Gold Remains at Record 27 Year Highs

Commodities / Gold & Silver Sep 24, 2007 - 08:39 AM GMTBy: Gold_Investments

Gold

Gold

Gold continued to rise Monday after last week's 3% increase.

Gold was up to $734.50/735.00 per ounce against $731.50 in late New York trade on Friday.

It remains at record 27 year highs, the highest since January 1980, when gold reached a record $873 an ounce.

The gold price continues to surge due to record low dollar prices (the USD hit new lows against the EUR this morning at 1.4129) and record high oil prices (oil remains near record highs above $81 per barrel).

Also there is increasing concern regarding the health of the U.S. economy and a clear increase in systemic risk for the first time in many years.

The FT reports that analysts at Goldman Sachs said they expected to see gold prices reach $775 a troy ounce over the next three months and $800 in six months time. “The momentum in the recent rally has been supported by continued gains in ETF exchange traded fund demand and high jewellery demand during the Indian wedding season,” said James Gutman of Goldman Sachs.

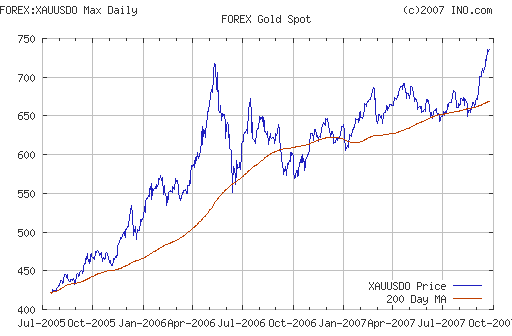

While we have warned that gold may succumb to profit taking in the coming days as we are slightly overbought in the short term, there are many precedents for gold continuing to surge prior to a meaningful correction. When gold broke through resistance at $560 to $580 at the end of March 2006 (see chart) it quickly rose to $730 per ounce in just two months before a sharp sell off.

Gold surged by some $150 from previous resistance prior to reaching a top and a profit taking sell off and further period of consolidation between $560 and $700. Thus, gold could, given the length of the consolidation of strong foundation built and the strong fundamentals, act similarly today. Strong resistance has been seen at $700. This resistance has been overcome and we could again rally some $150 to $850 prior to any significant correction.

An indication that the global credit crisis is far from over was seen with European bank stocks declining on concern that the turmoil in the credit markets will hurt investments and erode earnings. Deutsche Bank AG fell for a third day after Reuters reported that Germany's biggest bank may have to write down as much as 1.7 billion euro ($2.4 billion) in leveraged loan commitments. BNP Paribas SA, France's largest bank, also dropped.

Forex and Gold

The USD again hit new all time low against the euro at 1.4129 and analysts see 1.45 as the next level of resistance. The USD has fallen to a new low mark on the U.S. Dollar Index at 78.313.

Market players are keeping a close eye on whether the dollar breaks the all-time low of 78.19 struck on its trade-weighted index in 1992, a level that analysts said would provide a key test of whether the U.S. currency's sell-off deepens or pauses. Should it deepen and the USD sell off more aggressively and sharply there could be some form of international currency crisis.

The U.S. Federal Funds target rate could fall as low as 3 percent as the Federal Reserve continues to ease monetary policy to shore up growth, Bill Gross, chief investment officer at Pacific Investment Management Co, the world's largest bond fund ($104.4 billion) said. "I think what the U.S. economy needs is somewhere in the 2-1/2 to 3 percent real rate of growth. We are down in the 1 to 2 percent category," Gross told CNBC television. "It's going to take interest rates at 1 percent real ... that means somewhere in the 3 percent category. I wouldn't go as low as 3 percent, but 3 to 3.25 percent fed funds rate target looks very real."

Gross also said that European central banks would likely be forced to cut interest rates due to housing bubbles in the U.K., Ireland and Spain. This is very inflationary and gold's inflationary hedge qualities will be realised in a 1970s style low growth and high inflation environment.

Silver

Spot silver is trading at $13.60/13.62 (1200 GMT).

PGMs

Platinum was trading at $1332/1336 (1200 GMT).

Spot palladium was trading at $338/344 an ounce (1200 GMT).

Oil

Oil prices eased Monday but remain near record highs above $81 per barrel.

Reuters reported that the surge in oil prices to record highs will shield OPEC nations, some of which peg their currencies to the U.S. dollar, from current dollar weakness, a Saudi newspaper quoted OPEC sources as saying on Saturday. OPEC members have no immediate plans to hold consultations on a rise in oil prices to record peaks above $82 a barrel last week, the al-Riyadh newspaper reported, quoting unnamed OPEC sources it said were well-informed.

The continual mantra of oil bears has been that OPEC can at will open the spigots and this will lead to lower prices. This has proved incorrect in recent years. It seems likely that given the massive global demand, OPEC are producing close to maximum capacity and will not be able to increase production in any meaningful way that would result in lower oil prices.

| Gold Investments 63 Fitzwilliam Square Dublin 2 Ireland Ph +353 1 6325010 Fax +353 1 6619664 Email info@gold.ie Web www.gold.ie |

Gold Investments Tower 42, Level 7 25 Old Broad Street London EC2N 1HN United Kingdom Ph +44 (0) 207 0604653 Fax +44 (0) 207 8770708 Email info@goldinvestments.org Web www.goldinvestments.org |

Mission Statement

Gold and Silver Investments Limited hope to inform our clientele of important financial and economic developments and thus help our clientele and prospective clientele understand our rapidly changing global economy and the implications for their livelihoods and wealth.

We focus on the medium and long term global macroeconomic trends and how they pertain to the precious metal markets and our clienteles savings, investments and livelihoods. We emphasise prudence, safety and security as they are of paramount importance in the preservation of wealth.

Financial Regulation: Gold & Silver Investments Limited trading as Gold Investments is regulated by the Financial Regulator as a multi-agency intermediary. Our Financial Regulator Reference Number is 39656. Gold Investments is registered in the Companies Registration Office under Company number 377252 . Registered for VAT under number 6397252A . Codes of Conduct are imposed by the Financial Regulator and can be accessed at www.financialregulator.ie or from the Financial Regulator at PO Box 9138, College Green, Dublin 2, Ireland. Property, Commodities and Precious Metals are not regulated by the Financial Regulator

Disclaimer: The information in this document has been obtained from sources, which we believe to be reliable. We cannot guarantee its accuracy or completeness. It does not constitute a solicitation for the purchase or sale of any investment. Any person acting on the information contained in this document does so at their own risk. Recommendations in this document may not be suitable for all investors. Individual circumstances should be considered before a decision to invest is taken. Investors should note the following: The value of investments may fall or rise against investors' interests. Income levels from investments may fluctuate. Changes in exchange rates may have an adverse effect on the value of, or income from, investments denominated in foreign currencies. Past experience is not necessarily a guide to future performance.

All the opinions expressed herein are solely those of Gold & Silver Investments Limited and not those of the Perth Mint. They do not reflect the views of the Perth Mint and the Perth Mint accepts no legal liability or responsibility for any claims made or opinions expressed herein.

Fair Use Notice: This newsletter contains copyrighted material the use of which has not always been specifically authorized by the copyright owner. We are making such material available in our efforts to advance understanding of issues of financial and economic significance. At all times we credit and attribute the copywrite owner and publication.

We believe this constitutes a 'fair use' of any such copyrighted material as provided for in Copyright Law. The material on this site is distributed without profit to those who have expressed a prior interest in receiving the included information for economic research purposes. If you wish to use copyrighted material from this site for purposes of your own that go beyond 'fair use', you must obtain permission from the copyright owner.

Gold Investments Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.