Stock Market Deflationary Dreams, Reflationary Reality

Stock-Markets / Stock Markets 2010 Sep 14, 2010 - 02:52 AM GMTBy: Steven_Vincent

(originally published 09/06/10-09/12/10 for BullBear Trading members) - In the last BullBear Weekend Report I called for an important bottom and a sharp rally and we did get just that. We are now long from SPX 1048. Technicals indicate that the rally has further to go both in the short and intermediate terms. There are significant indications that a long term bottom has been put in place and that at a minimum a revisit of the April highs is possible. So far there are little if any indications that a bear trend will resume any time soon.

(originally published 09/06/10-09/12/10 for BullBear Trading members) - In the last BullBear Weekend Report I called for an important bottom and a sharp rally and we did get just that. We are now long from SPX 1048. Technicals indicate that the rally has further to go both in the short and intermediate terms. There are significant indications that a long term bottom has been put in place and that at a minimum a revisit of the April highs is possible. So far there are little if any indications that a bear trend will resume any time soon.

I am sure that upwards of 80% of those who read this analysis will allow an ingrained bearish bias to doubt it, disdain it and disregard it. Others who perhaps accept it will still, in fear, be unable to pull the trigger and buy

Keep in mind that your own mentality reflects a larger reality. It is important for bears to realize that they are no longer the outsiders standing at the fringes shaking their fists at The Man. The bearish view is now the official, accepted, mainstream dogma of the majority. It took over ten years for this to happen but it has happened. And it has happened at a significantly higher low in the market indices. It is this divergence of sentiment and technicals which always marks significant market turning points. The emotional and mental resistance to this that we experience is a part of that process.

A lot has happened since the last secular bear market from 1966-1982. The price bottom came in 1974 and the final, orthodox, psychological bottom came in 1982. Due to many factors, not the least of which is the information technology revolution, time frames may now be significantly compressed. We are faced with the possibility that the price bottom for this bear market came on March 2009 at SPX 666 and the psychological bottom occurred recently at SPX 1010.

My personal, philosophical disposition is to favor a deflationary view in which the powers of Keynesian Monetarism are rendered impotent, irrelevant and discredited, ushering in, after the Great Debt Destruction, a New Age of entrepreneurial capitalism and sound money economics. In this dream, the laws of Free Market Capitalism overpower the will of Central Planners, Ron Paul is President and I am the official White House yoga instructor, or sometimes Head Chef, or (my favorite) the guy responsible for firing 50% of the gummint bureaucrats (it varies), and Bernanke, Greenspan, Paulson and Geithner all share a 6X6 cell with Bernie Madoff. And the lion lies down with the lamb.

While it's a nice dream, I have learned that markets don't really give a damn what I think, prefer or dream. As a BullBear, I can change my position--mentally and financially--at any time. When the market gives cause to do so, I will. At the moment I think the right side of the market is with the contrarian, minority view, which is bullish. Naturally I have no intention of being on the wrong side for any significant market move, so I will be monitoring the situation for any shifts. All long term moves begin as intermediate term moves. By positioning myself on the right side of any intermediate term move I set myself up to be on the right side of a long term move should it develop. Ergo, I currently favor the long side of the markets.

Sometimes dreams do come true, but I get all my tradable opinions from the market. What is the market saying now?

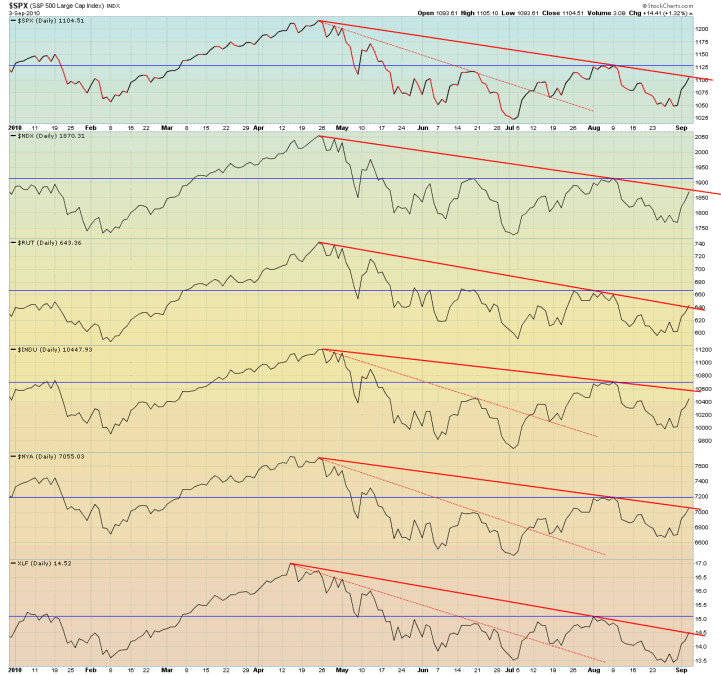

All major indices, save the Dow Industrials, are challenging the downtrend from April.

A variety of world markets are breaking out, closing above prior highs and challenging important resistance levels.

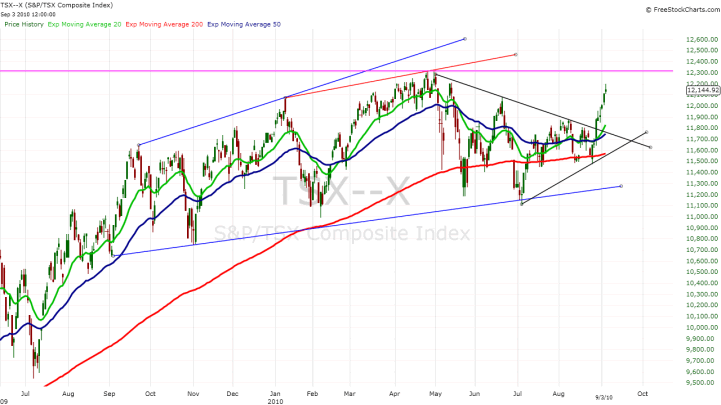

Canada has caught fire as agriculture and metals lead world asset prices to the upside:

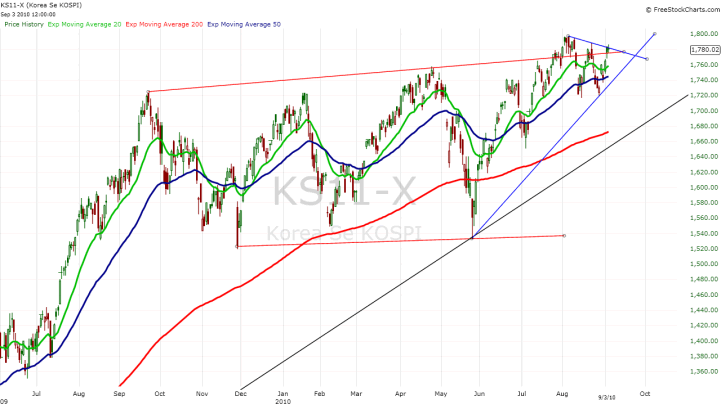

Korea looks set to break out to new highs soon:

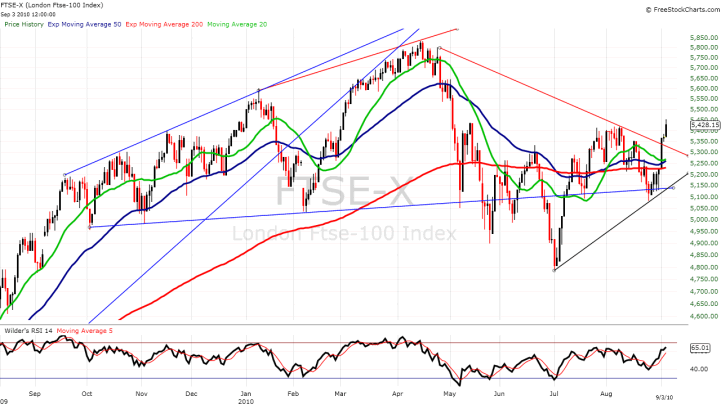

London has already taken out it's August highs on a closing basis:

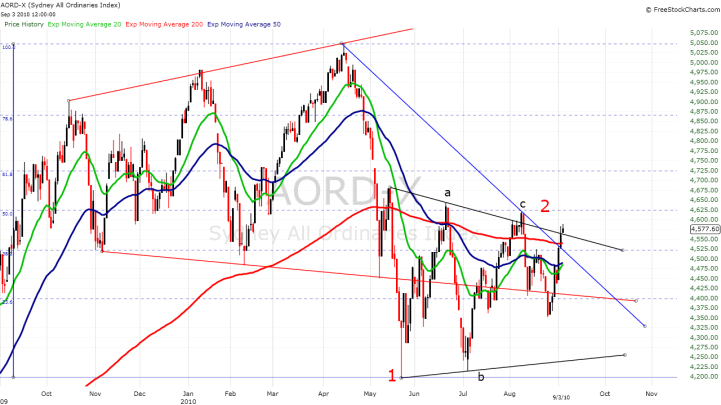

Australia has taken out the August downtrend and the 200 EMA decisively:

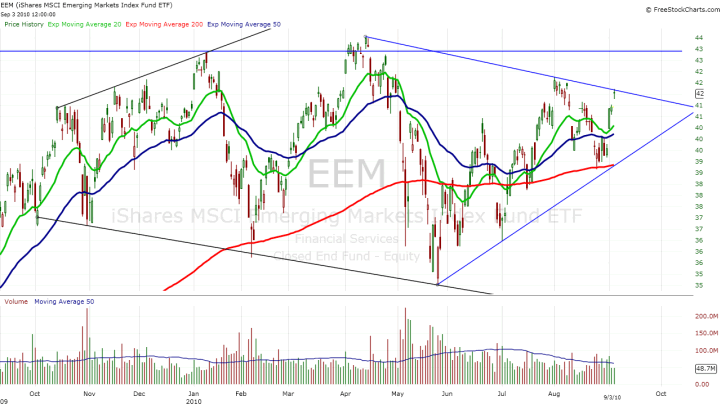

The Emerging Markets ETF appears set to break out of its year long diamond pattern. EMAs are in a clear bullish configuration:

From the above data set we can see that a broad sample of world markets is leaning towards a bullish resolution to the generally lateral price action of the prior 10-12 months.

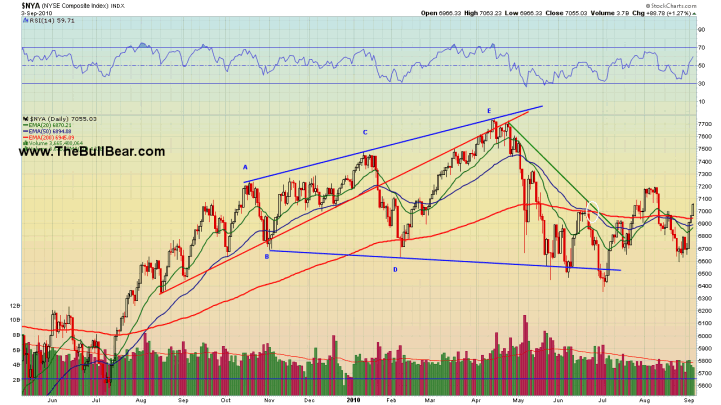

NYSE showed a jump in buying volume at the recent bottom. Thursday and Friday were subpar volume days, however that may be simply a function of pre-Labor Day trading. Also note that the broad market index closed the week well above the 200 EMA.

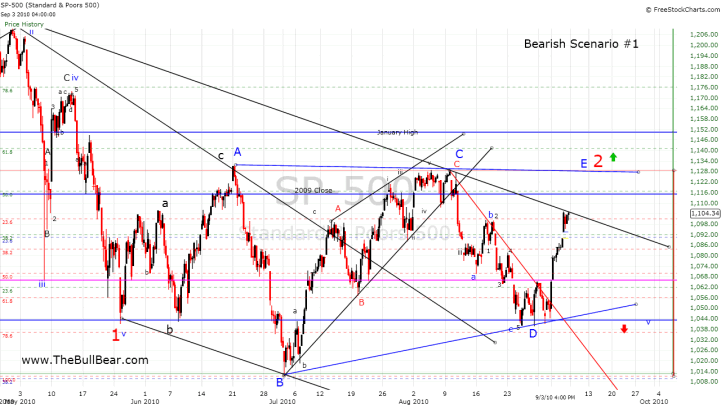

The bullish scenario is favored by the current available technical evidence. Here, a reverse Head and Shoulders pattern is in the final approach to its neckline in the context of persistent fear, skepticism and pessimism. The wave count has the market in i of 3 of (3) up.

Article Continues here.

Generally these reports as well as twice weekly video reports are prepared for BullBear Trading Service members and then released to the general public on a time delayed basis. To get immediate access just become a member. It's easy and currently free of charge.

Disclosure: No current positions.

By Steve Vincent

Steven Vincent has been studying and trading the markets since 1998 and is a member of the Market Technicians Association. He is proprietor of BullBear Trading which provides market analysis, timing and guidance to subscribers. He focuses intermediate to long term swing trading. When he is not charting and analyzing the markets he teaches yoga and meditation in Los Angeles.

© 2010 Copyright Steven Vincent - All Rights Reserved Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.