Gold Makes New All Time High! Where Next?

Commodities / Gold and Silver 2010 Sep 14, 2010 - 04:06 PM GMTBy: Steve_Betts

Here’s the game for anyone who doesn’t have the time or inclination to follow the markets, and you won’t hear this on TV either. The US Federal Reserve is acting as the buyer of last resort in the bond market in an effort to give the appearance that demand for US debt exists. They print dollars to do this. In supporting the bond, and stocks to a lesser degree, they will destroy the US dollar. Yesterday the greenback took a big hit and today it is getting walloped again. Sooner or later this will spill over into bonds and stocks, and I am convinced it will be sooner.

Here’s the game for anyone who doesn’t have the time or inclination to follow the markets, and you won’t hear this on TV either. The US Federal Reserve is acting as the buyer of last resort in the bond market in an effort to give the appearance that demand for US debt exists. They print dollars to do this. In supporting the bond, and stocks to a lesser degree, they will destroy the US dollar. Yesterday the greenback took a big hit and today it is getting walloped again. Sooner or later this will spill over into bonds and stocks, and I am convinced it will be sooner.

In fact I believe it will happen now! Everyone talks about buying blue chip stocks with good dividends, or bonds as a “safe haven” investment, but the smart money won’t touch either. The smart money is buying the true save havens of gold, silver and the Swiss Franc in that order. That’s why the Swiss Franc has broken through par today, in spite of the best efforts of the Swiss central bank, and that’s why gold made a new all-time high today. These events are no accidents!

As I type the October gold futures contract is trading up by 28.40 at 1,274.00 and that is a new all-time intraday high. Now take a look at a

weekly chart for the October futures contract and you’ll see the breakout above the old high (arrow). You’ll also see how the primary and secondary trends are intact and headed higher. The October gold has support at 1,249.80 while the next level of critical resistance is up at 1,298.10 and we should see a test of that area within a week. Since the late July low gold has not experienced anything more than a standard first degree four day reaction and I don’t expect that to change right now. Gold will have a need to back, and fill and that will produce a seven to twelve day reaction somewhere along the line, but all that means is we‘ll get a chance to buy again. I remain convinced that gold is headed to a minimum of 1,372.80 this year and could run as high as 1,500.00. Watch the US dollar for signs of collapse, and if you see them gold could go to 1,500.00 in a hurry:

SUPPORT RESISTANCE

OCT GOLD 1,249.8 1,298.1

1,228.1 1372.8

1,219.8 1,440.2

Although not shown on the chart, the RSI was at 59.48 as of yesterday’s close so gold will not technically be overbought even with today’s jump in price.

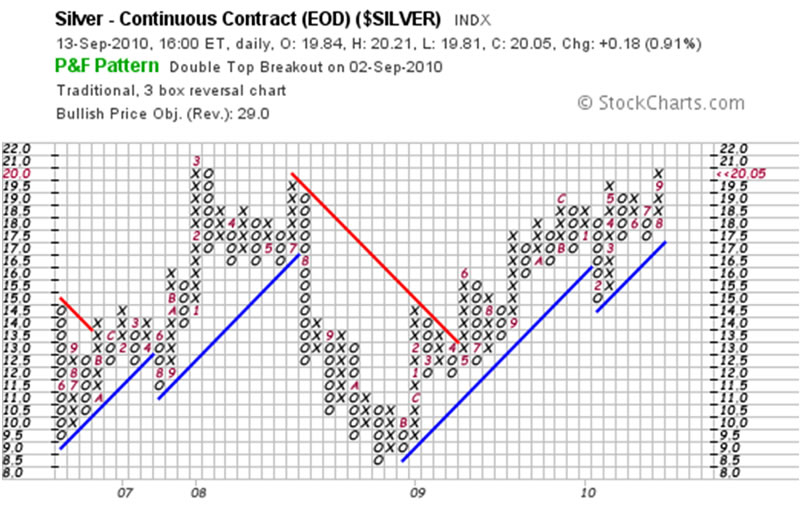

As much as I like gold, I like silver even better. I would like you to take a look at the weekly chart for silver that I’ve posted below and then I will make a few comments:

It broke out to the upside before gold and like gold made a new closing intraday high for the entire bull market run today. The key was silver’s ability to move through and stay above the resistance at 19.81. As I type the December silver futures contract is up 30 cents at 20.45 and it

SUPPORT RESISTANCE

DEC SILVER 19.81 20.98

19.58 26.48

18.98 31.91

will not face any more resistance until it hits 20.98. Once that is surpassed, it has a free ride all the way up to 26.48 although the silver

Point & Figure chart now has a bullish price target of 29.00 and I think that may be closer to the truth.

Notice that I have neglected the subject of gold and silver stocks and that’s because they are paper. I sold out the last of my portfolio two weeks ago and don’t own a single gold stock for the first time since 2002. With that said if I wanted to own stocks I would be extremely selective and would only buy stocks listed on the Canadian (Toronto) Exchange, with one exception and that is Buenaventura which is listed on the Lima (Peru) Stock Exchange. I would buy them in their local currency thereby avoiding exposure to the US dollar. There are only four companies I would consider, Royal Gold, Goldcorp, Buenaventura, and Silver Wheaton, and three of those pay dividends. Today the HUI made a new intraday high for the entire move higher and looks good, but its only paper. My fear is that it will be affected with guilt by association, meaning that when stocks, bonds and the dollar fall, all paper will go down with it. What’s more I worry about confiscation of gold and gold producing companies in the US, and the IRS recently raising taxes on gold investments is just the first step. They could raise capital gains taxes on profits from gold stocks and then seize your stock. Everything is possible with a desperate government.

The fact that the US dollar was crushed two days in a row, and that the Swiss Franc shot through par with the greenback today, is a result of fear. That is the same fear that is pushing gold and silver higher. That’s why gold is to be accumulated, stashed in a safe place, and not traded. There has been a lot of manipulation in the gold and silver market, and these huge short positions in the OTC market will not unwind well. There isn’t enough physical available to cover the short positions and some very big players like China and India know that. Then you have to consider that central banks around the world are buying gold. Last week it was announced that Bangladesh bought ten tons from the IMF! Why do you think that is? It’s because they know something is wrong. A panic out of the greenback will drive gold much higher than anyone would have thought, so I would just sit tight and enjoy the show. It just may be your only salvation

[You can contact us at our new e-mails, info@stockmarketbarometer.net (general inquiries regarding services), team@stockmarketbarometer.net (administrative issues) or analyst@stockmarketbarometer.net (any market related observations).] By Steve Betts

E-mail: analyst@stockmarketbarometer.net

Web site: www.stockmarketbarometer.net

The Stock Market Barometer: Properly Applied Information Is Power

Through the utilization of our service you'll begin to grasp that the market is a forward looking instrument. You'll cease to be a prisoner of the past and you'll stop looking to the financial news networks for answers that aren't there. The end result is an improvement in your trading account. Subscribers will enjoy forward looking Daily Reports that are not fixated on yesterday's news, complete with daily, weekly, and monthly charts. In addition, you'll have a password that allows access to historical information that is updated daily. Read a sample of our work, subscribe, and your service will begin the very next day

© 2010 Copyright The Stock Market Barometer- All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.