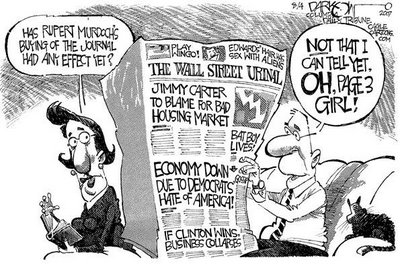

Uncle Rupert Throws A Tantrum on Stock Market Tuesday

Stock-Markets / Financial Markets 2010 Sep 07, 2010 - 02:02 PM GMTBy: PhilStockWorld

Happy Tuesday to you!

Happy Tuesday to you!

Nice market take-down by the Journal this morning, who led off with an article questioning the EU stress tests saying: "From this point of view, it is not surprising that the doubts raised about the validity of the stress tests are weighing on the Euro and also on other risk-correlated currencies." Then, to make sure no one misses the article, they run another headline for the US markets that says "Concerns Over EU Banks Hit Euro" in which they quote themselves:

New concerns about the ability of European banks to weather the financial crisis came after the WSJ story highlighted once again the weaknesses of the stress tests. The report helped to widen the bond spreads on peripheral debtors and knocked European stock markets lower as another wave of euro zone jitters hit the market.

If this seems like BS manipulation to you, you will be doubly insulted to know that the US isn't even the target of the manipulation. Mr. Murdoch, an Aussie and long-time foe of the Euro, is simply expressing his displeasure in a Labor Party victory in the Australian elections this weekend (real Democracy's hold elections on weekends to encourage voting) and is knocking down their dollar by simultaneously boosting both the dollar and the Yen (also in the article is news that the BOJ will not intervene in the Yen, which is total BS) to push down his native currency and make a post-election statement. Just a media giant throwing a temper tantrum this morning.

Think about the "nature" of this story. There is nothing NEW in this NEWs, is there? It's the kind of article that could be written any time someone wants to push the markets. Even the data they are using is from back on 3/31 - they didn't even bother to update their facts for Q2! Notice that the article is pure worst-case speculation by the WSJ, followed by comments like:

Think about the "nature" of this story. There is nothing NEW in this NEWs, is there? It's the kind of article that could be written any time someone wants to push the markets. Even the data they are using is from back on 3/31 - they didn't even bother to update their facts for Q2! Notice that the article is pure worst-case speculation by the WSJ, followed by comments like:

- An FSA spokeswoman declined to comment.

- CEBS didn't disclose that the banks were calculating the figures in that way.

Wow, pretty damning evidence that they couldn't get a comment contrary to their BS on a holiday weekend, right? This news is also conveniently drowning out Obama's proposed 6-year Public Works Program to combat unemployment by committing $50Bn for needed repairs on roads, rails and airport runways - putting some of our nation's unemployed construction workers back to work. Of course, you need to read the NY Times to find this out as the front-page of the Journal makes no mention of it (what do Journal readers care about construction workers?) and their front page this morning is all about (of course) tax breaks!

Does it bother you at all that your knowledge of what's going on in the World depends on which paper you decide to read? How about the fact that they not only omit news that doesn't fit their agenda, but the articles themselves are then slanted to favor one point of view over the other?

Does it bother you at all that your knowledge of what's going on in the World depends on which paper you decide to read? How about the fact that they not only omit news that doesn't fit their agenda, but the articles themselves are then slanted to favor one point of view over the other?

I always encourage Members to spend at least 25% of their time reading things they totally disagree with. For my Conservative Members, that requirement is easily filled by reading my own posts and commentary and, for our Liberal members (the few, the proud...), we have articles like this weekend's post by Mish, who wrote a huge counterpoint to our featured post by Robert Reich, "The Real Lesson of Labor Day," which was my favorite post of the week.

Of course, Mr. Murdoch's hissy fit against his native country is knocking down commodities: Copper is down 3%, oil 2.5% and gold is back below $1,250. Nat gas is back down to $3.85 ($3.75 is still our buy point on the futures). Miners will get whacked in Australia over the mining tax again, which the Conservatives were sure they defeated (kind of like the Conservatives in this country are already doing a victory dance - yet another feature in the WSJ!). This does not change our long-term RTP play as I called a good bottom on them back in the 8/23 morning post (you're welcome!) - RTP jumped 14% in the two weeks since my public pick and the vertical spread is well-hedged and is already up 36%. Before moving on, I must say I love this one: The WSJ's photo essay of "Tea Party Names on the Ballot" - now THAT'S news! Although, I would suggest a more honest alternate title of "Candidates We Fund and Promote Endlessly on Our Television Network."

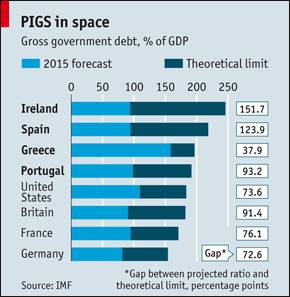

Asia had been flat with the Nikkei down 0.8% on Yen strength this morning and Europe was opening up but dropped fast and is now down 1% as Mr. Murdoch stirs the pot (he controls the British press as well, including the EU's main satellite network) despite the fact that the Economist reported this weekend that the IMF concluded in not one, but TWO papers this weekend "that there is too much pessimism about public finances."

The IMF argues that despite historically high debt-to-GDP ratios, many countries still have room for fiscal maneuver. Typically, the debate on the point at which a country’s debt burden spirals out of control has tried to identify a single debt-to-GDP threshold, above which things are no longer sustainable. The fund’s economists argue that a universal debt limit does not make sense.

The IMF argues that despite historically high debt-to-GDP ratios, many countries still have room for fiscal maneuver. Typically, the debate on the point at which a country’s debt burden spirals out of control has tried to identify a single debt-to-GDP threshold, above which things are no longer sustainable. The fund’s economists argue that a universal debt limit does not make sense.

Also this weekend, BGN points out that According to figures to be published by the Bank for International Settlements, foreign bank loans and other commitments to Portugal, the Republic of Ireland, Greece and Spain, which are the so-called Pigs, rose by 4.3% or $109bn, in January-March. This is actually a positive report that shows faith in the system but it's the same data the WSJ spun into a doom and gloom scenario - isn't spin fun?

Also hard to find in the Journal this weekend is Bloomberg's feature of IMF's #2 man, John Lipsky saying that, after a G20 meeting, deputies showed confidence about the global economic recovery, even taking into account challenges and risks. “They’re mainly confident that there’s a moderate recovery under way globally,” Lipsky said yesterday after a G-20 deputies’ meeting in the South Korean city of Gwangju. There are “obviously risks and challenges but things seem to be moving more or less in the line with our forecasts.” You see, "we report, you decide" only works if the reports include ALL the facts, right?

On the DOOM side if the table, we can always count on the boys at PimpCo to have something dreary to say to start off the week. Today it's Andy Bosomworth, who says, very simply: "Greece is insolvent," as if that's some new discovery that he MUST release at the EU open. “I see it as being quite a substantial risk that Greece eventually defaults or restructures. If the interest rates of other southern European countries stay where they are, they are going to have some problems as well,” Bosomworth said. “You have the contagion risk and until we know precisely how this contagion risk will be contained, it is a pretty risky strategy staying in the other countries as well.” Of course the bond pimps must protect their interests at all costs - TBT had rocketed up to $33.50 on Friday night, indicating a potential drop in TLT that would have cost PimpCo Billions, if left unchecked, so they bang the fear drums once again...

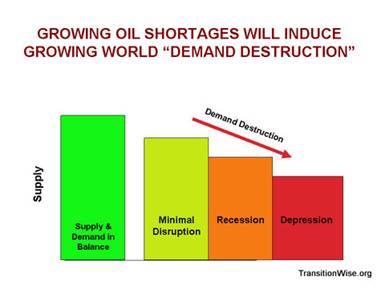

Another negative indicator is a report that hedge funds have turned net short on gasoline futures for the first time in 4 years as a very disappointing summer driving season comes to a close. Net-short positions held by money managers in gasoline futures and options increased to 1,169 contracts the week ended Aug. 31, the first time speculators have been bearish since November 2006, according to the Commodity Futures Trading Commission’s weekly Commitments of Traders report. Hedge funds cut bullish bets for four straight weeks. Gasoline for October delivery dropped 0.64 cent to $1.9131 a gallon in electronic trading on the New York Mercantile Exchange as of 1:35 p.m. local time. Prices declined 1.5 percent last week. Gasoline demand slid 3.1 percent to a 12-week low in the seven days ended Aug. 27, MasterCard Inc. said in its weekly SpendingPulse report.

Another negative indicator is a report that hedge funds have turned net short on gasoline futures for the first time in 4 years as a very disappointing summer driving season comes to a close. Net-short positions held by money managers in gasoline futures and options increased to 1,169 contracts the week ended Aug. 31, the first time speculators have been bearish since November 2006, according to the Commodity Futures Trading Commission’s weekly Commitments of Traders report. Hedge funds cut bullish bets for four straight weeks. Gasoline for October delivery dropped 0.64 cent to $1.9131 a gallon in electronic trading on the New York Mercantile Exchange as of 1:35 p.m. local time. Prices declined 1.5 percent last week. Gasoline demand slid 3.1 percent to a 12-week low in the seven days ended Aug. 27, MasterCard Inc. said in its weekly SpendingPulse report.

The summer driving season, when consumption peaks, ends today with the U.S. Labor Day holiday. Net-short positions have climbed to the highest level since records began in 2006 amid a drop in trading. The increase in short positions “is just a realization that gasoline supplies are substantially above a five-year average,” said Phil Flynn, vice president of research at PFGBest in Chicago. “Instead of clamoring to build new refinery capacity, we’re looking for new places to sell gasoline.” According to Lloyd's list, however, the number of tankers storing crude has fallen to the lowest level in 18 months - down to 58 tankers from 149 last November. It is very strange to see all this dumping ahead of hurricane season so it seems like the betting is very heavy that oil and gas prices will collapse - which makes the other side of the trade very interesting...

Contrary to the idea that banking regulation will kill growth, the Bank for International Settlements estimates tougher rules could actually bring 1.9% additional output to the economy - on the basis that fewer crises would outweigh the additional cost of regulating. The new and extensive study concludes that if regulators around the world require banks to set aside more capital as a buffer against losses and hold more cash as insurance against panics, annual economic output could actually be 1.9% higher in the long run. That’s because the benefit of having fewer banking crises would far outweigh the costs of the added regulatory burden.

Contrary to the idea that banking regulation will kill growth, the Bank for International Settlements estimates tougher rules could actually bring 1.9% additional output to the economy - on the basis that fewer crises would outweigh the additional cost of regulating. The new and extensive study concludes that if regulators around the world require banks to set aside more capital as a buffer against losses and hold more cash as insurance against panics, annual economic output could actually be 1.9% higher in the long run. That’s because the benefit of having fewer banking crises would far outweigh the costs of the added regulatory burden.

The BIS calculations allow for an interesting thought experiment. As of 2006, average wages in finance were about 72% higher than in other professions – largely due to the massive salaries and bonuses commanded by executives, traders and others at the top end of the salary range. If that gap were erased (it didn’t exist 30 years ago), the average bank could reduce its operating costs by about 19% — enough to raise capital ratios to almost the optimal level with zero increase in interest rates.

In other action today: The government will roll out a new mortgage aid program on Tuesday, this time targeting underwater homeowners who are current on their mortgage payments but at risk of default. Officials say up to 1.5M loans could be modified, but skeptics think the plan is likely to be as ineffective as past efforts.

Also, I wouldn't want to call Mr. Murdoch a liar or to insinuate that he makes things up to mislead investors to support positions he already holds but the BOJ's Finance Minister Yoshihiko Noda pretty much said the opposite of everything the WSJ had to say as he signaled that any sales of the nation’s currency would have to be unilateral. “This is about what options we have on the assumption coordination would be difficult,” Noda said on a TV Tokyo program today. “Our statements on taking ‘bold action when necessary’ cover everything.” Ichiro Ozawa, former deputy leader of the DPJ and Kan’s opponent in party contest, said this week he would take “every measure,” INCLUDING INTERVENTION, to keep the yen from rising. Kan said last week the government is “ready when necessary to take bold measures” in the currency market. Gosh, Uncle Rupert sure is an insightful fellow to be able to dig into those comments and come up with: "the BOJ will not intervene in the Yen," isn't he?

We shouldn't take the market moves too seriously this morning as long as our levels hold and, of course, let's watch the volume - we had NONE last week so the whole thing could topple like a house of cards but, if we have only a minor sell-off on strong volume - that will be a positive sign, not a negative one.

We're still watching the same levels and using the 3 of 5 rule to guide our short-term trading so not too bullish until )(if) we pop the Dow AND the Nas, who were close but no cigar on Friday:

- Up 2.5% (we hope): Dow 10,455, S&P 1,100, Nas 2,255, NYSE 7,000 and Russell 650

- Middle Range (MUST hold): Dow 10,200, S&P 1,070, Nas 2,200, NYSE 6,800, and Russell 635.

- Down 2.5%: Dow 9,945, S&P 1,043, Nas 2,145, NYSE 6,630 and Russell 619

We'd like to see the S&P and the NYSE hold the line this morning but they only had about 0.5% wiggle room from Friday's close. The RUT needs to hold 635, which is 1% down for them and, if they don't, then the S&P is a good short candidate. We are using SDS as a cover play below S&P 1,000 as it gives you a lot of bang for the buck, especially in the October contracts.

It's a short but interesting week and we get our Beige Book tomorrow at 2pm (see my notes on the last one) and that should give us a great idea of how the economy is shaping up right through the end of August.

Have a great weekend,

By Phil

Philip R. Davis is a founder of Phil's Stock World (www.philstockworld.com), a stock and options trading site that teaches the art of options trading to newcomers and devises advanced strategies for expert traders. Mr. Davis is a serial entrepreneur, having founded software company Accu-Title, a real estate title insurance software solution, and is also the President of the Delphi Consulting Corp., an M&A consulting firm that helps large and small companies obtain funding and close deals. He was also the founder of Accu-Search, a property data corporation that was sold to DataTrace in 2004 and Personality Plus, a precursor to eHarmony.com. Phil was a former editor of a UMass/Amherst humor magazine and it shows in his writing -- which is filled with colorful commentary along with very specific ideas on stock option purchases (Phil rarely holds actual stocks). Visit: Phil's Stock World (www.philstockworld.com)

© 2010 Copyright PhilStockWorld - All Rights Reserved Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.

Comments

|

Paul

07 Sep 10, 15:17 |

no surprise

"Murdoch press" has always been a disparaging term in Australian media. It usually signifies gossip, lying, editorial interference, and a general lack of integrity. |