Gold Forecast to Hit $1500 During 2011

Commodities / Gold and Silver 2010 Aug 31, 2010 - 07:34 AM GMTBy: GoldCore

Concerns that the US economy is sliding back into recession has led to equities internationally coming under pressure and further flows into safe-haven assets. Gold and silver have consolidated from last week's gains and remain near closing levels from yesterday and last week. The yen - a preferred carry trade at times of financial stress - rose back to a 15-year high against the dollar as doubts remain about Japan's attempt to weaken the currency. Interestingly, despite the yen's recent strength, gold remains near multiyear record highs in the Japanese currency (see chart).

Gold is currently trading at $1,233.70/oz, €972.03/oz, £800.32/oz.

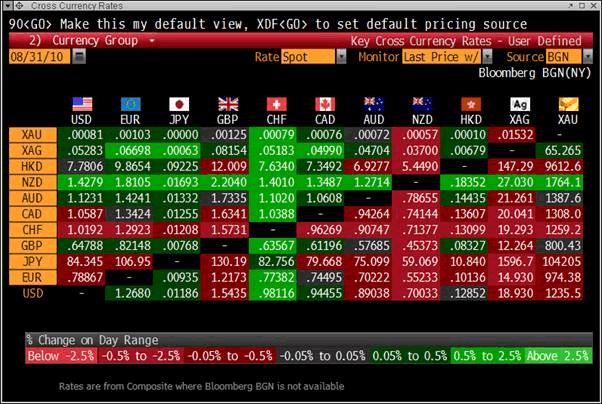

Cross Currency Rates at 1000 GMT

Benchmark German government bond yields hit record highs and the Swiss franc rose against all currencies (see table). Gold is slightly weaker against most currencies but is flat in British pounds and has surged in New Zealand dollar which is under pressure. Asian markets were down (especially the Nikkei - down 3.55%) and European indices have followed lower.

Gold in Yen - 5 Year (Daily)

Gold's most accurate forecasters say the current bull market has further to go no matter what the economy holds, according to Bloomberg. Analysts raised their 2011 forecasts for gold more than for any other precious metal the past two months, predicting a 10th annual advance, as shown by data compiled by Bloomberg. The most widely held option on gold futures traded in New York is for $1,500 an ounce by December, or 18 percent more than the inter day record $1,266.50/oz reached June 21.

Gold may rise as high as $1,500/oz next year, 21 percent more than the $1,237/oz traded at 5:30PM in London yesterday, according to the median in a Bloomberg survey of 29 analysts, traders and investors. Bullion has gained 13 percent since January, beating a 7.9 percent return on Treasuries, a 7.2 percent decline in the MSCI World Index of shares and the 9.4 percent slump in the S&P GSCI Total Return Index of 24 raw materials.

Growing US economic concerns should see safe havens such as gold and silver remain well bid at these levels.

Silver

Silver is currently trading at $18.91/oz, €14.90/oz and £12.27/oz.

Platinum Group Metals

Platinum is trading at $1,508.15/oz, palladium is at $486/oz and rhodium is at $2,050/oz.

This update can be found on the GoldCore blog here.

Mark O'Byrne

Director

IRL |

UK |

IRL +353 (0)1 632 5010 |

WINNERS MoneyMate and Investor Magazine Financial Analysts 2006

Disclaimer: The information in this document has been obtained from sources, which we believe to be reliable. We cannot guarantee its accuracy or completeness. It does not constitute a solicitation for the purchase or sale of any investment. Any person acting on the information contained in this document does so at their own risk. Recommendations in this document may not be suitable for all investors. Individual circumstances should be considered before a decision to invest is taken. Investors should note the following: Past experience is not necessarily a guide to future performance. The value of investments may fall or rise against investors' interests. Income levels from investments may fluctuate. Changes in exchange rates may have an adverse effect on the value of, or income from, investments denominated in foreign currencies. GoldCore Limited, trading as GoldCore is a Multi-Agency Intermediary regulated by the Irish Financial Regulator.

GoldCore is committed to complying with the requirements of the Data Protection Act. This means that in the provision of our services, appropriate personal information is processed and kept securely. It also means that we will never sell your details to a third party. The information you provide will remain confidential and may be used for the provision of related services. Such information may be disclosed in confidence to agents or service providers, regulatory bodies and group companies. You have the right to ask for a copy of certain information held by us in our records in return for payment of a small fee. You also have the right to require us to correct any inaccuracies in your information. The details you are being asked to supply may be used to provide you with information about other products and services either from GoldCore or other group companies or to provide services which any member of the group has arranged for you with a third party. If you do not wish to receive such contact, please write to the Marketing Manager GoldCore, 63 Fitzwilliam Square, Dublin 2 marking the envelope 'data protection'

GoldCore Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.