How to Invest in Junior Gold and Silver Mining Companies

Commodities / Gold & Silver Stocks Aug 31, 2010 - 02:25 AM GMTBy: Jordan_Roy_Byrne

The various large-cap gold stock indices are readying for a major breakout. As we’ve noted, this isn’t just a breakout through 2008 highs but a breakout through highs dating back to 1980. Yes, there are some gold stock indices like the Barron’s Gold Mining Index and others, which show a 30-year base dating back to 1980. This will be a historic breakout for the gold stocks.

The various large-cap gold stock indices are readying for a major breakout. As we’ve noted, this isn’t just a breakout through 2008 highs but a breakout through highs dating back to 1980. Yes, there are some gold stock indices like the Barron’s Gold Mining Index and others, which show a 30-year base dating back to 1980. This will be a historic breakout for the gold stocks.

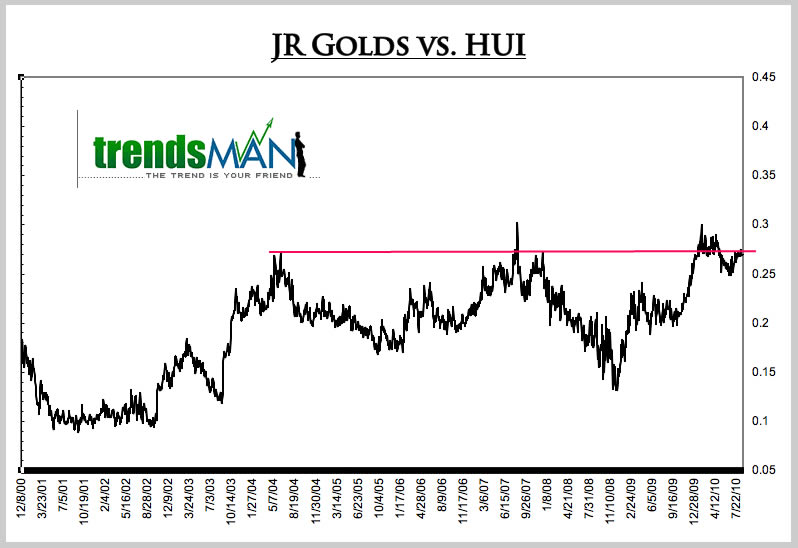

Yet, there are two things you should note about the large cap gold stocks. First, as a group, over time they notoriously underperform or struggle to outperform gold. Secondly, those stocks are starting to lose out to the juniors. The following chart shows our junior gold index versus the HUI Gold bugs index. As you can see, the juniors are likely to perform better than the large cap gold stocks, which themselves are on the cusp of a historic breakout.

Hence, its time most folks start learning how to invest in the juniors. It can be difficult and risky, but with the right plan in place, it can be extremely rewarding. We wanted to share some of the things we look for.

Timing

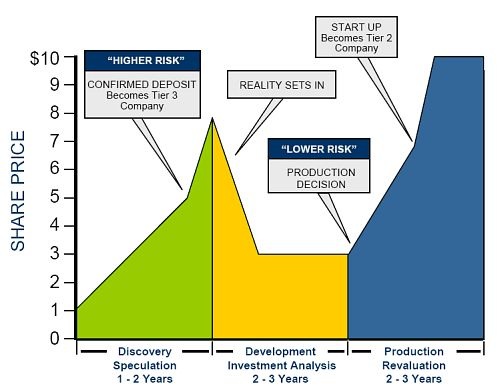

As you can see from the chart below, timing is critical. Never chase an exploration company that has already gone vertical. The same should be said for a company just going into production. The best time to buy is in the development or early production phase. Usually that coincides with a basing pattern. If the company has a successful catalyst or news, then the stock will breakout of the basing pattern and make a big move.

Share Structure

This is important for many reasons. First, it tells us how successful the company has been to date. If the company has a lot going for it and only has, say 40 or 60 million shares, then that tells you that management has done on a good job so far. However, if the company has 200 million shares and hasn’t achieved its objective yet, it is a bad sign. Moreover, how will that stock make huge gains quickly with such a large float? Hence, another reason the former scenario is highly favorable.

Financial Health

How is the company financed? Did it have to issue extra shares numerous times before adding value? Is it hugely in debt? Will it need to issue more shares again? Generally speaking, avoid those companies that have to engage in numerous financings without adding significant value. We favor the companies that can raise capital without diluting shareholders or adding significant debt.

Management

Invest in companies whose management teams have a track record. Why go with those who haven’t built a mine or developed a resource? You can perform an ongoing evaluation by looking at the company’s progress relative to the shares outstanding. Again, we want to see progress without management having to significantly dilute existing shareholders.

Political Risk

This is an obvious one. If you are going to speculate on a company with political risk inherent in its projects then make sure you are compensated for taking the risk. In fact, if it is a significant risk, then don’t take the chance unless you are compensated for that risk and the company has home run potential.

Potential

Lastly, realize that you can profitably invest in GDXJ or a great fund like the Tocqueville Gold Fund. Hence, don’t take the risk on a junior only to make 50% or 100%. You can do that with the aforementioned. Remember, that quality juniors can rise 300% or 500%. These are the ones you want to own and not those that may only rise 50% or 100%.

In our premium service, we have paid little attention to inflation-deflation or money supply or velocity. Instead, we correctly focus on the fiscal health of various governments. As that deteriorates, it brings us closer and closer to the eventual end game, which is a new currency regime. For what it is worth, I do believe we will see severe inflation but note that hyperinflation of the Zimbabwe or German kind is out of the question due to the deep and liquid bond markets that we, Europe and the UK have. If you’d be interested in more clear analysis and how you can reap big profits while protecting yourself, consider a free 14-day trial to our premium service.

Jordan Roy-Byrne, CMT

Jordan@thedailygold.com

http://www.thedailygold.com/newsletter

Trendsman” is an affiliate member of the Market Technicians Association (MTA) and is enrolled in their CMT Program, which certifies professionals in the field of technical analysis. He will be taking the final exam in Spring 07. Trendsman focuses on technical analysis but analyzes fundamentals and investor psychology in tandem with the charts. He credits his success to an immense love of the markets and an insatiable thirst for knowledge and profits.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.