Market Outlook - US Dollar Down, Commodities Up

Commodities / Financial Markets Sep 27, 2007 - 02:07 AM GMTBy: Donald_W_Dony

KEY POINTS:

KEY POINTS:

• CCI breaking to new highs in October

• Oil feels upward pressure until November; target is $85 to $86

• Copper holds above $3.00 and rises to resistance of $3.80

• Gasoline prices soften in October

• Silver lifts to $13.60 to $14.00 this month

• Nickel stabilizes above $12; rebound begins in October

• Upward pressure on gold holds with $750 target, as weak dollar and jewellery season push the metal upward

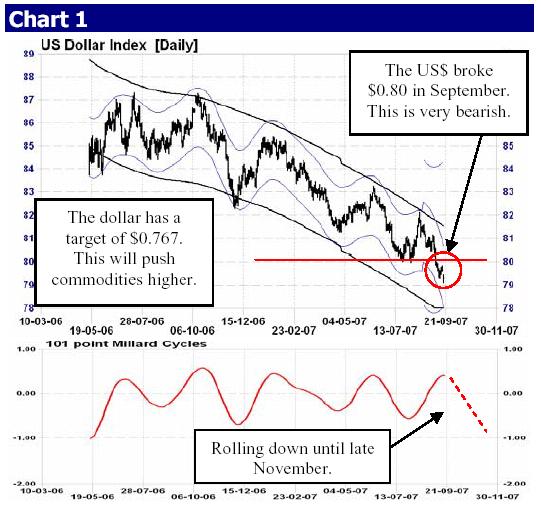

The U.S. dollar plays a very important role in the movement of commodities. A rising currency removes inflationary pressures, and a falling dollar fuels the fire. In September, after months of downward pounding, the U.S. dollar finally broke through the very important $0.80 support line. This is the last main support level for the greenback. Although the dollar has bounced off of this line seven times over the past 25 years, it has not remained below it.

Breaking support is key

All of this appears to be changing now. In Chart 1 , we see the U.S. dollar slowly but tenaciously inching lower. The breaking of this well-established support level means that this line in the sand will likely become the resistance level in the near future. Support levels often become resistance lines, once they are broken. I expect this $0.80 mark to do the same. Technically, now that $0.80 is broached, the new downward target is $0.767. The implications for commodities are positive. A lower dollar fans the fires of inflation and raises prices.

In Chart 2 , of the Continuous Commodity Index (CCI), we see a steady long-term advance in prices, with no indications of stalling or flattening in the trend. I used to refer to the Commodity Research Bureau (CRB) Index, but it is heavily (about 40%) weighted toward energy and does not properly reflect all commodities. The CCI, in contrast, is evenly weighted and achieves this task of viewing commodities better. The symbol is CCI.

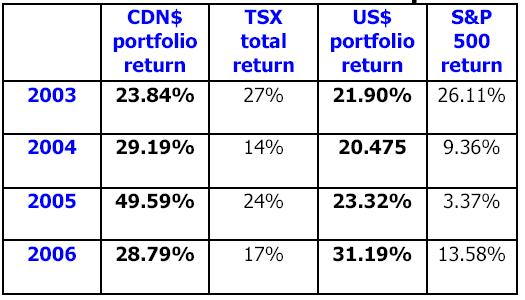

TS Model Growth Portfolios Update

This is the first page of the August issue. Go to www.technicalspeculator.com and click on member login to download the full 14 page newsletter.

By Donald W. Dony, FCSI, MFTA

www.technicalspeculator.com

COPYRIGHT © 2007 Donald W. Dony

Donald W. Dony, FCSI, MFTA has been in the investment profession for over 20 years, first as a stock broker in the mid 1980's and then as the principal of D. W. Dony and Associates Inc., a financial consulting firm to present. He is the editor and publisher of the Technical Speculator, a monthly international investment newsletter, which specializes in major world equity markets, currencies, bonds and interest rates as well as the precious metals markets.

Donald is also an instructor for the Canadian Securities Institute (CSI). He is often called upon to design technical analysis training programs and to provide teaching to industry professionals on technical analysis at many of Canada's leading brokerage firms. He is a respected specialist in the area of intermarket and cycle analysis and a frequent speaker at investment conferences.

Mr. Dony is a member of the Canadian Society of Technical Analysts (CSTA) and the International Federation of Technical Analysts (IFTA).

Donald W. Dony Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.