U.S. Wholesale Inventories Rise More than Expected; But Where's the Demand?

Economics / US Economy Sep 11, 2010 - 10:24 AM GMTBy: Mike_Shedlock

Rising inventories to meet rising demand is one thing, rising inventories in the face of weak or falling consumer demand is another. On the inventory side of the equation, Wholesale Inventories in U.S. Rose More Than Forecast

Rising inventories to meet rising demand is one thing, rising inventories in the face of weak or falling consumer demand is another. On the inventory side of the equation, Wholesale Inventories in U.S. Rose More Than Forecast

Inventories at U.S. wholesalers rose in July by the most in two years as a rebound in demand prompted companies to add to stockpiles.

The 1.3 percent increase in the value of inventories was three times the median estimate in a Bloomberg News survey and followed a 0.3 percent gain the prior month, Commerce Department figures showed today in Washington. Sales at distributors climbed 0.6 percent, the most since April, after falling 0.5 percent.

Economists forecast inventories would increase 0.4 percent, following a previously reported 0.1 percent gain in June, according to the median of 32 projections in a Bloomberg survey. Estimates ranged from increases of 0.1 percent to 0.8 percent. The July gain was the biggest since July 2008.

Wholesalers make up about 30 percent of all business stockpiles. Factory inventories, which comprise more of the total, advanced 1 percent in July, the Commerce Department said last week. Retail stockpiles, which make up the rest, will be included in the Sept. 14 business inventories report.

Today’s report showed wholesalers’ stockpiles of durable goods, or those meant to last several years, increased 1 percent in July, led by gains in autos, furniture, machinery and metals.

The Commerce Department’s latest figures on gross domestic product showed the economy is getting less of a boost from inventories. Stockpiles added 0.63 percentage point to growth in the second quarter, compared with 2.64 percentage points in the prior three months and 2.83 percentage points in the fourth quarter.

Census Bureau Report

Inquiring minds are investigating the Census Bureau Trade Report for July 2010.

Inventories

Total inventories of merchant wholesalers, except manufacturers’ sales branches and offices, after adjustment for seasonal variations but not for price changes, were $405.0 billion at the end of July, up 1.3 percent (0.4%) from the revised June level and were up 2.5 percent (1.2%) from a year ago. The June preliminary estimate was revised upward $0.8 billion or 0.2 percent. End-of-month inventories of durable goods were up 1.0 percent (0.4%) from last month, but were virtually unchanged (1.6%)* from last July.

Inventories of metals and minerals, except petroleum were up 2.7 percent from last month and electrical and electronic goods were up 2.1 percent. End-of-month inventories of nondurable goods were up 1.7 percent (0.7%) from June and were up 6.4 percent (2.1%) compared to last July. Inventories of farm product raw materials were up 11.6 percent from last month and inventories of apparel, piece goods, and notions were up 4.1 percent.

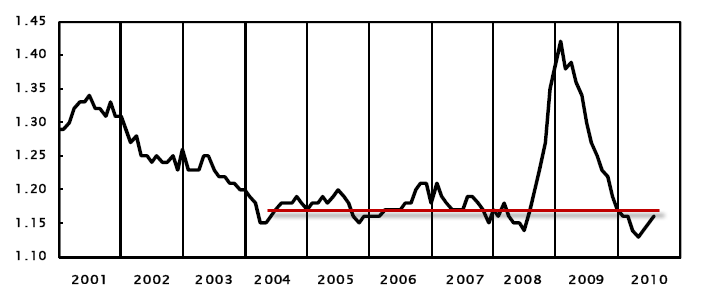

Inventories/Sales Ratio

The July inventories/sales ratio for merchant wholesalers, except manufacturers’ sales branches and offices, based on seasonally adjusted da data, was 1.16. The July 2009 ratio was 1.27.

Looking Ahead

In terms of adding to GDP, the increase in inventories has played out, and in fact may have more than played out.

The Bloomberg article states "The amount of goods on hand compared with sales suggests manufacturing gains will be sustained in coming months."

I disagree.

Ignoring the effects of the credit bubble and housing bust in 2008-2009 the inventory to sales ratio is on the trendline from 2004-2010. What it suggests is manufacturers expect consumer sales to pick up in the second half or at least stay steady headed into next year.

Will Expectations Pan Out?

Expectations are one thing, reality will be another.

It is now September 10th, and the Census Report is for July.

In the meantime it's important to note Gallup Poll Shows Consumer Spending Pullback, Consumer Confidence Levels Below Depressed 2009 Levels ; Back-to-School Sales Bust Says WSJ

Not only are consumers are pulling back, a Wells Fargo/Gallup Small Business Index Hits Record Low, Future Expectations Dip Below Zero First Time Ever. If small businesses are not hiring, consumer sentiment will remain sour as will consumer spending.

There is no reason to expect consumer sentiment to change, or small business sentiment to change. Indeed, increasingly sour voters are likely to "throw the bums out" as noted in Voters Strongly Favor Non-Incumbent GOP Newcomers in Midterm Elections.

All of this adds up to an inventory build for consumer sales that will not happen. Expect more layoffs if sales do not materialize.

By Mike "Mish" Shedlock

http://globaleconomicanalysis.blogspot.com

Click Here To Scroll Thru My Recent Post ListMike Shedlock / Mish is a registered investment advisor representative for SitkaPacific Capital Management . Sitka Pacific is an asset management firm whose goal is strong performance and low volatility, regardless of market direction.

Visit Sitka Pacific's Account Management Page to learn more about wealth management and capital preservation strategies of Sitka Pacific.

I do weekly podcasts every Thursday on HoweStreet and a brief 7 minute segment on Saturday on CKNW AM 980 in Vancouver.

When not writing about stocks or the economy I spends a great deal of time on photography and in the garden. I have over 80 magazine and book cover credits. Some of my Wisconsin and gardening images can be seen at MichaelShedlock.com .

© 2010 Mike Shedlock, All Rights Reserved.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.