Inflation Mega-Trend Long-term Growth Spiral Continues to Drive Stock Market Trend

News_Letter / Financial Markets 2010 Sep 12, 2010 - 03:16 AM GMTBy: NewsLetter

The Market Oracle Newsletter

The Market Oracle Newsletter

Sept 5th, 2010 Issue #52 Vol. 4

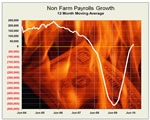

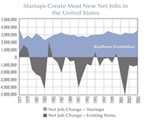

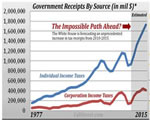

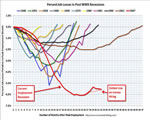

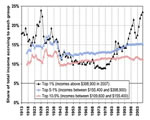

Inflation Mega-Trend Long-term Growth Spiral Continues to Drive Stock Market TrendInflation Mega-Trend Ebook Direct Download Link (PDF 3.2m/b) Dear Reader The stock market closed up 298 points on the week at 10,448 (10,150). The bears that predominantly follow a non existant deflationary scenario, consistently and persistently fail to comprehend what drives the worlds economies and stock markets which is the inflation mega-trend. Governments and their respective central banks are engaged in a perpetual cycle of inflationary money printing policies with the sole aim of concentrating power and wealth into their own hands by stealing the wealth of savers and purchasing power of workers. Why ? Because inflation gives the illusion of prosperity whereas Deflation acts as a tax on the government (therefore forces governments to contract in size) by increasing the purchasing power of savings and earnings thus under a deflationary environment workers can over time work less for a greater standard of living whilst wages stay constant, which is how it should be in a deflationary world because of constantly increasing productivity of workers that SHOULD result in falling prices. However governments cannot allow for deflation because it effectively takes power away from governments and central banks and places it firmly into the hands of the people. Under deflation governments cannot spend more than they receive in tax revenues, as deficit spending would be inflationary, thus government or the state would be far, far smaller and less significant under a deflationary environment whilst under perpetual inflation, the higher the inflation rate the bigger the size of government which controls all aspects of its people employing ever increasing number of bureaucrats as it in effect taxes purchasing power of earnings and savings through inflation and then again taxes the inflation induced notional gains whereas under deflation there is NO Capital TAX as asset prices would FALL under deflation but at a slower pace than the level of general prices in the economy, so the government LOSES its power to tax earnings and assets under deflation as more wealth is transferred into the hands of savers and earners and corporations and less revenue available for governments to spend on a bloated public sector. Therefore as the Inflation Mega-Trend ebook concluded some 8 months ago, governments just cannot allow for deflation to exist and as a consequence of which are in effect always stoking the fires of high inflation as they constantly attempt to play the goldilocks game of inflating the money supply without triggering an out of control wage price spiral towards hyper inflation, the ultimate risks is always of a spiral towards hyperinflation rather then the phony debate of deflation which is just fear mongering to ALLOW governments to fool their populations into perceiving Inflation to be Good and Deflation to be Evil. To achieve this the governments are engaged in a perpetual game of under reporting the real rate of inflation and engaged in the production of propaganda on future inflation expectation as the following two recent in depth articles illustrated - 26 Aug 2010 - Deflation Delusion Continues as Economies Trend Towards High Inflation 13 Aug 2010 - The Real Reason for Bank of England's Worthless CPI Inflation Forecasts Whilst the inflation mega-trend continues to manifests itself in a subdued manner in the official CPI statistics, however readers should note that these are highly manipulated price indices that do not reflect reality. However despite the role of income and capital gain taxes, the reality of the inflation mega-trend cannot be hidden from the asset markets that always tend to respond as though leveraged to the official indices. Which despite inherent sentiment driven volatility is great news for it allows investors to monetize on the government induced inflation mega-trend to an extent far greater than taxes by means of investing in assets in scarce resources such as consistently dividend raising stocks, commodities, and ironically housing with more examples covered at length in the Inflation Mega-trend Ebook. Stock Market Trend Quick Update The Dow closed up on the week at 10,448, last weekends analysis (29 Aug 2010 - UK Economy Booms Whilst U.S. Stutters, Stocks Fail to Follow Crash Script ) concluded in an anticipated break of the downtrend channel that the Dow had been in, with the primary buy trigger at 10,200 to target the top of its trading range of 10,700. The Dow spent early week trading to the bottom end of the range of Dow 10k, before finally breaking out of the down channel on Wednesday's open at 10,060, with confirmation of the break on the rally above 10,200 (same day). My next in depth analysis remains pending as the Dow remains within its trading range of approx 10,700 to 10,000. However my original expectations for the year remain for the Dow to target 12,000 to 12,500 by year end as illustrated by the below graph from the Inflation Mega-Trend Ebook (FREE DOWNLOAD). The longer term trend remains as I voiced right at the very bottom in March 2009 (15 Mar 2009 - Stealth Bull Market Follows Stocks Bear Market Bottom at Dow 6,470), is for the stock market to have entered into a multi-year bull market, so far the market has done NOTHING to negate this scenario.

THERE WILL BE NO REVERSION TO BELOW THE MEAN, THE S&P PRICE / EARNINGS RATIO WILL NOT FALL TO SINGLE DIGITS ! The stock market is in a long-term growth spiral as illustrated by the below graph again from the Inflation Mega-trend Ebook. We are in the consolidation phase before the next ramping up of stock prices takes places. The consolidation zone IS the time for LOW P/E's, which means today's market P/E is LOW NOT HIGH!

The Dow is only 7% from its bull market peak. The Dow is STILL in its corrective trading range that continues to work off the preceding 13 months bull run, 4 months so far, with my last in depth analysis (16th May 2010 - Stocks Bull Market Hits Eurozone Debt Crisis Brick Wall, Forecast Into July 2010 ) concluding that the corrective sideways trend could extend all the way into early October, so far the Dow is pretty much following the script, the more time the stock market spends within its corrective trading range the more powerful will be the eventual breakout, then those waiting for corrections to enter will be waiting all the way to Dow 12,000+! And then we have the flash crashers with their ever expanding H&S necklines, for how long will they keep extending this pattern that was busted nearly 2 months ago? and not forgetting our Hindenburg Omen friends, don't they know that all airships these days use helium? :) Bottom Line - Nothing new to report short-term the Dow remains in a corrective trading range of approx 10,700 to 10,000. Everybody tells you that September is usually one of the the worst months for stocks. I say its in a range with probability favouring a break higher. Pakistan Continues to Suffer in Silence The crooks in the Pakistan Cricket Team and the irrelevant gossip obsessed bigger crooks in the mainstream press have completely wiped out coverage of the crisis in Pakistan from all mainstream media. The facts are 17 million people continue to be affected by the floods and its aftermath, with a staggering 8 million requiring immediate life saving aid (more than the population of Afghanistan). The floods have destroyed or damaged 1.5 million homes, with more than 6 million homeless with tents just for 1 million. That SHOULD be what the so called press should be concerning themselves with! Not floor to wall coverage of 3 bat and ball hitting idiots and broadcasting the utterances of some senile corrupt counsellor officials. UK Donations USA Donations Your analyst. Comments and Source: http://www.marketoracle.co.uk/Article22462.html By Nadeem Walayat Copyright © 2005-10 Marketoracle.co.uk (Market Oracle Ltd). All rights reserved. Featured Analysis of the Week

Most Popular Financial Markets Analysis of the Week :

By: Matthias_Chang Readers of my articles will recall that I have warned as far back as December 2006, that the global banks will collapse when the Financial Tsunami hits the global economy in 2007. And as they say, the rest is history.

By: James_Quinn "Financiers - like bank robbers - do not create wealth. They merely distribute it. While the mob may idolize holdup men in good times, in the bad times it lynches them. What they will do to the new money men when their blood is up, we wait eagerly to find out." - Mobs, Messiahs and Markets

By: Jim_Willie_CB Many observers to the wild gyrations, deep contortions, extreme measures, and other bizarre activity in the government and banking arenas are suffering from severe confusion. The public is alarmed, even frightened, by the sequence of events, without much benefit of comprehension of what is happening or which clans are in control. The degree of deception hit a peak during the TARP Fund creation and disbursement, done behind private closed doors for the replenishment of sacred preferred stock, that bridge between corporate bonds and stock equity. The deception hit a very high pitch with the financial titan failures, the entire string of them. It has never stopped since.

By: Jon D. Markman Jon D. Markman writes: Pessimism increased again among investors last week, as a slew of economic data stoked fears of a double-dip recession. Indeed, housing and unemployment continue to weigh on the U.S. economy. But don't panic. Remember that the prospects for a full economic recovery are much better outside the United States, and that it's often good to be greedy when others are fearful.

By: DeepCaster_LLC “The crucial passage comes in Chapter 17 entitled "Velocity". Each big inflation -- whether the early 1920s in Germany, or the Korean and Vietnam wars in the US -- starts with a passive expansion of the quantity of money. This sits inert for a surprisingly long time. Asset prices may go up, but latent price inflation is disguised. The effect is much like lighter fuel on a camp fire before the match is struck.

By: JD_Rosendahl Today’s rise in the stock market seems to have put in a near term bottom by advancing over the recent gap in price @ 1,071 on the SP500. Today, we had a strong move covering the gap resistance and the market closed right at its high and the 50 day MA. Above the 50 day MA is the next hurdle. MACD and RSI are turning up to support price.

By: Nadeem_Walayat Did the stock market crash Monday ? Nope, Tuesday ? Nope. How about Wednesday, Thursday or Friday ? The Dow closed down 63 points on the week at 10,150 (10,213) which given the much publicised Hindenburg Crash Omen, is not exactly following the script though off course the Hindenburg Omen has plenty of get out of jail cards in the small print which ensures that all eventualities are covered

By: Barry_M_Ferguson There has been a lot of discussion lately about whether or not we are in a bull market or bear market. Is the economic ‘recovery’ for real or just a government stimulus blip? Should Representative Maxine Waters face charges of misusing her office to get her husband’s bank some of that TARP money? Personally, I think Ms. Waters is being unjustly accused. So she used her office for self-enrichment. Isn’t that what we elect Congress people to do? Aren’t they just pigs at a trough helping themselves to everything they can plunder from the suckers that vote for them? She’s an American politician for crying out loud. I expect them to be corrupt, sleazy, self-promoting, narcissistic pigs. I’m never disappointed. What’s all the fuss about? Back to my story.

You're receiving this Email because you've registered with our website. How to Subscribe Click here to register and get our FREE Newsletter To access the Newsletter archive this link Forward a Message to Someone [FORWARD] To update your preferences [PREFERENCES] How to Unsubscribe - [UNSUBSCRIBE]

The Market Oracle is a FREE Financial Markets Forecasting & Analysis Newsletter and online publication. |

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.