Soverign Debt Panic Amongst The PIIGS

Stock-Markets / European Stock Markets Sep 08, 2010 - 08:57 AM GMTBy: PaddyPowerTrader

U.S. stocks fell for the first time in five days Tuesday, ending the longest streak of gains for the S&P 500 Index since July, on concern the European debt crisis may worsen and hamper global growth. Bank of America and Citigroup fell at least 2% as European banks slid on concern stress tests understated potential losses from sovereign debt.

U.S. stocks fell for the first time in five days Tuesday, ending the longest streak of gains for the S&P 500 Index since July, on concern the European debt crisis may worsen and hamper global growth. Bank of America and Citigroup fell at least 2% as European banks slid on concern stress tests understated potential losses from sovereign debt.

Meanwhile ConocoPhillips and Chevron slumped more than 1.2% as crude oil fell the most in a week. But Oracle rallied 5.9% after naming Mark Hurd, former chief executive officer of Hewlett-Packard as president.

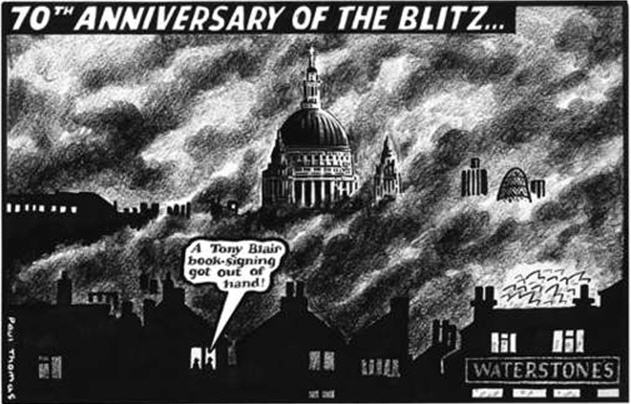

Today despite some token buying by the ECB and a decent Portuguese bond auction the bond vigilantes have again been out doing their worst pushing the Irish / German 10 year spread out to levels not seem since 1988 when the debt GDP ratio was 118% . Indeed yesterday saw the worst single daily performance by Irish Government bonds ever in terms of spread widening.

Greece is also back in the crosshairs in response to a downward revision to Q2 Greek GDP to -1.8% from -1.5% originally, and on news the National Bank of Greece plans to raise Eur2.8 bln of capital. The latter may be especially alarming in the current environment, but really reflects a desire for extra security and also a cash hoard to potentially spend on weaker rivals; ATEbank stands prominently in this respect.

Today’s Market Moving Stories

The stand-out mover in FX today was GBP, which rallied sharply, largely it would seem on news that Vodafone has sold its stake in China Mobile and intends to use 70% of the proceeds (£4.2bn) to fund share buybacks. The macros community had started to build GBP shorts in recent days and this M&A flow prompted a flurry of short-covering, assisted as well by better than feared Halifax house price data.

Irish Banking

According to the Irish Times this morning, the bank’s chairman has stated that a statement on Anglo should be expected today. Who will make it or what the nature of the announcement will be is not evident, but keep eyes peeled around 4pm. Recent media reports have indicated strongly that an orderly wind down of the bank over 10-15yrs is the new preferred option. But what the markets are really looking for is an update on the total FINAL bottom line kitchen sink cost of the bailout and whether its closer to Eur 25bn or S&P’s recent & much criticized Eur 35bn figure. UPDATE – SEE VERY BOTTOM OF THIS POST.

Bloomberg reports that private equity heavyweight J.C. Flowers and three other bidders for Ireland’s EBS Building Society may buy and merge several lenders to create a new competitor to the country’s biggest banks, two people familiar with the situation said. J.C. Flowers., the U.S. buyout firm, Dublin-based Cardinal Asset Management, backed by U.S. private equity firm Carlyle Group, and Doughty Hanson & Co. are vying with Irish Life & Permanent Plc to take control of EBS, said the people who declined to be identified. Each of the bidders said in talks that they plan to merge EBS, the country’s biggest customer-owned lender, with other building societies. That would create a new rival to Bank of Ireland Plc and Allied Irish Banks Plc, the country’s biggest lenders. EBS and the National Treasury Management Agency, which is overseeing the sale, will probably select a preferred bidder or two short-listed bidders next week, according to one of the people.

Japan

Japanese Finance Minister Yoshihiko Noda said he is prepared to take “bold” action on currencies, including intervention in foreign-exchange markets, after the yen reached a 15-year high against the dollar. “We will take bold action if necessary and naturally that can include intervention,” Noda told lawmakers in parliament today. “We have to use every option available as a strong yen is likely to have a severe impact on companies.” The yen rose to 83.52 per dollar yesterday, the highest level since June 1995, as concerns about weakening growth in the U.S. and Europe bolstered the currency’s appeal as a refuge.

UK Outlook

A U.K. index of hiring for permanent jobs in August showed the slowest growth pace in 10 months, KPMG LLP and the Recruitment and Employment Confederation said. The gauge of full-time job placements dropped to 56.3 from 60.2 in July, the groups said in an e-mailed report today in London. That’s the slowest pace since October. Readings above 50 indicate an increase in hiring. The U.K. is bracing itself for a period of austerity as Prime Minister David Cameron pledges to reduce the country’s record budget deficit.

U.K. shop price inflation accelerated in August as the price of food rose at the quickest annual pace in over a year, a survey showed Tuesday. Total shop price inflation was 1.7% on the year in August and 0.1% on the month, compared with a 1.5% annual rate and 0.1% monthly decline in prices in July, the monthly survey by the British Retail Consortium showed. That was due to a more-than-one percentage point rise in the cost of food. Food prices were 3.8% higher in August than a year earlier, while food prices rose 0.2% from July.

And July’s UK industrial production figures suggest that the manufacturing sector continues to enjoy steady, if unspectacular, growth. The 0.3% rise in manufacturing output was the third such gain in a row and pushed the yoy rate of output growth up to a new cycle high of 4.9%. Overall industrial production saw a similar monthly gain. For now, then, the output data are defying the rather gloomier tone of some of the recent industrial surveys, such as last week’s CIPS report on manufacturing. But it is worth remembering that the surveys normally lead the hard data by a few months, so it would be no surprise if output growth were to start to weaken over the next few months. And even if output posts similar increases in August and September, industry won’t make as strong a contribution to GDP growth in Q3 as it did in Q2. Overall, UK industry is still doing pretty well, but it may not last too much longer.

Company / Equity News

•UK homebuilder Berkeley Group has issued an interim management statement this morning covering the period from 1stMay 2010 to 31st August 2010. The group pointed out that demand for properties over the period has been resilient, particularly in London which has a shortage of supply and specific demand from international purchasers. Outside of London, which is more reliant on the UK domestic economy, a lack of credit availability and weak consumer confidence is weighing on transactions currently.

•Barratt Developments also reported full year results this morning. The group reported a full-year loss of £118.4m compared to a loss of £468.6m. Market expectations were for a loss of £125m. Revenue declined by 11% to 2.04bn with the group selling 11,377 homes during the period, compared with 13,277 last year. The group’s operating margin increased to 5.9% from 1.8% a year earlier. The group expects a ‘modest’ increase in average selling price this year, however the group noted that the outlook for new housing ‘remains challenging’. For clients looking for exposure to a UK home builder, Persimmon is my preferred play.

•Securities firms (investment banks) around the world will cut as many as 80,000 jobs in the next 18 months as revenue growth begins to slow, said Meredith Whitney, the former Oppenheimer & Co. analyst who now runs her own firm. The reductions, about 10 percent of current levels, will come after 2010 compensation payments. “The key product drivers of Wall Street’s revenues and profits over the past decade have been in a structural decline over the past three years,” Whitney said in the report. “2010 marks the first year in many in which Wall Street-centric firms will go through structural changes.”

•Vodafone’s $6.6 billion sale of its stake in China Mobile Ltd. is the biggest divestment since Chief Executive Officer Vittorio Colao took charge in 2008. Investors want to know what’s next. Vodafone sold its 3.2 percent stake in China’s largest mobile phone company today. About 70 percent of the proceeds will be returned to shareholders through a stock repurchase and the rest will be used to pay down debt, Newbury, England-based Vodafone said in a statement yesterday.

•Nokia Oyj, the world’s biggest maker of mobile phones, has a lot riding on its annual showcase event next week as it tries to claw back lost ground to Apple Inc.’s iPhone and devices based on Google’s Android software. The Finnish company is likely to focus attention at Nokia World in London on its high-end Symbian smartphone line, including the touch screen N8, its latest effort to take on Android and iPhone handsets.

•Google’s CEO Eric Schmidt said the company plans to extend its Web television service from U.S. viewers to global consumers in 2011. Google has an agreement with Sony Corp. to launch Web TV in the U.S. this fall, while Samsung Electronics Co., the world’s largest television manufacturer, said today it may make sets run by Google’s software to compete with Sony and Apple Inc. in the market for TVs that access movies, shows and games online.

•The life of Germany’s nuclear power plants will be extended by up to 15 years under a deal agreed between energy companies and the government of Chancellor Angela Merkel. Germany’s energy giants will pay [euro]15 billion to fund research into renewable energy and Berlin will, in return, set aside a 2000 agreement forced by the Schroder government to wind down all nuclear energy plants by 2025.

•According to the FT , Ryanair may return to the market for a purchase of up to 300 airplanes, the Financial Times said late Tuesday, citing an interview with chief executive Michael O’ Leary. O’Leary told the FT his company also plans on writing to aviation authorities asking to use a single pilot for short-haul flights, the report on the FT website said.

•Evidence emerged yesterday that the strained relations of late between Tullow and the Ugandan Government over the issue of tax arising from the Heritage Oil transaction eased somewhat based on comments attributed to the Energy Minister. Questioned on the Government stance regarding the recently rescinded Kingfisher licence in Block 3A and Tullow’s ability to redress the situation, the Energy Minister appeared to soften the Government position indicating a favourable response should Tullow apply.

•Dana Petroleum offered a strong defence this morning against the unsolicited offer of £18 per share from the Korean National Oil Company (KNOC) and also announced the widely anticipated acquisition of Petro-Canada’s UK assets for a cash consideration of £240m ($372m).

UPDATE – Text of announcement on Anglo Irish

The Minister for Finance today briefed his Government colleagues on the strategic options for the future of Anglo Irish Bank. The Minister conveyed to the Government the views of the Board of Anglo Irish Bank, the Central Bank, the National Treasury Management Agency, the Department of Finance, the EU Commission and his own assessment of the position.

The Government decided that Anglo Irish Bank will be split into a Funding Bank and an Asset Recovery Bank. Anglo Irish Bank has not expanded its loan book since it was nationalised in early 2009 and this will remain the case. It is intended that in due course the Recovery Bank will be sold in whole or in part or that its assets will be run off over a period of time.

The guaranteed position of depositors will be unchanged by the new arrangements and no action is required of them as a result of today’s announcement. The depositors will become customers of the Funding Bank which will be fully capitalized and continue as a regulated bank.

In order to restore the reputation of the Irish Financial System it is essential to bring finality to the problem of Anglo Irish Bank – our most distressed institution.

The Government’s primary objective in dealing with Anglo Irish Bank has been to minimise the cost of this distressed bank to the Irish taxpayer.

The Board of Anglo Irish Bank submitted its preferred option to the Minister and to the European Commission at the end of May for consideration under State Aid rules. The board’s plan envisaged splitting the bank into an asset management company and a new good bank. The asset management company would have managed out over time the bank’s lower quality assets remaining after the transfers to NAMA. The new good bank would have managed the remaining share of the loan book, retained the bank’s deposit funding and sought new lending opportunities to grow the bank.

The Minister acknowledges the good faith and hard work of the board in producing a credible proposal for the future of the bank.

However, the Government has concluded that this plan in its current form does not now provide the most viable and sustainable solution to ensure the continued stability of the Irish banking system.

Resolution Proposal

In these circumstances, the Government has decided to opt for a variation of the board’s restructuring proposal. The Government’s decision does not affect existing guarantee arrangements.

Under the restructuring plan, the Funding Bank will be a Government-backed/guaranteed specialist deposit bank which will contain the bank’s deposit book. It will be a stand-alone, regulated bank, completely separated from Anglo’s loan assets and it will be owned directly by the Minister for Finance. This bank will not engage in any lending, but will provide a secure home for Anglo’s depositors and any new customers who wish to deposit their funds with it. Depositors with the Funding Bank will be completely insulated from the future performance of the rest of the current Anglo Irish Bank loan book.

The Asset Recovery Bank will also be a licensed regulated bank. Its dedicated focus will be on the work-out over a period of time of the assets not being transferred to NAMA in a manner which maximises the return to the taxpayer.

Costs

The Government believes that it is essential to identify, with as much certainty as possible, the final cost for the restructuring and resolution of the bank. This will underpin international financial confidence in Ireland. Accordingly, the Central Bank will determine the appropriate levels of capital needed in both institutions. Its decision will be announced by October.

EU Commission

The Department of Finance has conducted intensive discussions with the EU Commission in recent weeks about the future of Anglo Irish Bank. The Minister for Finance met Commissioner Almunia last Monday to discuss the issue. A formal detailed plan is being prepared for submission to the Commission for approval.

The Minister said:

“Today’s decision by the Government will provide certainty about the future of Anglo Irish Bank. Resolution of this, our most distressed institution, is essential to the promotion of confidence and stability in our financial system.”

8th September 2010

ENDS

Brian Meenan

Press Office

PH: 6045875

email: brian.meenan@finance.gov.ie

By The Mole

PaddyPowerTrader.com

The Mole is a man in the know. I don’t trade for a living, but instead work for a well-known Irish institution, heading a desk that regularly trades over €100 million a day. I aim to provide top quality, up-to-date and relevant market news and data, so that traders can make more informed decisions”.© 2010 Copyright PaddyPowerTrader - All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

PaddyPowerTrader Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.