Stock Market Relief Rally Beckons?

Stock-Markets / Stock Markets 2010 Sep 03, 2010 - 09:27 AM GMTBy: PaddyPowerTrader

The calendar was crowded yesterday with an ECB meeting and a number of key US data releases, but market movements were tempered as participants remain sidelined ahead of today’s Sultan of all statistics, the US payrolls report.

The calendar was crowded yesterday with an ECB meeting and a number of key US data releases, but market movements were tempered as participants remain sidelined ahead of today’s Sultan of all statistics, the US payrolls report.

Non Farms

So the mother of all monthly stats came out & it was a win for the bulls, with the pivotal US non farm payrolls at just -54k versus an expected read of -115k. More crucially though the private sector actually added 67k jobs & there were chunky positive revisions to the previous two months data. An big up day ahead of the long US Labour day weekend looks in prospect at the off.

Yesterday’s And This Morning’s Wrap

The S&P 500 gained 0.7% Thursday following a surprisingly strong 5.2% m/m increase in pending homes sales for July, beating expectations of a -1.0% decline and a welcome fall in weekly jobless claims. However, some weaker than expected July factory orders likely offset some of the optimism from the improvement in housing data following the expiration of the homebuyers tax credit. Retailers Nordstrom, J.C. Penney and Limited Brands all pushed ahead by at least 3.2 percent after reporting August same-store sales that beat analyst estimates and Burger King Holdings gained a whopp(er)ing 25% after affiliates of 3G Capital offered $4 billion for the company. But Mariner Energy shed 2.6% after an explosion at its Gulf of Mexico rig.

It was a quiet European Friday morning as the markets observe their usual pre-payrolls vigil ahead of the US Labour Day weekend.

In London this morning Restaurant Group traded up 1.6% after the owner of the Garfunkel’s and Frankie & Benny’s chains dismissed speculation about a bid for the company that triggered a jump in its shares last week, the FT reported. Meanwhile F&C Asset Management is ahead by 2.3% after the U.K.’s oldest investment fund was raised to “buy” from “hold” over at Citigroup. And shares in power supply group Aggreko have /quotes/comstock/23s!a:agkrallied 5.6% and those of software firm Autonomy Corp have/quotes/comstock/23s!a:au. gained 3.3% Friday as both companies have been the subject of some recent takeover speculation.

But Soco International, a U.K. exploration company in Africa and Southeast Asia, shed 6.8% on news that it had decided to plug and abandon its first well in the Nganzi block in the Democratic Republic of Congo. Soco found water-bearing sands at the Nganga 1 well, which it will now abandon to drill in a different part of the block. The explorer, which is drilling wells in the African country and Vietnam, had planned to quadruple recoverable oil reserves to 700 million barrels, CEO Ed T. Story Jr. said last week.

Elsewhere Take-Two is better by 13% in German trading after the video game publisher reported an unexpected third-quarter profit of 28 cents a share and boosted its earnings outlook on sales of the newest release, “Red Dead Redemption.” Analysts had estimated a full-year loss of 20 cents.

Today’s Other Market Moving Stories

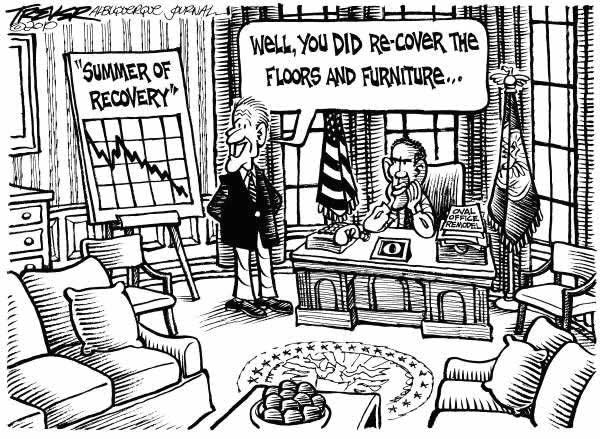

The WP is reporting that the Obama Administration may propose a significant fiscal stimulus package. This would represent a policy shift — although it is hardly a major surprise given the disappointing tone to the economic data over the course of the past few months and the hints (such as an article in yesterday’s WSJ) that some small scale stimulus options were being explored. The reference to “hundreds of billions of dollars” in the WP article probably refers to the 10-year budgetary impact — which is the standard way of treating these types of proposals in the wonderful world of budget accounting. A payroll tax holiday would be worth about $65 bil per month. So, we could be talking about a 3 to 6 month suspension, combined with permanent extension of the R&D tax credit and perhaps some other minor business tax breaks. It’s unclear to me how Congress will respond to such a proposal given the contentious political environment. However it is probably a response to the cumulative impact of all bad economic news received over the past few months — as well as plummeting popularity ratings for the President.

Russia yesterday announced a 12 month extension of its grain export ban, as the UN’s FAO held an emergency meeting to discuss wheat shortages, and amid riots in Mozambique which left seven dead, following a 30pc rise in bread prices. Having come down somewhat from their highs in recent weeks wheat prices rose sharply again, with the European price back to EUR231.5/tonne, just shy of last month’s two year high of EUR236, and up nearly 70pc since January. Separately, cotton prices hit a 15 year high yesterday, threatening higher clothing prices. Coffee prices are at a 12 year high

Meat prices are at a 20 year high.

Corporate treasurers from leading UK and continental companies, with revenues of over $240bn, told the FT that they were increasingly shunning banks from Spain, Italy and even Germany amid growing concern about credit risk, despite the stress tests. The treasurers said they were watching CDS spreads and bank share prices very closely.

The chief executive of electricals retailer DSG (which owns Dixons, Currys and PC World) has said he does not see evidence of a double-dip recession emerging, although consumer demand remains subdued.

August’s UK CIPS/Markit Report on Services echoes the sister reports on manufacturing and construction already released this week in signalling a sharp slowdown in growth across the economy. The drop in the main business activity index from 53.1 to 51.3 (consensus 52.5) leaves it at its lowest level since April last year and consistent, on past form, with very little expansion – if any – in activity the biggest sector of the economy. After the falls also seen in the manufacturing and construction surveys, our composite index suggests that the overall economic recovery has now pretty much ground to a halt. The fact that the surveys tend to lead the hard economic data by a few months means that GDP is still likely to post a reasonable expansion in the third quarter of the year. But should the surveys continue to weaken in the next few months, the threat of a renewed contraction in Q4 and beyond would become very real indeed.

HSBC, Europe’s biggest bank, and rivals including Barclays Plc and Standard Chartered Plc may be forced to move their headquarters out of Britain if the government decides to break up the banks said Stuart Gulliver, chairman of Europe, Middle East and Global Businesses. The conclusion of a government-sponsored commission examining whether banks should separate their consumer and securities units “has significant implications for where we may choose to headquarter our institution and that would also probably be the case for those other two institutions,” Gulliver told a conference in London, referring to Standard Chartered and Barclays.

Allied Irish Banks

Bloomberg has just reported that PKO Bank Polski SA plans to make a revised cash bid today for a controlling stake in Bank Zachodni WBK SA, a smaller competitor being sold by Allied Irish Bank Plc, a person with knowledge of the matter said. PKO, Poland’s largest bank, is bidding for 66 percent of Warsaw-based Zachodni, less than the 70 percent held by Allied Irish, because the purchase of a bigger stake would compel it to make an offer for the entire company, said the person, who declined to be identified because the discussions are private. Under PKO’s proposal, Allied Irish would place its remaining 4 percent in the market, the person said.

AIB is seeking to sell its entire stake in Bank Zachodni as part of a series of measures aimed at raising 7.4 billion euros by the year- end to reach new regulatory capital targets. Spain’s Banco Santander SA and France’s BNP Paribas SA have also made bids for Allied Irish’s Polish unit, another person briefed on the situation said on Aug. 23. AIB’s stake was valued at 9.6 billion zloty ($3.11 billion) as of 12:45 p.m. in Warsaw today. A preferred bidder is expected to be identified as early as Sept 7, but it is unlikely to be granted exclusivity until later in September, said the person.

Company / Equity News

•Fruit distributor Fyffes H1 2010 results show adjusted eps of 3.38c, down from 4.46c in the comparable period. The H1 outcome includes a particularly difficult first quarter due to weather conditions with continental Europe weaker than the UK. The group is maintaining its full year guidance for EBITA in the range €14-18m. A flat interim dividend of 0.55c is to be paid.

•In tech news Samsung Electronics Co. and Toshiba Corp. unveiled tablet computers in Berlin yesterday, aiming to take market share from Apple Inc.’s iPad with their lower-priced “me-too” devices. Toshiba said at the consumer electronics fair IFA that the recommended price for its Folio 100 tablet in Europe is 399 euros, undercutting the iPad, which goes for about 499 euros in the region. Samsung’s Galaxy Tab, which like Toshiba’s Folio will debut in Europe next month, said it will let phone operators determine the price.

•Google Inc.’s Android application store has twice the proportion of free software as smartphone rivals Apple Inc. and Research In Motion Ltd., according to market researcher Distimo. Free applications comprised 60 percent of software on Android Market in July, Distimo said. That compares with 29 percent for the Apple App Store for iPhone and 26 percent for RIM’s BlackBerry App World, the Utrecht, Netherlands-based researcher said on its website yesterday.

•BHP Billiton Ltd. would get Canadian approval for its $40 billion hostile bid for Potash Corp. of Saskatchewan Inc. by pledging to preserve head-office jobs and support a fertilizer-marketing company, said lawyers specializing in foreign investment and a former minister. In the past 25 years, Canada has only formally rejected one takeover offer, Alliant Techsystems Inc.’s bid for MacDonald Dettwiler & Associates Ltd.’s space business in 2008, according to John Manley, who was federal industry minister from 1993 to 2000. Prime Minister Stephen Harper has made increased foreign investment one of his Conservative government’s priorities.

•Air France-KLM Group plans a low-cost structure to rival EasyJet Plc and Ryanair Holdings Plc on domestic French routes, Les Echos reported, without citing anyone. The plans involve altering the contracts of some pilots to increase their annual flying hours to between 650 and 700, compared with a current average of 560, in return for better pay, Les Echos said.

•Press reports this morning suggest that the private equity partners, Blackstone and Warburg Pincus, are considering an IPO of Kosmos Energy with a reported value of $5bn. Kosmos along with Anadarko are Tullow’s main partners in the West Cape Three Points and Deepwater Tano licences offshore Ghana, which encompass the Jubilee field. If executed, the listing would provide fresh capital for Kosmos and remove uncertainty over its ability to fund its share of development costs and thus would be viewed as a positive.

By The Mole

PaddyPowerTrader.com

The Mole is a man in the know. I don’t trade for a living, but instead work for a well-known Irish institution, heading a desk that regularly trades over €100 million a day. I aim to provide top quality, up-to-date and relevant market news and data, so that traders can make more informed decisions”.© 2010 Copyright PaddyPowerTrader - All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

PaddyPowerTrader Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.