Three Ways to Profit From Silver's Looming Bull Market Breakout

Commodities / Gold and Silver 2010 Sep 08, 2010 - 05:49 AM GMTBy: Money_Morning

JACK BARNES writes: It's the last major commodity to enjoy a true price breakout, and it's already doing so in a foreign currency.

JACK BARNES writes: It's the last major commodity to enjoy a true price breakout, and it's already doing so in a foreign currency.

This commodity has yet to break out in U.S. dollar terms, although its breakout in India is a signal that it's time for U.S. investors to make their move.

I'm talking, of course, about silver.

Silver is trading at just under $20 an ounce right now. I think it could hit $50 an ounce by the 2012 presidential election, which would represent a 150% move from here.

Clearly, the "white metal" can be a major profit center for your portfolio during these uncertain times. Let's look at the strategy that I've put together for you to reap that gain.

Ode to the 'White Metal'

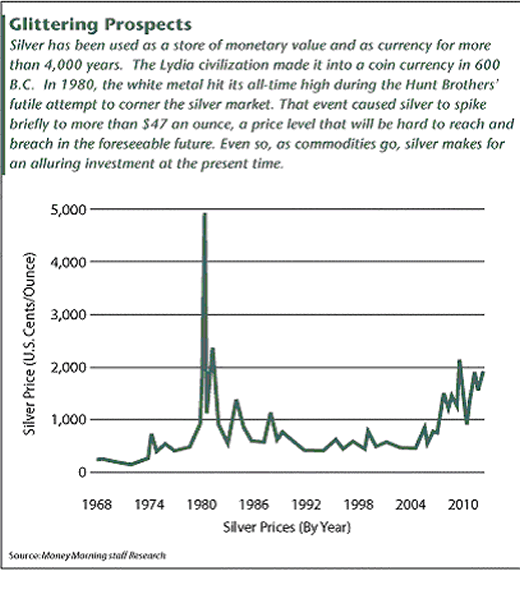

Silver has been used as a store of monetary value and as currency for more than 4,000 years. The Lydia civilization made it into a coin currency in 600 B.C. In 1980, the white metal hit its all-time high during the Hunt Brothers' futile attempt to corner the silver market. That event caused silver to spike briefly to more than $47 an ounce, a price level that will be hard to reach and breach in the foreseeable future. Even so, as commodities go, silver makes for an alluring investment at the present time.

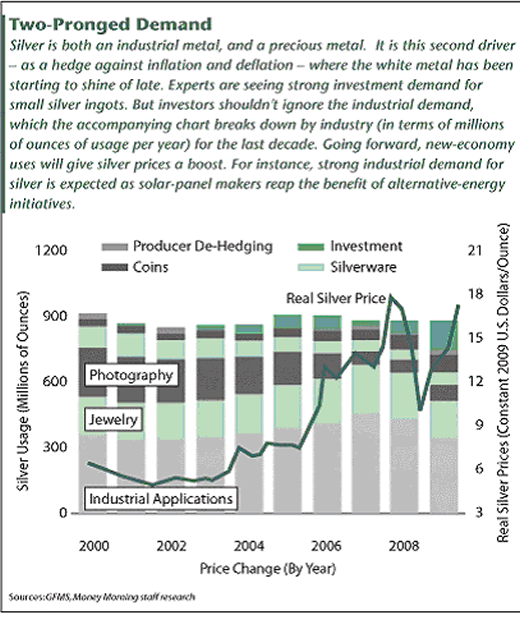

When investors think of silver, they tend to view it as a cheaper version of gold. That's a mistake. On one hand, silver is like gold in that it is an investment-worth precious metal. However, there is also a strong industrial demand - when companies such as chip giant Intel Corp. (Nasdaq: INTC) think of silver, they do so for its industrial uses.

And the industrial uses of this white, lustrous metal only figure to increase. Silver has the highest electrical conductivity of any element and the highest thermal conductivity of any metal. That conductivity makes silver the perfect metal for solar-cell production, meaning the metal figures to be a critical component in the developing alternative energy sector.

The Silver Bull's Early Warning Signal

A historic breakout in silver appears to be under way - in India. In other words, silver prices are starting to make a run in terms of the Indian rupee - but not in U.S. dollar terms. Silver is the last major commodity to break out, and the fact that it's doing so in a foreign currency is tantamount to an early-warning signal that U.S. investors should place their silver bets in U.S. dollar terms.

The move in prices in India is what I call a "stealth price-discovery movement." The increase in prices in rupee terms provides U.S. investors with a view of what investors in other markets are thinking - and a look at the moves they are making as a result of that thinking.

In this case, Indian investors see inflation as a cause for concern. And they see silver as the solution.

Historically, silver has shown itself to be a hedge against inflation in other asset prices. It serves as a store of value. Indeed, in today's world of debt-backed currencies with sovereign-bond risk, silver is poised to return to its precious-metal/store-of-value roots, joining gold as a "currency" with no debt-default risk.

As fears of inflation sweep through India's economy, that country's silver market keeps establishing new higher highs. At the same time, the price of silver in the U.S. market also has shown early signs of waking up.

Silver is currently cheap, when priced in gold. This has happened because gold has already been setting new nominal high prices this year - though silver has failed to follow suit. This price divergence between gold and silver has attracted some relative value traders, who might try to place a trade that is based on the ratio between gold and silver as quoted in silver ounces.

In this type of trade, the potential exists to make money as silver goes up or as gold goes down in price. Silver has traded at an average ratio of 61 ounces of silver to one ounce of gold. Currently, the trading ratio is roughly 65. This lets us know that silver is cheap compared to gold at current prices.

During the Hunt brothers pricing bubble, silver reached an all-time low ratio of 17 ounces to one ounce of gold.

(The extreme nature of the 1980 price moved caused by the Hunt Brothers is probably why silver has yet to have a price breakout - at least not in U.S. dollar terms. As measured in rupees, silver is currently trading at all-time highs.)

Poised for a Breakout?

A quick review of the following checklist reveals why silver appears to be poised for a breakout:

•Silver has not yet set a new "nominal" record price in U.S. dollars.

•Silver has established a new nominal record price in other currencies - such as in the Indian rupee.

•Gold, a leading indicator for silver prices, has established a new nominal high price of late.

•The ratio between gold and silver is high, meaning that silver is cheap as compared to gold.

•Silver has traded as low as 17-to-1 during its last bull market.

While silver is currently cheap in comparison to gold, the white metal also is currently moving more quickly than gold. A week ago, for instance, silver was up 6.6% in a 30-hour window. During the same time frame, gold moved about 1%.

"Silver is looking cheap and we're seeing strong investment demand for small ingots, as well as good industrial demand from solar-panel makers," Dick Poon, Hong Kong-based manager of precious metals trading at Heraeus Ltd., told Bloomberg News recently.

The solar industry will consume up to 1,500 metric tons (48 million ounces) this year, Poon estimates.

"Even if investors are expecting another downturn, there will always be demand for alternative sources of energy," Heraeus' Poon says. "We could see prices back up above $20 very soon."

Silver last traded at more than $20 an ounce back in March 2008.

Time to Make Your Move

As sovereign debt risks have risen, so has the demand for silver as an investment class. This demand shows up in the market through investors investing in exchange-traded funds (ETFs), like the ones I suggest in the "Actions to Take" section at the end of this article.

Silver is rarely produced as a primary product in a mine. This is due to the fact that most silver is produced as a byproduct of something else. This means that very few companies have silver-specific mines.

Clearly, it's time to factor silver into your long-term investment strategy. Demand is growing for silver in emerging markets, as inflation fears hit export nations such as China and India. Meanwhile, in developed nations like the United States and Europe, silver is shining again due to deflationary fears. Make it a core component of your portfolio.

Action to Take: The fact that silver is setting new nominal high prices in foreign currencies is an indication that it's time to factor silver into your investment plans. I suggest considering investing in silver on the next market pullback. It will subsequently break out and establish new record highs in U.S. dollar terms.

If you were going to make silver 10% of your portfolio, you could break that into holdings like this:

•Physical Acquisition and Accumulation: 3%.

•Exchange-Traded Funds and Stocks: 5%.

•Options on Futures: 2%.

Here are three strategies that you could use to invest in silver:

1. Physical Acquisition and Accumulation: Physical silver can be held either by yourself, or at a bonded silver warehouse. If you go the route of having it held by someone else, make sure to have it allocated. You want to be able to prove that your holdings were not co-mingled with the silver of other investors. Physical bullion sales are available from these sites. In the case of Bullion Direct (which I have used), you can choose to have the company hold it, or they will provide discrete shipping to your front door via UPS/FEDEX. Other firms that handle physical bullion sales include:

•North West Territorial Mint.

•American Precious Metals Exchange (APMEX).

•The Tulving Co.

2. Exchange-Traded Funds and Stocks: The following ETFs will give you exposure to silver prices via futures, or physical silver held in ETFs, or in the case of the Ultra Silver Proshares, you will have a 2x leverage move (meaning your gain, or loss, will be double the market move in silver prices).

•iShares Silver Trust (NYSE: SLV)

•ETFS Silver Trust (NYSE: SIVR)

•PowerShares DB Silver (NYSE: DBS)

•E-TRACS UBS Bloomberg CMCI Silver ETN (NYSE: USV)

•Ultra Silver ProShares (NYSE: AGQ)

There are equity-based investments that focus on silver bullion production. Here is a list of a few that trades on major exchanges.

•Silver Wheaton Corp. (NYSE: SLW)

•Coeur d'Alene Mines Corp. (NYSE: CDE)

•Pan American Silver Corp. (NASDAQ: PAAS)

•Silver Standard Resources Inc. (NASDAQ: SSRI)

•Hecla Mining Co. (NYSE: HL)

3. Options on Futures: Finally, there is the futures market, where you can purchase contracts of 5,000 oz. each. Please note, however, that these contracts open you up to unlimited risk, and should not be traded without doing your due diligence, and making sure you have a sound strategy to manage the risk. They do, however, provide a direct leveraged bet on silver prices.

[Editor's Note: Jack Barnes started his career at Franklin Templeton in 1997, working in the company's fund-information department - just as the Asian contagion infected the Asian tiger countries. He launched his own RIA shop in 2003 just as the second Gulf War was breaking out. In early 2006, after logging a one-year return of nearly 83%, Forbes named Barnes the top stock picker in its "Armchair Investors Who Beat the Pros" competition. His two audited hedge funds generated double-digit returns in 2008. Last summer, Barnes retired to the beach - which is where he writes from now.]

Source : http://moneymorning.com/2010/09/08/silver-2/

Money Morning/The Money Map Report

©2010 Monument Street Publishing. All Rights Reserved. Protected by copyright laws of the United States and international treaties. Any reproduction, copying, or redistribution (electronic or otherwise, including on the world wide web), of content from this website, in whole or in part, is strictly prohibited without the express written permission of Monument Street Publishing. 105 West Monument Street, Baltimore MD 21201, Email: customerservice@moneymorning.com

Disclaimer: Nothing published by Money Morning should be considered personalized investment advice. Although our employees may answer your general customer service questions, they are not licensed under securities laws to address your particular investment situation. No communication by our employees to you should be deemed as personalized investent advice. We expressly forbid our writers from having a financial interest in any security recommended to our readers. All of our employees and agents must wait 24 hours after on-line publication, or 72 hours after the mailing of printed-only publication prior to following an initial recommendation. Any investments recommended by Money Morning should be made only after consulting with your investment advisor and only after reviewing the prospectus or financial statements of the company.

Money Morning Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.