Gold New All Time High Prevented by Determined Sellers at $1260

Commodities / Gold and Silver 2010 Sep 10, 2010 - 07:09 AM GMTBy: GoldCore

Gold and silver have gradually eked out gains in Asia and European trade after yesterday's slight sell off. The central bank of Bangladesh's purchase of 10 metric tonnes of gold from the IMF (worth some $403 million) is supporting gold as it reminds market participants that central banks are set to be net buyers of gold this year rather than net sellers. This is a monumental shift in terms of the supply and demand dynamics in the gold market and is bullish. Asian central banks worried about their large dollar and euro holdings look set to put a floor under the market and will be buyers on dips in the price.

Gold and silver have gradually eked out gains in Asia and European trade after yesterday's slight sell off. The central bank of Bangladesh's purchase of 10 metric tonnes of gold from the IMF (worth some $403 million) is supporting gold as it reminds market participants that central banks are set to be net buyers of gold this year rather than net sellers. This is a monumental shift in terms of the supply and demand dynamics in the gold market and is bullish. Asian central banks worried about their large dollar and euro holdings look set to put a floor under the market and will be buyers on dips in the price.

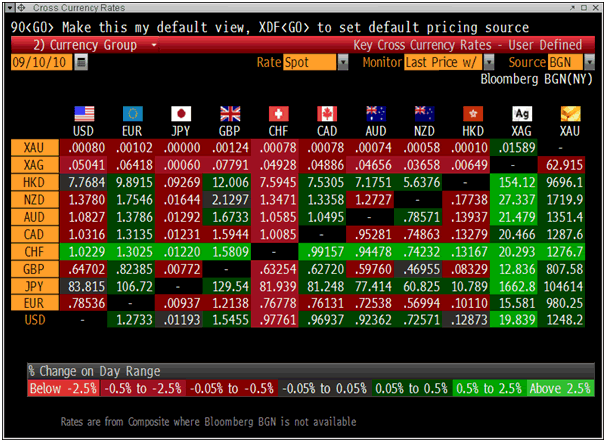

Gold is currently trading at $1,247.80/oz, €981.13/oz, £808.00/oz.

Gold has met significant resistance at the $1,260/oz level (see chart above) which may be a bearish omen. It could signify gold needs a breather and may correct again and consolidate before making new record highs. If gold closes below $1,248.04/oz we will have a lower weekly close which will take the sheen of the recent very positive technicals. A close above $1,248.04 will be extremely positive technically and from a momentum point of view and likely lead to a challenge of the record high next week. Physical demand for gold and particularly silver certificates, coins and bars has remained unusually robust in the summer months and our trading desk reports that sales have picked up again in recent days as doubts about the Eurozone banking system returned.

Some market observers and participants, most prominent of whom are GATA (Gold Anti-Trust Action Committee), assert that gold's failure to reach the record highs is due to manipulation by some large banks who are short the market, possibly backed by officialdom. Whether this is true or not, and the allegations are gradually gaining more mainstream adherents and respect, there has been very determined selling at the $1,260/oz level. Certain sellers seemed determined to prevent a new record daily high close with all the positive media coverage that this would engender and increased gold buying. Whether these sellers are operating purely for profit motives in the usual battle between buyers and sellers and bulls and bears or whether there is direction from officialdom is difficult to establish.

It is important to be aware of the allegations as artificially suppressed markets tend to surprise on the upside as was seen with the ending of the London Gold Pool from 1961 to 1968 which involved selling of gold in order to cap the price and maintain faith in sterling and the dollar. Markets can only be artificially manipulated for so long before the all important supply demand fundamentals ultimately dictate the price.

Silver

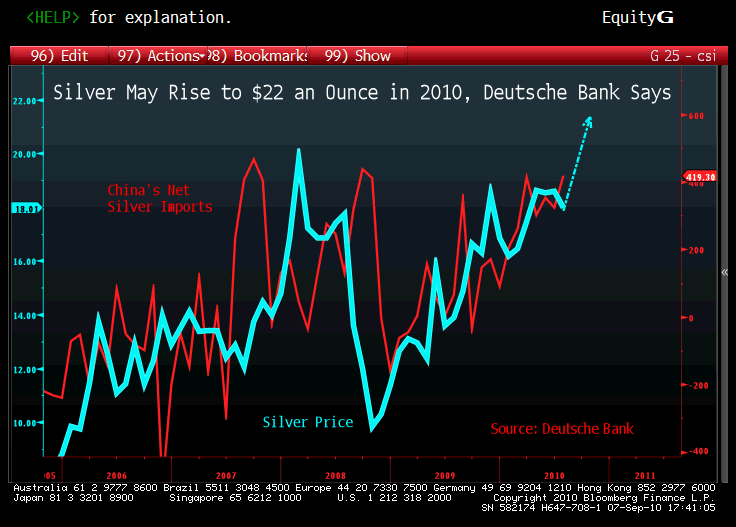

Silver may rise another 11 percent before the end of this year as investors in China buy the metal as an alternative to real estate, according to Deutsche Bank AG and as reported by Bloomberg. The Bloomberg CHART OF THE DAY shows silver has climbed since the end of 2008 as Chinese imports gained. Shipments of the metal to China may set a record, potentially lifting prices as high as $22 an ounce before this year's close, said Daniel Brebner, an analyst at Deutsche Bank in London.

Prices may average $22 an ounce next year, Brebner said, compared with about $17.85 so far in 2010. Silver has added 11 percent since China in April told banks to stop loans for third- home purchases in cities with excessive property-price gains. The metal on Sept. 8 touched $20.15, the highest intraday price since March 18, 2008. "Investors in China are starting to look for alternative vehicles to put their money in, and silver in particular is benefiting from that," Brebner said. China is the world's third-largest user of silver for industrial and jewelry purposes after the U.S. and India, according to Deutsche Bank. Net imports of the metal into China quadrupled in 2010's first seven months, the bank says. Silver, often associated with jewelry and photography, is used in industrial products from chemical catalysts to ball bearings, according to the Washington-based Silver Institute.

Silver is currently trading at $19.84/oz, €15.60/oz and £12.84/oz.

Platinum Group Metals

Platinum is trading at $1,548.00/oz, palladium is at $520/oz and rhodium is at $2,050/oz.

Today's News and Commentary

Gold Approaches Record Price on Investor Demand for Protector of Wealth (GC in Bloomberg)

Gold Rebounds From Biggest Drop Since July After Bangladesh IMF Purchase

Gold heads for 1st weekly drop in over a month

IMF sells 10 tonnes of gold to Bangladesh

Hinde Capital: A Golden Renaissance

Mark Gilbert:Drunken, Rowdy Bond Market Is About to Be Ill

David Einhorn on Gold

This update can be found on the GoldCore blog here.

Mark O'Byrne

Director

IRL |

UK |

IRL +353 (0)1 632 5010 |

WINNERS MoneyMate and Investor Magazine Financial Analysts 2006

Disclaimer: The information in this document has been obtained from sources, which we believe to be reliable. We cannot guarantee its accuracy or completeness. It does not constitute a solicitation for the purchase or sale of any investment. Any person acting on the information contained in this document does so at their own risk. Recommendations in this document may not be suitable for all investors. Individual circumstances should be considered before a decision to invest is taken. Investors should note the following: Past experience is not necessarily a guide to future performance. The value of investments may fall or rise against investors' interests. Income levels from investments may fluctuate. Changes in exchange rates may have an adverse effect on the value of, or income from, investments denominated in foreign currencies. GoldCore Limited, trading as GoldCore is a Multi-Agency Intermediary regulated by the Irish Financial Regulator.

GoldCore is committed to complying with the requirements of the Data Protection Act. This means that in the provision of our services, appropriate personal information is processed and kept securely. It also means that we will never sell your details to a third party. The information you provide will remain confidential and may be used for the provision of related services. Such information may be disclosed in confidence to agents or service providers, regulatory bodies and group companies. You have the right to ask for a copy of certain information held by us in our records in return for payment of a small fee. You also have the right to require us to correct any inaccuracies in your information. The details you are being asked to supply may be used to provide you with information about other products and services either from GoldCore or other group companies or to provide services which any member of the group has arranged for you with a third party. If you do not wish to receive such contact, please write to the Marketing Manager GoldCore, 63 Fitzwilliam Square, Dublin 2 marking the envelope 'data protection'

GoldCore Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.