Urgent Financial Self-Defense and Massive Profit Opportunities

Stock-Markets / Financial Crash Sep 24, 2007 - 09:36 AM GMT Martin Weiss writes: We are on the verge of some of the greatest market convulsions of a lifetime.

Martin Weiss writes: We are on the verge of some of the greatest market convulsions of a lifetime.

And we're already seeing the first symptoms: Oil surging to all-time highs … gold making a beeline for $800 per ounce … long-term bonds suffering their worst one-day decline since 2003 … and behind it all, the US dollar getting slammed day after day, now within just an inch of its lowest level in history.

That's why we just held our Emergency Video Summit. And that's why we created this 14-page gala issue of Money and Markets …

The Great Dollar Panic of 2007-2008: Urgent Self-Defense and Massive Profit Opportunities Edited Transcript of Emergency Video Summit

Bob Nichols: Hello, everyone. I've been a financial TV journalist and news anchor for 30 years. I've interviewed countless experts and I've witnessed a myriad of crises. But I can tell you flatly: I have never — ever — seen anything like what's happening in the financial markets today.

Not just a housing bust, but also a mortgage meltdown. Not just a mortgage meltdown, but also a credit crunch. Not just a credit crunch, but also a dollar panic.

This is why you need self-defense so urgently. This is why the profit opportunities are so massive. And this is also why we have come together to hold this Emergency Video Summit.

With us today is Martin Weiss, the founder of Weiss Research and the editor of the Safe Money Report . Martin Weiss is also the Chairman of the Sound Dollar Committee, an organization that has been fighting for a sound dollar ever since the Eisenhower years.

Also with us today is Jack Crooks, one of the nation's leading experts on the dollar and foreign currencies.

Martin, this month, something very unusual happened: In a landmark speech, the most widely known economic leader of our times, former Fed Chairman Alan Greenspan, talked about something that you and your team have been writing about all year.

He said that today's credit crisis is identical to the crisis of 1998, when small Asian economies tanked and a major hedge fund, Long Term Capital Management, collapsed. Do you agree?

|

| Greenspan says the great crisis he dealt with in 1998 was similar to today's. But the reality is that his successor, Ben Bernanke, is now trying to deal with a crisis that is many times larger. |

Martin Weiss: No, I disagree. I think this credit crisis is many times larger.

Back in 1998, Greenspan was dealing with a small tumor in our financial system that could quickly be isolated and contained. Today, his successor, Fed Chairman Ben Bernanke, is dealing with a cancer that has already spread throughout the financial system.

Bob: How is that going to impact investors like me?

Martin: Almost everything you own that's in U.S. dollars — almost every stock, bond, real estate property, insurance policy, or business asset — is impacted because of the falling value of the dollar.

Bob: I see the housing market collapsing. My brain tells me it can't be true, that it can't really be happening. But my eyes and ears tell me it is happening.

All day long, at work, folks are talking about "For Sale" signs going up everywhere in their neighborhoods, about new homes being foreclosed on. Then, I go home and turn on the evening news, and there it is again ! Everyone is talking about it. But no one is doing anything about it. They're all just sitting around waiting for the next shoe to drop.

Martin: But you don't have to sit around. You don't have to wait for the next shoe to drop. You can harness the tremendous power of this situation to build your wealth . And because this crisis is so large — many times larger than it was last time — I think you can do it with greater ease, greater certainty and greater speed than at almost any time in modern history.

Bob: I assume you're going to walk us through that, step by step, before the hour is over. But first, tell us exactly why you think this crisis is so much larger than the 1998 crisis.

Martin: I don't just think it's larger. I know it's larger.

Back in 1998, Greenspan was dealing with a crisis that was isolated and easily contained. Now, in 2007, Bernanke is dealing with a crisis that is already spreading out of control to 20,000 cities and towns across America.

In 1998, the epicenter of the crisis was small Asian markets. This time, the epicenter is right here in the United States, with financial markets that are at least a hundred times larger.

In 1998, Greenspan was dealing with just one major hedge fund in trouble. He was able to sit down with the big banks. They were able to hash out a bailout. They were able to nip the crisis in the bud.

Now, Bernanke is trying to cope with at least a thousand hedge funds in this sector. If even just one-tenth of them are entangled in this mess — and there's every indication they are — that alone is 100 times more than 1998. Plus, this time, we already have 140 mortgage companies in trouble, bankrupt or mortally wounded.

Greenspan's 1998 crisis was a ripple. Bernanke's 2007 crisis is a tidal wave.

Bob: But where — exactly where — do you think the tidal wave is going to strike?

Martin: Going to strike? It's already striking. Bernanke is facing a tidal wave of foreclosures in the $824 billion subprime mortgage market … the $722 billion Alt-A mortgage market … the $517 billion jumbo mortgage market … and, ultimately, in the entire $13.5 trillion mortgage market.

Bob: $13.5 trillion in mortgages? How much is that really?

Martin: It's similar in size to the entire GDP of the United States. It's the largest debt market in the world. Plus, as if that weren't enough, Bernanke faces a far broader crisis that threatens to spread to many more debt markets.

Not only the $13.5 trillion mortgage market, but also the $2.2 trillion U.S commercial paper market … the $2.4 trillion consumer credit market … the $10.1 trillion corporate bond market … and, biggest of all, the $144.8 trillion in derivatives held by U.S. banks alone.

Bob: So what is Bernanke going to do about it?

Martin: You keep talking about this as if it were in the future tense. Where is the meltdown " going" to strike? What is Bernanke "going" to do about it? But this is not a future event. It's a present, ongoing situation that's unfolding rapidly, that's accelerating even as we speak.

Bob: So if it's already spreading and Bernanke can't perform micro-surgery, how is he coping with it?

Martin: The only way he knows how: One — with interest-rate cuts. Two — by pumping more money into the U.S. banking system. Three — with more government bailouts.

Bob: This is what the American people want. And this is what the U.S. government provides. So everyone's happy, right?

Martin: Not exactly.There's another group of people, a very large and powerful group of people, who are extremely un happy about this situation.

Bob: Who's that?

Martin: Foreign investors holding U.S. dollars.

Bob: Is that really such a big factor?

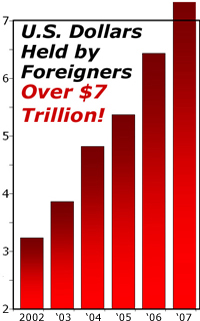

Martin: Are you kidding? It's a huge factor. Back in the late 1990s, the dollars held by foreign investors amounted to about one and a half trillion, and even then there were some people who were very alarmed. "Wow! This is dangerous," they said. "Foreign investors and central banks control over one trillion in our wealth! What happens to us if they decide to pull out?"

But look what happened next! The amount of dollars in the hands of foreigners grew by leaps and bounds. There are now over 7 trillion in U.S. dollars held by foreign investors and central banks, according to the U.S. Treasury Department.

Here's the truly big change: Now, they have virtually no reason to hang on to dollars issued by a country with an economy that's wracked by crisis, that's debasing its own currency, and that's sliding into recession.

And they have every reason to stop buying dollars or to convert their dollar into currencies issued by nations that do not have a housing bust … that do not have a mortgage meltdown … that do not have a recession.

I repeat: Foreign investors and central banks now hold over $7 trillion in U.S. bonds, U.S. stocks, U.S. money markets … plus U.S. real estate and U.S. mortgages.

Bob: You told us how the Fed is responding to this crisis. Now tell us how foreign investors are responding to the Fed's response.

Martin: First, the interest-rate cuts in the U.S. mean lower yields on their dollars. Second, more money-pumping by the Fed floods paper dollars into the marketplace and guts the value of the dollar. Third, more government bailouts gut the dollar's value still more.

So all these steps — everything the government does to supposedly save the housing market — just drives the dollar down further.

Bob: OK. I see the power of foreign investors. Over $7 trillion! I had no idea it was that much. But help me get into the mind of the foreign investor, so I can really feel what you're talking about.

Martin: Sure. Let's say you're a big foreign investor. You've got a lot of money in U.S. real estate and mortgages. And you've got a lot more money in U.S. bonds and U.S. stocks.

Because of the U.S. housing and mortgage crisis, you're taking a big loss on some of your money invested in America. That's bad enough.

But because of Mr. Bernanke's response to the crisis, you're also taking a loss on all of your money invested in America, because the U.S. dollar itself is sinking in value.

Bob: The cure is worse than the disease.

Martin: Yes. If Mr. Bernanke fails to end the crisis, you want out. And if he succeeds by flooding the world with paper dollars, you also want out. Either way, this is one hospital you want to check out of.

Bob: OK. Could you sum this up? So we can see the big picture?

Martin: First, we know that there are similarities between the 1998 crisis and the 2007 crisis. Even former Fed Chairman Greenspan is saying that now.

Second, we have evidence — plenty of evidence — that today's situation could be many times worse than the 1998 crisis.

Third, it's clear that all this is driving the U.S. dollar down and that the dollar will continue to go down no matter what the Fed does. If they do too little, the dollar will go down because of the housing bust and mortgage meltdown. If they do too much, the dollar will go down because of cheap dollars flooding our economy. Either way, the dollar is going down.

How To Harness This Crisis To Transform it Into a Massive Profit Opportunity

Bob: That's clear. Now, here's the $64,000 question: How do you do what you told us about earlier — how do you harness the crisis? How do you transform it into a massive profit opportunity?

Martin: The dollar is crashing. So you profit by investing in currencies that are surging against the dollar. That's the simple answer. But to give you a much more specific answer on exactly which currency to buy and how to buy it, I've invited our currency expert, Jack Crooks, to join us.

Bob: And I'm glad you did! Jack has over 20 years experience in the currency market, and he is especially well versed in the 1998 crisis and the profit opportunities that are possible in precisely this kind of situation. Jack, you heard what Martin said earlier — that you can harness these powerful forces in your favor. How do you do that?

Jack: With the Japanese yen. The Japanese yen has emerged as the world's premier crisis currency. In 1998, when there was a crisis like this one, the yen went through the roof. And that's what it's starting to do now in 2007.

Bob: Can you take us back to 1998 and show us, step by step, how that happened?

Jack: Yes. The time is 1998. Small Asian economies have collapsed. Later, Russia defaults on its massive debts. And the giant U.S. hedge fund, Long Term Capital Management, comes to the brink of collapse.

Fears sweep the world that the entire financial system could be brought to its knees. But the biggest impact of the crisis is also the least understood — in the currency market, especially in the gigantic market for Japanese yen.

Bob: And why is that?

Jack: Because of the yen-carry trade.

Bob: Please explain how that works step by step.

Jack: Step 1. Investors borrow Japanese yen at very low interest rates.

Step 2. They convert the yen into U.S. dollars and other currencies.

Step 3. They then take that money and buy higher yielding, riskier investments elsewhere around the globe.

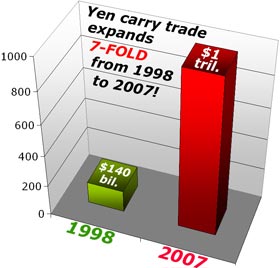

That's the yen-carry trade, and in 1998, it was already huge — close to $140 billion. But that's not the big problem. The big problem comes when they try to unwind this trade.

Bob: Please explain why that would happen.

Jack: For three powerful reasons: In a global crisis like we saw in 1998, and like we're seeing now, the first thing that happens is that investors in the yen carry trade start to suffer losses.

The second thing that happens is that they suddenly discover that their investments are a lot riskier than they originally thought.

And third, their financing costs go up when Japan raises interest rates.

Bob: So walk us through how that unwinding process unfolds.

Jack: They just reverse the transaction I told you about a moment ago:

Step 1. They sell their investments in the U.S. (and elsewhere).

Step 2. They buy back Japanese yen to pay back all those loans from Japan.

Step 3. When they rush to buy yen, naturally, they drive up the value of the Japanese yen.

Bob: So the more this crisis unfolds, the higher the yen should go. Is that how it happens?

Jack: That's exactly how it happens, and 1998 is a perfect example of that.

Let's go back to the summer of 1998. The yen is gradually meandering higher. Then, suddenly, the crisis — the same one Greenspan was talking about and that we've been talking about today — hits the marketplace. So investors rush to buy back yen, and there's a sudden surge in the currency.

Within just a month, the Japanese yen surges by over 20%, one of the largest and sharpest moves in the history of major world currencies. Look at that yen go!

But it's not over yet. The unwinding of the yen-carry trade continues to drive the yen higher at a rapid pace for over a year . And that, by the way, happens even though the Japanese economy is weak.

Bob: How does that compare to a typically large move in foreign currencies?

Jack: It's several times larger than some of the largest foreign currency moves in history. Typically, if you get a currency move of 4% or 5% in a single month, that's a lot. This is twenty percent!

Bob: That was 1998. What about now? Are they still doing the yen-carry trade like they used to? Is it still as big?

Martin: Ha-ha! Still as big?! Show him the next slide, Jack.

Jack: Back in 1998, the yen-carry trade was about $140 billion. Now it's estimated to be about $1 trillion! That's about seven times more, driving that much more money into the yen.

Martin: Plus, don't forget the other factors I talked about earlier:

In 1998, the crisis was isolated. Now it's spreading like wildfire. That drives more money into the yen.

In 1998, it was triggered by smaller economies abroad. In 2007, it's triggered by a massive housing bust and mortgage meltdown in the United States. That drives more money into the yen.

In 1998, you had just one hedge fund in trouble. In 2007, you're talking about thousands of hedge funds and institutions dragged into the mess. That drives still more money into the yen.

Jack: Never in all my 20 years in the currency market have I seen the stars line up like this!

Bob: I'm doing the math here. The Japanese yen surged 20% in just one month back in 1998. This time, you gentlemen are telling me that the forces lined up to drive the yen higher are many times bigger. So what does that mean for the yen?

Jack: You can't plug a formula into this and say "A times B equals C." But you can say, and with a high degree of confidence: There is a far greater chance of a bigger move in the yen now than there was in 1998.

Bob: Now I see the big picture very clearly. And now I want to know: How do I get into the currency market? The last time I looked into this market a few years ago, it was next to impossible. Either I had to have a fortune, which on a news anchor salary with kids to put in college wasn't exactly my situation … or I had to go into the futures market, which isn't my cup of tea either. So where does an investor like me go?

Jack: To any stock broker. To use the new currency ETFs or exchange-traded funds.

Bob: That's right! Last month you held a special teleconference on that.

Jack: Yes. This is a revolutionary new investment vehicle for investing currencies. It gives you direct and immediate protection against a falling dollar. And it gives you the opportunity to go for profits that can be tremendous in times like these.

Bob: And how are they doing?

Jack: They're soaring. Just in the last few weeks, these ETFs have gone through the roof, as the dollar has plunged. And there are ETFs on every major currency.

You can buy an ETF that invests exclusively in euros, the Euro Currency Trust, symbol FXE. You can buy the Swiss franc ETF, symbol FXF. You can buy ETFs dedicated to the British pound, the Canadian dollar, the Australian dollar, the Mexican peso, the Swedish krona, and of course the Japanese yen.

Plus, there's an ETF to let you ride a bullish trend in the U.S. dollar and another ETF that lets you ride a bearish trend in the dollar.

Bob: What are the advantages of using these ETFs as compared to other things like futures or Forex?

Jack: The main advantage is the fact that they're ETFs. So now you can buy them just like you would any other exchange-traded fund — like any ETF traded on the NYSE or Amex.

This gives you the purest, simplest possible protection against the falling dollar. And it gives you the simplest single way to profit with the currencies that are soaring against the dollar.

I repeat: They're listed on the exchange like any Exchange Traded Fund. You can buy or sell them in standard stock brokerage account. They are always liquid. You can trade as often as you like. There's no minimum investment. And you can do it all with discount commissions online or offline.

Bob: That can add up and make a huge difference.

Jack: It sure can. And an advantage most people forget about is the yield . Whatever currency ETFs earn in yield, they pass right along to you in the form of regular dividends.

Martin: I'm a conservative investor. So I really like that.

Jack: But please understand: the yield is just a kicker. It's not the main advantage and not the primary goal of currency ETFs. The main advantage is that every time a currency moves, you have a great profit opportunity.

Plus, there's one more huge advantage that I want to tell you about.

Bob: Go ahead.

Jack: These new, revolutionary investment vehicles now open the door to the richest market in the world — the market for foreign currencies, or the Forex market.

The Forex market is, without a doubt, the largest market in the world — and the most liquid: $3 trillion a day trade in the currency market. That's more than ALL of the world's stock markets combined, with 80% of all that trading in seven major currencies.

The currency market is the most critical market to support global trade and international transactions.

What I like most — one of the reasons I specialize in this market — is that there's always a bull market in currencies. It gives you the power to make money regardless of what's happening in other markets. Whether the stock market is sinking or soaring … whether real estate is booming or busting … whether interest rates are flying or falling … and regardless of what happens to bonds or commodities.

No matter what's happening elsewhere, opportunities abound in the currency market.

Martin: There's always a bull market.

Bob: Why is that?

Jack: It's pretty simple. Currencies are different from stocks, bonds or commodities in that you make money buying and selling one currency against another.

It's like a seesaw: When one is going down, the other one has to be going up. So there is always a bull market.

Plus, equally important is the fact that currencies move independently from stocks and bonds. They are non-correlated.

Bob: What does that mean to the average investor?

Jack: It means that currencies are a great asset class for diversification.

Bob: To me, the greatest advantage of all is the profit potential. And the most fascinating part of your recent teleconference was the examples of profit after profit after profit. I found that absolutely intriguing. Can you run through those again for us real quickly?

Martin: These are examples of how much money you could make in currency ETFs:

This year, if you bought the British pound ETF, you could have grabbed a nice gain that's the equivalent of 36% per year on an annualized basis. Add in the yield, and you'd have a total return of 41%.

And here's another example: If you had bought the euro ETF, you could have had an annualized gain of 41%. The yield on the euro is lower than that pound, but I don't think you'd mind that too much. Because your total return comes to 44%.

Bob: Is that the best example on your list?

Martin: No. The best example from this year is the Canadian dollar. Annualized return: 44%. Add in the yield, and you're looking at a total return of 48%. Folks, these are very impressive numbers. And this is exclusively with ETFs.

Bob: And these ETFs are just like the ordinary ETFs I'm already buying all the time, right?

Jack: Exactly like ordinary ETFs. The same ease of buying and selling. The same access through any online or offline broker.

Bob: But what do I buy and when? I'm new to this. Help me.

Martin: That's why we're launching a new service that's dedicated to trading international currencies with ETFs. It's our new World Currency Alert .

Bob: I've spent a lot of time looking at this project. So if you'll permit me, let me step in here and give our participants some of the highlights.

For starters, you get Jack Crooks' World Currency Trading Manual. In the manual, Jack shows you his #1 strategy for selecting the ETFs that offer you the potential for the greatest returns. He shows exactly how they work and how he identifies the best ones to buy. He shows you how to whittle your risk down to the bare bones minimum. Then stand by for very precise instructions on exactly what to buy or sell in your inbox.

Martin: I'm a risk-averse person. So I want to add that I'm really pleased to see this provides several risk barriers:

The first risk barrier is diversification — you're investing in the currencies of entire nations, not just a few stocks. And Jack recommends a variety of different currencies.

The second risk barrier is the ETFs themselves. Even in the worst-case scenario, you're never exposed to unlimited risk.

The third is Jack — providing close monitoring of each position, with strict limits.

And while we're on the subject of risk, I want to remind you of one more thing: One of the greatest risk of all, in my opinion, is being taken by the folks who do nothing to protect themselves from this dollar crisis.

Bob: I've always been intrigued by currencies, how dramatic the moves can be, how huge the leverage is. But I have always been hesitant because of the unlimited risk.

Over the years, I've seen the huge profits that are made in the currency markets. And I was always amazed that there was no viable way for the average investor to participate without taking huge risks. No one brought together what has got to be the most liquid, most wildly profitable market with the investor-friendly instruments like these currency ETFs. Now you have done it!

Normally, a one-year membership in World Currency Alert is $595. And that's a great value, considering the potential to earn many times that amount just with the yield you get on these instruments — not to mention the huge profit potential when the dollar falls.

But if you become a Charter Member today (Monday, September 24), you can join for one year for just $245, less than half the regular membership rate.

Or for an even better deal, join for two years . The cost is just $395, and you save $795!

Our video is now offline. But as a special courtesy to readers who did not have the software to access it, we have provided this transcript and extended our special offer for 24 hours until midnight tonight.

The number to call is 1-800-393-0189. Or you can order online at our secure site. Click here for 2-years and here for 1 year .

You must be delighted with the profits World Currency Alert earns you, or cancel anytime in your first 60 days for a full refund of your membership fee — or anytime thereafter for a refund on the remaining portion of your membership.

Martin: May I add a final word?

Bob: Go ahead, Martin.

Martin: I want you to understand that our goal goes beyond profits. Many years ago, my father tried to protect the U.S. dollar and prevent it from declining.

He founded our Sound Dollar Committee and enlisted the support of men like Bernard Baruch, the adviser to many presidents … Herbert Hoover, the president who presided over the worst of times … and William Machesney Martin, Chairman of the Federal Reserve.

He organized a grassroots campaign to balance the budget, fight inflation and protect the American dollar. Dad helped Eisenhower achieve one of the few balanced budgets of the 20th century. And he won several landmark battles for the dollar. But he lost the war.

Today, I am the Chairman of the Sound Dollar Committee, and I wish I could accomplish as much as Dad did to stop the dollar's decline. But the forces driving it down are far too powerful; and our leaders, far too complacent.

Bob: How do you feel about that, Martin?

Martin: I have mixed emotions. As a citizen, I'm distressed that all those years Dad and I worked to defend the dollar have failed so far. But as an investor, I'm fascinated by the tremendous opportunities.

But regardless of my feelings, one thing is certain: The time has come to take action to defend yourself and your family.

Bob: Agreed, Martin. Thank you, Martin. Thank you, Jack. And our special thank-you to everyone who has logged in to participate in our Emergency Summit.

Have a great day!

By Martin Weiss

This investment news is brought to you by Money and Markets . Money and Markets is a free daily investment newsletter from Martin D. Weiss and Weiss Research analysts offering the latest investing news and financial insights for the stock market, including tips and advice on investing in gold, energy and oil. Dr. Weiss is a leader in the fields of investing, interest rates, financial safety and economic forecasting. To view archives or subscribe, visit http://www.moneyandmarkets.com .

Money and Markets Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.