Total Stock Market Returns For USA, EAFE and Emerging Markets

Stock-Markets / Emerging Markets Aug 31, 2010 - 08:57 AM GMTBy: Richard_Shaw

Emerging stock markets are generally held to have the highest growth potential in the future. Their economies are generally in better debt/GDP shape than the aggregate developed stock market countries. Their GDP growth rates have been, are currently, and are expected to be higher than aggregate developed stock market countries.

Emerging stock markets are generally held to have the highest growth potential in the future. Their economies are generally in better debt/GDP shape than the aggregate developed stock market countries. Their GDP growth rates have been, are currently, and are expected to be higher than aggregate developed stock market countries.

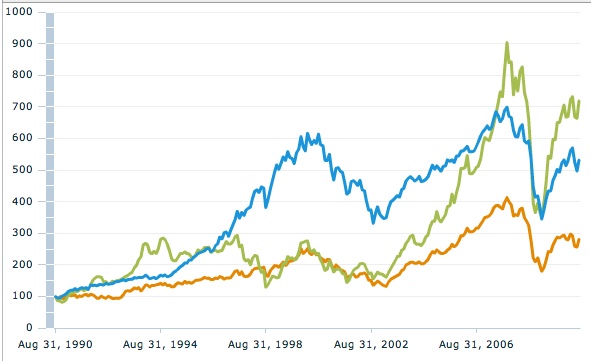

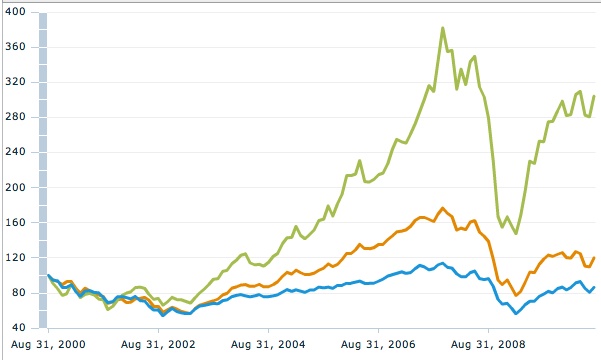

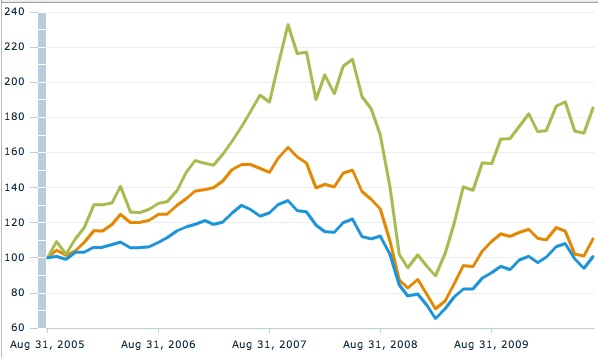

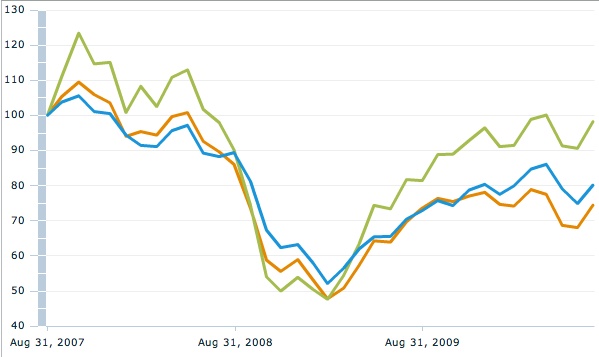

The total return history of emerging markets for 20, 10, 5, 3 and 1 years shows emerging markets to have generated higher returns than the US or non-US developed markets, although with higher volatility.

Emerging markets had the lead in the early 1990's but surrendered that to the US during the technology run-up in the second half of the 1990's. From the 2002 general bottom area, they greatly outperformed the other two equity categories, but took steeper dive into the 2008 crash. Since the 2009 lows they have strongly outperformed again.

For those aggressive investors who can take the volatility (and their is a lot of it), emerging markets deserve higher allocations than was typically recommended for most portfolios in recent years. To the extent that volatility can be tolerated, and to the extent that equities are used at all, emerging markets should be over-weighted relative to the US and non-US developed markets.

We think that emerging markets are perhaps best for active allocators with the fortitude to rebalance into deeply diving asset classes (those are people are very few in number), or for trend followers to will own emerging markets in up phases, and either hold cash or go short in their steep down phases. For conservative investors and everybody else, judicious holdings are most suitable.

SPY, VTI, IVV, IWV and IWB are good proxies for the US market. EFA and VEA are good proxies for the non-US markets. EEM and VWO are good proxies for the emerging markets.

We have some equity market exposure at this time (substantially lower than our long-term target weights), but are not comfortable with the overall developed stock markets picture. Our developed stock markets holdings are for the most part conservative, high dividend stocks. Our emerging markets exposure is through country funds among those that are in strong up trends.

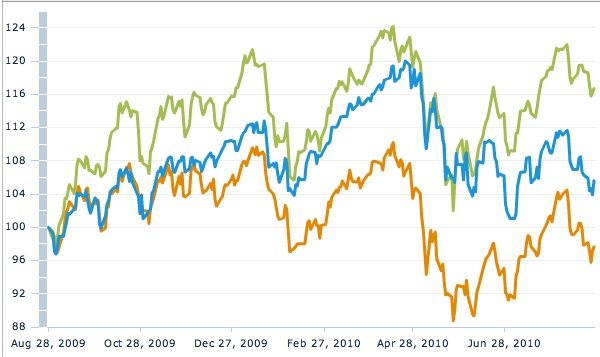

The following charts are total return charts (price and dividends) for broad indexes published by MSCI Barra, and the charts are from MSCI Barra as well. Emerging Markets are shown by the green line, the USA by the blue line, and non-US developed stock markets by the orange line.

20 Years

10 Years

5 Years

3 Years

1 Year

Holdings Disclosure: As of August 30, we do not own any mentioned security in any managed account.

By Richard Shaw

http://www.qvmgroup.com

Richard Shaw leads the QVM team as President of QVM Group. Richard has extensive investment industry experience including serving on the board of directors of two large investment management companies, including Aberdeen Asset Management (listed London Stock Exchange) and as a charter investor and director of Lending Tree ( download short professional profile ). He provides portfolio design and management services to individual and corporate clients. He also edits the QVM investment blog. His writings are generally republished by SeekingAlpha and Reuters and are linked to sites such as Kiplinger and Yahoo Finance and other sites. He is a 1970 graduate of Dartmouth College.

Copyright 2006-2010 by QVM Group LLC All rights reserved.

Disclaimer: The above is a matter of opinion and is not intended as investment advice. Information and analysis above are derived from sources and utilizing methods believed reliable, but we cannot accept responsibility for any trading losses you may incur as a result of this analysis. Do your own due diligence.

Richard Shaw Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.