U.S. Government Policy Caused America's Unemployment Crisis

Economics / US Economy Sep 04, 2010 - 07:30 AM GMTBy: Washingtons_Blog

The unemployment rate has risen again for the the first time in 4 months. I predicted a growing, long-term unemployment problem last year.

The unemployment rate has risen again for the the first time in 4 months. I predicted a growing, long-term unemployment problem last year.

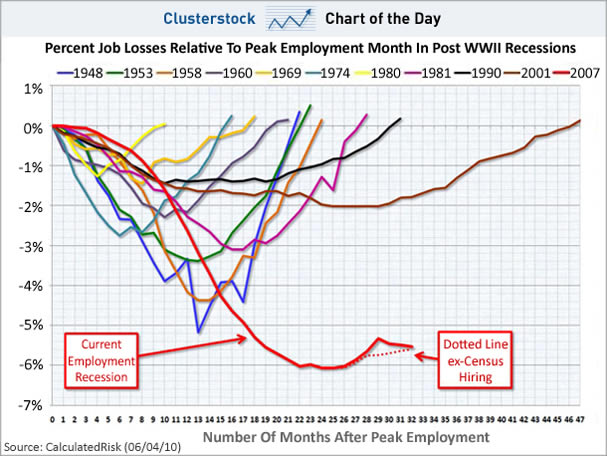

Indeed, even after the government plays with the numbers to make them look better (using inaccurate birth-death models and other tricks-of-the-trade), this is how the current jobs downturn compares with other post-WWII recessions:

In fact, as demonstrated below, the government's actions have directly contributed to the rising tide of unemployment.

The Government Has Encouraged the Offshoring of American Jobs for More Than 50 Years

President Eisenhower re-wrote the tax laws so that they would favor investment abroad. President Kennedy railed against tax provisions that "consistently favor United States private investment abroad compared with investment in our own economy", but nothing has changed under either Democratic or Republican administrations.

For the last 50-plus years, the tax benefits to American companies making things abroad has encouraged jobs to move out of the U.S.

The Government Has Encouraged Mergers

The government has actively encouraged mergers, which destroy jobs.

For example, the Treasury Department encouraged banks to use the bailout money to buy their competitors, and pushed through an amendment to the tax laws which rewards mergers in the banking industry.

This is nothing new.

Citigroup's former chief executive says that when Citigroup was formed in 1998 out of the merger of banking and insurance giants, Alan Greenspan told him, “I have nothing against size. It doesn’t bother me at all”.

And the government has actively encouraged the big banks to grow into mega-banks.

The Government Has Let Unemployment Rise in an Attempt to Fight Inflation

As I noted last year:

The Federal Reserve is mandated by law to maximize employment. The relevant statute states:

The Board of Governors of the Federal Reserve System and the Federal Open Market Committee shall maintain long run growth of the monetary and credit aggregates commensurate with the economy's long run potential to increase production, so as to promote effectively the goals of maximum employment, stable prices, and moderate long-term interest rates.

***

The Fed could have stemmed the unemployment crisis by demanding that banks lend more as a condition to the various government assistance programs, but Mr. Bernanke failed to do so.

Ryan Grim argues that the Fed might have broken the law by letting unemployment rise in order to keep inflation low:

The Fed is mandated by law to maximize employment, but focuses on inflation -- and "expected inflation" -- at the expense of job creation. At its most recent meeting, board members bluntly stated that they feared banks might increase lending, which they worried could lead to inflation.

Board members expressed concern "that banks might seek to reduce appreciably their excess reserves as the economy improves by purchasing securities or by easing credit standards and expanding their lending substantially. Such a development, if not offset by Federal Reserve actions, could give additional impetus to spending and, potentially, to actual and expected inflation." That summary was spotted by Naked Capitalism and is included in a summary of the minutes of the most recent meeting...

Suffering high unemployment in order to keep inflation low cuts against the Fed's legal mandate. Or, to put it more bluntly, it may be illegal.

In fact, the unemployment situation is getting worse, and many leading economists say that - under Mr. Bernanke's leadership - America is suffering a permanent destruction of jobs.

For example, JPMorgan Chase’s Chief Economist Bruce Kasman told Bloomberg:

[We've had a] permanent destruction of hundreds of thousands of jobs in industries from housing to finance.

The chief economists for Wells Fargo Securities, John Silvia, says:

Companies “really have diminished their willingness to hire labor for any production level,” Silvia said. “It’s really a strategic change,” where companies will be keeping fewer employees for any particular level of sales, in good times and bad, he said.

And former Merrill Lynch chief economist David Rosenberg writes:

The number of people not on temporary layoff surged 220,000 in August and the level continues to reach new highs, now at 8.1 million. This accounts for 53.9% of the unemployed — again a record high — and this is a proxy for permanent job loss, in other words, these jobs are not coming back. Against that backdrop, the number of people who have been looking for a job for at least six months with no success rose a further half-percent in August, to stand at 5 million — the long-term unemployed now represent a record 33% of the total pool of joblessness.

And see this.

In fact, the Fed intentionally curbed lending by banks in an attempt to stem inflation, without addressing whether public banks could provide credit.

The Government Has Allowed Wealth to be Concentrated in Fewer and Fewer Hands

As I pointed out a year ago:

A new report by University of California, Berkeley economics professor Emmanuel Saez concludes that income inequality in the United States is at an all-time high, surpassing even levels seen during the Great Depression.

The report shows that:

Income inequality is worse than it has been since at least 1917

"The top 1 percent incomes captured half of the overall economic growth over the period 1993-2007"

"In the economic expansion of 2002-2007, the top 1 percent captured two thirds of income growth."

As others have pointed out, the average wage of Americans, adjusting for inflation, is lower than it was in the 1970s. The minimum wage, adjusting for inflation, is lower than it was in the 1950s. See this. On the other hand, billionaires have never had it better.

As I wrote in September:

The economy is like a poker game . . . it is human nature to want to get all of the chips, but - if one person does get all of the chips - the game ends.

In other words, the game of capitalism only continues as long as everyone has some money to play with. If the government and corporations take everyone's money, the game ends.

The fed and Treasury are not giving more chips to those who need them: the American consumer. Instead, they are giving chips to the 800-pound gorillas at the poker table, such as Wall Street investment banks. Indeed, a good chunk of the money used by surviving mammoth players to buy the failing behemoths actually comes from the Fed...

This is not a question of big government versus small government, or republican versus democrat. It is not even a question of Keynes versus Friedman (two influential, competing economic thinkers).

It is a question of focusing any government funding which is made to the majority of poker players - instead of the titans of finance - so that the game can continue. If the hundreds of billions or trillions spent on bailouts had instead been given to ease the burden of consumers, we would have already recovered from the financial crisis.

I noted in April:

FDR’s Fed chairman Marriner S. Eccles explained:

As in a poker game where the chips were concentrated in fewer and fewer hands, the other fellows could stay in the game only by borrowing. When their credit ran out, the game stopped.

***

When most people lose their poker chips - and the game is set up so that only those with the most chips get more - free market capitalism is destroyed, as the "too big to fails" crowd out everyone else.

And the economy as a whole is destroyed. Remember, consumer spending accounts for the lion's share of economic activity. If most consumers are out of chips, the economy slumps.

And unemployment soars.

As former Secretary of Labor Robert Reich wrote yesterday:

Where have all the economic gains gone? Mostly to the top.

***

It’s no coincidence that the last time income was this concentrated was in 1928. I do not mean to suggest that such astonishing consolidations of income at the top directly cause sharp economic declines. The connection is more subtle.

The rich spend a much smaller proportion of their incomes than the rest of us. So when they get a disproportionate share of total income, the economy is robbed of the demand it needs to keep growing and creating jobs.

What’s more, the rich don’t necessarily invest their earnings and savings in the American economy; they send them anywhere around the globe where they’ll summon the highest returns — sometimes that’s here, but often it’s the Cayman Islands, China or elsewhere. The rich also put their money into assets most likely to attract other big investors (commodities, stocks, dot-coms or real estate), which can become wildly inflated as a result.

***

THE Great Depression and its aftermath demonstrate that there is only one way back to full recovery: through more widely shared prosperity.

***

And as America’s middle class shared more of the economy’s gains, it was able to buy more of the goods and services the economy could provide. The result: rapid growth and more jobs. By contrast, little has been done since 2008 to widen the circle of prosperity.

So through it's policies encouraging the offshoring of jobs, mergers, decreasing of economic activity to fight inflation, allowing wealth to be concentrated in fewer and fewer hands, and other policy mistakes (like pretending that there is a "jobless recovery"), the government has channeled water away from U.S. jobs, creating a worsening unemployment drought.

Note for Keynesians: As I have repeatedly explained, the government hasn't spent money on the right kind of things to stimulate employment. See this and this.

Note for followers of Austrian economic theory: I have repeatedly railed against the government artificially propping up asset prices and leverage, so that malinvestments can't be cleared, and we we have a stagnant, zombie economy which prevents job creation.

Global Research Articles by Washington's Blog

© Copyright Washingtons Blog, Global Research, 2010

Disclaimer: The views expressed in this article are the sole responsibility of the author and do not necessarily reflect those of the Centre for Research on Globalization. The contents of this article are of sole responsibility of the author(s). The Centre for Research on Globalization will not be responsible or liable for any inaccurate or incorrect statements contained in this article.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.