Silver Steals Some Thunder From Gold

Commodities / Gold and Silver 2010 Sep 15, 2010 - 03:03 AM GMTBy: Clif_Droke

The XAU Gold Silver Index closed 2.69% higher on Tuesday at 190.63. The Gold Bugs Index (HUI) closed 3.36% higher at 495.99. December gold closed 1.835 higher at $1,268. December silver ended 1.71% higher at $20.50.

The XAU Gold Silver Index closed 2.69% higher on Tuesday at 190.63. The Gold Bugs Index (HUI) closed 3.36% higher at 495.99. December gold closed 1.835 higher at $1,268. December silver ended 1.71% higher at $20.50.

Throughout the last few weeks of summer there has been a slow, steady migration into silver as an investment. Investor worries over the state of the global economy have helped silver gain traction in the face of a low-volume stock market this summer. The white metal continues has built some fairly strong forward momentum this summer as a secondary safe haven among investors who desire the protection of precious metals without the heftier price tag of the yellow metal.

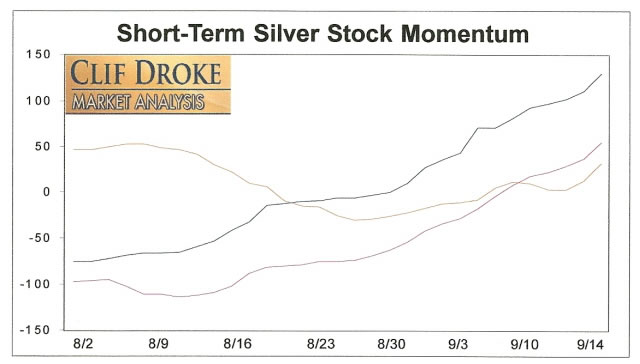

Silver stocks have also benefited from this growing attraction among investors seeking safety. The strong demand for silver shares can be seen in the internal momentum indicators shown below. These indicators track the rate of change (momentum) in the incremental demand for silver mining shares by measuring the daily new highs against the new lows among actively traded silver stocks.

As observed in the previous commentary, crowd sentiment on the metals and mining stocks is obviously running high but one get the sense it has quite yet reached the dangerously high proportions seen at major tops. The number of articles dedicated to the gold and silver in mainstream news publications has increased in recent weeks but we still haven’t seen the enthusiastic spotlight coverage that has always been the accompaniment of trading peaks. At minimum, the increased coverage is a sign that investors should exercise caution on the near term trend, using the favorable publicity gold and silver achieves as a warning to tighten up stop losses on existing long positions. Yet we don’t have a contrarian “sell” signal yet since we haven’t seen those extreme levels of excitement over gold and silver yet.

From a fundamental standpoint, seasonal demand factors also bode well for silver. The September-October time frame typically sees increased demand for silver jewelry for wedding gifts. Silver has also enjoyed a resurgence in the wake of higher gold prices, making silver more attractive on a cost basis compared to other precious metals traditionally associated with the fall wedding season.

The iShares ishaers Silver Trust ETF (SLV), our proxy for silver, gave us an immediate term buy signal in early August and has since taken off to new highs, closing at a new rally high of 20.05 on Tuesday, Sept. 14. As long as SLV remains above its rising 15-day moving average the main immediate term trend is up. As long as the silver stock momentum indicators shown above are rising, the path of least resistance for SLV and the silver shares is also up. The SLV appears to be benefiting from not only the growing demand for physical silver as a financial safety hedge but also from growing short interest. Some high profile financial analysts have been recommending short sales of the precious metals and mining stocks and this has only fed the ongoing market rally.

Some of the technical indicators have suggested a top was imminent in recent days, but technicals mean very little in a runaway momentum market (as the short sellers are learning to their chagrin). An unusually high number of silver stocks made new quarterly highs on Tuesday; in fact, 20 of the 40 or so stocks on my list made new highs. This is abnormally high and suggests an immediate-term correction is imminent (likely needed to work off the excessive internal “heat” generated by the latest rally). But as long as internal momentum remains up, higher highs are likely notwithstanding the immediate term corrections along the way.

Silver Trading Techniques

With the precious metals long-term bull market well underway, many independent traders and investors are looking for ways to capitalize on short-term and interim moves in the metals. Realizing that the long-term “buy and hold” approach isn’t always the best, many are seeking a more disciplined, technical approach for realizing gains in the market for metals and the PM mining shares.

It’s for that reason that I wrote “Silver Trading Techniques” back in 2005. My goal in writing this book was to provide traders with some reliable trading indicators for anticipating and capturing meaningful moves in the price for silver and the silver mining shares. Included in this guide are rules for using the best moving averages when trading silver stocks, how to spot a turnaround in the silver stocks before it happens (best-kept secret!), how to tell when a silver stock has topped and which moving average crossovers work and which don't . Also explained are the best technical indicators for capturing profitable swings in silver and silver stocks and how to apply them.

You won't find these techniques in a copy of Edward's & Magee's book on technical analysis or anywhere else. These reliable "tricks of the trade" are available to you in Silver Trading Techniques. Click here to order:

http://www.clifdroke.com/books/silvertrading.mgi

All orders for the book will also receive a FREE copy of the recently published, “Gold Stock Trading Techniques,” which contains reliable strategies for short-term technical trading in the gold mining shares with an emphasis on safety and capital preservation.

By Clif Droke

www.clifdroke.com

Clif Droke is the editor of the daily Gold & Silver Stock Report. Published daily since 2002, the report provides forecasts and analysis of the leading gold, silver, uranium and energy stocks from a short-term technical standpoint. He is also the author of numerous books, including 'How to Read Chart Patterns for Greater Profits.' For more information visit www.clifdroke.com

Clif Droke Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.