Filtering Through the Economic Noise, America's Second Great Depression

Economics / Great Depression II Sep 10, 2010 - 05:06 AM GMTBy: Mike_Stathis

Early last month, the Commerce Department released the latest GDP data. For Q2 of 2010 the GDP growth came in at 2.4%, missing the consensus estimate of 2.5%.

Early last month, the Commerce Department released the latest GDP data. For Q2 of 2010 the GDP growth came in at 2.4%, missing the consensus estimate of 2.5%.

The Commerce Department also released its latest revisions to 2007-2009 GDP data. As I had predicted, the economy shrank more than the previous estimate of 2.6% versus the 2.4% data recorded last year. That made it the largest drop in GDP since 1946.

Moreover, the revisions in August indicated 0% economic growth for all of 2008 versus the previous estimate of 0.4%.

Finally, in 2007 the economy grew by only 1.9% versus the previous 2.1% figure. Overall, since the recession began in December 2007 through June of 2010, GDP has declined by 4.1% according to the latest revisions by the Commerce Department.

Fast-forward to a month later. On August 27, the Commerce Department revised the Q2 2010 GDP data downward. From April to June (Q2) the GDP was revised down to 1.6%, from the initial 2.4% estimate. This latest data has strengthened the growing consensus that the “recovery” is weakening.

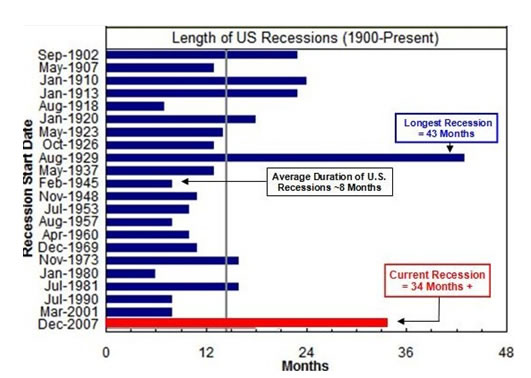

I have continued to insist that the initial GDP data would be revised down significantly. This is precisely what we are now seeing. By now, you should understand that there is no recovery in progress. The recession is alive and well, now entering its 34th month. This is a fact which no one who is familiar with the economic environment can legitimately refute. Let me be crystal clear.

As I predicted would be the case in America’s Financial Apocalypse (2006), we are in the midst of America’s Second Great Depression. The current recession is just one component of the socioeconomic depression that will be recorded in history books long after it has ended.

Amazingly, most people still have not read this book, despite the fact that it still represents by far the most accurate and comprehensive look at America’s problems. If you are unfamiliar with this book, you can blame the media. They wanted to make certain to hide the realities from the people. Thus, it was the media who ultimately caused you to lose your life savings. If you pay attention to the media, you only have yourself to blame when you lose money.

Wall Street and Washington hacks scattered throughout America’s media monopoly continue to mislead the public, with debates about a double-dip recession as if this terminology has legitimacy. Understand that anyone who uses this bogus term has NO CREDIBILITY, as I have previously discussed.

Sadly, everyone who enters a discussion about the economy has chosen to adhere to buzz words created by hacks without bothering to question whether they’re applicable. This includes the perma-bears and gold bugs. They’re all followers in thought. They’re all behind the curve.

Understand that the revisions in economic growth have not yet been adequately factored into the stock market in my opinion. Perhaps the reason accounting for this is because investors fail to realize these downward revisions represent a future trend. Once they realize this fact, the stock market is likely to take some big hits.

I’ve been forecasting major moves in the stock market with near 100% accuracy over the past four years, so I think I have a good idea where the market is headed down the road.

As you can see from the table below, the cheerleaders are going to be embarrassed yet again once final GDP data is tabulated (and revised) for 2010. According to virtually every hack organization out there, the U.S. economy is forecast to grow at or over 3% for 2010. Even with the help of numerous tax subsidies and the ARRA, this forecast is ridiculous, as I’ve mentioned in the past.

Based on what I see currently, the official growth will be 1.5 to 2.1% for the year once all data has been completely revised. Depending on the timing of how this data is revised downward, it could potentially cause some big problems for the U.S. stock market. But as you know, this game is one of a relative nature. Thus, continuing problems in Europe could neutralize the full impact of the economic situation in the U.S.

As you can see from the 2011 data, the hacks have come down a bit knowing that the stimulus will be all but exhausted. As a result, they have forecast 2.9% growth for 2011. This too is ludicrous. Without additional stimulus packages, I am confident productivity won’t exceed 1.3%. It’s likely to come in below 1% once the data has been fully revised.

If the proper adjustments were made, GDP since 2001 might be less than 1%. I made this same argument through 2006 in America’s Financial Apocalypse, when the “experts” claimed the economy was doing great.

There’s no way on earth productivity can increase with unemployment so high. The length of time the unemployed have remained without work is going to add to the nation’s chronically high unemployment rate.

If there’s no real consumer demand, there’s no demand by companies to hire more workers. It’s as simple as that. Even Washington shills expect unemployment to remain high for quite some time. Yet, they continue to inflate productivity estimates.

Upon seeing the wave of worsening economic data roll in, the White House’s economic cheerleader, Fed Chairman Bernanke rushed to downplay the severity of the recession, as he has done since it began. In a statement flooded out by the media, Bernanke flip-flopped from statements made just a few months ago when he proclaimed the “recovery” was advancing even more rapidly than expected.

According to Ben’s latest outlook, the current pace of economic growth is "somewhat less vigorous" than expected, but he remained optimistic for improvements in 2011. He added that the central bank is prepared to provide additional "unconventional measures" if the outlook were to "deteriorate significantly."

Incidentally, the timing of Bernanke’s statement couldn't have been better, as the Dow was flirting with the critical support around 9900.

As lost as Bernanke remains as to the extent of the economic collapse, the nation’s “leading” economists appear to be equally confused. In a recent survey, 38% of economists believe the nation's current fiscal policy is "about right." However, 64% support an extension of unemployment benefits for up to two years. As well, the majority of economists surveyed stated that none of the existing tax cuts on individual income, dividends and capital gains should be allowed to expire. The fate of more than 100 tax breaks will be decided over the next several months.

This illustrates just how misguided the majority of U.S. economists remain. Extending the duration of unemployment benefits will surely reduce the incentive of millions to find gainful employment. With unemployment at a stand-still, Congress has already extended unemployment benefits a whopping seven times over the past two years. It sure sounds like a great time to be unemployed; that is if you don’t feel like working. No doubt, Congress will pass more unemployment extensions over the next few years, along with additional subsidies and other desperate attempts to create false demand.

The National Association of Business Economists (NABE) recently stated that 75% of its members feel that promoting economic growth is more important than reducing the national deficit. However, the same number of economists doesn’t feel another stimulus package is necessary. The majority believe that policymakers should do more to boost job growth, but they don’t seem to have any answers. I discussed the solutions in the January 2010 issue of the AVAIA newsletter.

So what are they saying? If they don’t want another stimulus, how do they propose to stimulate economic growth? These are the same economists who support America’s unfair trade policies which continue to export millions of jobs overseas. These economists are clearly confused.

For the past several years, the U.S. has only been able to promote economic growth by flooding money into the banking system so as to create bubbles. Current trade policies do not permit viable economic growth in the absence of excessive credit. Meanwhile, the U.S. relies on foreign nations to finance Washington's ridiculous spending sprees. But China will only continue to hold dollars if U.S. consumers keep buying their goods.

Washington and the Federal Reserve have clearly established a Ponzi scheme, and have labeled it economic growth. Regardless how much U.S. Treasuries foreigners agree to buy, it will not lower America's massive national debt.

Ever since Fannie and Freddie were bailed out, I discussed the fact that there would be many more bailouts. This is exactly what we have seen. And ever since the ARRA was passed, I predicted this would be only one of many more economic stimulus packages to come over the next several years.

I have not changed my opinion. It should be clear that several additional stimulus packages and subsides will be passed because creating false demand through debt-spending has become the primary manner by which to create the impression of real economic growth in the U.S. This keeps the Ponzi scheme going.

But we all know that all Ponzi schemes come to a very brutal end. Bernie Madoff mitigated the losses to his investors when he turned himself in. If he had waited until he was discovered, there probably wouldn’t have been any funds remaining. Will Washington finally admit the fundamental problems embedded within the U.S. economy, or will they remain arrogant, thinking they can keep up this scam forever?

With the Q2 earnings nearly finished, more than 80% of companies that have reported have beat earnings estimates, while around 70% have beat revenues expectations. Sounds pretty good right?

First, keep in mind that estimates were understated so as to not disappoint. Second, most corporations have focused on aggressive cost-cutting measures in order to boost profits. This is why revenues are down relative to earnings.

Finally, forward guidance from many companies has not been particularly encouraging, even from the blue chips and tech giants. As revenues continue to show signs of decline and margins continue to shrink from record highs, many of the giants have turned to acquisitions as a way to enter new markets. Instead of recognizing these transactions as acts of desperation, investors have hailed them as indicators of future earnings growth.

Much of the reason for the boost to the U.S. stock market has been due to Europe’s problems. Investors are looking for a safer place to hide. However, for non-professional traders the safest place to be is in cash. As of late, it would appear that Wall Street has recently extrapolated earnings data through the rest of 2010. This is going to prove as a big mistake.

Also in August came the highly anticipated news that for the first time ever, China surpassed Japan as the world’s second largest economy. However, China’s per capita income remains stuck at about $3,800. The low wages in China is already creating many problems, from labor protests to suicides.

Some of America’s largest multinational giants have already begun to pull out of China because they see the end of the cheap labor gravy train. Imagine what higher wages in China will do to the U.S. and Chinese economy. Now combine that with the continued (although gradual) removal of the Yuan-Dollar currency peg. There is no doubt that systemic risk is building in China’s economy.

The hacks have created the perception that the troubles in Europe are subsiding. Last month, earnings from many of the large European corporations surprised even the most optimistic forecasts from analysts. As well, the economic data was a bit better than expected. However, much of this positive data was restricted to Germany and France. As you might imagine, the problems in Europe are far from over.

It doesn’t really matter whether Germany and France are showing some (short-term) signs of improvement. One reporting period does not mean much. Moreover, what’s important is the state of the European Union taken as a whole. To imply that the problems in Europe have subsided based on upbeat data from Germany and France is like saying that the U.S. is improving because the economic data in Texas and New York came in better than expected.

A rather surprising recent trend has been the huge international demand for emerging market debt. Even more surprising is that investors have been willing to buy Brazil’s bonds at yields at about 150 basis points above comparable U.S. Treasuries. This means that the spread between the two bonds (150 basis points) represents the risk of default. Apparently, there was no where near enough of these bonds to meet investor demand, as the new issues outpaced demand by a factor of seven.

As much as I like Brazil's future economic growth, to me that’s just crazy. Brazil’s economy, just like China’s, has been largely propped up by U.S. economic policy and the global credible created by the Federal Reserve. Thus, any problems in the U.S. will adversely impact Brazil, China and the other emerging markets.

Even Chile, which has a lower credit rating than Brazil, sold bonds at just 90 basis points above U.S. Treasuries.

Now there is speculation that soon, Argentina, a nation that defaulted on its debt just ten years ago (2001) will soon auction bonds.

In July, the cost for emerging market governments to issue dollar-denominated bonds fell to its lowest since early May, or 279 basis points over U.S. Treasuries, according to JPMorgan's EMBI+ index.

In part, this rush to buy emerging market sovereign debt has been catalyzed by the much better economic performance seen in these nations, not only since 2008, but for several years prior to that. But when you see yield spreads between emerging sovereign debt and risk-free U.S. Treasuries that low, it tells you institutional investors have no idea what’s going on. It’s truly shocking.

As well, with global uncertainty growing by the day, it is likely that many of these investors, which represent pensions and insurance plans, will want the more certain returns bond coupons provide. However, the current spreads simply fail to account for adequate risk.

I am willing to bet that over the next few years, many emerging market bonds being issued today will be trading with significantly higher yields in the secondary market, due to the economic volatility and increasing risks building in China. What that means is that investors lining up for these bonds are making very foolish decisions.

At the very least, if these record-setting levels of emerging debt issuances increase, there could be a bubble formed in this market, albeit a few years down the road. Remember, the U.S. is in a unique position, having its economy and thus debt financing linked to oil. Thus, it has a much better ability to take on large levels of debt without a commensurate impact within the U.S.

Perhaps you recall the Federal Reserve’s analysis and forecasts for the economy a few of months ago. The Federal Reserve stated that the pace of the so-called economic recovery in the U.S. was faster than they had anticipated. As a result they raised their forecasts for GDP growth. The World Bank and IMF followed suit, as you would expect from any syndicate, issuing similar forecasts for the “global recovery.” Of course, I mentioned this was all hogwash in my newsletter.

Recently, the Fed lowered its estimate for economic growth in the U.S. for 2010. That should confirm once again that to listen to the Federal Reserve, Washington, the World Bank or the IMF is similar to handing your money to liars and thieves.

The Fed now predicts the economy will grow between 3% and 3.5% for 2010, down from their previous forecast of 3.2% to 3.7% made in April.

Sorry, but they’re still delusional. Growth will come in at 2010 well-below 3% when all numbers have been revised. And still, much of this growth will come as a result of the various stimulus plans and other actions taken by Washington and the Fed.

From an absolute sense, it is likely that the U.S. will register maybe about 0.5% growth for 2010, once all appropriate factors have been adjusted. The problem is that neither Washington nor the Fed ever makes these adjustments. Of course, you will never hear mention of this by Washington or the media because they want to keep the Ponzi scheme going.

Even after the Fed announced a more downbeat forecast for the so-called economic recovery, Fed Chairman Bernanke remains loyal in his role as a political cheerleader. Even after the Fed announced a more downbeat forecast for the so-called economic recovery, Fed Chairman Bernanke remains loyal in his role as a political cheerleader. Accordingly, he continues to downplay any chance of a double-dip recession, which as I have discussed isn’t even applicable. It’s truly a huge dog-and-pony show. And it’s getting very old from where I stand.

This is just more evidence that you cannot take what Washington says at face value. Yet, the media focuses on these incompetent fools.

Why am I bothering to point this out?

Because I want you to understand how the game is played. Sentiment is largely determined by the media because the media is presumed to present an objective assessment of the economy.

However, the problem is that the media is highly irresponsible because it presents the views of cheerleaders like the Wall Street analysts, the Fed and university economics professors.

And when they want to present a counter punch, they only air extremists who ultimately end up looking like fools. This is specifically why these men have been inducted into the media club.

In the end, by providing the public with extremists, the media repositions credibility back towards Wall Street and Washington because real experts with excellent track record and without bias are never interviewed. This explains why investors get blind-sided when reality hits. They can’t win either way. That’s why it’s impossible to win by listening to the media. This is how the game has been designed.

However, if you understand the real picture in advance, you can model appropriate levels of risk into your investment strategy. And when the shoe drops, you’ll have cash to buy in at the lows, while most are stuck watching their portfolios crash and burn.

Please do NOT forget what the clowns have been saying. You need to keep a journal so you will know who to trust and who to ignore. After searching for numerous years, I’ve not found anyone who is reasonably consistent with their forecasts.

The list of wrong forecasts and misguided investment advice over the past three years would fill the contents of a very large book, from the perma-bears who kept their followers out of the biggest stock market rally in decades, advised them to short the market by 200% leverage as of November of 2009, continue to insist the dollar is headed to zero, and gold will top $10,000; to the perma-bulls who have made claims that a new bull market began in August of 2009, and who insist that the recession ended last summer.

The list of ridiculous forecasts is endless, as anyone who has kept a written tally can confirm. The blame ultimately lies with investors because most fail to document track records. They fail to do this because they are lazy and they associate media exposure with expertise and credibility. As we have seen, this is not at all the case.

For instance, Liz Sonders of Charles Schwab was one of the many hacks that claimed the recession was over in the spring of 2009. Abby Cohen stated that a new bull market began in August 2009. In contrast, the gold bugs and perpetual doomers told investors to stay out of the stock market ever since it bottomed in March of 2009. As a result, Main Street has largely missed out on the biggest rally in decades.

Some have performance records that make you think their purpose is to cause you to lose your money. If you want to make money and avoid losses, you need to start waking up and realize you’re being misled by a circus show designed to misinform you.

The ringmasters of this circus show are the various financial media outlets, who intermingle perma-bulls with perma-bears into the act. All of them are extremists. Most of them are idiots. The rest are liars. They all have agendas and they all have terrible track records. That is precisely why the media has selected them as their designated “experts.”

If you aren’t documenting what the media’s “experts” are saying; if you are blindly listening to the views provided by the media, you are walking into a financial landmine.

The first rule of thumb to remember is that analysts and strategists working for discount brokers are clueless. If they had a clue they wouldn’t be working for discount brokers. They merely follow what Wall Street strategists are saying, much like the financial bloggers follow what the extremists in the media state. Of course we cannot assume that Wall Street has much more credibility. All Wall Street strategists were claiming the recession was over by early to late summer.

The second rule of thumb is to avoid any rhetoric from those who have agendas, such as that found from those who sell securities or gold.

And remember, when you hear or read of anyone mention buzz words like double-dip recession or green shoots, you need to run like hell because that confirms they have no idea what they’re talking about. They are merely followers of the media Macarena.

What that means is that you aren't going to find many individuals out there who have a clue.

Order your copy of my latest interview (unavailable in the public domain). This interview transcript is over 52 pages and covers more topics than you will find in any interview.

Check here for more information.

Also, I want to urge those of you who haven't locked in the promotional rate for the newsletter to take advantage while it lasts because it will never be offered at such a low rate again.

By Mike Stathis

www.avaresearch.com

Copyright © 2010. All Rights Reserved. Mike Stathis.

Mike Stathis is the Managing Principal of Apex Venture Advisors , a business and investment intelligence firm serving the needs of venture firms, corporations and hedge funds on a variety of projects. Mike's work in the private markets includes valuation analysis, deal structuring, and business strategy. In the public markets he has assisted hedge funds with investment strategy, valuation analysis, market forecasting, risk management, and distressed securities analysis. Prior to Apex Advisors, Mike worked at UBS and Bear Stearns, focusing on asset management and merchant banking.

The accuracy of his predictions and insights detailed in the 2006 release of America's Financial Apocalypse and Cashing in on the Real Estate Bubble have positioned him as one of America's most insightful and creative financial minds. These books serve as proof that he remains well ahead of the curve, as he continues to position his clients with a unique competitive advantage. His first book, The Startup Company Bible for Entrepreneurs has become required reading for high-tech entrepreneurs, and is used in several business schools as a required text for completion of the MBA program.

Restrictions Against Reproduction: No part of this publication may be reproduced, stored in a retrieval system, or transmitted in any form or by any means, electronic, mechanical, photocopying, recording, scanning, or otherwise, except as permitted under Section 107 or 108 of the 1976 United States Copyright Act, without the prior written permission of the copyright owner and the Publisher. These articles and commentaries cannot be reposted or used in any publications for which there is any revenue generated directly or indirectly. These articles cannot be used to enhance the viewer appeal of any website, including any ad revenue on the website, other than those sites for which specific written permission has been granted. Any such violations are unlawful and violators will be prosecuted in accordance with these laws.

Requests to the Publisher for permission or further information should be sent to info@apexva.com

Books Published

"America's Financial Apocalypse" (Condensed Version) http://www.amazon.com/...

"Cashing in on the Real Estate Bubble" http://www.amazon.com/...

"The Startup Company Bible for Entrepreneurs" http://www.amazon.com...

Disclaimer: All investment commentaries and recommendations herein have been presented for educational purposes, are generic and not meant to serve as individual investment advice, and should not be taken as such. Readers should consult their registered financial representative to determine the suitability of all investment strategies discussed. Without a consideration of each investor's financial profile. The investment strategies herein do not apply to 401(k), IRA or any other tax-deferred retirement accounts due to the limitations of these investment vehicles.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.