Chinese Data Cheers Stock Markets But NFP Looms

Stock-Markets / Stock Markets 2010 Sep 01, 2010 - 12:36 PM GMTBy: PaddyPowerTrader

By The Mole on 1 September 2010 at 14:08Category: Market Commentary, Market Watch by The Mole Comment US stocks rose, trimming the biggest August slump since 2001 Tuesday, as regulators approved a Chinese investment in Morgan Stanley and gains in home prices and consumer confidence tempered concern the economy is double dipping. Morgan Stanley added 1.1 percent as the Federal Reserve approved China Investment Corp.’s plan to buy as much as 10 percent of the company. AT&T Inc., JPMorgan and Merck both gained at least 1.2 percent to lead the Dow higher.

By The Mole on 1 September 2010 at 14:08Category: Market Commentary, Market Watch by The Mole Comment US stocks rose, trimming the biggest August slump since 2001 Tuesday, as regulators approved a Chinese investment in Morgan Stanley and gains in home prices and consumer confidence tempered concern the economy is double dipping. Morgan Stanley added 1.1 percent as the Federal Reserve approved China Investment Corp.’s plan to buy as much as 10 percent of the company. AT&T Inc., JPMorgan and Merck both gained at least 1.2 percent to lead the Dow higher.

Overnight sentiment has been buoyed by news that China’s manufacturing expanded at a faster pace in August, damping concerns that growth in the engine of the world’s economic recovery is slowing and Australia, the biggest supplier of iron to China, reported gross domestic product growth of 1.2 percent, beating the median estimate of 0.9 percent in a Bloomberg News survey of 23 analysts. Before we get carried away though.

It is interesting to note that the PMI’s from other Asian economies have continued to move lower with both the South Korean and Taiwanese indicators declining. In fact the South Korean export data also show signs of starting to slow from the recent exceptionally strong pace. In addition, US domestic demand is still globally dominant and although Chinese GDP has now reached 45 percent of US GDP, it must be noted that 35 percent of China’s income has gone into savings, suggesting that its domestic demand is only a fraction of US demand. A further slowing of the US economy will derail the global de-coupling story.

So at the risk of sounding like a broken record, this months early macro could be key in determining direction for the rest of the year should it surprise in either direction. Following today’s weaker than expected ADP jobs number which came in at -10k versus the expected +15k all eyes will be on the key US Non Farm Payrolls data due Friday at 13.30 BST. Despite the data the Dow futures are up over 100 Wednesday with money being put to work at the start of the new quarter and the market turns its attention to the US manufacturing ISM numbers due at 15.00 BTS (expected to come in at 52.7, but watch the employment sub component for a lead into the NFP number Friday). US Vehicle sales numbers at due after the close (8.85m Dom or 11.5m total are the expectations)

On a company level today in Europe , Vivendi, having run +7 percent into numbers, have posted good enough results to add a further 4% so far today. Havas, -6.4 percent disappointed, while Bouygues mixed numbers have seen it drop 1.3 percent. Tui Travel, +5.6 percent, has lead the FTSE, on a story in FT Deutschland that TUI AG is weighing the purchase of the shares that it does not already own. Cable & Wireless is up 5.55 percent on some talk that AT&T or some other firm may be readying a bid for the company

Today’s Market Moving Stories

•Manufacturing in China grew at a faster pace in August after the weakest performance since early 2009, signalling that the economy’s slowdown will be limited. The purchasing managers’ index rose to 51.7 from 51.2, exceeding forecasts, a government-backed report showed. Seasonal factors might have had an effect because the index typically gains as factories restart following July maintenance, Mizuho Securities Asia Ltd. said. A separate PMI released by HSBC and Markit Economics gained to 51.9 from 49.4. So the Goldilocks economy seems alive and well, not too hot & not to cold !

•That said an article in the China daily caught my eye in which China’s banking regulator will strictly implement the central government’s macroeconomic policies that aim to curb soaring housing prices, an official said Tuesday. Ye Yanfei, deputy head of the Statistics Department of the China Banking Regulatory Commission (CBRC), said the CBRC will restrain speculative property investment and support the building of affordable housing while controlling risk

•News overnight that Australia’s economy grew at the fastest pace in three years last quarter, stoked by China’s demand for iron ore, boosting the currency on speculation interest-rate increases will resume early next year. Gross domestic product advanced 1.2 percent from the first quarter, when it rose a revised 0.7 percent, the Bureau of Statistics said in Sydney today. That beat the median estimate in a Bloomberg survey of 23 economists for a 0.9 percent gain.

•This may have been the least eagerly awaited release of FOMC minutes in history. That’s because all the key details of the meeting were leaked to the WSJ’s Jon Hilsenrath and his report probably provided more interesting color than we will get from the minutes themselves. Here is the link to the Hilsenrath article from last week. There were no real surprises from the minutes. FOMC members saw heightened downside risk to growth and inflation and decided to take action to avoid shrinkage in their balance sheet. Also, “several members emphasized that in addition to continuing to develop and test instruments to facilitate an eventual exit from the period of unusually accommodative monetary policy, the Committee would need to consider steps it could take to provide additional policy stimulus if the outlook were to weaken appreciably further.” Finally, the FOMC will continue to monitor the reinvestment program and could decide to redirect some or all of their Treasury purchases into MBS, as described here: “while reinvesting in Treasury securities was seen as preferable given current market conditions, reinvesting in MBS might become desirable if conditions were to change.”

•The UK Markit/CIPS manufacturing PMI showed a more significant deterioration in August than had been expected joining the global moderation, with the headline index declining to its lowest reading since last November, at 54.3 (SA) after a revised 56.9 in July (revised down from 57.3 previously). Moreover, there was a significant reduction in the new orders component, and in particular the gap between the diffusion indicies for new orders less finished goods inventories has dropped significantly, to its lowest level since March, 2009, and suggesting that the pace of manufacturing production expansion is set to slow significantly.

•Bloomberg reports that JPMorgan Chase & Co. told traders who bet on commodities for the firm’s account that their unit will be closed as the company, the second-biggest U.S. bank by assets, starts to shut down all proprietary trading, according to a person briefed on the matter. The bank eventually will close all in-house trading to comply with new U.S. curbs on investment banks, said the person, who asked not to be identified because New York-based JPMorgan’s decision hasn’t been made public. Closing the proprietary trading desk for commodities affects fewer than 20 traders, one in the U.S. and the rest in the U.K., the person said. The unit is based in London, and traders there were given notice on Aug. 27 that their jobs were at risk as required by U.K. law, according to the person. Proprietary traders in fixed-income and equities, who account for 50 to 75 employees, will need to find jobs when those desks are shut down, this person said. Note prop traders usually contribute handsomely to an investment banks bottom line per capita and are so rewarded. The bank’s loss will be the hedge fund’s gain.

•U.K. banks and building societies wrote off a record 2.1 billion pounds of credit- card debt in the second quarter, 70% more than in the first, the London-based Times reported, citing Bank of England figures. Total write-offs of all loans to individuals reached 3.47 billion pounds, another all-time high, the newspaper said. Last year, 48 percent of credit-card applications were rejected, up from 33 percent in 2004-05, the Times said, citing the U.K. Cards Association. British households have the biggest debt burden in the Group of Seven advanced countries, at 180 percent of personal incomes, the

newspaper said.

•Trading in currencies has surged by one-fifth over the past three years to hit an average of $4 trillion a day in April, according to the latest triennial report from the Bank for International Settlements, released Wednesday. The report also revealed a series of other shifts over the last three years, with big banks losing their dominance over trading volumes for the first time, taking second place to hedge funds and other financial institutions. London continued to pull away from New York as the world’s preeminent trading centre for currencies, while some big Asian markets also posted a surge in trading volumes over the past three years, as did some peripheral markets, like Brazil and Turkey.

•Staying with the FX markets, Ichiro Ozawa has kicked off his campaign to become Japan’s prime minister this month with a promise to intervene in currency markets to weaken the yen and to honour his party’s vow to increase child support payments. Ozawa would take “every measure” to keep the yen from rising, including intervention, he said in a campaign statement released in Tokyo today. He also vowed to introduce a 2 trillion yen economic stimulus, more than double that planned by Prime Minister Naoto Kan, the ruling party colleague he is seeking to replace. Ozawa’s policy platform for the Sept. 14 Democratic Party of Japan leadership election focuses on issues that contributed to the party’s losses in July’s upper-house election. He pledged to renegotiate an agreement with the U.S. to keep the Futenma Marine Air Base in Okinawa, reopening a dispute that damaged relations with the White House.

•Aussie Prime Minister Julia Gillard says (following news that the Green Party has signed stability agreement with the Labour Party): “Our election commitments are our election commitments. In the days since the election I’ve been asked will you change the Minerals Resource Rent Tax, and the answer of course is no.”

•French paper Les Echos reports that The WFO has revised downwards wheat production forecasts to 646mn tons in 2010, 5% below the 2009 level, while wheat consumption is projected to increase slightly to 665mn.

Company / Equity News

•According to media reports in Poland, the Polish Deputy Minister Krzysztof Walenczak plans to come to Ireland tomorrow to discuss PKO Bank Polski’s offer to buy AIB’s stake in Bank Zachodni. AIB have received bids from PKO, Banco Santander and BNP Paribas, and may pick a buyer this week. The Polish government have already made it clear that their preferred buyer would be the Polish bank.

•Vivendi , one of the world’s biggest media and telecommunications companies, Wednesday raised its full-year targets but reported a drop in second-quarter net profit. Vivendi said for that for 2010, it expects growth in adjusted earnings before interest and tax, or EBIT, and a higher adjusted profit than the one recorded in 2009. The group had previously targeted slight growth in adjusted EBIT, the measure analysts use to gauge the group’s operational performance and which excludes certain charges relating to acquisitions and mergers. It also said that it will keep its dividend at €1.4 a share in 2010. Vivendi said net profit for the period fell 3.7 percent to €669 million, hit notably by higher taxes. Adjusted profit, which strips out most non-recurring gains and charges, also fell 3.4 percent to €790 million from €818 million. Adjusted EBIT, however, rose 9.8 percent to €1.65 billion in the three months ended June 30, from €1.51 billion last year, driven by growth at Activision Blizzard, and at SFR and GVT. This figure beat the average €1.52 billion forecast in a Dow Jones Newswires poll. Revenue in the quarter rose 6.2 percent to €7.06 billion from €6.65 billion last year, also beating analysts’ forecasts of €6.86 billion.

•Vinci , the world’s biggest builder, reported first-half profit that beat analysts’ estimates, as French rival Bouygues SA raised its full-year sales target, signaling the industry may have bottomed out. Net income at Vinci rose 1.9 percent to €703 million, the company based near Paris said today. That beat the €681 million average estimate of three analysts polled by Bloomberg.

•Research In Motion Ltd., maker of the BlackBerry smartphone, fell the most in two months in U.S. trading as a Sanford C. Bernstein Ltd. survey found more companies opting for rival devices such as Apple’s iPhone. Of 200 companies in the U.S. and U.K. surveyed, 74 percent now let their employees use devices other than BlackBerrys, Sanford Bernstein analyst Pierre Ferragu said in a report. For the U.S. alone, the figure was 83 percent. RIM fell $2.75, or 6 percent, to $42.84 at 4 p.m. New York time in Nasdaq Stock Market trading, for the shares’ biggest daily slide since June 29.

•Bloomberg reports that Amazon.com has approached media companies including Time Warner Inc. with plans to start an online video subscription service to rival Netflix Inc., said three people with knowledge of the talks. The service, sold for a monthly fee by the Seattle-based Web retailer, would consist of older films and TV shows, said the people, who asked not to be identified because the conversations are private. They said talks are early and could still fall apart.

•And Apple, hosting their annual love in on music and media plans to unveil an updated version of its Apple TV set-top box that will include programming from Netflix Inc., according to people familiar with the product. Users of the set-top box would pay a subscription fee to Netflix for its streaming service, said two people, who asked not to be identified because the plans haven’t been made public. The San Francisco event will also probably showcase a higher- definition iPod Touch and revamped iTunes service.

•Coking coal and iron ore sold by BHP Billiton Ltd. and Rio Tinto Group, will post the first price decline in three quarters as steelmakers cut orders on weaker demand from automakers and builders in China. Contract prices for iron ore are set to fall 11 percent to $129 a metric ton in the quarter starting Oct. 1, down from the previous three months, said Hu Kai, an analyst at researcher UC361.com., citing Platts index prices. BHP, the biggest exporter of coking coal, will cut prices by 7 percent for Japanese steelmakers, UBS AG said. BHP and Brazil’s Vale SA, the biggest iron ore supplier, this year dropped a

custom of setting annual prices for steelmaking commodities in favor of quarterly agreements as they bet on rising prices. Steel prices in China are under pressure to fall because of weaker demand, Baoshan Iron & Steel Co., the nation’s biggest publicly traded steelmaker, said this week

•The WSJ reports that Burger King has been in talks with private-equity firms in recent weeks about a possible sale of the second-largest hamburger chain, people familiar with the matter said. The status of the talks is unclear but one interested firm was 3i Group PLC, a British private-equity firm, these people said. It is uncertain whether these discussions will result in a sale. Burger King has been a public company since 2006

•German shipping, travel and tourism company TUI has received expressions of interest from several parties for its 43.3 percent stake in shipping company Hapag-Lloyd, Financial Times Deutschland reported Wednesday, without citing specific sources. TUI’s supervisory board may consider whether to use any proceeds from such a sale to acquire the outstanding shares in TUI Travel PLC, in which it holds a majority stake, the report said.

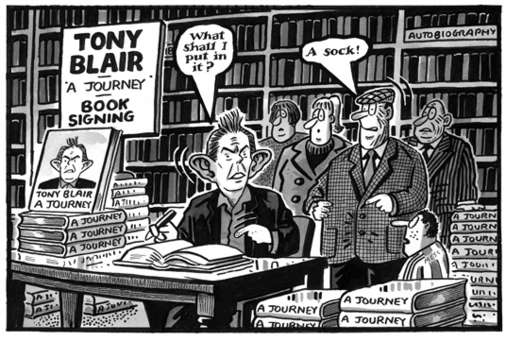

Maybe Failte Ireland should give this guy a job and Ireland would go viral.

By The Mole

PaddyPowerTrader.com

The Mole is a man in the know. I don’t trade for a living, but instead work for a well-known Irish institution, heading a desk that regularly trades over €100 million a day. I aim to provide top quality, up-to-date and relevant market news and data, so that traders can make more informed decisions”.© 2010 Copyright PaddyPowerTrader - All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

PaddyPowerTrader Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.