Silver Closes Above $20/oz - Higest Silver Close Since March 2008

Commodities / Gold and Silver 2010 Sep 14, 2010 - 06:04 AM GMTBy: GoldCore

The Japanese yen, Swiss franc, gold and particularly silver are stronger this morning as risk aversion has returned as seen in lower European equity markets. The dollar has recovered from earlier weakness and the euro has fallen to 1.284 USD and €976/oz. Oil back above $77 a barrel and rising commodity prices is likely also supporting gold and silver.

The Japanese yen, Swiss franc, gold and particularly silver are stronger this morning as risk aversion has returned as seen in lower European equity markets. The dollar has recovered from earlier weakness and the euro has fallen to 1.284 USD and €976/oz. Oil back above $77 a barrel and rising commodity prices is likely also supporting gold and silver.

Gold is currently trading at $1,253.10/oz, €975.55/oz, £812.96/oz.

Inflation pressures in the UK continue as seen in this morning's UK inflation figures again exceeding the government's 3 percent limit for a sixth month in August. Higher costs of items from air fares to food stoked price pressures in the economy. This saw sterling fall and gold has risen to £814.20/oz.

The ECB bought some €237 million of European sovereign debt last week and this along with the continuing dependency of some European banks on continued ECB funding clearly shows that the debt crisis is not over yet. Indeed, we could soon see a second more serious phase of the sovereign debt crisis. This should lead to continuing safe haven demand in Germany and other European countries affected by the crisis.

Silver

Silver closed over the important $20/oz level yesterday, up 19 cents to close at $20.11/oz which is its highest close since March 2008. It is trading even more robustly than gold with sell offs increasingly shallow and indeed it has been leading gold in the recent move up. It has even managed to close higher when gold has been lower on certain days which is very unusual and may be an indication that silver's historical underperformance of gold may be changing leading to silver outperforming gold in the coming months.

Silver is currently trading at $20.25/oz, €15.77/oz and £13.14/oz.

Silver in USD - 5 Year (Daily)

Technically silver looks very well and may challenge the 2008 record daily close of $20.81/oz. Above this level silver would be in territory not seen since the late 1970's and it is possible that silver could rise as high as $25/oz in the coming months. Conversely, a failure to reach new record highs would see a new period of correction and consolidation which could see silver fall back to support at $18/oz.

Silver in USD - 5 Year (Daily)

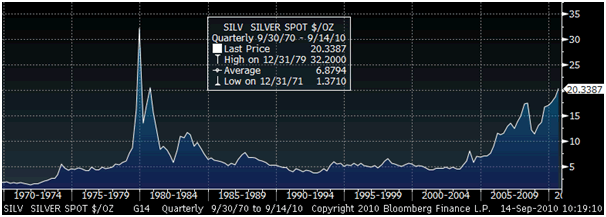

It is worthwhile looking at silver's quarterly chart which takes out the volatility and speculative froth from the price. It shows that the record quarterly close for silver was on the last day of 1979 (31/12/79) at $32.20/oz. Given the even stronger fundamentals today and the fact that a huge amount of silver has been used in a variety of industrial applications in the last 30 years, many analysts expect silver to replicate gold and reach record highs in the coming years.

This is especially the case because while silver was demonetised in the 20th Century and became seen more as an industrial metal, more recently investors and savers are looking to silver as a safe haven asset and a store of value (see http://www.goldcore.com/research/silver-set-soar-it-did-1970s). This trend looks set to continue with value buyers switching from gold to "poor man's gold" which remains cheap on a comparative basis to gold and other asset classes.

Platinum Group Metals

Platinum is trading at $1,565.10/oz, palladium is at $538/oz and rhodium is at $2,050/oz.

This update can be found on the GoldCore blog here.

Mark O'Byrne

Director

IRL |

UK |

IRL +353 (0)1 632 5010 |

WINNERS MoneyMate and Investor Magazine Financial Analysts 2006

Disclaimer: The information in this document has been obtained from sources, which we believe to be reliable. We cannot guarantee its accuracy or completeness. It does not constitute a solicitation for the purchase or sale of any investment. Any person acting on the information contained in this document does so at their own risk. Recommendations in this document may not be suitable for all investors. Individual circumstances should be considered before a decision to invest is taken. Investors should note the following: Past experience is not necessarily a guide to future performance. The value of investments may fall or rise against investors' interests. Income levels from investments may fluctuate. Changes in exchange rates may have an adverse effect on the value of, or income from, investments denominated in foreign currencies. GoldCore Limited, trading as GoldCore is a Multi-Agency Intermediary regulated by the Irish Financial Regulator.

GoldCore is committed to complying with the requirements of the Data Protection Act. This means that in the provision of our services, appropriate personal information is processed and kept securely. It also means that we will never sell your details to a third party. The information you provide will remain confidential and may be used for the provision of related services. Such information may be disclosed in confidence to agents or service providers, regulatory bodies and group companies. You have the right to ask for a copy of certain information held by us in our records in return for payment of a small fee. You also have the right to require us to correct any inaccuracies in your information. The details you are being asked to supply may be used to provide you with information about other products and services either from GoldCore or other group companies or to provide services which any member of the group has arranged for you with a third party. If you do not wish to receive such contact, please write to the Marketing Manager GoldCore, 63 Fitzwilliam Square, Dublin 2 marking the envelope 'data protection'

GoldCore Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.