Welcome To the (Tech) Jungle: Cisco’s Reaching Up to Skype?

Companies / Mergers & Acquisitions Aug 31, 2010 - 09:07 AM GMTBy: Dian_L_Chu

Merger mania is definitely back in the Tech sector. HP (HPQ) and Dell (DELL) are still seriously locking horns over 3PAR (as of this writing.) Intel’s (INTC) acquiring Infineon’s wireless business for about $1.4 billion in cash, less than two weeks after saying it would buy McAfee. However, the more intriguing story (or rumor) is when TechCrunch broke the news Sunday night that Cisco (CSCO) has made an offer to acquire Skype before they complete their IPO.

Merger mania is definitely back in the Tech sector. HP (HPQ) and Dell (DELL) are still seriously locking horns over 3PAR (as of this writing.) Intel’s (INTC) acquiring Infineon’s wireless business for about $1.4 billion in cash, less than two weeks after saying it would buy McAfee. However, the more intriguing story (or rumor) is when TechCrunch broke the news Sunday night that Cisco (CSCO) has made an offer to acquire Skype before they complete their IPO.

Skype has had quite a few “colorful” years. You might recall eBay (EBAY) bought Skype for $3.1 billion back in 2005, and a drawn-out legal battle soon ensued between the Skype founders and eBay over the rights to Skype’s P2P technology. While this turmoil was still going on, eBay sold Skype to a group of investors last year at a loss, citing Skype didn't fit well within eBay’s core business of connecting buyers and sellers.

The legal saga finally came to an end last November, eBay ended up owning 30% of Skype with some quite favorable considerations to the Skype founders. Fast forward to present, Skype filed for an IPO on Aug. 9. In the filing, Skype disclosed it has a subscriber base of 560 million with 8.1 million paid users. The revenue for the first six months of 2010 is $406 million, and net income at $13.2 million.

The consumer base, technology and market position make Skype an attractive investment, although some analysts believe its revenue stream is not that impressive given a lot of its users are not paid subscribers.

|

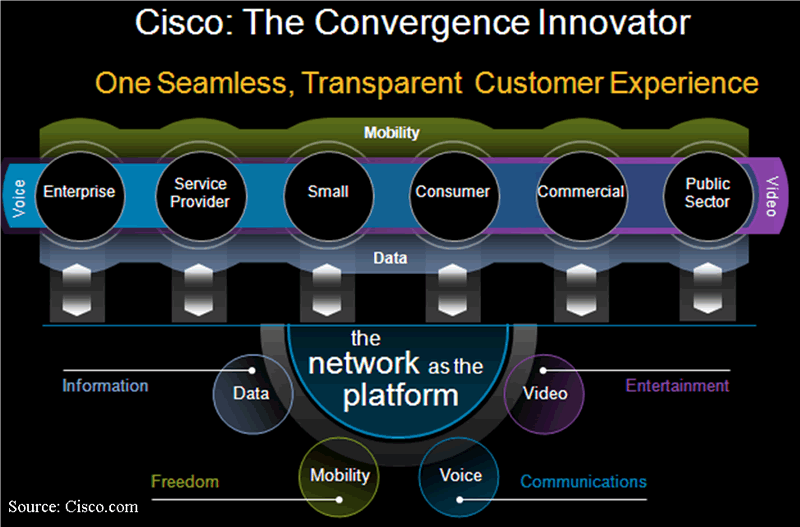

Chart 1 |

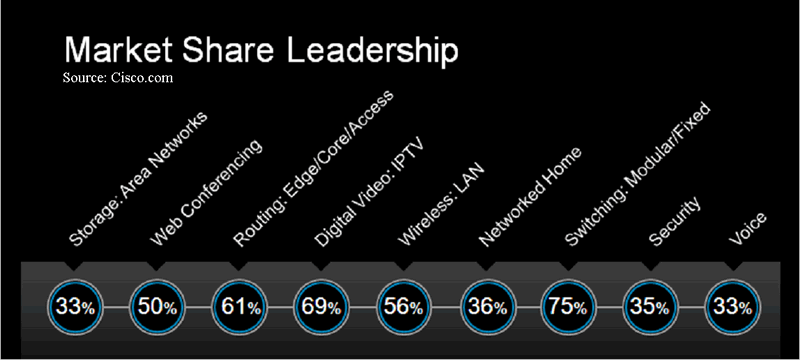

In terms of strategic fit, Voice is a crucial component of Cisco’s vision (Chart 1), but is also one of the weakest business segments of Cisco, in terms of market share (Chart 2). An acquisition of Skype or other similar technology could strengthen Cisco’s presence in the voice category, and augment its suite of network and router business.

Most importantly it seems a strategic move so Cisco would be at the same entry point--the same time as Google--into a category both consider lucrative. As such, Cisco would be in a better position to rival or even prevent Google from gobbling up yet another tech niche.

|

Chart 2 |

A Cisco-Skype union would also make it the first time Cisco venturing into the service business. The transition and integration would be challenging, and at the same time pitting Cisco against many of its telecom and cable clients and partners.

Judging from CEO Chambers’ very bearish Q2 earning call and with all the tech M&A actions, Cisco could be getting anxious and possibly on the hunt trying to juice up its asset portfolio. In addition to Voice, it is logical Cisco could be looking to plug holes in categories where it has lower market share--Security, Home Network, and Storage/Area Networks.

And if there’s a Skype deal in the making, it would undoubtedly attract other big players, even just to give Cisco a harder time and jack up the price tag along the way. Based on my "short list”, Microsoft (MSFT) and Google (GOOG) could be two potentials vying for Skype.

While Skype did not specify the number of shares or a price range for the IPOs; TechCrunch noted, “Skype insiders are hoping for an out of the gate valuation of $5 billion or so.” Meanwhile, Based on Skype’s growth prospects, Jeffrey & Co. put the business worth at $3.7 to $4.7 billion. But taking inference from the 3PAR's bidding war, the final deal value for Skype could be much higher, if a buyout were to take place.

On the other hand, it could be that Skype investors would want to go through with the IPO, as the thin float would most likely mean a spectacular debut, similar to that of Baidu (BIDU) n 2005 when its stock jumped 340% on day one. Well, if that's the case, could there be another 6 am underwriters' press conference to downgrade Skype stock--Déjà vu Goldman Sacks (GS), Piper Jaffray and Baidu--thus inadvertently making Skype ripe for deal...again?

Welcome to the jungle, and its new reality show called “Tech Survivor.” Stay tuned.

Dian L. Chu, M.B.A., C.P.M. and Chartered Economist, is a market analyst and financial writer regularly contributing to Seeking Alpha, Zero Hedge, and other major investment websites. Ms. Chu has been syndicated to Reuters, USA Today, NPR, and BusinessWeek. She blogs at Economic Forecasts & Opinions.

© 2010 Copyright Dian L. Chu - All Rights Reserved Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.