Endeavour Merchant Bank Becomes Gold Producer

Companies / Gold & Silver Stocks Sep 03, 2010 - 08:06 AM GMTBy: Richard_Mills

For the last decade, Endeavour (EDV: TSX) has been the architect of numerous equity financings and acquisitions in the junior gold sector. Over the years, the company has proven to be a savvy dealmaker, participating in M&A transactions valued at over US$28 billion.

For the last decade, Endeavour (EDV: TSX) has been the architect of numerous equity financings and acquisitions in the junior gold sector. Over the years, the company has proven to be a savvy dealmaker, participating in M&A transactions valued at over US$28 billion.

In October 2009, EDV paid US$58.3 million for 55% ownership (average cost of C$0.33/share) of Etruscan Resources (EET-TSX) - a West African gold miner.

A few months later, EDV had acquired 43% of Crew Gold (CRU-TSX) for approximately $135 million at an average cost of 15 cents, whose primary asset is the LEFA Gold mine in Guinea, West Africa.

On August 24th, 2010 the Supreme Court of Nova Scotia approved EDV's purchase of the remaining 45% of Etruscan common shares.

Suddenly the wily merchant bank is looking like a gold producer but the market seems unsure how to assimilate this news. All summer the stock has oscillated around $2.20 as the institutional investors ask themselves: what does a merchant bank know about running a gold mine and can a leopard change its spots?

From the early evidence, the answers appear to be: quite a bit and yes it can.

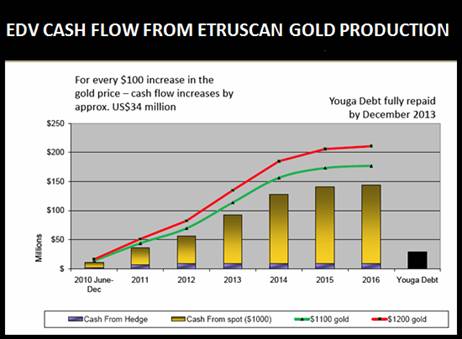

The former Etruscan's producing Youga mine in Burkina Faso has total reserves of 474,000 oz and is currently producing at an annual rate of 80,000 oz with a life of mine (LOM) of 5 years.

Before acquiring Etruscan Endeavour's analytical team identified Youga as an excellent turnaround story. Currently a program is well under way to improve operations and maximize value for shareholders by reducing costs at the Youga Mine:

- Replace underperforming drill and blast contractor

- Better grade control

- Fuel savings from improved operating efficiencies

- Lower power costs with grid power vs. gensets

- Solve CIL tank sanding problems

- Improve inventory and supply of machine parts

- Higher mill throughputs

- Upgrade management team

- Tighter control on requisitions and spending

According to a July 27, 2010 OB Research report, Endeavour "is viewed and priced by the market today as a merchant bank...this view is no longer valid. We are of the view that the Etruscan assets alone justify most of the current EDV market cap of $220 million."

If this research report is correct, and the increased operational efficiencies at Etruscan are not a mirage, then the current valuation of EDV offers the following assets for free:

- 46.21 million shares of Crew Gold (43.2% of the company) worth about $210 million.

- The book value of the merchant banking business is worth about $90 million.

Endeavour Financial Corporation will release its financial results for the year ended June 30, 2010 on Wednesday, September 8, 2010. Endeavour currently has a P/E of less than one - the market always assumes that a leopard can't change its spots. I guess time will tell.

Is this merchant bank AND gold producer on your radar screen?

If not, maybe it should be.

By Richard (Rick) Mills

If you're interested in learning more about specific lithium juniors and the junior resource market in general please come and visit us at www.aheadoftheherd.com. Membership is free, no credit card or personal information is asked for.

Copyright © 2010 Richard (Rick) Mills - All Rights Reserved

Legal Notice / Disclaimer: This document is not and should not be construed as an offer to sell or the solicitation of an offer to purchase or subscribe for any investment. Richard Mills has based this document on information obtained from sources he believes to be reliable but which has not been independently verified; Richard Mills makes no guarantee, representation or warranty and accepts no responsibility or liability as to its accuracy or completeness. Expressions of opinion are those of Richard Mills only and are subject to change without notice. Richard Mills assumes no warranty, liability or guarantee for the current relevance, correctness or completeness of any information provided within this Report and will not be held liable for the consequence of reliance upon any opinion or statement contained herein or any omission. Furthermore, I, Richard Mills, assume no liability for any direct or indirect loss or damage or, in particular, for lost profit, which you may incur as a result of the use and existence of the information provided within this Report.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.