Japan’s Economic Problem Is Bigger Than Yen

Economics / Japan Economy Sep 17, 2010 - 04:25 AM GMTBy: Dian_L_Chu

After much speculation and many flying rumors, Japanese government stepped in on Wednesday, Sep. 15 and intervened--sell yen, buy dollar--for the first time in six years. The yen had risen about 10% against the dollar this year, and just reached yet another new 15-year high against the US dollar, an eight-year high against the euro, on Tuesday, Sep. 14.

After much speculation and many flying rumors, Japanese government stepped in on Wednesday, Sep. 15 and intervened--sell yen, buy dollar--for the first time in six years. The yen had risen about 10% against the dollar this year, and just reached yet another new 15-year high against the US dollar, an eight-year high against the euro, on Tuesday, Sep. 14.

Graphic Source: FT.com

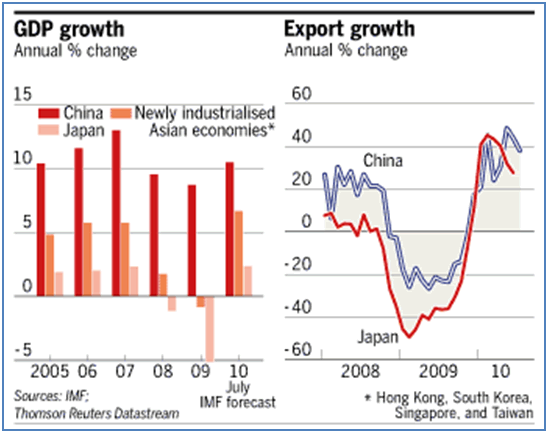

In the context of a slowing economy, the rapid rise of yen is bad news as it hurts exports, stalls domestic consumptions, and further aggravates the existing macro problem (see graph). Toyota Motor Corp. estimates that every 1-yen climb versus the dollar saps 30 billion yen, or $351 million from earnings.

This also caught some traders and hedge funds off guard as few expected Prime Minister Naoto Kan would initiate such unilateral intervention. The surprise move propped up the dollar and Chinese yuan, while hosing down long yen ETFs (e.g., FXY was down about 3% in one day.)

Yen as Safe Haven

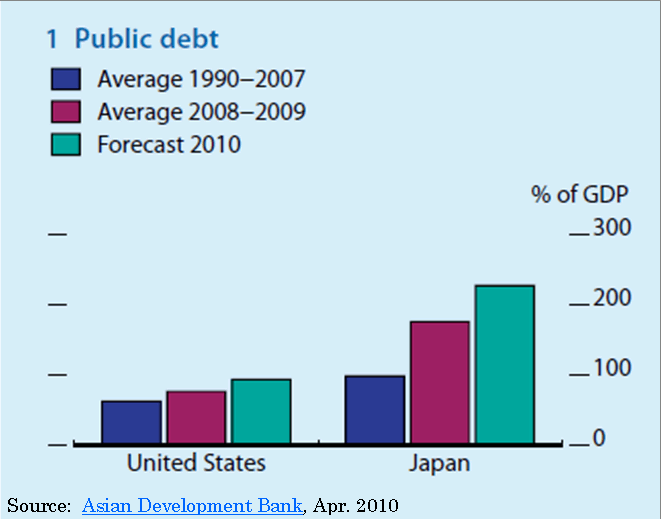

Sadly but truely, as dismal as Japan’s economic outlook seems, yen (along with Swiss Franc) is replacing the US dollar as the safe haven currency with the continuing unwind of risk trades. Investors see yen as “safe” due to the fact that Japan has a current account surplus and its government debt is mostly domestic instead of foreign.

Moreover, prospect of a slowing growth in the U.S. and talk of the Fed's continuing quantitative easing--driving interest rates even lower--further discourage dollar holding.

Generally, a country’s currency value rises with a healthy GDP growth, but in the case of Japan, it is quite the opposite. Despite Japan's ongoing current account surplus, a currency out of line with fundamentals could pose risks to its stability.

Global Race – Devalue to Prosperity

Some analysts are now worried about a possible global race of devalue-to-prosperity as other countries with appreciating currency may follow Japan’s lead.

Reuters reported that already Colombia's central bank said it was starting to buy at least $20 million daily to slow the rise in its peso currency, and Brazil indicated it wouldn't stand by if others weakened their currencies at Brazil's exporting expense.

Thailand, with its baht setting a series of 13-year highs against the dollar this month, is the next most likely to jump into intervention. The Philippines has also threatened as its peso hit a two year high against the dollar. Other Asian countries are also no strangers at the currency game, with South Korea and Taiwan among the most active.

Reversal of Fortune into Crisis?

In its Asian Development Outlook 2010 published this April, the Asian Development Bank (ADB) noted the speed and strength of the recovery in developing Asia, and low interest rates in developed countries, was prompting “huge” short-term capital inflows.

“…..In particular, the sudden reversal of short-term capital flows [as a result of intervention] could endanger financial and economic stability and bring about a currency and financial crisis.”

The good news is that so far, there is no immediate large scale reactions by other central bankers as most developing countries tend to focus more on the dollar exchange rate and thus are not yet too excited about yen’s movement.

Intervention Track Record – Not So Good

So, will this yen intervention work for Japan?

Typically, market factors and forces behind a currency appreciation that's out of sync with fundamentals are too strong to be countered by the act of currency intervention alone, and often with unintended consequences.

Swiss National Bank (SNB), for instance, started buying euro earlier this year trying to halt the rise of the Swiss franc. Well, Franc has continued to appreciate regardless, and hit an all-time high against the euro in July. Since then the SNB has been offloading euros, pushing Franc even higher against the euro. There is speculation that SNB could intervene again, but cue to the lesson learned not long ago, SNB should be more inclined looking to other instruments to tamper the Franc.

As for Japan's own track record, it is just as unimpressive. Its last intervention six years ago also failed to halt the yen's appreciation despite a 15-month Dollar shopping spree.

China in the Mix

Furthermore, unilateral intervention is not effective as a coordinated one with supports from other central banks. However, as it stands, don't expect United States, and Europe (or anyone else for that matter) act too kindly towards Japan’s solo act amid ongoing currency row with China.

Bigger Than Yen

As for yen itself, the intervention succeeded as the currency fell 3%, the biggest one-day move against the dollar since the financial crisis. But the bigger question is whether this would achieve the ultimate goal--pushing export and domestic price levels high enough to help fight deflation--which has plagued the country for a decade.

Japan's intervention war chest is estimated at 2 trillion yen, and officials already said more action could be expected, suggesting Japanese authorities are in it for the long haul.

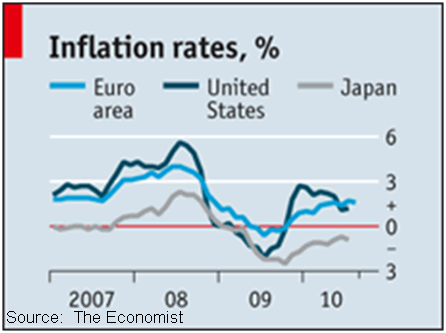

However, currency intervention along is unlikely the magic bullet for the fundamental and structural issues of Japan’s macro environment (see charts), which are still under intense debate among many experts and economists, and warrant an entirely separate discussion.

Disclosure: No Positions

Dian L. Chu, M.B.A., C.P.M. and Chartered Economist, is a market analyst and financial writer regularly contributing to Seeking Alpha, Zero Hedge, and other major investment websites. Ms. Chu has been syndicated to Reuters, USA Today, NPR, and BusinessWeek. She blogs at Economic Forecasts & Opinions.

© 2010 Copyright Dian L. Chu - All Rights Reserved Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.