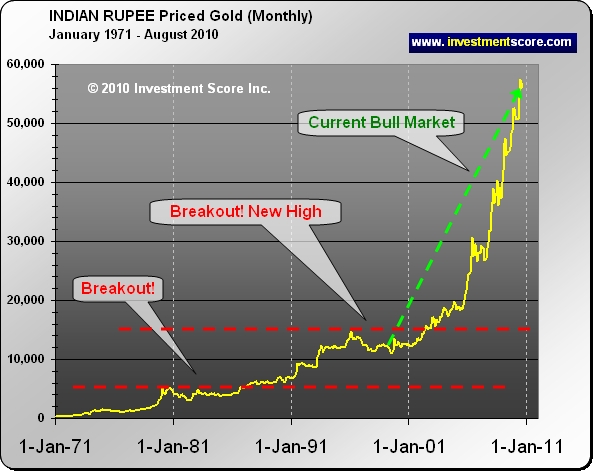

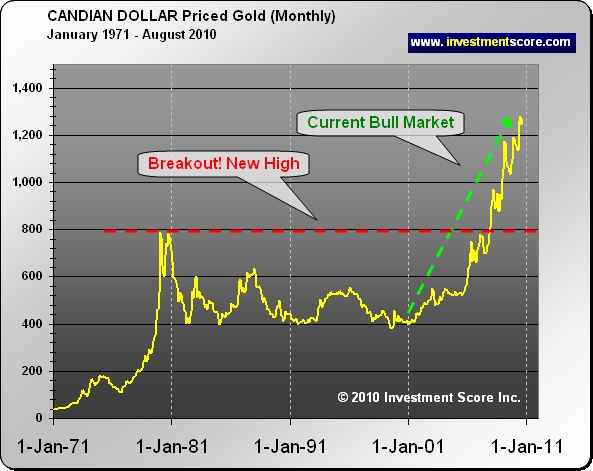

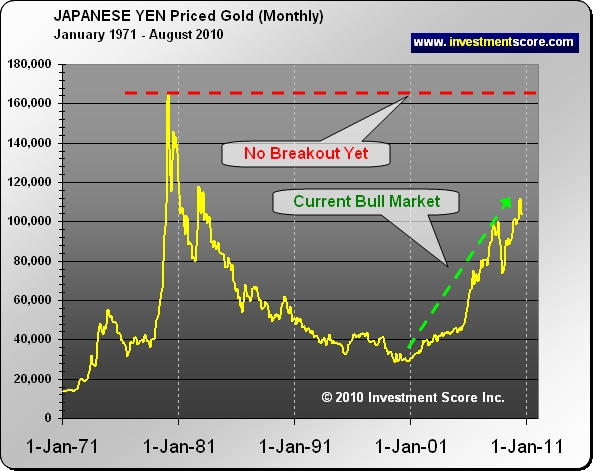

Some investors know that the price of gold has been performing well in the past few years but let’s look at the charts to see how well gold has done for investors around the world.

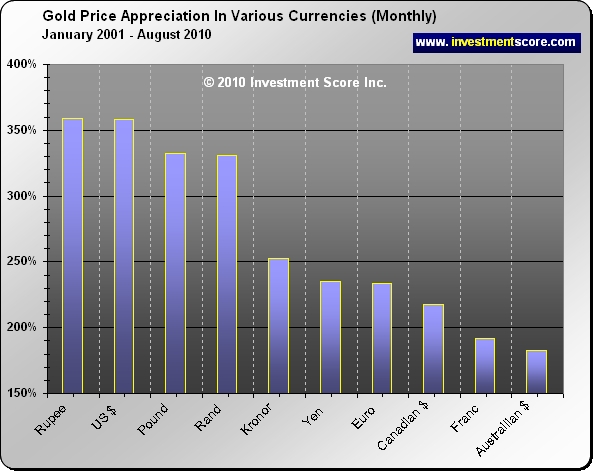

The above chart tells us the following:

- Since roughly 2001 the price of gold appears to be rising relative to most currencies and therefore the value or purchasing power of most currencies has been shrinking.

- Depending on where an investor is living, the price of gold has appreciated differently against the various currencies.

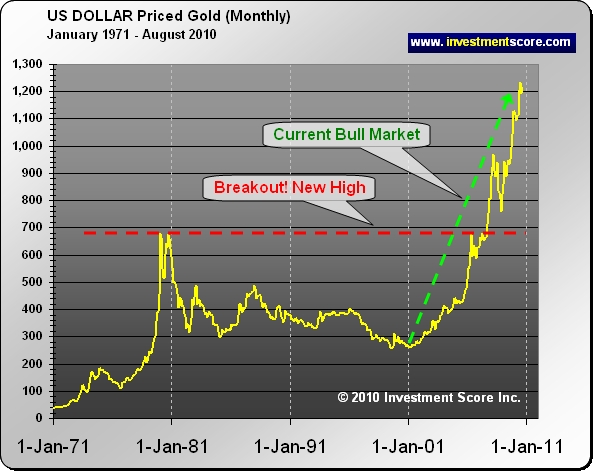

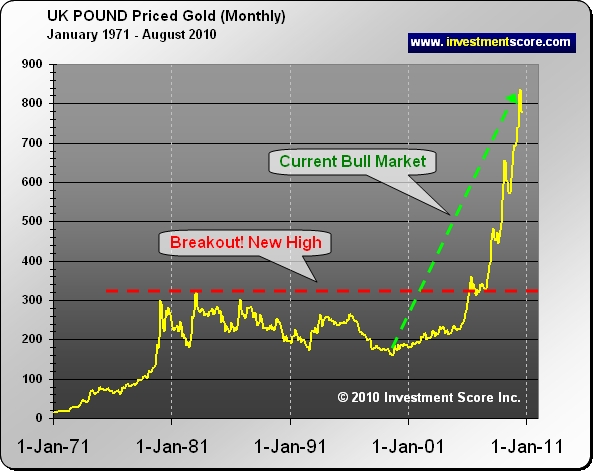

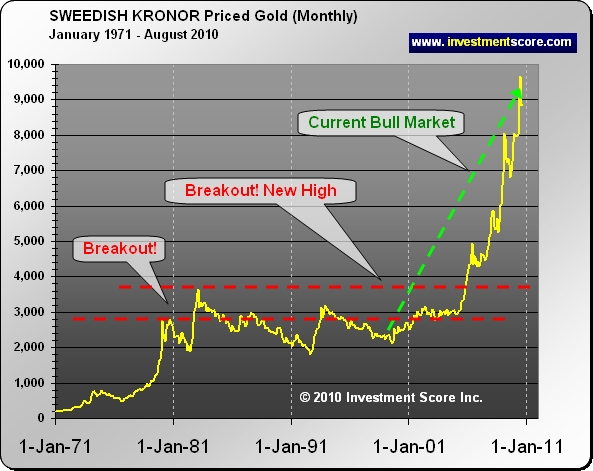

In our opinion it can be very helpful to look at the price of an investment like gold in multiple currencies regardless of where the citizen lives. Please review the following charts with this in mind and we will explain this statement more clearly below:

In the above charts one will notice:

- Again the price of gold has been rising in all currencies. This clearly illustrates that the bull market in Gold is very strong as currencies around the world are losing value relative to Gold.

- Depending on the currency the value of gold is measured in, new highs, breakouts, big drops or big advances will vary.

So how can looking at the price of gold in foreign currencies help all investors including US base investors?

It is our opinion that looking at gold in other currencies can sometimes give us a glimpse into the future of what may happen to the price of gold in our own currency. For example, if gold is breaking out in most currencies around the world at different times, but one country has yet to see gold break out in that nations currency, then that nation’s citizen’s may still have an opportunity to buy at lower prices. For example, Japanese (Yen) investors have been seeing the price of gold explode to new highs in other nations and this may give a Japanese investor insight for what may happen to their investments in gold in the future.

Additionally, seeing gold advance in multiple currencies gives the market’s advance more validity. If gold were only advancing in US dollars, one could argue that the advance is more of a reflection of the US dollar losing value instead of gold gaining real value. In fact, we would argue that any appreciation in US Stocks would be a reflection of the US dollar losing value instead of stocks gaining in value. This would be an example of looking at markets through various “measuring sticks”, such as other currencies, to get a better perspective on actual change in value. There will be ups and downs along the way but we believe that Silver, Gold and other commodities are well entrenched in a long term bull market that started in early 2000.

At investmentscore.com we look at investments relative to various markets in order to gain a unique perspective to their “Value” instead of their “Price”. We believe it is a common mistake for investors to be misguided by “price movement” instead of by true value. At the end of the day understanding “Value” is where wealth can be created and stored as “Price” can be greatly distorted by the constant fluctuations of currencies. To learn more about our strategies and to sign up for our free newsletter please visit us at www.investmentscore.com.

By Michael Kilback

Investmentscore.com

Investmentscore.com is the home of the Investment Scoring & Timing Newsletter. Through our custom built, Scoring and Timing Charts , we offer a one of a kind perspective on the markets.

Our newsletter service was founded on revolutionary insight yet simple principles. Our contrarian views help us remain focused on locating undervalued assets based on major macro market moves. Instead of comparing a single market to a continuously moving currency, we directly compare multiple major markets to one another. We expect this direct market to market comparison will help us locate the beginning and end of major bull markets and thereby capitalize on the largest, most profitable trades. We pride ourselves on cutting through the "noise" of popular opinion, media hype, investing myths, standard over used analysis tools and other distractions and try to offer a unique, clear perspective for investing.

Disclaimer: No content provided as part of the Investment Score Inc. information constitutes a recommendation that any particular security, portfolio of securities, transaction or investment strategy is suitable for any specific person. None of the information providers, including the staff of Investment Score Inc. or their affiliates will advise you personally concerning the nature, potential, value or suitability or any particular security, portfolio of securities, transaction, investment strategy or other matter. Investment Score Inc. its officers, directors, employees, affiliates, suppliers, advertisers and agents may or may not own precious metals investments at any given time. To the extent any of the content published as part of the Investment Score Inc. information may be deemed to be investment advice, such information is impersonal and not tailored to the investment needs of any specific person. Investment Score Inc. does not claim any of the information provided is complete, absolute and/or exact. Investment Score Inc. its officers, directors, employees, affiliates, suppliers, advertisers and agents are not qualified investment advisers. It is recommended investors conduct their own due diligence on any investment including seeking professional advice from a certified investment adviser before entering into any transaction. The performance data is supplied by sources believed to be reliable, that the calculations herein are made using such data, and that such calculations are not guaranteed by these sources, the information providers, or any other person or entity, and may not be complete. From time to time, reference may be made in our information materials to prior articles and opinions we have provided. These references may be selective, may reference only a portion of an article or recommendation, and are likely not to be current. As markets change continuously, previously provided information and data may not be current and should not be relied upon.

Investmentscore.com Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.