Buy Stocks “In The Face Of Fear”

Stock-Markets / Stock Markets 2010 Sep 01, 2010 - 12:54 AM GMTBy: David_Grandey

TESTING 1 2 3 TESTING 1 2 3

TESTING 1 2 3 TESTING 1 2 3

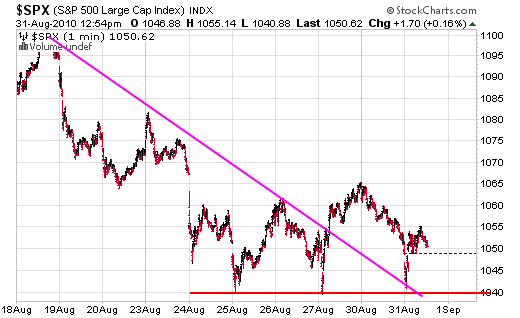

And that folks is the order of the day when you look at the S&P 500 today.

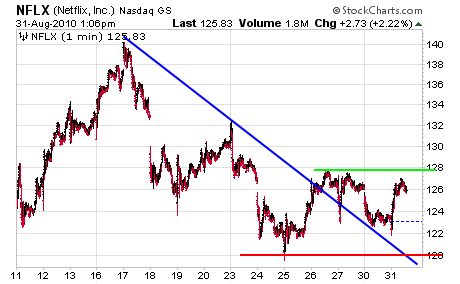

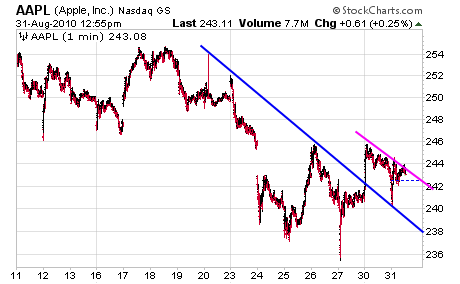

1040 going once, 1040 going twice, SOLD at 1040. The market has now defended the 1040 level twice and in both instances we’ve bounced off of it. If you were watching the indexes this morning at the 1040 level you’ll have seen before we pulled away from it to the upside, the leaders (AAPL, BIDU, NFLX) all took off before the index did. It showed you that the market always moves with the leaders first.

While the premarket didn’t look good, THAT my friends is what we want to touch upon for a moment. Just because you see premarket looks horrible DOES NOT mean that you should immediately jump to an emotional conclusion out of FEAR. More often than not the first half hour knee jerk open is always garbage anyway, recent case in point? INTC news from a few days ago the last time we tested 1040.

This is why we always say:

“Let Your Stocks Tell You What To Do By The Action They Exhibit”

In addition to that we constantly drill into your subconscious the famous phrase heard around our world here at All About Trends and that is:

“In The Face Of FEAR”

Believe it or not, this is the secret to successful investing — to keep your most important asset in the game, that being YOUR STATE OF MIND. We’ll continue to drill this in your head so that it becomes second nature to you. Consider yourself warned. The funny thing about all this is that none of it has to do with stocks or indexes or chart patterns, its that of managing your emotional state of being. They say YOUR perception creates your reality and to a big degree that is true. But Ahhh when looking at the market through the reality of what is vs. what we want to see? That is the secret — The standpoint of the un-opinionated observer. It’s a mindset you really want to cultivate. Try it, practice makes perfect.

Let’s take a look at the S&P 500 over the last few days.

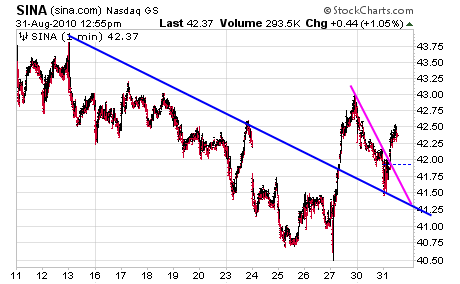

While we are at it let’s look at the leaders charts over the same time frame and frequency.

As you can see, the market takes off, the leaders take off and sometimes it’s the other way around — that being it’s a market of stocks and not a stock market.

By David Grandey

www.allabouttrends.net

To learn more, sign up for our free newsletter and receive our free report -- "How To Outperform 90% Of Wall Street With Just $500 A Week."

David Grandey is the founder of All About Trends, an email newsletter service revealing stocks in ideal set-ups offering potential significant short-term gains. A successful canslim-based stock market investor for the past 10 years, he has worked for Meriwest Credit Union Silicon Valley Bank, helping to establish brand awareness and credibility through feature editorial coverage in leading national and local news media.

© 2010 Copyright David Grandey- All Rights Reserved Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.